- Metaplanet elevated Bitcoin holdings to 398.8 BTC amid the worth decline, boosting its share worth.

- Institutional traders, comparable to Metaplanet and MicroStrategy, maintained their Bitcoin investments regardless of market volatility.

Metaplanet, a publicly-listed funding and consulting agency based mostly in Japan, is sticking to its technique of “purchase the dip” amidst Bitcoin [BTC]’s latest struggles.

As BTC battles to interrupt the $60,000 mark, its worth lately fell to $56,497.76, reflecting a 0.915% drop over the previous 24 hours, in keeping with CoinMarketCap.

Metaplanet will increase its Bitcoin holdings

Regardless of this downturn, Metaplanet has seized the chance to extend its Bitcoin holdings to just about 400 BTC.

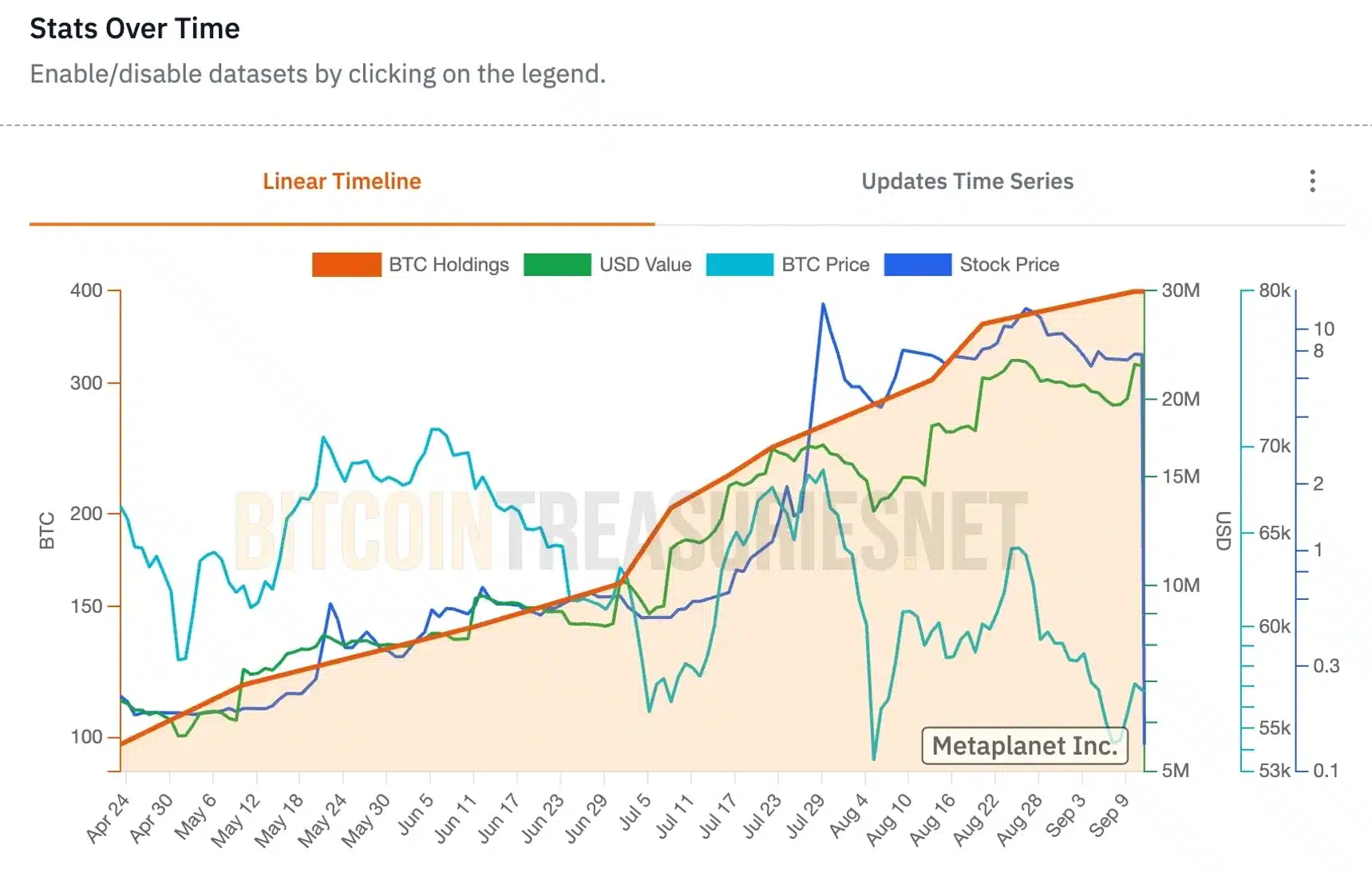

Supply: bitcointreasuries.web

This transfer has positively impacted its share worth, which surged by 5.9% on the Tokyo Inventory Alternate.

Metaplanet’s latest BTC acquisition highlights the funding technique referred to as “shopping for the dip.”

This strategy includes buying property when their costs drop, with the expectation that their worth will rise sooner or later.

By capitalizing on Bitcoin’s latest decline and including to its holdings, Metaplanet demonstrates confidence within the cryptocurrency’s long-term potential, regardless of present market volatility.

This technique reveals confidence in BTC’s long-term worth and displays a development of shopping for property throughout worth drops to profit later.

What does the info spotlight?

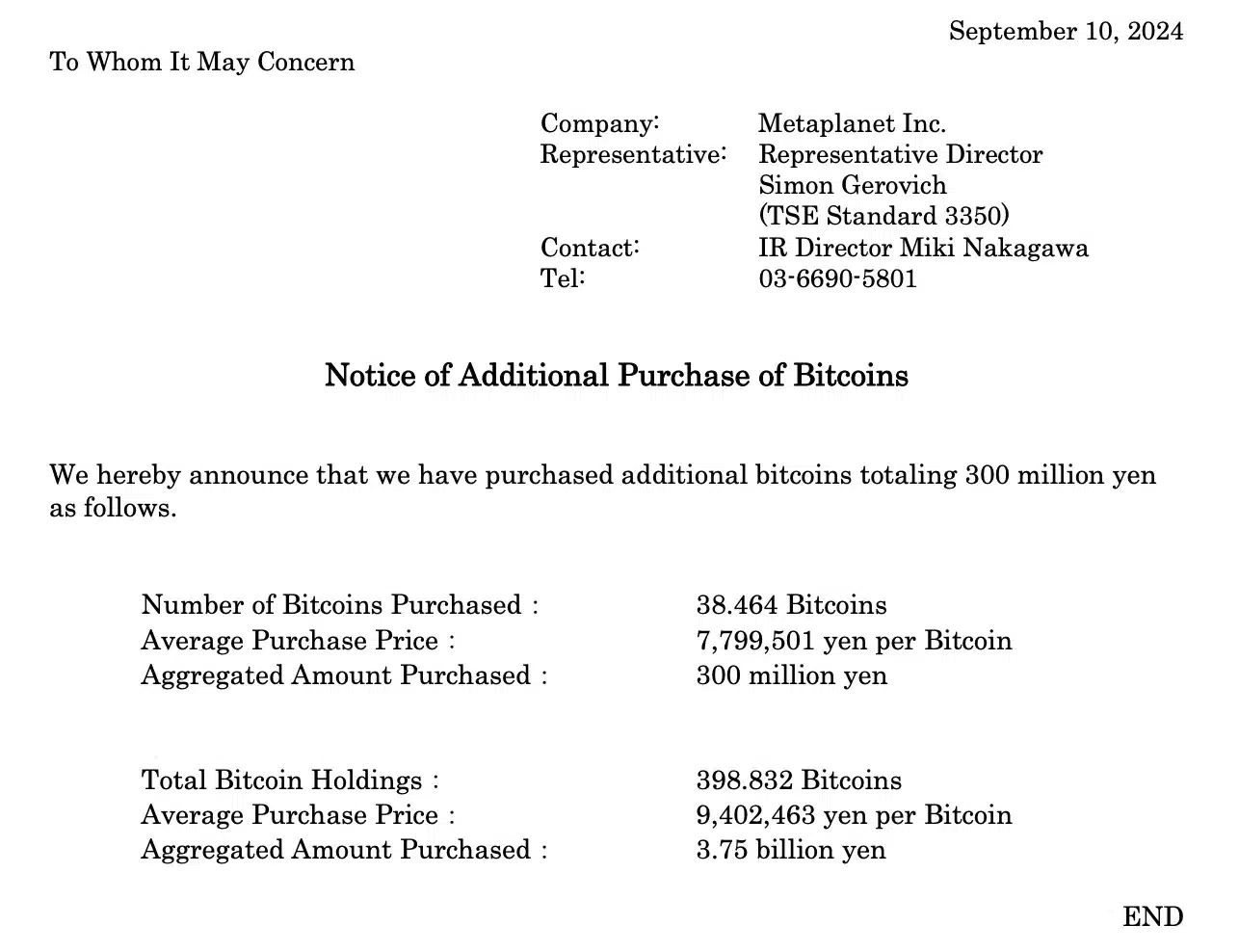

Based on the most recent report launched on the tenth of September, Metaplanet acquired 38.46 Bitcoin for $2.1 million (300 million Japanese Yen).

This buy elevated their whole holdings to 398.8 BTC, valued at roughly $23 million.

Supply: metaplanet.jp

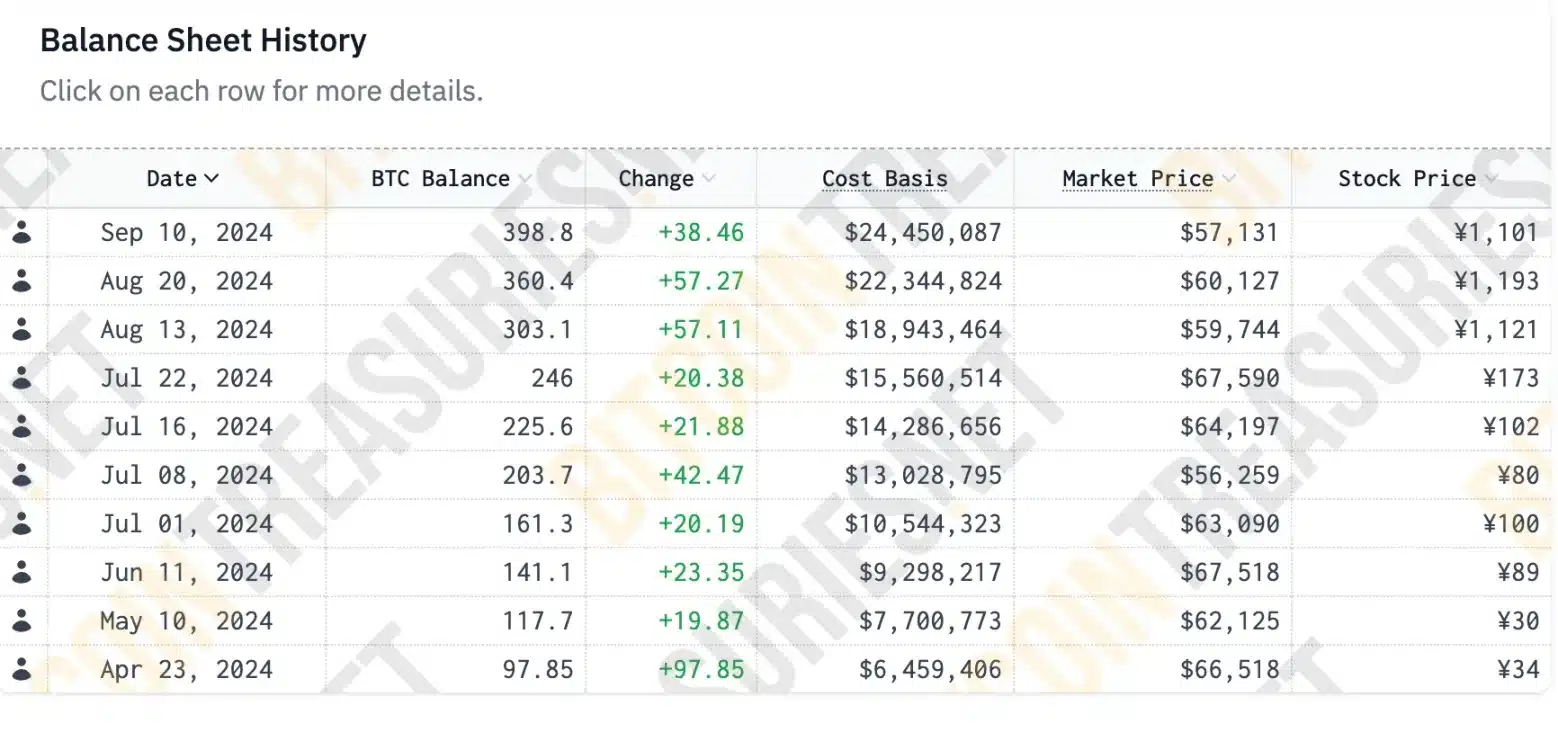

Moreover, in keeping with Bitcoin Treasuries data, Metaplanet started its BTC acquisition on the twenty third of April and made its tenth buy on the tenth of September.

Supply: bitcointreasuries.web

Because of this, Metaplanet now holds the Twenty seventh-largest company Bitcoin reserve globally and ranks third in Asia.

The Impression

Regardless of this vital buildup, the agency’s inventory worth noticed a minor decline of 0.45%, buying and selling at 1,096 JPY, and Bitcoin additionally skilled a downturn.

Supply: Buying and selling View

Nonetheless, Metaplanet’s share worth has surged by 480% because the firm first introduced its Bitcoin funding technique in early April, in keeping with MarketWatch.

In Might, Metaplanet revealed its technique to boost its BTC reserves by adopting a complete vary of capital market devices, mirroring the strategy taken by MicroStrategy.

MicroStrategy accumulates BTC

As anticipated, MicroStrategy, the most important company holder of Bitcoin, lately published its second quarter 2024 monetary outcomes.

The discharge highlighted MicroStrategy’s ongoing dedication to increasing its BTC holdings.

“After yet one more profitable quarter for our bitcoin technique, MicroStrategy at present holds 226,500 bitcoins reflecting a present market worth 70% greater than our price foundation. We stay laser targeted on our Bitcoin growth technique and intend to proceed to realize constructive “BTC Yield.”

This development underscores how institutional traders are rising their BTC holdings regardless of short-term worth fluctuations, suggesting a possible bullish flip for BTC quickly.

What lies forward for Bitcoin?

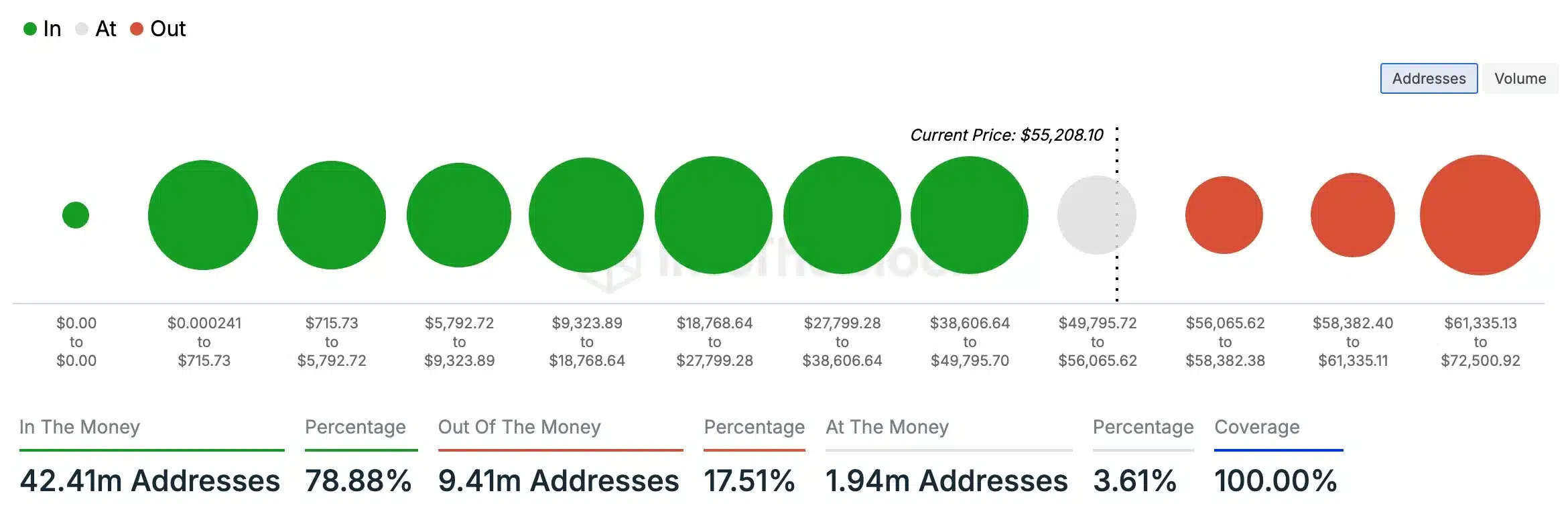

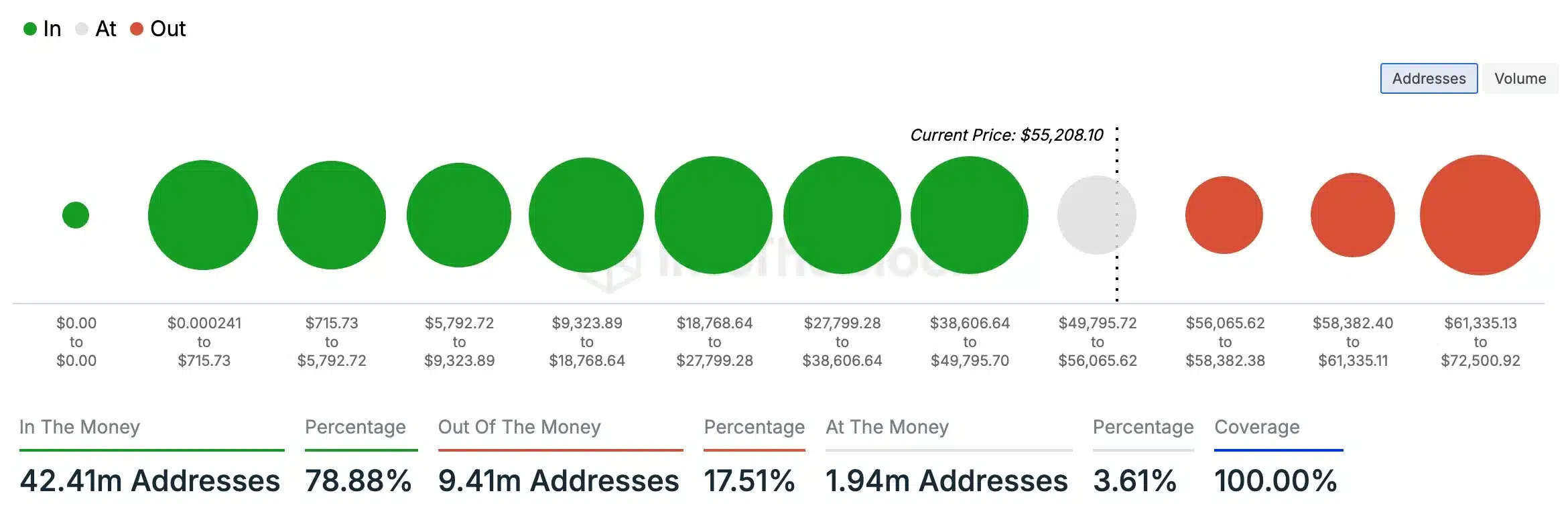

Evaluation by AMBCrypto, utilizing information from IntoTheBlock, reveals {that a} substantial majority (78.88%) of Bitcoin holders are at the moment “within the cash,” holding tokens valued above their buy worth.

Conversely, solely 17.51% of holders are “out of the cash,” with tokens price lower than their preliminary funding.

Supply: IntoTheBlock

This information additional reinforces the expectation that Bitcoin might expertise a constructive shift in worth quickly.