This information launch accommodates forward-looking details about anticipated future occasions and monetary and working efficiency of the Firm. We consult with the dangers and assumptions set out in our Cautionary Assertion on Ahead-Trying Info positioned on web page 13 of this launch. All greenback quantities are expressed in U.S. {dollars}, until in any other case famous.

Kinross has accomplished a Preliminary Financial Evaluation (PEA) for the Nice Bear mission which helps the Firm’s acquisition thesis of a prime tier high-margin operation in a steady jurisdiction with robust infrastructure. Based mostly on mineral assets drilled to this point, the PEA outlines a high-grade mixed open pit and underground mine with an preliminary deliberate mine life of roughly 12 years and manufacturing price of gross sales 3 of $594 per ounce. The Undertaking is anticipated to provide over 500,000 ounces per yr at an all-in sustaining price (AISC) 1 of roughly $800 per ounce through the first 8 years by a standard, modest capital 10,000 tonne per day (tpd) mill.

Kinross has additionally launched an up to date mineral useful resource estimate growing the inferred useful resource estimate by 568koz. to three.884 Moz. which is along with the present M&I useful resource estimate of two.738 Moz 4 . The mineral useful resource estimate and PEA for the Nice Bear mission can be found here .

CEO Commentary:

“This PEA marks an necessary milestone for Nice Bear and reaffirms our view of it as a high-quality asset with sturdy economics and a transparent path to change into a world class working mine,” mentioned Paul Rollinson, Chief Govt Officer of Kinross Gold Company. “The Undertaking represents a powerful mixture of high-margin manufacturing and modest capital necessities, with the chance for vital useful resource development sooner or later.

“This PEA represents the primary view of unlocking Nice Bear’s full potential. Based mostly on floor drilling to this point, the PEA supplies an preliminary snapshot in time of the Undertaking. The continuing drilling to depth has already proven a number of broad, high-grade intercepts past the present useful resource used within the PEA. This deep drilling from floor demonstrates the continuation of mineralization at depth and the upside potential for additional useful resource and mine life additions sooner or later as we progress exploration from depth.

“These optimistic outcomes are underpinned by a powerful mining jurisdiction with a talented labour pool and stable regional infrastructure. We now have each the monetary and technical assets to advance the event of this thrilling new Undertaking in our portfolio.”

________________________

1 Annual manufacturing over 500,000 ounces for the primary 8 years .

2 AISC is a non-GAAP monetary measure. T he definition and objective of this non-GAAP monetary measure is included on web page 1 1 of this information launch. Non-GAAP monetary measures and ratios haven’t any standardized which means beneath IFRS and due to this fact, might not be corresponding to comparable measures offered by different issuers. Please see common manufacturing price of gross sales within the desk entitled “PEA examine monetary highlights” for the associated estimated GAAP monetary measure .

3 ” Manufacturing price of gross sales per ounce ” is outlined as manufacturing price of gross sales divided by whole ounces offered . In the PEA, manufacturing prices of gross sales is known as manufacturing money prices.

4 See the desk beneath titled “Nice Bear Abstract of mission mineral assets” for grade and amount of mineral useful resource estimate.

Key PEA Highlights:

- The Nice Bear PEA demonstrates a top-tier excessive margin operation in a steady jurisdiction in Ontario, Canada. The Undertaking is positioned inside the prolific Crimson Lake Greenstone Belt 24 kilometres from Crimson Lake, a city with a protracted historical past of mining, vital infrastructure together with a paved freeway and provincial energy strains, and entry to skilled, expert labour.

- The outcomes from the PEA affirm that Nice Bear has the potential to be a cornerstone asset with a prime tier manufacturing profile, low prices, and vital worth.

- The PEA mine plan demonstrates a superb estimated inside price of return (IRR) and after-tax web current worth (NPV) at a variety of gold costs.

| PEA examine bodily highlights 5 | |

| Annual manufacturing (koz. / first 8 years) | 518 |

| Annual manufacturing (koz. / lifetime of mine common) | 431 |

| Lifetime of mine manufacturing (Moz. Au) | 5.3 |

| Mill Processing price (tpd) | 10,000 |

| Underground peak mining price (tpd) | 6,000 |

| Lifetime of mine tonnes processed (million tonnes) | 44.6 |

| Common grade processed (g/t Au) | 3.87 |

| Common restoration price (% Au) | 95.7 |

| PEA examine monetary highlights | ||

| Common manufacturing price of gross sales (per Au oz.) 3 , 6 | $594 | |

| Common all-in sustaining prices (per Au oz.) 2 , 5 | $812 | |

| Complete preliminary building capital price (US$ hundreds of thousands) | $1,181 | |

| Complete capitalized mine growth (US$ hundreds of thousands) | $248 | |

| Complete preliminary mission capital (US$ hundreds of thousands) | $1,429 | |

| Nice Bear IRR and NPV estimates based mostly on gold value 7 , 8 , 9 , 10 | ||

| $1,900/oz. | $2,500/oz. | |

| IRR | 24.3% | 35.5% |

| NPV | $1.9 billion | $3.3 billion |

| Payback interval (years) | 2.7 | 1.7 |

________________________

5 The PEA is preliminary in nature and is predicated, partly, on Inferred Mineral Assets. Inferred Mineral Assets are thought-about too geologically speculative to have the financial concerns utilized to them that may allow them to be categorized as Mineral Reserves. There isn’t a certainty that the financial forecasts on which the PEA is predicated can be realized.

6 Common manufacturing price of gross sales and common AISC symbolize prices for projected manufacturing for the lifetime of mine .

7 The financial evaluation of the mission was carried out utilizing a reduced money stream method on a pre-tax and after-tax foundation, based mostly on a long-term gold value of $1,900/ozin USD and value estimates ready in CAD.

8 An change price of 0.74 USD per 1.00 CAD was assumed to transform CAD market value projections and specific parts of the capital price estimates into USD.

9 The IRR on whole funding that’s offered within the financial evaluation was calculated assuming 100% fairness financing besides open pit fleet, although Kinross could determine sooner or later to finance a part of the mission with debt financing.

10 The NPV was calculated from the after-tax money stream generated by the mission, based mostly on a low cost price of 5% and a valuation date of Jan uary 1, 2026.

Mine Plan

The preliminary mine plan outlines concurrent open pit and underground mining over the primary 8 years adopted by mixed underground mining and stockpile processing in years 8 to 12. The choice to mine the open pit and underground concurrently from the beginning supplies vital manufacturing flexibility and time to proceed exploration drilling from underground to additional broaden the useful resource and mine life.

The PEA demonstrates an preliminary life-of-mine (LOM) of roughly 12 years with whole manufacturing of roughly 5.3 Moz. of gold. Nonetheless this represents a cut-off date estimate of the mine plan and is barely a window into the long-term potential of the asset given the constraints of drilling at depth from floor. Exploration drilling at depths as much as 1,600 metres has already demonstrated continuation of high-grade mineralization with robust widths effectively beneath the present PEA stock, highlighting the upside potential of this asset.

The high-grade open pit can be mined with a twin fleet technique to supply selective mining of the high-grade materials and decrease price mining of the waste, mining a peak of 26 million tonnes of fabric, and offering a peak of 9,000 tpd of mineralized materials.

Determine 1: Open Pit mining plan

A determine accompanying this announcement is on the market at https://www.globenewswire.com/NewsRoom/AttachmentNg/c0000d00-833d-44c3-bb2b-c9f6256efdf9

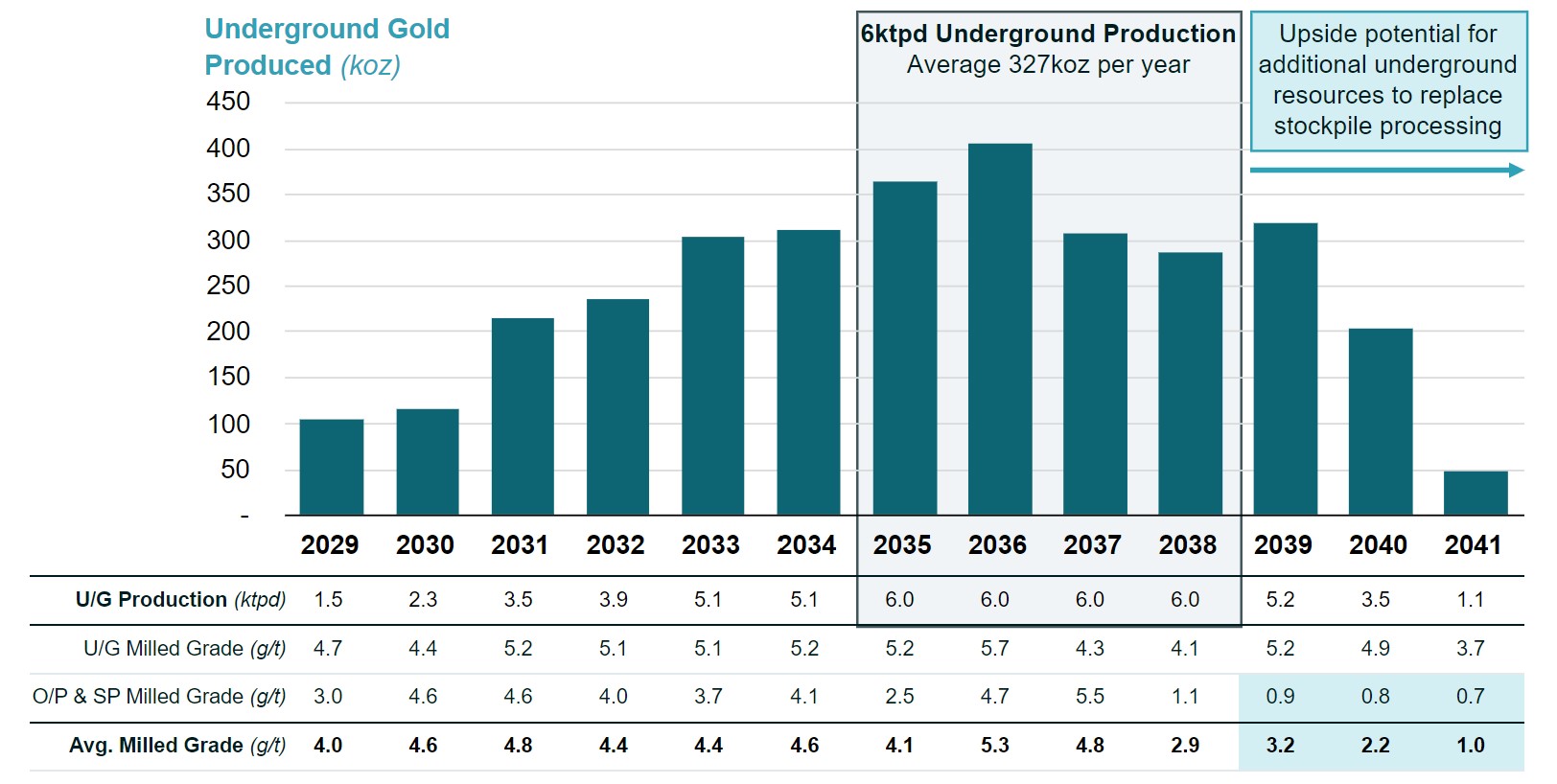

For the underground, the first mining methodology is lengthy gap open stoping with paste backfill and cemented rock fill. First stope manufacturing is anticipated to start in 2029, topic to allowing, and to proceed for 12 years with a peak manufacturing price of 6,000 tpd, with potential to broaden past this run price as extensions to the underground useful resource are focused. At peak, the underground could have a mining price of 6,000 tpd between 2035 and 2038, producing a median of 327koz. each year.

Determine 2: Underground mining plan

A determine accompanying this announcement is on the market at https://www.globenewswire.com/NewsRoom/AttachmentNg/db93d57c-524e-4059-a891-d0e374224711

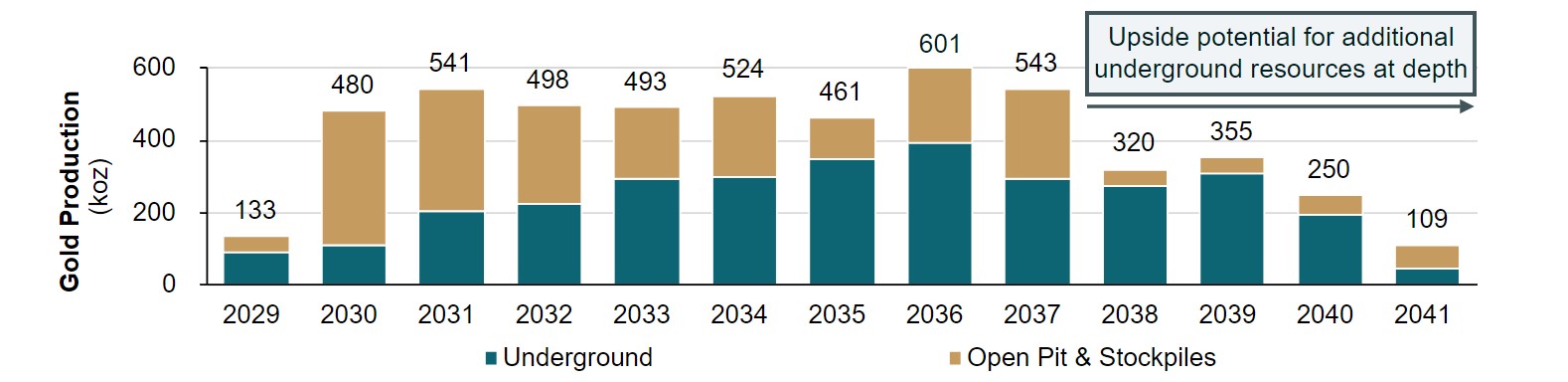

The mixture of the open pit and underground manufacturing within the years 1 to eight will enable for processing of higher-grade materials and stockpiling of the remaining feed to complement underground manufacturing within the latter years of the mine life. This technique drives a milled grade of 4.6 g/t in years 1 to eight and a median manufacturing of 518koz. each year over these years.

Determine 3: Concurrent Open Pit and Underground Gold Manufacturing

A determine accompanying this announcement is on the market at https://www.globenewswire.com/NewsRoom/AttachmentNg/5e007df4-b44f-49a2-86f8-dc548712d631

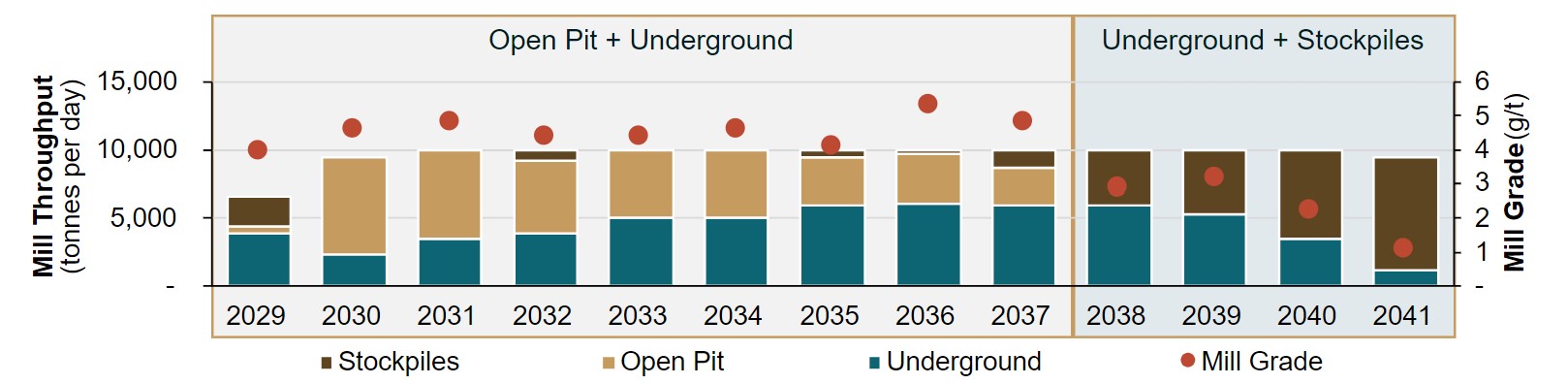

Determine 4: Mill Throughput

A determine accompanying this announcement is on the market at https://www.globenewswire.com/NewsRoom/AttachmentNg/0eaceeda-6b16-47d2-b979-b54899734d36

| Open pit mining operations | |

| LOM materials mined | 187.9 Mt |

| LOM plant feed mined | 24.3 Mt |

| Common grade | 3.0 g/t Au |

| Strip ratio | 6.7 (waste: plant feed) |

| Peak mining price (all supplies) | 26.2 Mtpa |

| Mining unit price (together with capitalized mining) | $3.59 ($/t mined) |

| Underground mining operations | |

| LOM plant feed mined | 20.3 Mt |

| Common grade | 4.9 g/t Au |

| Regular State Mining Fee (plant feed) | 6,000 tpd |

| Mining unit price (excluding capitalized mining) | $68.70 ($/t processed) |

Mill, Processing and Tailings Design

For the PEA, a standard milling circuit totally free milling mineralization was chosen, focusing on a median processing price of 10,000 tpd. This scale of plant configuration simplifies building, drives excessive margins and manufacturing scale within the early years with selective processing of higher-grade materials when mining each open pit and underground, and avoids oversizing the mill for a possible underground solely situation within the latter years of the mine life at Nice Bear.

Kinross has accomplished a complete metallurgical take a look at work program together with detailed chemical head evaluation, mineralogy, gold deportment, comminution, and leaching and gravity restoration testing throughout a collection of composite samples. The outcomes of the take a look at work program indicated clear metallurgy with no deleterious components and really robust recoveries, with common LOM restoration of 95.7% projected within the PEA. The clear metallurgy and standard circuit are anticipated to additional de-risk mission building and execution.

Based mostly on the metallurgical take a look at outcomes, Nice Bear’s processing plant has been designed as a standard circuit with a proposed flowsheet together with semi-autogenous grinding (SAG) and ball milling, pebble crushing, gravity focus, leaching adopted by carbon-in-pulp adsorption (CIP), elution, electrowinning, and smelting to provide gold doré.

| Key Processing Knowledge | |

| Mill processing price (tpd) | 10,000 |

| Complete plant feed (Mt) | 44.6 |

| LOM avg. feed grade (g/t Au) | 3.87 |

| LOM contained gold (Moz) | 5.5 |

| LOM avg. restoration (% Au) | 95.7 |

| LOM recovered gold (Moz) | 5.3 |

Kinross has invested substantial effort into early technical research and design for tailings processing and administration services at Nice Bear leveraging the very best accessible applied sciences to make sure the very best environmental requirements.

Consequently, the PEA design contains the addition of a desulphurization flotation circuit to take away sulphides and render the tailings non-acid producing, and a rigorous design standards for all tailings storage services on the website.

As effectively, the LP Viggo Pit has been pulled ahead to be mined throughout mission building as a way to present a sturdy in-pit tailings storage facility for the sulphide focus from the desulphurization flotation circuit, eliminating the necessity for a dam to impound the sulphide focus.

Capital Expenditure

The full preliminary building capital is forecasted at $1.2 billion. Capitalized mine growth previous to industrial manufacturing is anticipated to be roughly $250 million, comprised of $105 million associated to open pit mining and $143 million associated to underground capital growth which is able to assist larger manufacturing within the early years. The vast majority of the capitalized open pit mining is pushed by the strategic choice to tug ahead mining of the Viggo pit throughout building to supply low-cost building rock, early mill feed and a sturdy in-pit answer for the tailings focus.

Throughout the building capital, the positioning growth, water remedy and infrastructure space contains the truck store, admin services, and camp. It additionally contains state-of-the-art water remedy together with ultra-filtration and a sturdy site-wide water administration technique to make sure the very best environmental requirements.

Moreover, the capital estimate contains oblique and contingency prices, the place oblique and proprietor prices are 40% of whole direct prices and the contingency is 22%, offering additional confidence within the PEA’s whole estimate.

The Undertaking’s capital necessities are anticipated to be manageable for Kinross and are forecasted inside the Firm’s deliberate annual capex profile within the vary of $1 billion. Kinross is assured it may well proceed to prioritize its funding grade steadiness sheet and comfortably fund Nice Bear, together with different deliberate capital spending.

| Nice Bear capital price estimates (US$ hundreds of thousands) |

|||

| Direct Capital Prices | |||

| Mine gear | $85 | ||

| Web site growth, water remedy and infrastructure | $239 | ||

| UG Infrastructure | $49 | ||

| Processing | $217 | ||

| Energy | $47 | ||

| Tailings administration facility | $52 | ||

| Complete Direct Prices | $ 689 | ||

| Oblique | $276 | ||

| Contingency | $216 | ||

| Complete Preliminary Building Capital Price | $ 1,181 | ||

| Capitalized open pit mining | $105 | ||

| Capitalized underground growth | $143 | ||

| Complete Capitalized Mine Improvement | $ 248 | ||

| Complete Preliminary Undertaking Capital | $ 1,429 | ||

| Lifetime of Mine Sustaining Capital | $ 1,034 | ||

| Complete Progress Capital | $ 97 11 | ||

Subsequent Steps and Allowing

Kinross is constant to progress work in a number of areas throughout the Undertaking, for each the superior exploration program (AEX) and the Principal Undertaking. Each the AEX and Principal Undertaking stay topic to allowing, which continues to advance. The AEX allowing is a provincial course of and Kinross is working carefully with the authorities on finalizing the permits. The Principal Undertaking’s allowing is principally a federal allowing overview course of pushed by the Influence Evaluation Company of Canada (IAAC), with some provincial allowing parts. Kinross was happy to just lately obtain the Tailor-made Influence Assertion Tips from IAAC, which is able to help with finishing the draft Influence Assertion.

For the AEX, detailed engineering, execution planning, and procurement continues to progress effectively. The Firm is focusing on to begin floor works in 2024, topic to receiving provincial permits.

For the Principal Undertaking, Kinross expects to advance engineering definition and execution planning following the collection of design companions later this yr. Work on allowing of the Principal Undertaking is ongoing and would require federal overview beneath the Influence Evaluation Act. An Influence Assertion is presently in course of and is anticipated to be submitted to the IAAC subsequent yr.

Kinross has actively engaged and consulted with Indigenous communities and organizations and has commenced negotiations of a Undertaking Settlement with its First Nations companions, Lac Seul and Wabauskang, on whose conventional territories the Nice Bear mission is positioned.

________________________

11 The long-term energy provide technique for the Undertaking is to acquire sufficient energy provide from the Ontario energy grid to keep away from self-generation and using pure fuel. To safe the mandatory grid energy provide, Kinross estimates it might want to make a capital contribution of roughly $97 million.

Useful resource replace and exploration

The Mineral Assets 12 on the property have been estimated for 3 zones: LP, Hinge, and Limb. As of April 2, 2024, roughly 568,000 ounces of inferred assets have been added from the LP zone to the whole useful resource in comparison with yr finish 2023, bringing the whole inferred useful resource to three.9 Moz., along with 2.7 Moz. of M&I assets.

Mineral assets have been calculated at a gold value of $1,700 and the open pit displays a $1,400 pit shell. The open pit cutoff grade is 0.55 g/t and the underground lower off grade of is 2.3 g/t for the principle LP zone. The $1,400 pit shell has been chosen as this represents the optimum trade-off level at which underground extraction beneath the pit exhibits larger potential margins then deepening the open pit.

| Nice Bear Abstract of mission mineral assets 13 , 14 , 15 , 16 , 17 , 18

(as at April 2, 2024) |

|||||

| Classification | Tonnes | Grade | Gold Ounces | ||

| (000 ) | (g/t Au) | (000 ) | |||

| Measured | 1,556 | 3.04 | 152 | ||

| Indicated | 28,711 | 2.80 | 2,586 | ||

| TOTAL M&I | 30,267 | 2.81 | 2,738 | ||

| Inferred | 25,480 | 4.74 | 3,884 | ||

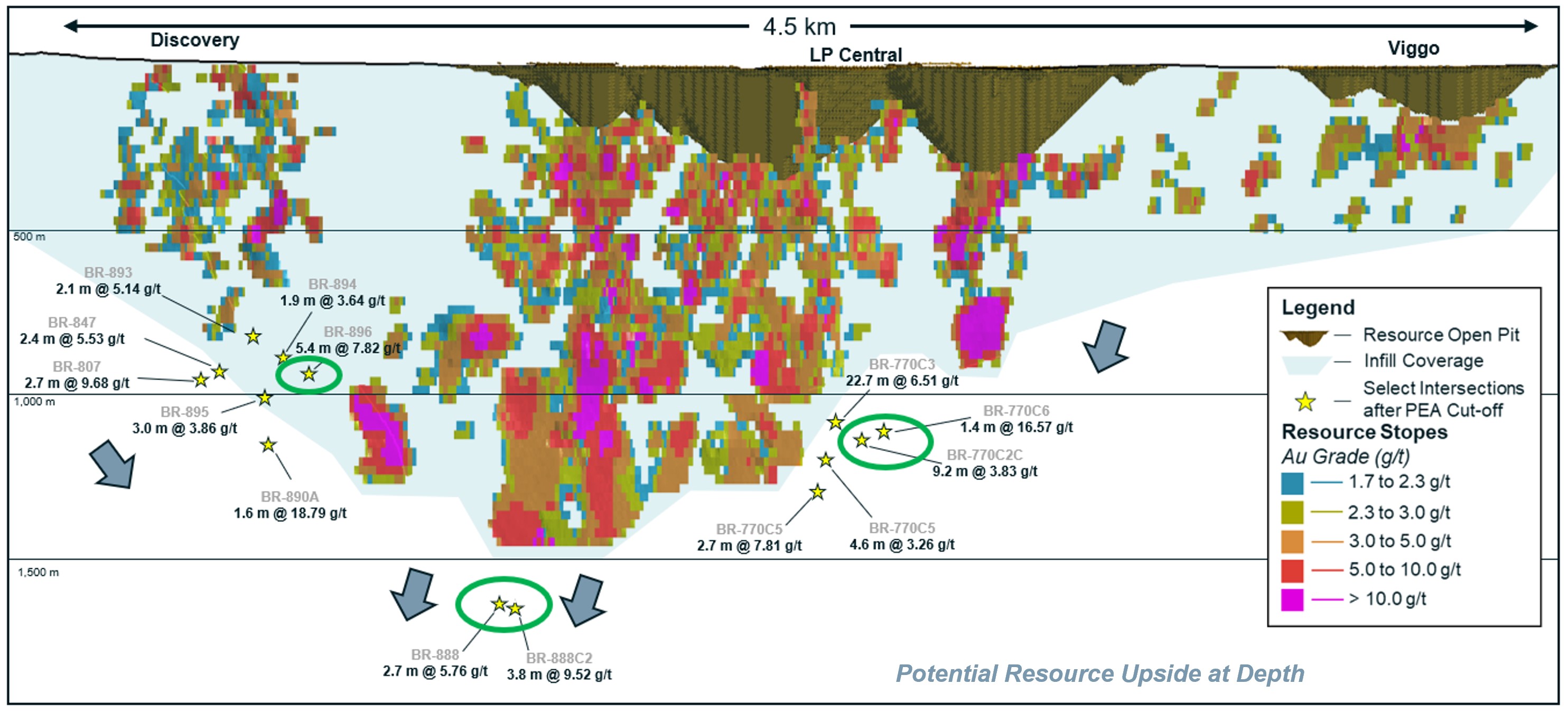

Given the Firm’s present understanding of the orogenic system, and the numerous high-grade extensions realized on the principal LP zone, Kinross expects the robust grades to proceed as drilling extends deeper. To this point, Kinross has accomplished greater than 420 kilometres of drilling on the property and outcomes have been very robust, supporting the Firm’s view that high-grade mineralization extends at depth and indicating the potential for useful resource development over time.

Kinross’ 2023 and 2024 exploration program resulted within the addition of serious ounces at improved grades in contrast with the preliminary mission mineral useful resource declared at yr finish 2022, with the majority of additives within the high-grade underground between 500 metres and 1 kilometre.

This latest drilling, highlighted by the deepest gap drilled on the property to this point, which returned 3.8 metres at a grade of 9.5 g/t at almost 1.6 kilometres vertical depth on the LP zone, demonstrates the spectacular continuity of this technique. Exploration drilling at Nice Bear continues to see success past the PEA stock. Drill holes BR-888 and BR-888C2 are the deepest drill holes on the property to this point and have intersected excessive grade mineralization 1,600 metre vertically beneath floor.

Moreover, exploration drilling at each the Discovery and Yauro zones have additionally intersected mineralization past the PEA stock. Drill gap BR-770C3 intersected 22.7 metres at 6.51 g/t at Yauro and BR-896 intersected 5.4 metres at 7.82 g/t at Discovery. These drill holes display the profitable growth of mineralization by drilling, not simply at depth, however alongside strike and linking zones.

________________________

12 Mineral Assets are said in accordance with CIM (2014) Definitions as integrated by reference into NI 43-101. Mineral Assets are estimated for the LP z one and satellite tv for pc Hinge and Limb z ones and have an efficient date of April 2, 2024.

13 Mineral r esources estimated in line with CIM (2014) Definitions.

14 Mineral r esources estimated at a gold value of $1 , 700 per ounce.

15 Open pit mineral assets are reported inside optimized pit shells at a cut-off grade of 0.55 g/t Au.

16 Underground mineral assets are reported inside underground reporting shapes at cut-off grades of two.3 g/t Au for the LP z one, 2.5 g/t Au for the Limb z one, and a couple of.4 g/t for the Hinge z one. An incremental cut-off grade of 1.7 g/t Au was used on the LP z one for areas that don’t require extra growth.

17 Mineral assets that aren’t mineral reserves shouldn’t have demonstrated financial viability.

18 Numbers could not add because of rounding.

Determine 5: Useful resource Progress – persevering with to see high-grade intercepts outdoors of the PEA stock

A determine accompanying this announcement is on the market at https://www.globenewswire.com/NewsRoom/AttachmentNg/b9aaeb87-b9e5-4fdd-989a-1c6282633600

The PEA represents a cut-off date estimate and is barely a window into the long-term potential of the asset given the indications of continued mineralization at depth. Consequently, the Firm is concentrated on progressing the AEX to start drilling underground to proceed unlocking the complete potential of the asset.

In 2024, the Firm will proceed to focus drilling to hyperlink zones at depth at LP and additional directional work at Hinge and Limb. Exploration may also focus assets on brownfield exploration work on the newly expanded ~120 sq. kilometre land package deal to search for extra open pit and underground alternatives.

Nice Bear Technical Presentation particulars

In reference to this information launch, Kinross will maintain a convention name and audio webcast on Tuesday, September 10, 2024, at 9:00 a.m. EDT, adopted by a question-and-answer session. To entry the decision, please dial:

To entry the decision:

Webcast Hyperlink: https://meetings.lumiconnect.com/400-478-546-594

Canada & US toll-free: 1-866-613-0812

Exterior of Canada & US: 647-694-2812

Replay (accessible 30 days after the decision):

Canada & US toll-free: 1 (877) 454-9859

Exterior of Canada & US: (647) 483-1416

Passcode : 4887947

You may additionally entry the convention name on a listen-only foundation through webcast at our web site www.kinross.com. The audio webcast can be archived on www.kinross.com.

About Kinross Gold Company

Kinross is a Canadian-based world senior gold mining firm with operations and tasks in america, Brazil, Mauritania, Chile and Canada. Our focus is on delivering worth based mostly on the core ideas of accountable mining, operational excellence, disciplined development, and steadiness sheet energy. Kinross maintains listings on the Toronto Inventory Trade (image: Ok) and the New York Inventory Trade (image: KGC).

Media Contact

Victoria Barrington

Senior Director, Company Communications

telephone: 647-788-4153

victoria.barrington@kinross.com

Investor Relations Contact

David Shaver

Senior Vice-President

telephone: 416-365-2761

david.shaver@kinross.com

APPENDIX A

Non-GAAP monetary measures

The Firm has included sure non-GAAP monetary measures on this doc. These monetary measures are usually not outlined beneath IFRS and shouldn’t be thought-about in isolation. The Firm believes that these monetary measures, along with monetary measures decided in accordance with IFRS, present traders with an improved capability to guage the underlying efficiency of the Firm. The inclusion of those monetary measures is supposed to supply extra data and shouldn’t be used as an alternative choice to efficiency measures ready in accordance with IFRS. These monetary measures are usually not essentially customary and due to this fact might not be corresponding to different issuers.

All-in sustaining price

All in sustaining price is a non-GAAP monetary measure calculated based mostly on steering revealed by the World Gold Council (“WGC”). The WGC is a market growth group for the gold business and is an affiliation whose membership includes main gold mining corporations together with Kinross. Though the WGC is just not a mining business regulatory group, it labored carefully with its member corporations to develop these metrics. Adoption of the all-in sustaining price metric is voluntary and never essentially customary, and due to this fact, this measure offered by the Firm might not be corresponding to comparable measures offered by different issuers. The Firm believes that the all-in sustaining price measure enhances present measures and ratios reported by Kinross.

All-in sustaining price contains each working and capital prices required to maintain gold manufacturing on an ongoing foundation. Sustaining working prices symbolize expenditures anticipated to be incurred at Nice Bear which might be thought-about obligatory to take care of manufacturing. Sustaining capital represents anticipated capital expenditures comprising mine growth prices, together with capitalized waste, and ongoing substitute of mine gear and different capital services, and doesn’t embody anticipated capital expenditures for main development tasks or enhancement capital for vital infrastructure enhancements.

APPENDIX B

Proposed Web site Structure

A determine accompanying this announcement is on the market at https://www.globenewswire.com/NewsRoom/AttachmentNg/a13ccfc5-3edf-4be5-85ed-f1c17ae69f9c

APPENDIX C

Cautionary assertion on forward-looking data

All statements, aside from statements of historic reality, contained or integrated by reference on this information launch together with, however not restricted to, any data as to the longer term monetary or working efficiency of Kinross, represent “forward-looking data” or “forward-looking statements” inside the which means of sure securities legal guidelines, together with the provisions of the Securities Act (Ontario) and the provisions for “secure harbor” beneath america Personal Securities Litigation Reform Act of 1995 and are based mostly on expectations, estimates and projections as of the date of this information launch. Ahead-looking statements contained on this information launch embody, with out limitation, statements with respect to: the calculation of mineral assets on the mission and the opportunity of eventual financial extraction of minerals from the mission; the identification of future mineral assets on the mission; the Firm’s capability to transform present mineral assets into classes of mineral assets or mineral reserves of elevated geological confidence; the projected yearly gold manufacturing profile from each open pit and underground operations, all-in sustaining prices, mill throughput and common grades; future plans for exploration drilling; the projected economics of the mission, together with whole gold gross sales, margins, taxes, common annual manufacturing, the web current worth of the mission, the inner price of return on the mission, mission payback interval, common yearly free money stream, lifetime of mine unit prices, projected mine life, the whole preliminary capital and sustaining capital required; the mission design, together with the situation of the tailings administration facility, course of plant, infrastructure space, stockpile areas, the anticipated superior exploration website and the proposed open pit and underground mine plans; the mission growth timeline to manufacturing together with the Firm’s work regarding its Influence Assertion and allowing future phases of the mission and growth and building of and manufacturing on the mission, together with the opportunity of establishing both or each of an open pit and underground mines; the timing of and future prospects for exploration and any growth of the mission, together with upside related to the mission’s land package deal and through exploration at depth beneath the proposed underground mine; the potential for increasing the preliminary mineral useful resource and the potential for figuring out extra mineralization in areas of intercepts and conceptual areas for extension and growth; potential restoration charges or processing methods; and the Firm’s plans to assemble an exploration decline. The phrases “consider”, “conceptual”, “anticipate”, “future”, “plan”, “potential”, “progress”, “potential”, “goal”, “view” and “upside” or variations of or comparable such phrases and phrases or statements that sure actions, occasions or outcomes “could”, “might”, “will” or “would” happen, and comparable expressions determine forward-looking statements. Ahead-looking statements are essentially based mostly upon quite a few estimates and assumptions that, whereas thought-about cheap by Kinross as of the date of such statements, are inherently topic to vital enterprise, financial and aggressive uncertainties and contingencies. The estimates, fashions and assumptions of Kinross referenced, contained or integrated by reference on this information launch, which can show to be incorrect, embody, however are usually not restricted to, the assorted assumptions set forth herein and in our Annual Info Type dated March 27, 2024 and our full-year 2023 Administration’s Dialogue and Evaluation in addition to: (1) there being no vital disruptions affecting the actions of the Firm whether or not because of excessive climate occasions and different or associated pure disasters, labour disruptions, provide disruptions, energy disruptions, injury to gear or in any other case; (2) allowing and growth of the mission being in line with the Firm’s expectations; (3) political and authorized developments in Ontario and Canada being in line with its present expectations; (4) the accuracy of the present mineral useful resource estimates of the Firm (together with however not restricted to ore tonnage and ore grade estimates); (5) sure value assumptions for gold and silver and overseas change charges; (6) Kinross’ future relationship with the Wabauskang and Lac Seul First Nations and different Indigenous teams being in line with the Firm’s expectations; and (7) inflation and costs for diesel, pure fuel, gas oil, electrical energy and different key provides being roughly in line with anticipated ranges. Identified and unknown components might trigger precise outcomes to vary materially from these projected within the forward-looking statements. There may be no assurance that forward-looking statements will show to be correct, as precise outcomes and future occasions might differ materially from these anticipated in such statements. Ahead-looking statements are supplied for the aim of offering details about administration’s expectations and plans regarding the longer term. All the forward-looking statements made on this information launch are certified by these cautionary statements and people made in our different filings with the securities regulators of Canada and america together with, however not restricted to, the cautionary statements made within the “Danger Elements” part of our Annual Info Type dated March 27, 2024, and the “Danger Evaluation” part of our full yr 2023 Administration’s Dialogue & Evaluation. These components are usually not supposed to symbolize a whole record of the components that would have an effect on Kinross. Kinross disclaims any intention or obligation to replace or revise any forward-looking statements or to elucidate any materials distinction between subsequent precise occasions and such ahead trying statements, besides to the extent required by relevant regulation.

Sure forward-looking statements on this press launch may additionally represent a “monetary outlook” inside the which means of relevant securities legal guidelines. A monetary outlook entails statements in regards to the Firm’s potential monetary efficiency, monetary place or money flows and is predicated on and topic to the assumptions about future financial circumstances and programs of motion and the danger components described above in respect of forward-looking data typically, in addition to another particular assumptions and danger components in relation to such monetary outlook famous on this press launch. Such assumptions are based mostly on administration’s evaluation of the related data presently accessible, and any monetary outlook included on this press launch is supplied for the aim of serving to viewers perceive the Firm’s present expectations and plans for the longer term. Viewers are cautioned that reliance on any monetary outlook might not be applicable for different functions or in different circumstances and that the danger components described above, or different components could trigger precise outcomes to vary materially from any monetary outlook. The precise outcomes of the Firm’s operations will seemingly differ from the quantities set forth in any monetary outlook and such variances could also be materials.

Different data

The place we are saying “we”, “us”, “our”, the “Firm”, or “Kinross” on this information launch, we imply Kinross Gold Company and/or a number of or all of its subsidiaries, as could also be relevant.

The technical details about the Firm’s mineral properties contained on this information launch has been ready beneath the supervision of Mr. Nicos Pfeiffer who’s a “certified particular person” inside the which means of Nationwide Instrument 43-101.

Supply: Kinross Gold Company