- Analysts are highlighting a number of catalysts for BTC’s transfer to an ATH together with a possible ‘golden cross’ formation.

- Additional, each technical and on-chain information signaled a bullish outlook for BTC however after a pullback.

Bitcoin [BTC] skilled a surge over the weekend, briefly climbing again to the $60,000 mark. Nevertheless, it has since returned to a press time value of $58,507.40.

Regardless of the worth solely growing by a modest 0.14% over the past seven buying and selling days, there was a notable 33% rise in buying and selling volumes, indicating a rising curiosity.

Though the present value motion seems sluggish, two analysts have argued that this development is barely non permanent and has justified their outlook.

AMBCrypto has expanded on these analysts’ views and, based on our unbiased evaluation, a pointy enhance in Bitcoin’s value appears inevitable at this juncture.

Specialists’ view on why a BTC rise is imminent

One crypto analyst, Moustache, in a “pleasant reminder,” has highlighted an 11-year trendline sample that BTC has revered each as resistance and assist.

In response to the chart he shared, it seems that this trendline is progressively turning into a vital assist once more, because it had earlier this 12 months.

Ought to BTC bounce off this trendline, we might witness a speedy ascent, just like earlier patterns when this trendline first acted as assist.

Supply: X

Moustache additionally famous that Bitcoin’s easy shifting common signifies a possible rally.

He added

“First ever golden cross of the 50/100 SMA can be within the making.”

Ought to the 50 SMA (pink line) cross above the 100 SMA (blue line), BTC is predicted to see a notable enhance in worth, probably rising into the $60k zone or greater.

Whereas this bullish outlook is evident, one other analyst, Mister Crypto, has added to the optimistic sentiment. He shared a chart demonstrating BTC’s efficiency post-Bitcoin halving.

In each eventualities he introduced, from 2016 and 2020, BTC skilled a big value enhance post-halving, reaching new all-time highs every time.

Supply: X

Mister Crypto described this sample as:

“A #Bitcoin provide shock is coming”

This implies that the worth of BTC might quickly oscillate between the $60k and $70k vary if this historic sample continues to carry.

Golden Cross may drive BTC’s rise to $70k

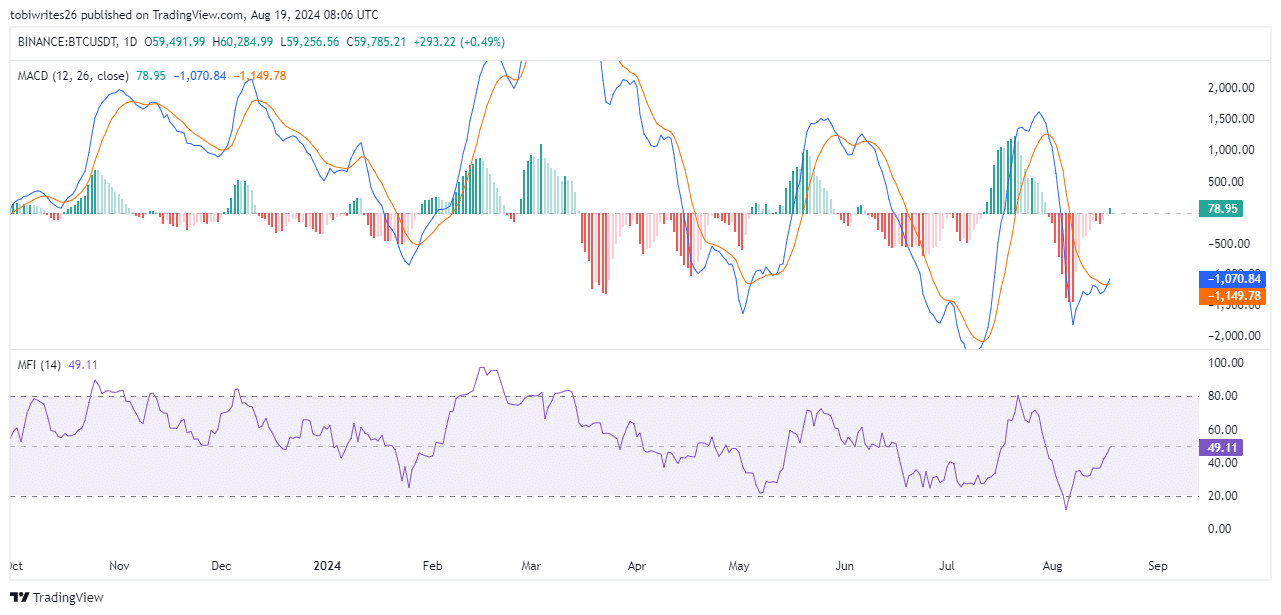

In response to AMBCrypto’s newest evaluation, BTC has simply witnessed a golden cross on the shifting common convergence and divergence (MACD) technical indicators.

A golden cross happens when the MACD line (blue) crosses above the sign line (orange), giving an indication of a bullish flip that sometimes predicts a big upward motion in value.

Supply: Buying and selling View

As an example, when this sample final appeared on July 12, BTC’s value rose from a low of $56.5k to a excessive of roughly $70k by July 29. If this sample holds, BTC might attain related heights within the coming weeks.

Additional evaluation of the Cash Movement Index (MFI)—a technical indicator that merges value and quantity information to pinpoint overbought or oversold circumstances and anticipates value reversals—signifies that bulls are progressively taking management of the market.

The MFI has been climbing steadily over the previous few days and at the moment stands at 49.11. Ought to this uptrend persist, Bitcoin might quickly be buying and selling at or above $70k.

Anticipated pullback earlier than a leg-up

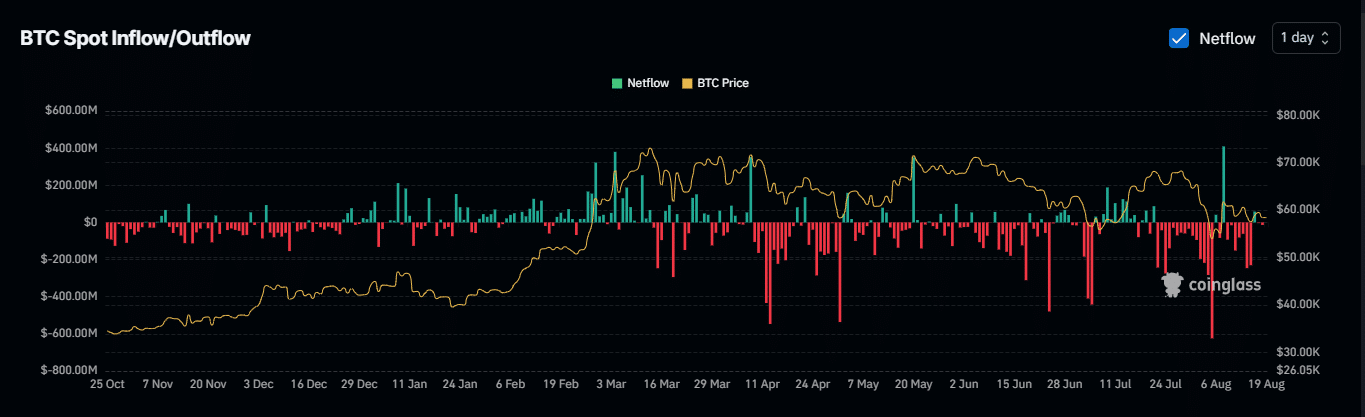

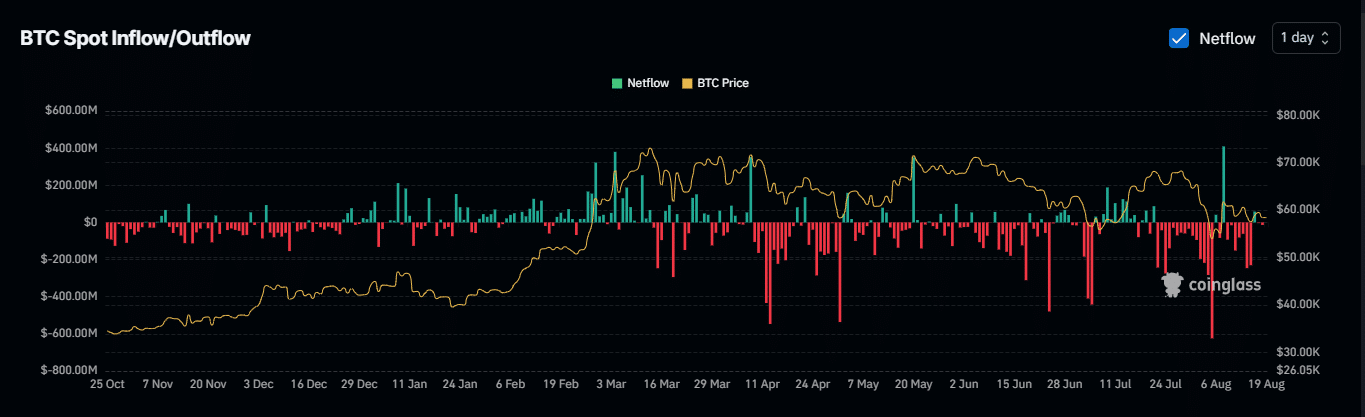

Evaluation of Netflow on BTC throughout weekly and each day timeframes Coinglass signifies a predominantly bullish development.

A detrimental web stream suggests BTC holders are transferring their belongings from exchanges to chilly storage, implying they aren’t planning to commerce their BTC within the close to future.

This discount in BTC provide on exchanges might drive up demand, probably pushing costs greater.

Supply: Coinglass

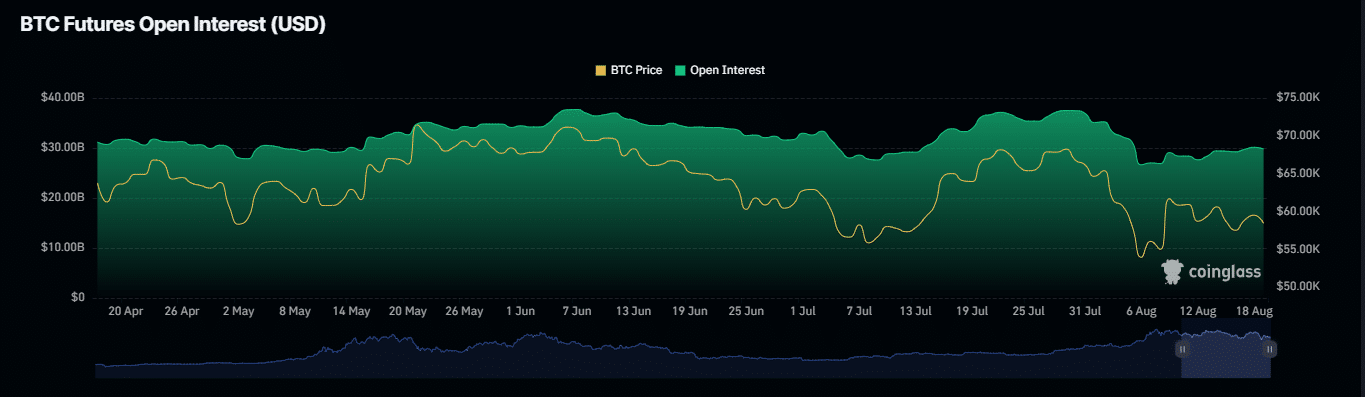

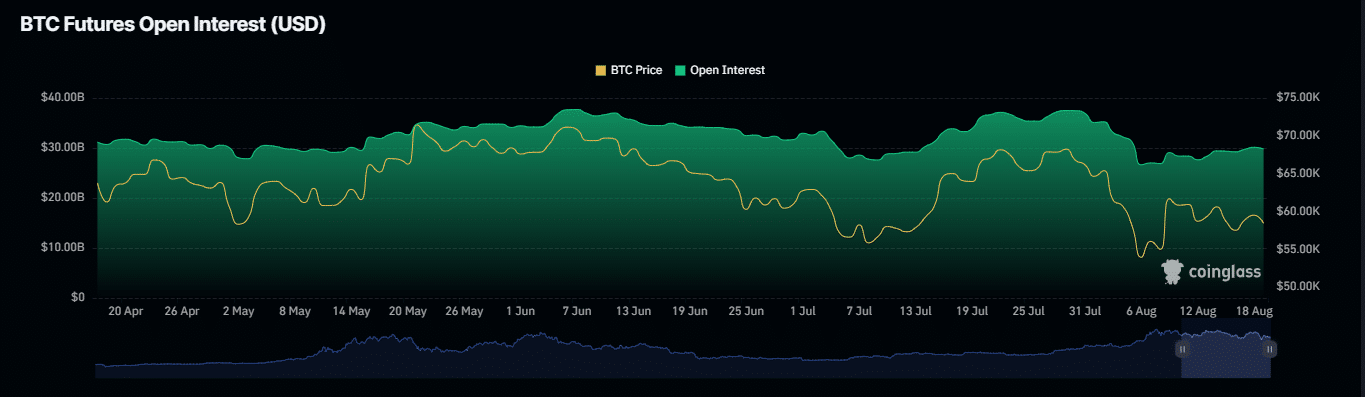

The open curiosity (OI), representing the whole variety of unsettled by-product contracts like futures or choices, gives additional bullish alerts.

Supply: Coinglass

From August 12 to August 19, OI rose from $27.64 billion to $29.81 billion, indicating rising bullish momentum in anticipation of a rally.

Nevertheless, within the brief time period, many lengthy merchants have confronted liquidation based on a dataset from Coinglass.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This happens when merchants with lengthy positions are compelled to shut their contracts because the market strikes towards them, typically leading to a sell-off to fulfill margin necessities.

This example means that Bitcoin may expertise a downward push earlier than it may well rally to probably new highs.