- We discover the potential of a Bitcoin provide shock after current market observations.

- Bitcoin velocity pivots, indicating that Bitcoin is effectively right into a extremely risky part.

When Bitcoin [BTC] underwent one other halving earlier this 12 months, there was hypothesis {that a} provide shock would quickly observe. Right this moment, the potential of a Bitcoin supply shock is way larger, particularly after the current crash.

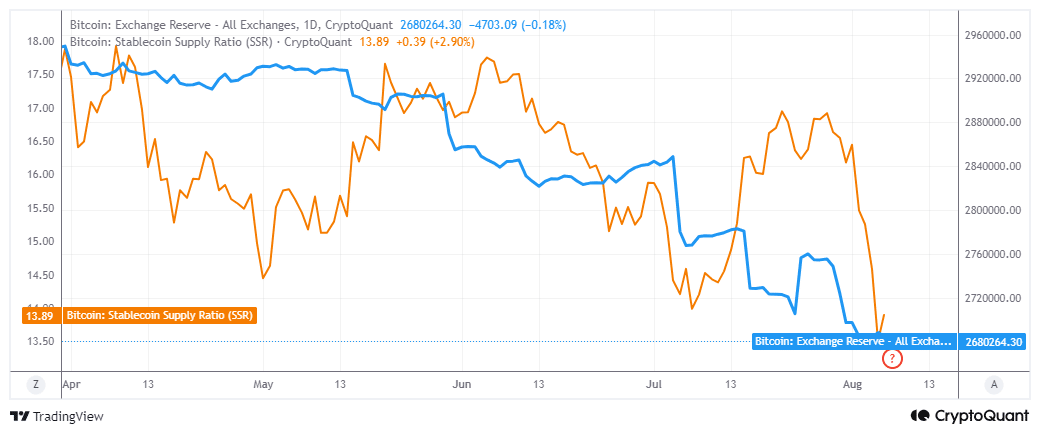

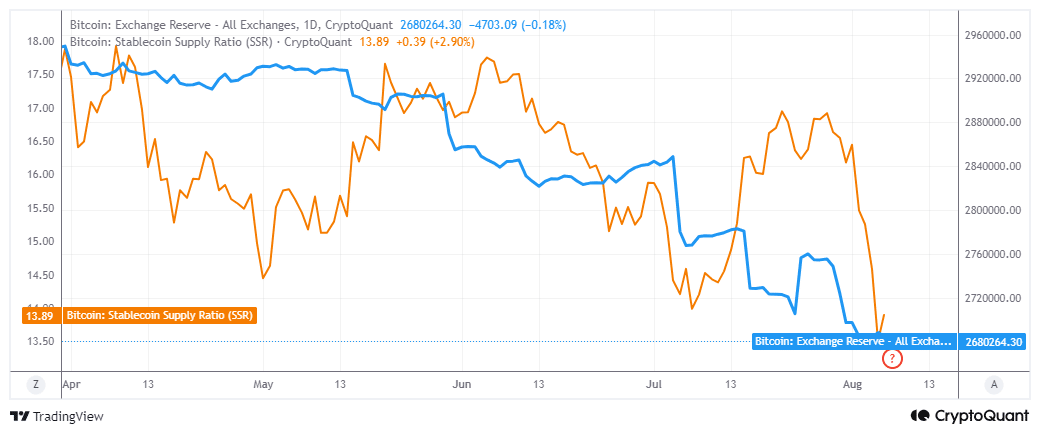

In Bitcoin’s case, a provide shock would happen if change reserves dropped to excessive lows. On the identical time, demand would possibly stay fixed or soar larger.

Such a state of affairs would probably result in an imbalance in favor of a speedy upside.

Bitcoin’s conduct throughout the newest crash provided some indication {that a} provide shock could be across the nook.

The primary main signal supporting this expectation was the commentary that the Bitcoin change reserves indicator is now decrease than it was final week.

The truth is, it solely leveled out throughout the crash with out a noteworthy uptick, regardless of the huge surge in promote aspect strain.

Supply: CryptoQuant

AMBCrypto did, nonetheless, observe a spike within the Bitcoin stablecoin provide ratio within the final two days after its earlier decline.

This was an vital commentary as a result of each time this indicator went up prior to now, it was accompanied by a BTC value rally. It might thus mark the star of one other reduction rally for the cryptocurrency.

Bitcoin velocity pivots

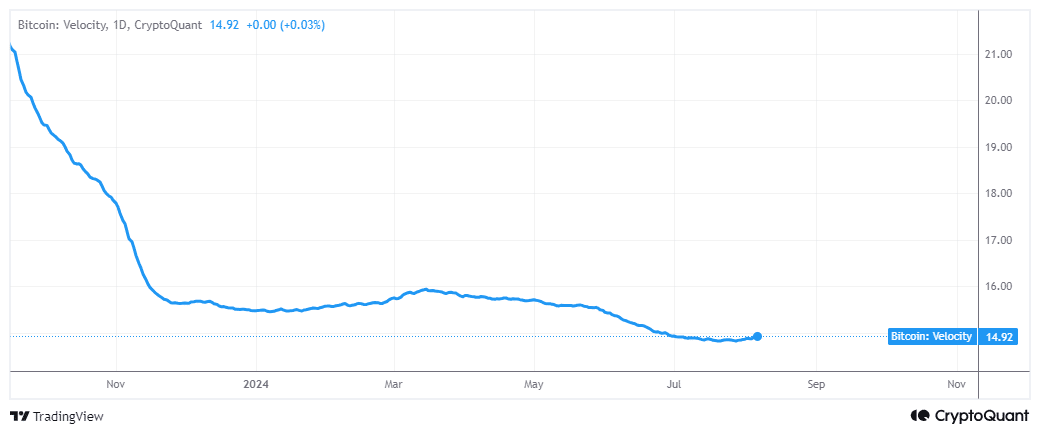

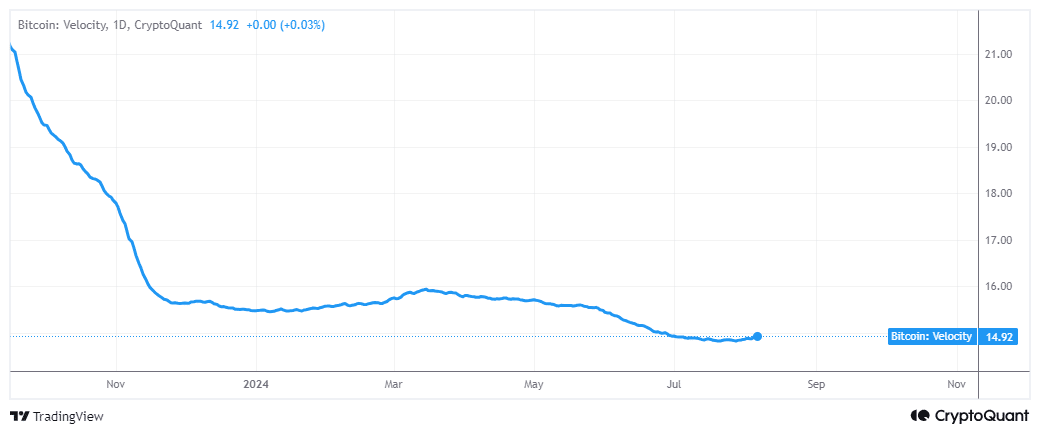

There are a number of the explanation why Bitcoin velocity (the speed at which it exchanges fingers) adjustments. A peak in pleasure, whether or not unfavorable or constructive, might result in extra velocity.

When liquidity flows out of the market and BTC demand goes low, the rate tends to dip.

The final main uptrend began in 2020 when pleasure and liquidity began flooding into crypto. It peaked in August 2022 after the FTX crash and stablecoin depeggings that occurred that 12 months.

The newest surge in BTC velocity began in January and resulted in March as liquidity examined the waters, resulting in some uptrend.

Supply: Cryptoquant

Bitcoin’s velocity, at press time, signaled a pivot to the uptrend. If this uptrend is sustained, it could point out that BTC is headed for one more season of pleasure and extremely risky value adjustments.

This can all rely on the extent of liquidity available in the market.

However what would occur available in the market, there was a powerful Bitcoin velocity surge?

Nicely, the truth that the BTC provide on exchanges retains declining signifies that there’s sturdy long run bullish optimism, largely as a result of ETFs at the moment are concerned, and loopy excessive predictions are but to be achieved.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Greater velocity mixed with sturdy demand might play out in favor of the bulls. It could additionally probably be accompanied by giant dips, identical to the one which occurred lately.

Enormous value actions would happen if a provide shock, probably pushing up Bitcoin’s velocity.