A broadly adopted crypto analyst says that he’s recognized when Bitcoin (BTC) may attain its cycle excessive if historical past have been to repeat itself.

In a brand new technique session, crypto dealer Rekt Capital tells his 481,200 followers on the social media platform X that the highest crypto asset by market cap tends to peak 518-546 days after its halving occasion, which happens in April each 4 years.

“Within the 2015-2017 cycle, Bitcoin peaked 518 days after the halving. Within the 2019-2021 cycle, Bitcoin peaked 546 days after the halving.

If historical past repeats and the following bull market peak happens 518-546 days after the halving… That might imply Bitcoin may peak on this cycle in mid-September or mid-October 2025.”

Nonetheless, Rekt Capital notes that because of the newest crypto market crash, the crypto king’s price of acceleration has drastically fallen.

“Earlier this 12 months, Bitcoin was accelerating on this cycle by 260 days. Presently nevertheless, due to this over 3-month consolidation, this price of acceleration has drastically dropped and is now roughly 150 days.

The longer Bitcoin consolidates after the halving, the higher it will likely be for resynchronizing this present cycle with the normal halving cycle.”

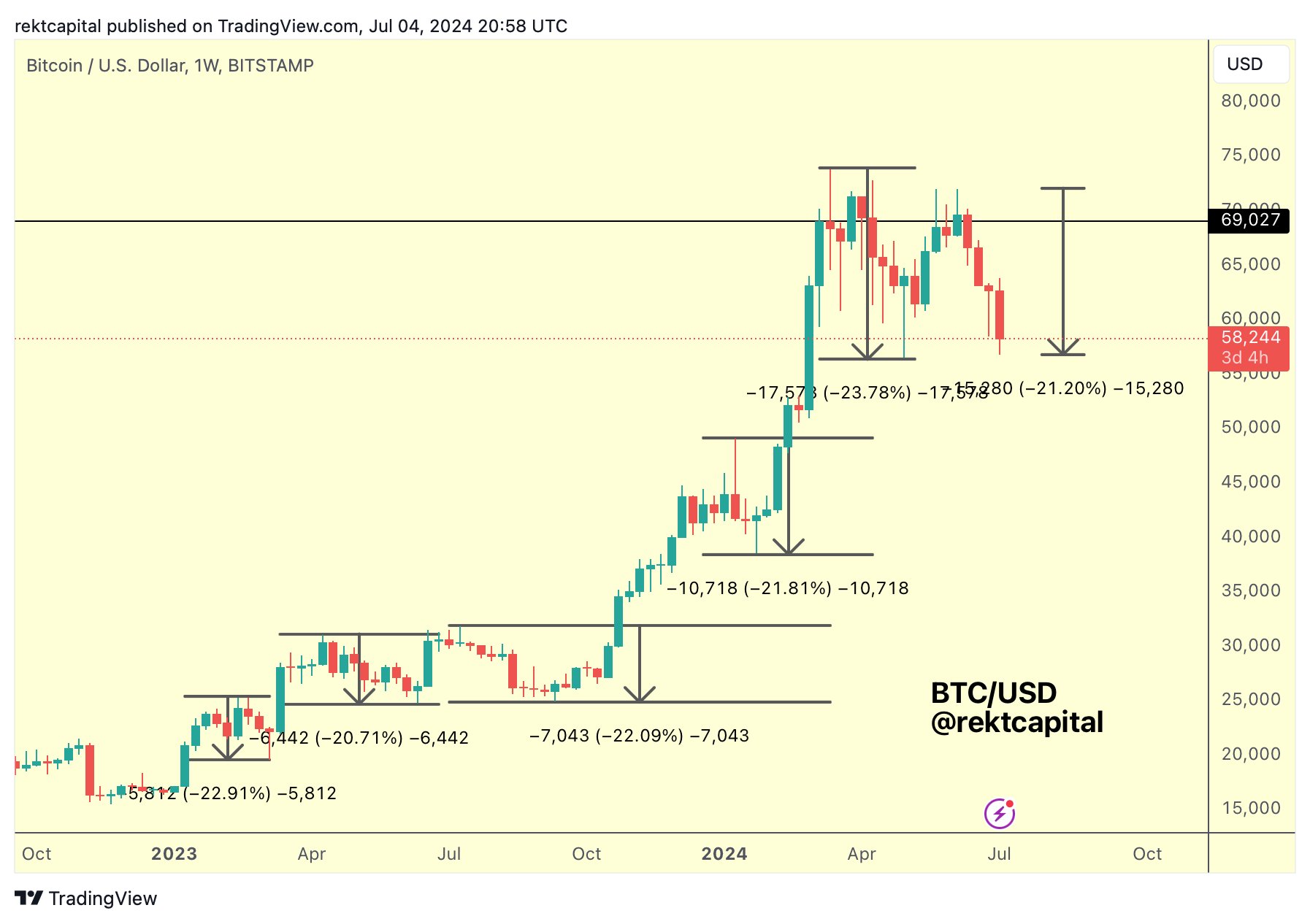

The dealer goes on to make the case that BTC has seemingly bottomed out by comparing all BTC pullbacks since February 2023.

“Here’s a record of all Bitcoin pullbacks relationship to the bear market backside of 2022:

- -23% (February 2023).

- -21% (April/Could 2023).

- -22% (July/September 2023).

- -21% (January 2024).

- -23.6% (April/Could 2024).

- -21% so far (June 2024) Common retrace on this cycle is -22%.

Subsequently this present pullback is nearly a mean -22% correction.”

Bitcoin is buying and selling for $56,521 at time of writing, a 2.6% lower over the last 24 hours.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on X, Facebook and Telegram

Surf The Every day Hodl Combine

Generated Picture: Midjourney