- Evaluation confirmed that worry has gripped the Bitcoin market.

- BTC continued to interrupt important help ranges.

The latest downtrend in Bitcoin’s [BTC] costs has stirred unfavorable sentiments amongst merchants, leading to substantial liquidation volumes.

Regardless of these setbacks, patrons have continued dominating the market, sustaining their positions regardless of losses.

Concern dominates Bitcoin’s sentiment

Evaluation of the BTC worry and greed index on Coinglass indicated that the market was experiencing a excessive degree of worry, with the index at round 29 at press time.

This urged a major prevalence of worry amongst merchants and traders.

Additionally, worry has maintained dominance in over 33% of the observations, making it the prevailing sentiment within the present market development.

The dominance of worry is additional underscored by the excessive quantity of liquidation. This helps clarify why this cautious sentiment is so distinguished.

Extra lengthy positions get liquidated

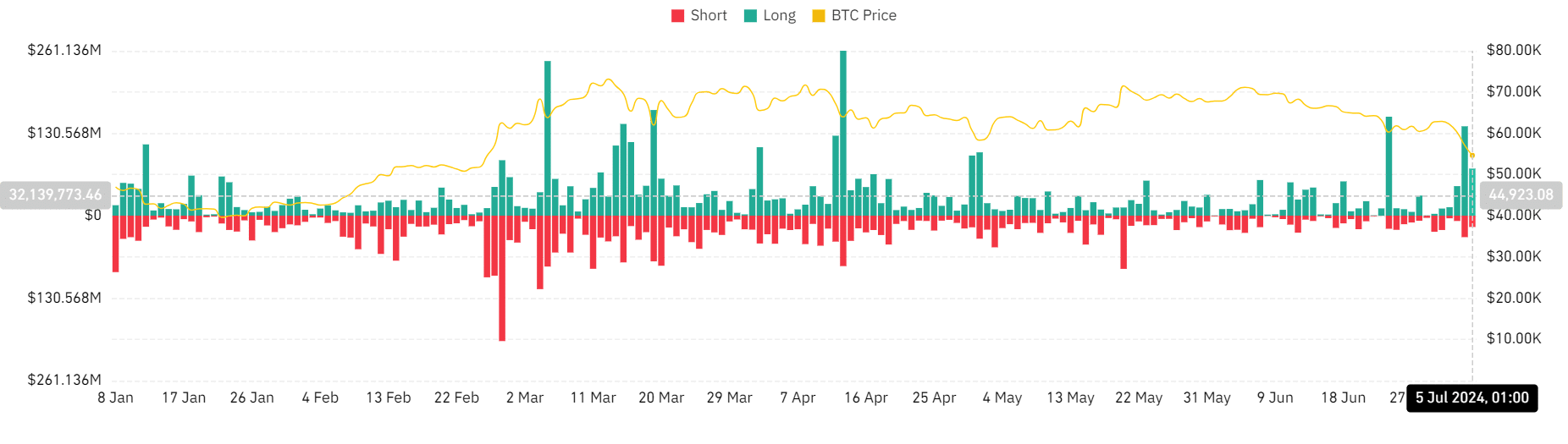

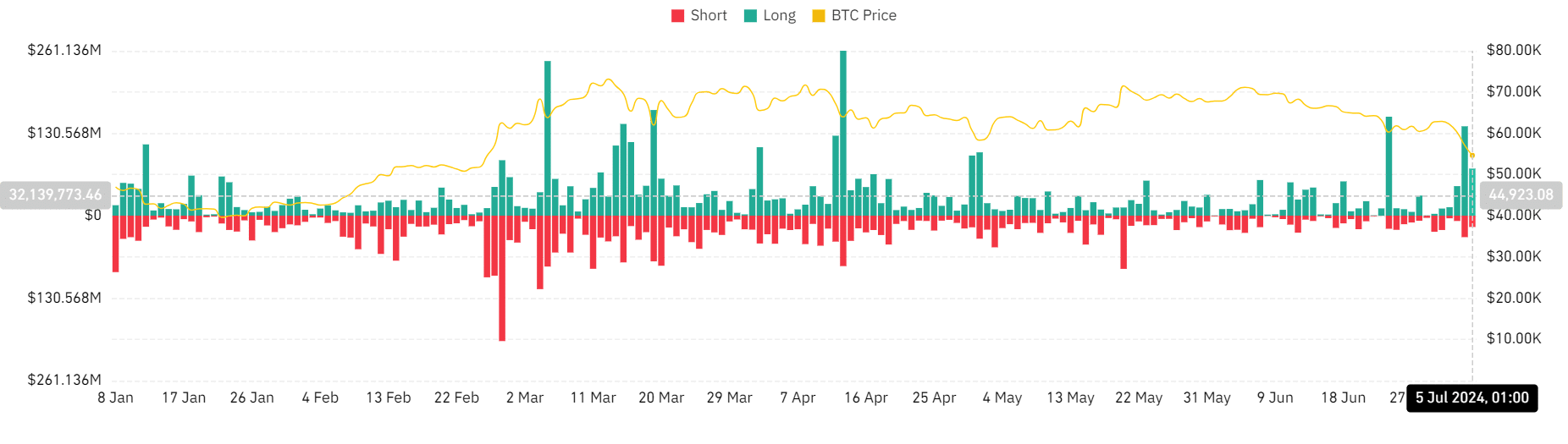

AMBCrypto’s evaluation of Bitcoin’s liquidation volumes revealed that over the previous 24 hours, greater than $256 million has been liquidated.

This era has predominantly seen lengthy positions being liquidated, with essentially the most quantity.

Supply: Coinglass

Particularly, on the 4th of July, lengthy liquidations have been almost $142 million, whereas brief liquidations have been about $34 million, totaling over $170 million.

This quantity represented the second-highest liquidation quantity in latest months. At press time, the lengthy liquidation quantity is over $73 million. Additionally, the brief liquidation quantity has exceeded $16 million.

There was a decline within the spinoff quantity for Bitcoin during the last 24 hours as properly. At press time, the amount was roughly $29 billion, down from over $31 billion recorded on the 4th of July.

This discount in buying and selling quantity is a key issue contributing to the present place of the BTC worry and greed index.

Bitcoin continues to say no

AMBCrypto’s evaluation of Bitcoin on a every day time-frame has highlighted why the BTC worry and greed index is at present dominated by worry.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

We famous that BTC was buying and selling with a decline of over 5%, priced at round $54,240 as of this writing. It concluded the earlier buying and selling session with an analogous decline of over 5%.

Supply: TradingView

This marked the primary occasion in additional than six months when BTC has skilled consecutive every day declines exceeding 5%. This has contributed considerably to the prevailing market worry.