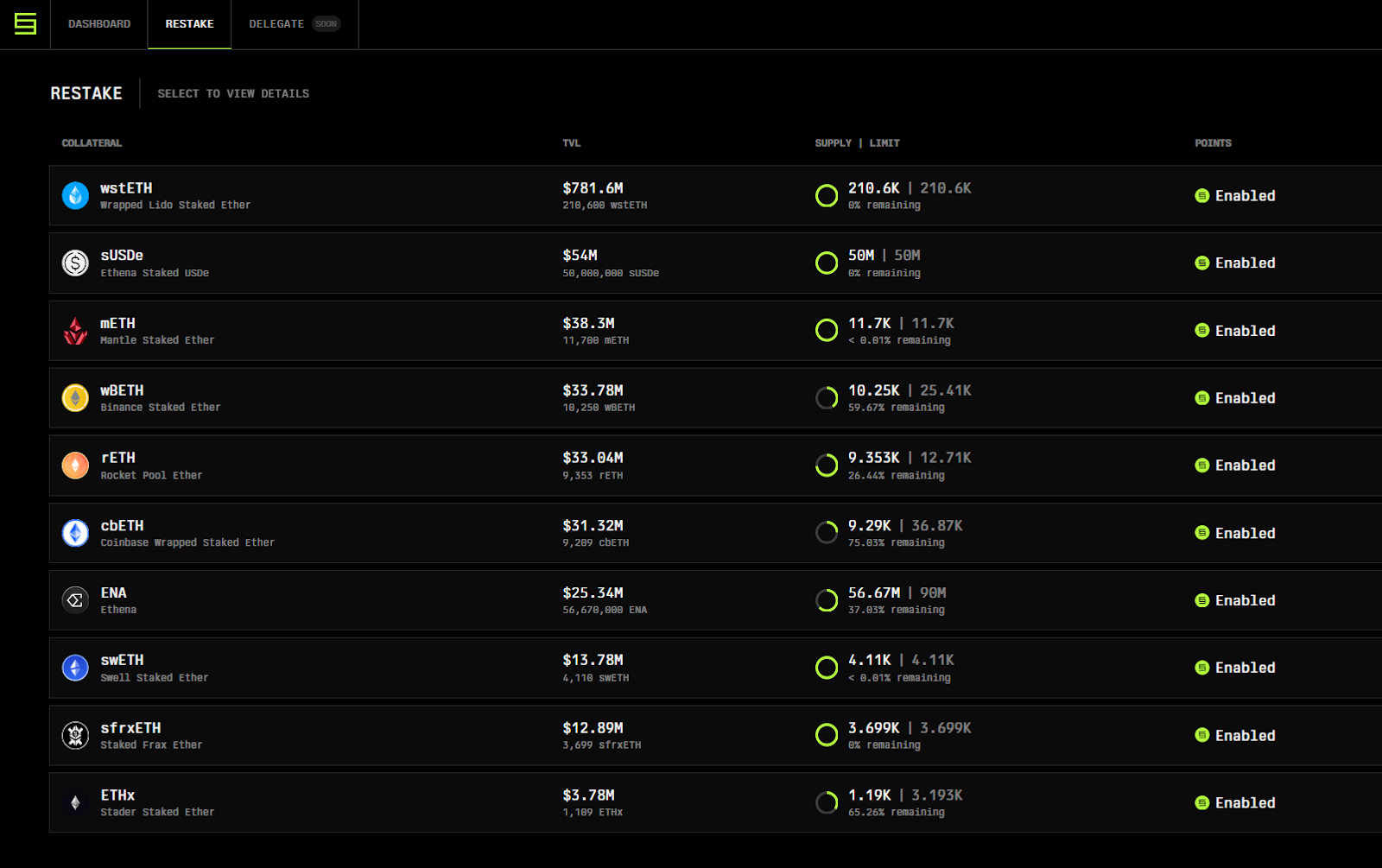

Yesterday, the well-known Symbiotic withdrawal protocol elevated the deposit restrict of its swimming pools to 210,600 wstETH, as a part of the scaling path.

Extremely, customers invested $800 million in crypto in simply 4 hours, reaching most availability.

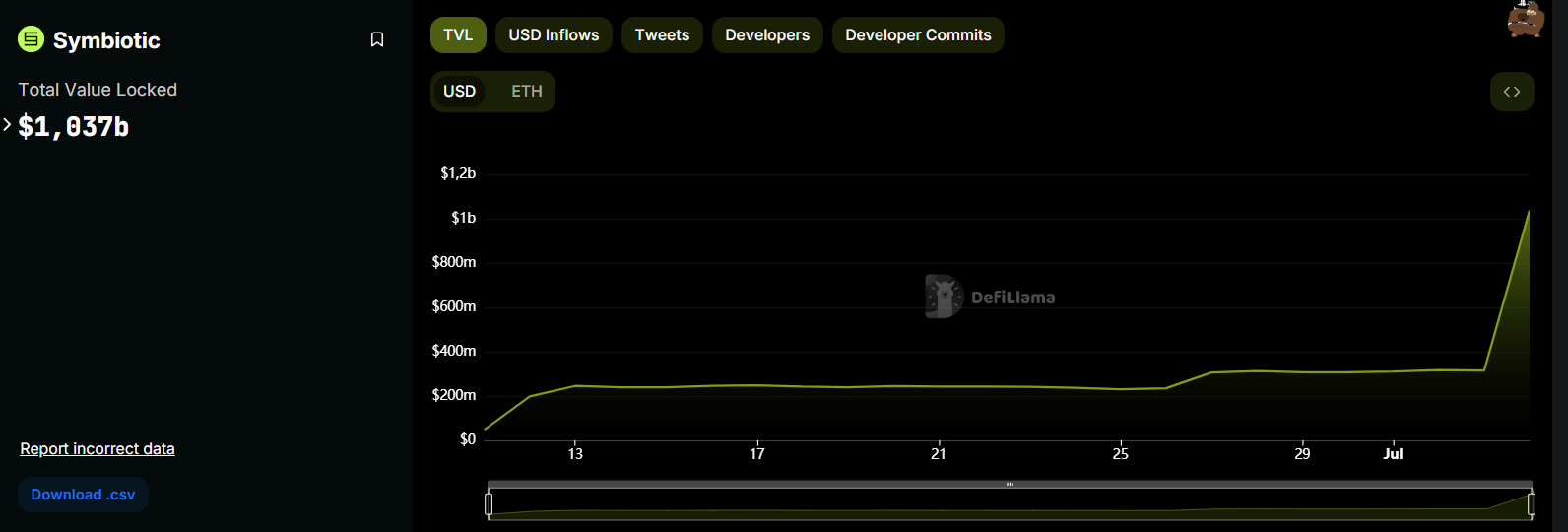

For instance, Symbiotic’s TVL has crossed the billion greenback threshold, thanks partially to the assistance of an airdrop incentive program.

The venture is getting nearer to competitor EigenLayer and threatens to cut back its market share.

Let’s examine all the small print beneath.

Symbiotic will increase the deposit restrict and fills $800 million in 4 hours

Yesterday, Symbiotic’s resumption protocol elevated the deposit restrict of its swimming pools, in view of the widespread scaling course of.

Intimately: the venture has added 210,600 wstETH to its deposit restrict to supply everybody the chance to take part.

Extraordinary, the restrict was reached in simply 4 hours, including $800 million in liquidity. We’re speaking about an enormous circulate of capital, captured on the price of $200 million per hour.

The Symbiotic staff celebrated the superb end result on X and reminded the neighborhood that new limits will probably be added any more.

These are the phrases used to explain the continued work:

“Extra sources will probably be added as we proceed with the preliminary scaling of the protocol”.

After 4 hours, Symbiotic’s wstETH restrict of 210,600 has been reached.

Different belongings can nonetheless be staked and limits will enhance over time.

Extra sources will probably be added as we proceed with the preliminary scaling of the protocol.— Symbiotic (@symbioticfi) July 3, 2024

Symbiotic is at present in a start-up part that features the combination of renewed ensures and rewards with factors campaigns for customers.

Like EigenLayer, Symbiotic goals to unravel the challenges of community safety by reallocating ether stakes capital.

On the time of writing, the wstETH pool is absolutely stuffed, as are these in sUSDe, mETH, swETH, and sfrxETH.

Nonetheless, I stay accessible for the remaining pool, denominated in wBETH, rETH, cbETH, ENA and ETHx.

Supply: https://app.symbiotic.fi/restake

We remind you that, as reported by CrunchBase, Symbiotic has raised a whopping $5.8 million within the “seed capitalpart.

The venture is backed by the well-known VC Paradigmgenerally known as a profitable investor and for having participated in a number of airdrops of latest tokens.

Among the many proponents of the protocol, charged with accelerating the event of the platform, we additionally discover Cyber.Fund.

The battle within the recovering sector: EigenLayer, Karak and Symbiotic

After the rise in Symbiotic’s deposit cap, instantly stuffed by the customers, the TVL of the protocol has handed the US$1 billion threshold.

With the newest enhance in inner liquidity of $800 million, the venture now threatens the way forward for different opponents resembling EigenLayer and Karak.

At present, EigenLayer leads the restorative market with a complete worth of $16.18 billion. Karak’s belongings, then again, quantity to $833 million.

Each have seen a slight decline of their market share after the arrival of Symbiotic.

Supply: https://defillama.com/protocol/symbiotic?denomination=USD

Symbiotic distinguishes itself from its foremost opponents by its extra versatile methodpermitting the withdrawal of a variety of ERC-20 sources resembling ENA, along with numerous LST and stablecoin.

Nonetheless, on EigenLayer, all direct deposits (in any foreign money) are transformed into ETH to take part within the withdrawal.

From an interoperability perspective, Symbiotic is proscribed as a result of it solely works on the Ethereum community (like EigenLayer), whereas Karak options multichain availability.

All three initiatives are preventing to take management of the battle of reconquest by providing numerous incentives resembling airdrop factors and bonus charges.

The true driver of change for Symbiotic is the flexibleness of its infrastructure: along with permitting stakes on a variety of tokens and increasing the extent of safety, it provides a random customization.

Certainly, the identical operators can select probably the most acceptable approach to handle rewards and scale back the stakes.

It is usually price noting how the venture makes use of immutable contracts, i.e. non-upgradeable contracts: this considerably reduces governance dangers whereas providing much less freedom of motion for the neighborhood.

Everybody: Hey the place is the residual analysis 😡?

Poopman: locked and loaded 🔒🔄This is a preview of “The Restaking Struggle, 2024”

Full investigation SOON,

Thanks for all of your help 🙏 pic.twitter.com/u2z2bk41np— Poopman (💩🧱✨) (@poopmandefi) July 1, 2024

We’re eagerly awaiting the launch of the primary AVS (Actively Validated Providers) on Symbtioc.

New airdrop incentives: farming on Mellow, Etherfi, Swell and Renzo

As talked about, Symbiotic can also be working an airdrop marketing campaign along with EigenLayer and Karak with the intention of producing site visitors from new customers.

The protocol goals to draw as a lot capital as potential in order that it could profit extra from the usage of ether and develop the ecosystem quicker.

As an incentive, Symbiotic is providing factors that can later be transformed into the platform’s subsequent native token.

The launch is anticipated within the third quarter of 2024, i.e. within the coming months, and the valuation of the useful resource may simply exceed a billion {dollars} at TGE.

I’ve completely no insider perception into Symbiotic.

But it surely appears like they’ll launch in direction of the top of the summer season and probably a Symbiotic airdrop might be tradable earlier than $OWN. pic.twitter.com/tVcAcdVeMX

–Ignas | DeFi (@DefiIgnas) June 11, 2024

Within the monetary world, the phrases ‘bull’ and ‘bear’ are sometimes used to explain market developments. A ‘bull’ market is characterised by rising costs, whereas a ‘bear’ market is characterised by falling costs. Understanding these ideas is vital for traders.

A number of third-party protocols have introduced partnerships with Symbiotic to supply a lift in airdrop rewards, to drive adoption of the platform.

Amongst these, the title of Comfortable finance instantly stands out, an utility supported by the chief of liquid staking Lido Finance.

On Mellow we will already deploy sources to completely different vaults, permitting us to farm each Mellow Factors and Symbiotic Factors on the identical time.

Nonetheless, we remind you that so long as the restrict of Symbiotic will not be elevated additional, we won’t acquire Symbiotic Factors, however a 1.5x multiplier on Mellow Factors.

It’s nonetheless a wonderful approach to anticipate when new deposits will probably be reopened beneath the withdrawal protocol, as you may be given precedence over new customers.

Symbiotic has pushed its boundaries at present. To Mellow depositors who have been queuing, congratulations! You have got reached the primary window and now earn 1x Symbiotic and 1x Mellow factors.

Select your favourite danger curator for the following restrict enhance: https://t.co/OjKZohaDOQ

You… pic.twitter.com/QKl8UnuMXO

— Mellow Protocol (@mellowprotocol) July 3, 2024

Additionally, Etherfi has introduced its vault in partnership with Symbiotic.

The Vault provides the flexibility to concurrently edit Etherfi’s season 3 airdrop, Veda’s, and certainly Symbiotic’s.

It is a wonderful incentive as a result of we’re speaking a couple of very stable and established utility within the DeFi panorama.

For Season 3, we remind you that Etherfi has allotted an quantity of fifty million ETHFI tokens, price 115 million {dollars}.

The season formally began on July 1 and ends in September.

The Tremendous Symbiotic LRT is now absolutely redeployed and prepared for extra ETH to earn these candy @symbioticfi factors 😋

Monkey in swords! https://t.co/hWAyClFsuL https://t.co/2Xh11uxv8d

— ether.fi (@ether_fi) July 3, 2024

Additionally the protocols Swell and Renzo present strategies to wager on Symbiotic and revel in extra rewards for his or her respective airdrop phases.