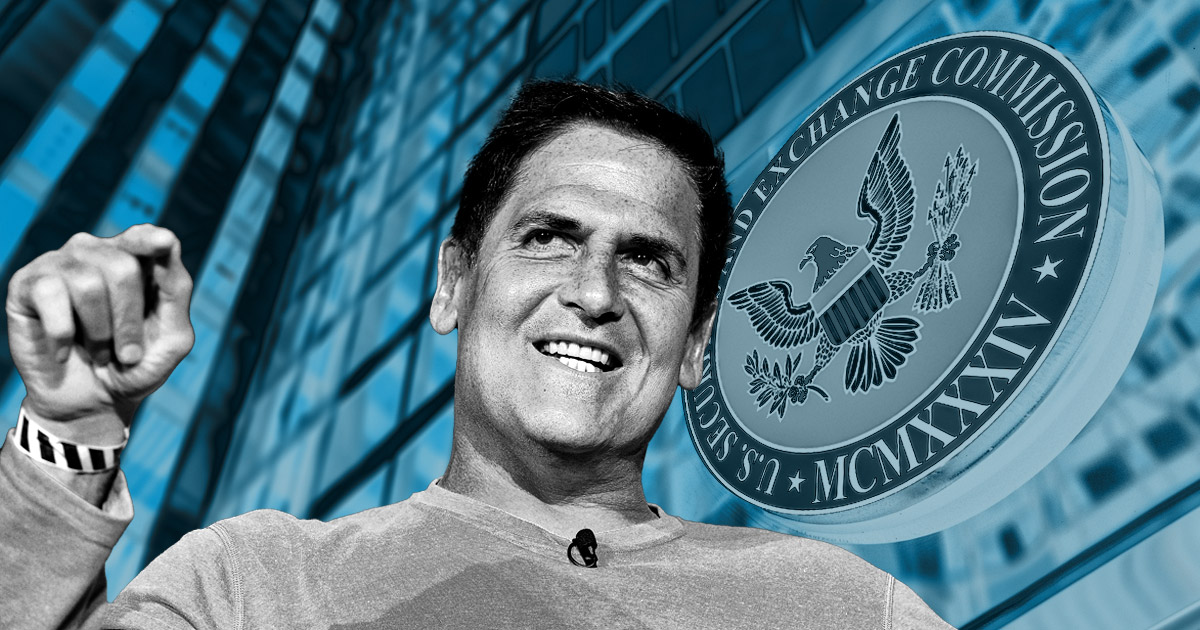

Billionaire investor Mark Cuban has urged the US Securities and Alternate Fee (SEC) to switch Type S-1 so token-based corporations can simply register with the authorities.

Cuban’s suggestion follows SEC Commissioner Mark Uyeda’s footnote describing the company’s present method to crypto disclosure filings as “problematic.”

Type S-1

Type S-1 is the registration assertion that the SEC requires home issuers to file to supply new securities publicly. The shape consists of important firm info akin to enterprise operations, danger components, and different vital particulars concerning the product choices. Any firm searching for to commerce its safety shares on a nationwide change just like the New York Inventory Alternate should file the shape.

Uyeda identified that almost all crypto issuers have distinctive traits which may not match the data at present required in Type S-1.

“Many of those issuers and crypto digital belongings have traits for which Type S-1 could technically require info that’s not related or relevant, however doesn’t require sure info that could be materials.”

Uyeda additional famous that the Fee’s present method “neither facilitates capital formation nor protects buyers.”

So, Uyeda proposed that the SEC enable variances for the Type S-1 filings of crypto digital belongings, much like these for funds, insurance coverage merchandise, and different securities. Uyeda believes this method might result in choices with extra related materials info for crypto and its issuers.

Uyeda added:

“[Such an approach may have] the accompanying investor safety and cures beneath the Securities Act.”

Crypto neighborhood agrees

In a July 2 social media publish, Cuban supported Uyeda’s view, stating:

“The problem isn’t that crypto corporations don’t wish to register. The problem is that it’s like attempting to place a sq. peg in a spherical gap. It doesn’t match. Which is why there’s not a single token-based firm that’s registered and working.”

Equally, the US Blockchain Affiliation praised Uyeda’s assertion because the considerate engagement wanted by the business. They mentioned:

“That is precisely what the business wants — considerate engagement by the SEC to make sure innovation thrives whereas shoppers are protected.”