- Bitcoin’s RSI indicated potential rebounds for altcoin market, particularly RUNE, RNDR, and ADA.

- Regardless of market lows, technical analyses steered that choose altcoins may supply promising funding alternatives.

The cryptocurrency market, significantly the altcoin sector, has skilled a big downturn after reaching a peak market capitalization of $1.28 trillion in March.

Not too long ago, the market cap dipped beneath the $1 trillion mark, signaling a bearish part that has left many buyers cautious.

Bitcoin RSI Says BTFD

Nevertheless, this era of decline may current shopping for alternatives, as indicated by key technical evaluation from notable crypto analysts.

Sheldon The Sniper, a well-regarded determine within the crypto evaluation neighborhood, has highlighted how Bitcoin’s Relative Energy Index (RSI) can be utilized to establish potential purchase zones.

This consists of altcoins like THORChain [RUNE], Render Token [RNDR], and Cardano [ADA].

In accordance with Sheldon, when Bitcoin’s RSI dips into sure ranges, it typically precedes rallies in choose altcoins.

This has been noticed with the likes of RUNE and ADA, which traditionally present robust recoveries when their RSI readings fall beneath 40% on the weekly charts.

This means that regardless of the broader market’s struggles, there are pockets of potential that would profit astute buyers.

As of press time, Bitcoin was buying and selling at $60,746, with a 1.5% lower within the final 24 hours, and its RSI had reached a important zone that would point out an impending shift in market sentiment.

Analyzing altcoins: Cardano as a case examine

Whereas Sheldon has highlighted RUNE, RNDR, and ADA as potential buys, it might solely make sense to delve into considered one of these altcoin fundamentals to confirm if they really current enticing funding alternatives.

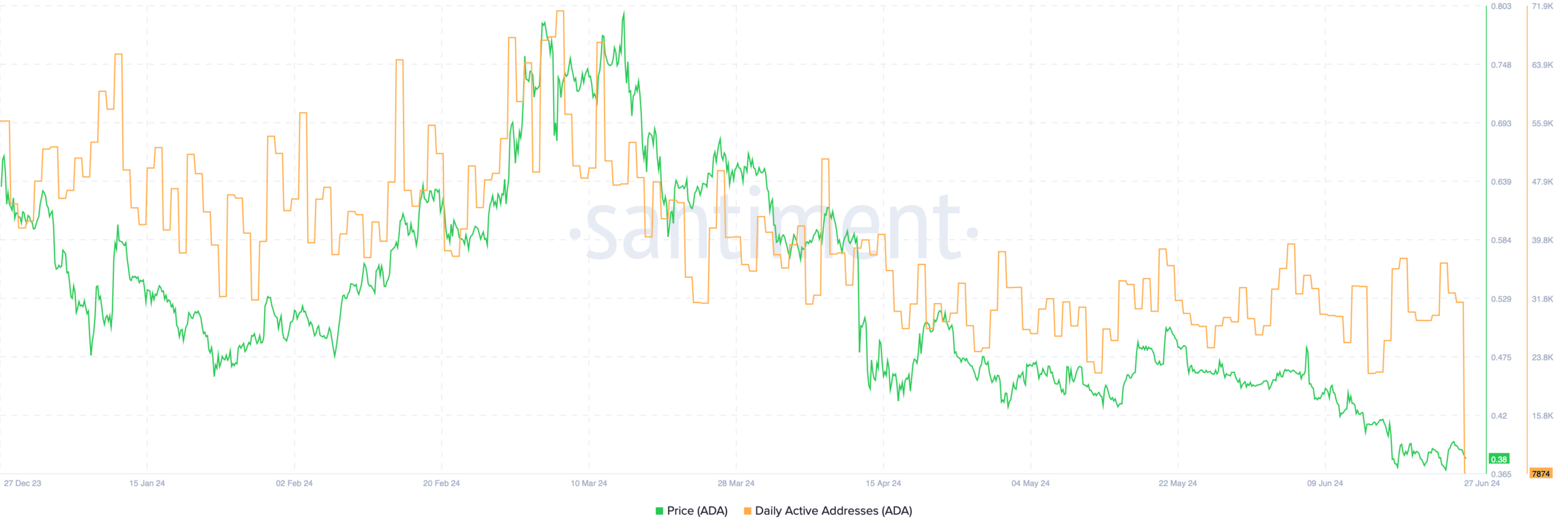

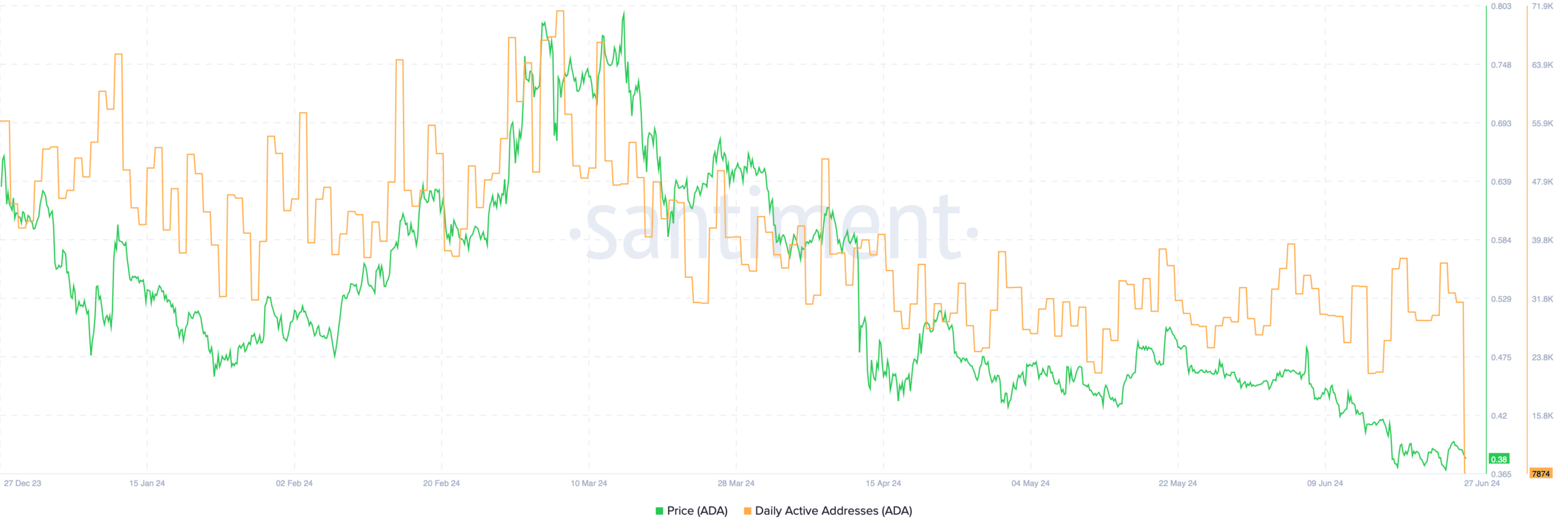

Now, utilizing Cardano as a case examine. Data from Santiment indicated that Cardano’s day by day lively addresses have considerably decreased, falling from 36,000 on the twenty fourth of June to simply beneath 8,000 not too long ago.

This sharp discount steered diminishing community exercise, which might negatively affect ADA’s worth.

Supply: Santiment

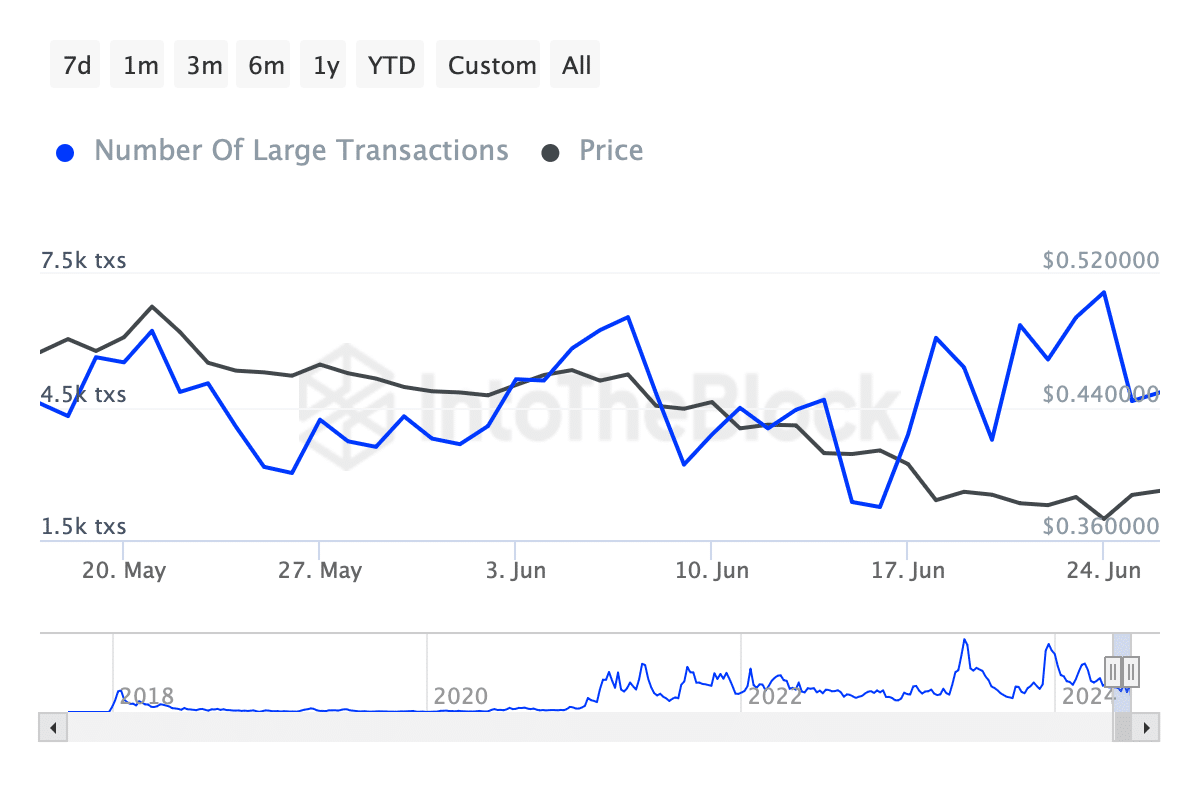

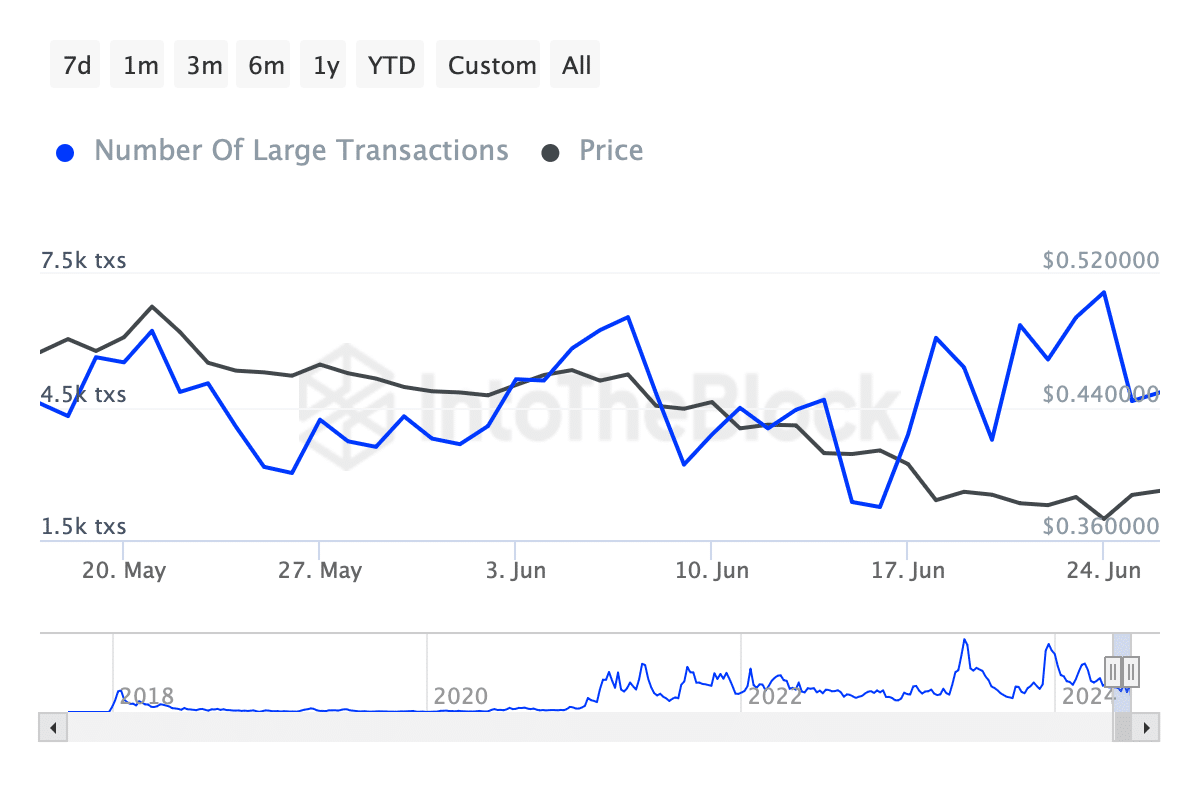

Moreover, IntoTheBlock data reveals that large-scale buyers, or whales, could at present discover ADA much less enticing.

The variety of transactions exceeding $100,000 has declined from 7,000 on the twenty fourth of June to 4,000 at press time, signaling a possible withdrawal of investor curiosity.

Supply: IntoTheBlock

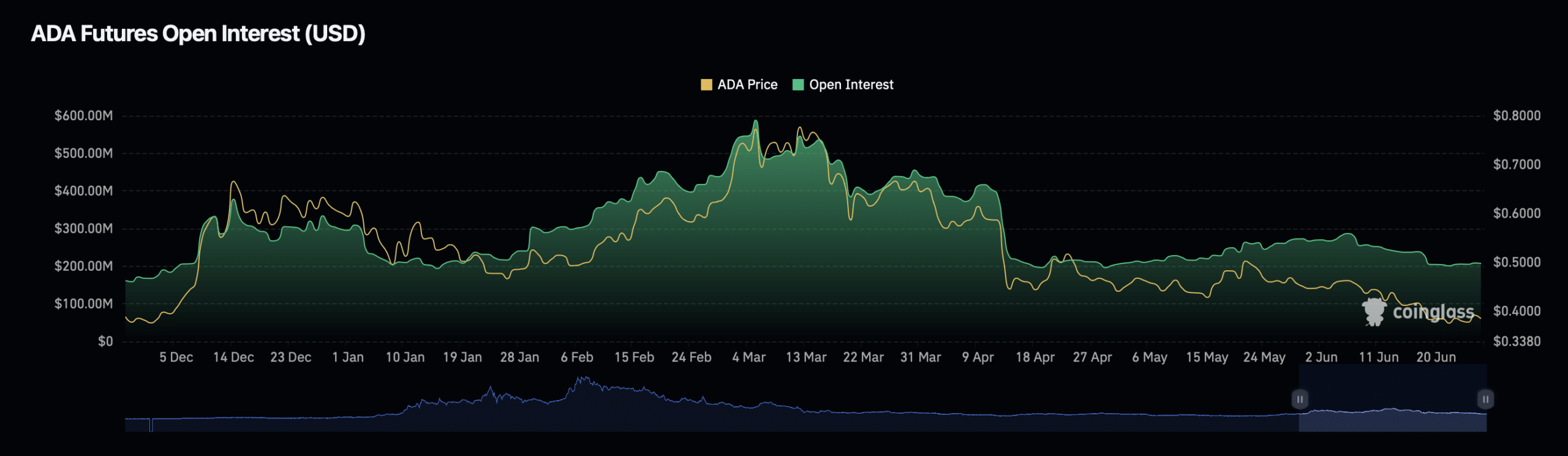

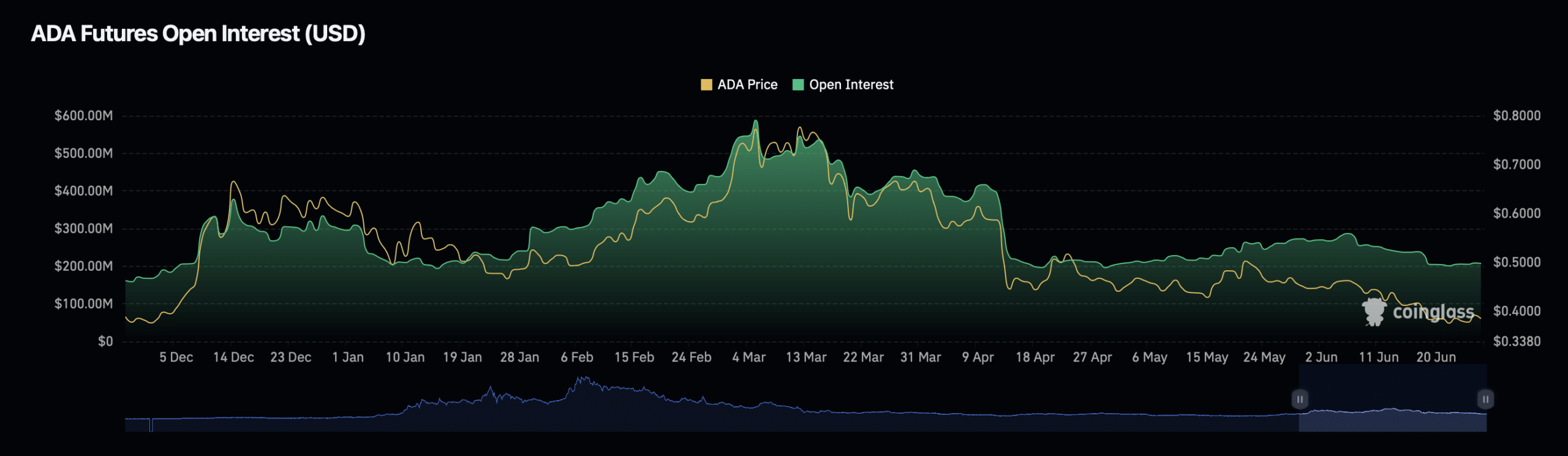

This pattern is mirrored within the asset’s Open Curiosity, which, in accordance with Coinglass, has decreased by 2.74% previously day to $203 million.

Conversely, there was a big improve in Open Curiosity quantity, which surged practically 50% to $307 million, indicating blended market alerts.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

These downward traits in key metrics not solely steered a worth decline but in addition have positioned about 74% of ADA holders at a loss, as reported by AMBCrypto.

This example poses a important query: will this result in elevated promoting stress?