- BTC miners have despatched fewer cash to exchanges over the previous few weeks

- In response to a CryptoQuant analyst, they could be ready for the coin’s worth to rally to promote at a revenue

Bitcoin’s [BTC] miner-to-exchange exercise has declined over the previous few weeks, regardless of the spike within the quantity of cash held in miners’ wallets on the community. This was one of many findings of pseudonymous CryptoQuant analyst The Kriptolik.

In response to the analyst, BTC miner reserves have climbed to a two-week excessive too. This represents the quantity of cash held in affiliated miners’ wallets. Its worth signifies the reserves that miners are but to promote. On the time of writing, these had a price $117 billion at prevailing market costs.

BTC’s ongoing poor worth efficiency has led to a development of miners refraining from offloading a big quantity of their coin holdings on exchanges. Kriptolik additionally famous,

“Regardless of miner reserves reaching the best degree within the final two weeks, miners aren’t sending important quantities of BTC to exchanges to promote, as an alternative opting to build up because of the decline in BTC worth.”

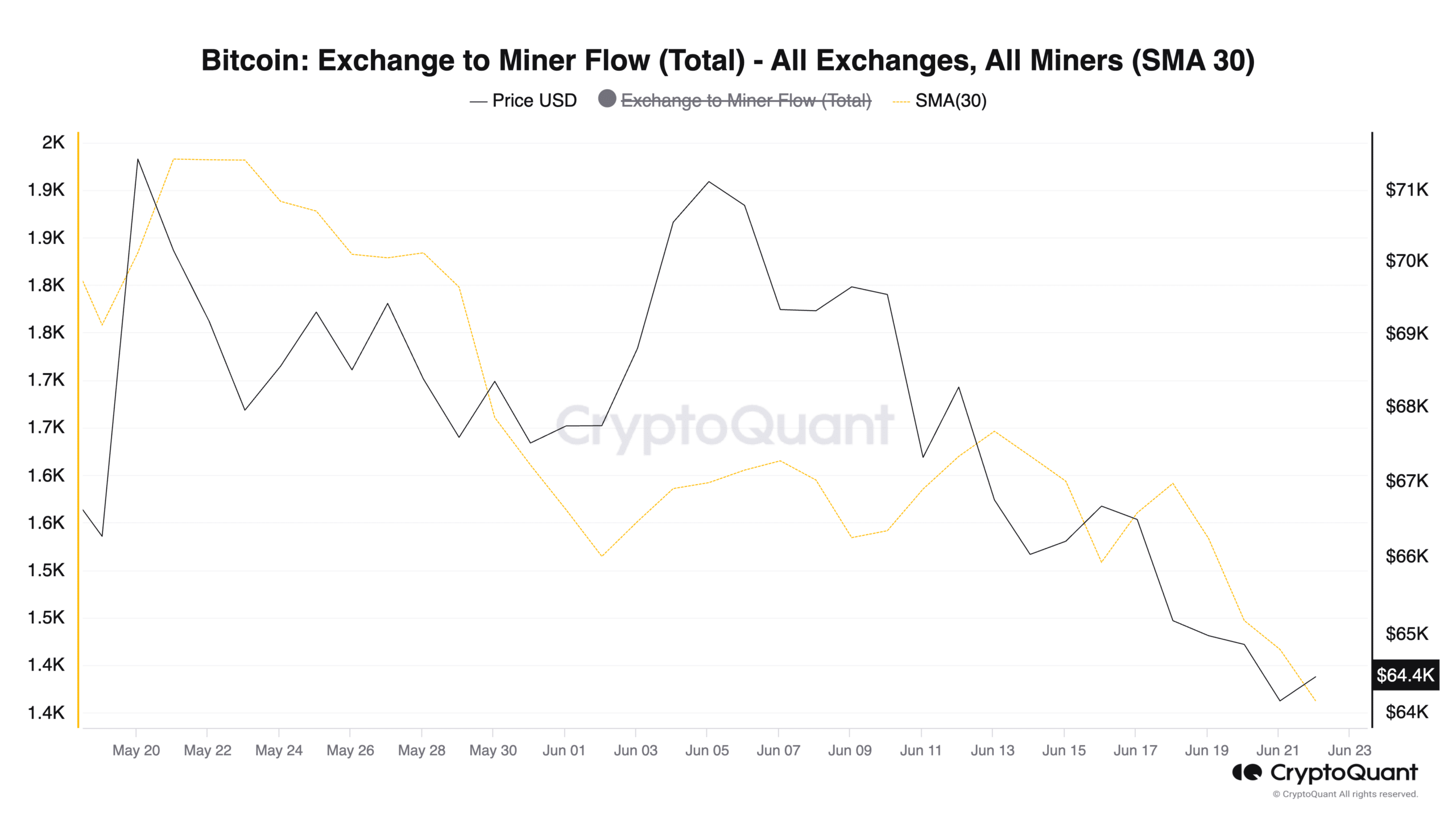

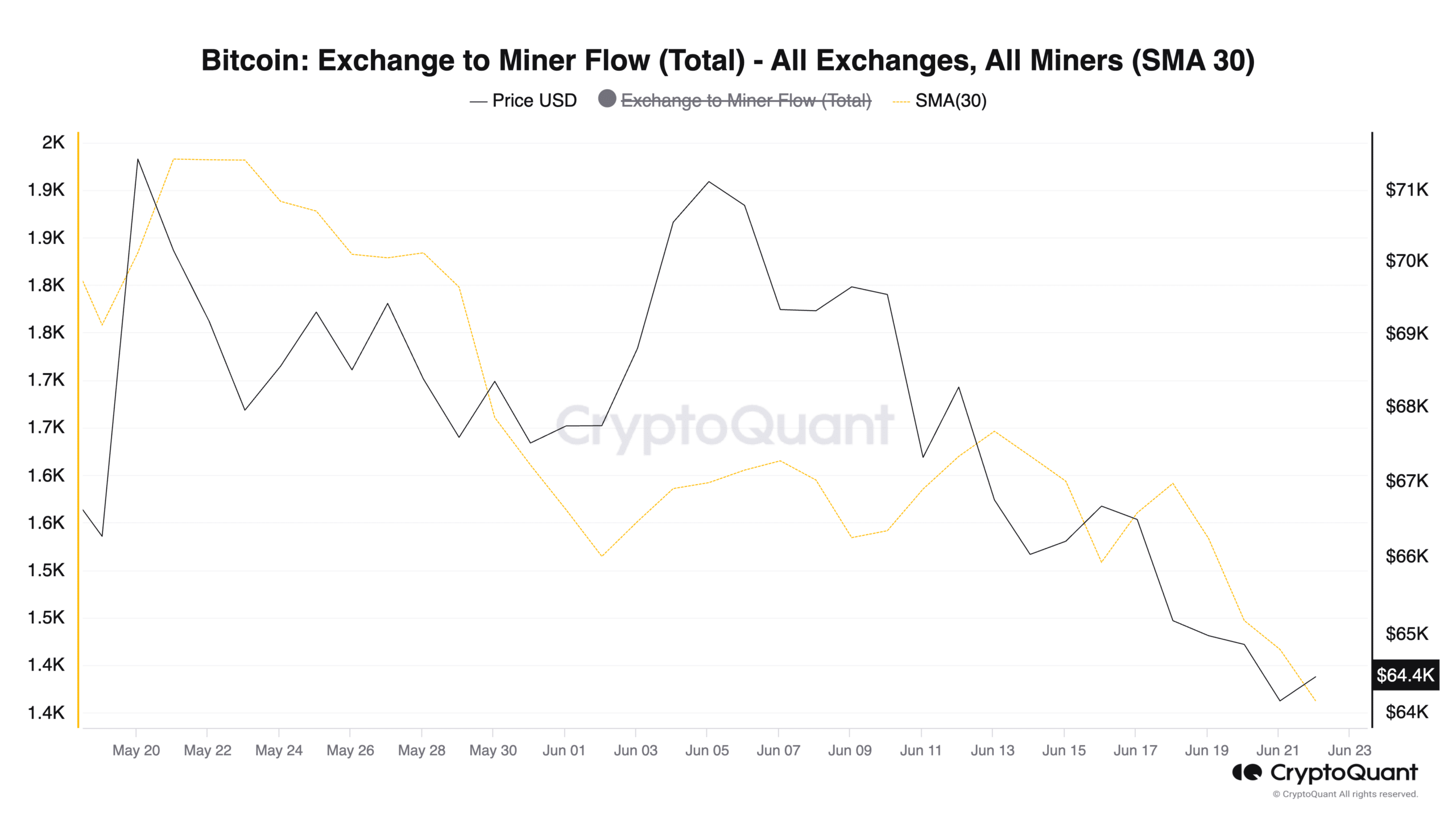

Assessed utilizing a 30-day transferring common, the BTC Miner to Alternate Stream has declined by 11% for the reason that starting of June. This metric tracks the quantity of BTC that miners are transferring from their mining wallets to cryptocurrency exchanges for onward gross sales.

Supply: CryptoQuant

This development means that BTC miners could also be ready for a worth surge, after which they’ll ship their coin holdings to exchanges for revenue. In actual fact, the analyst went on to say,

“This means that there might be promoting strain from miners throughout a future Bitcoin uptrend.”

BTC vulnerable to additional decline

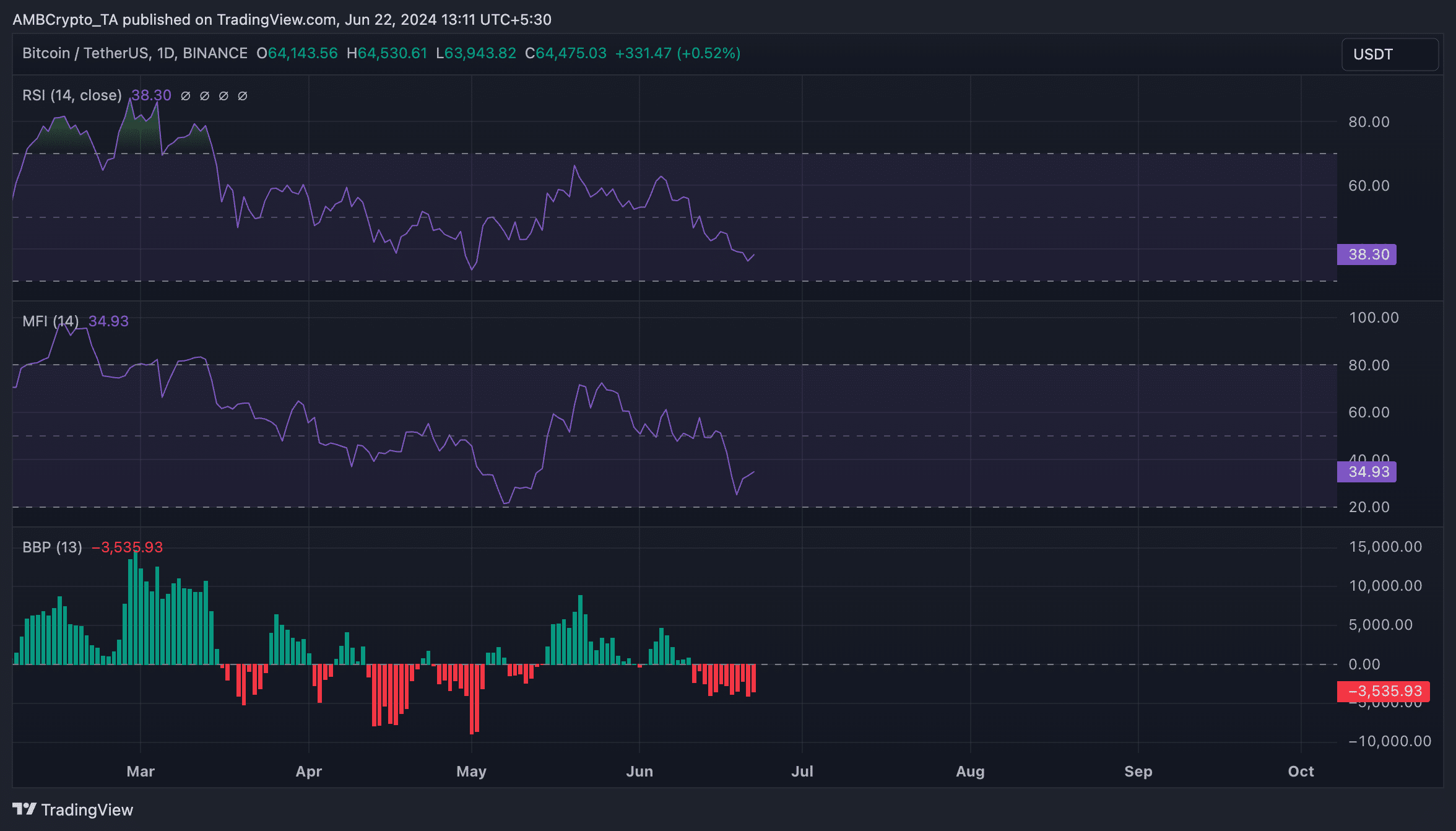

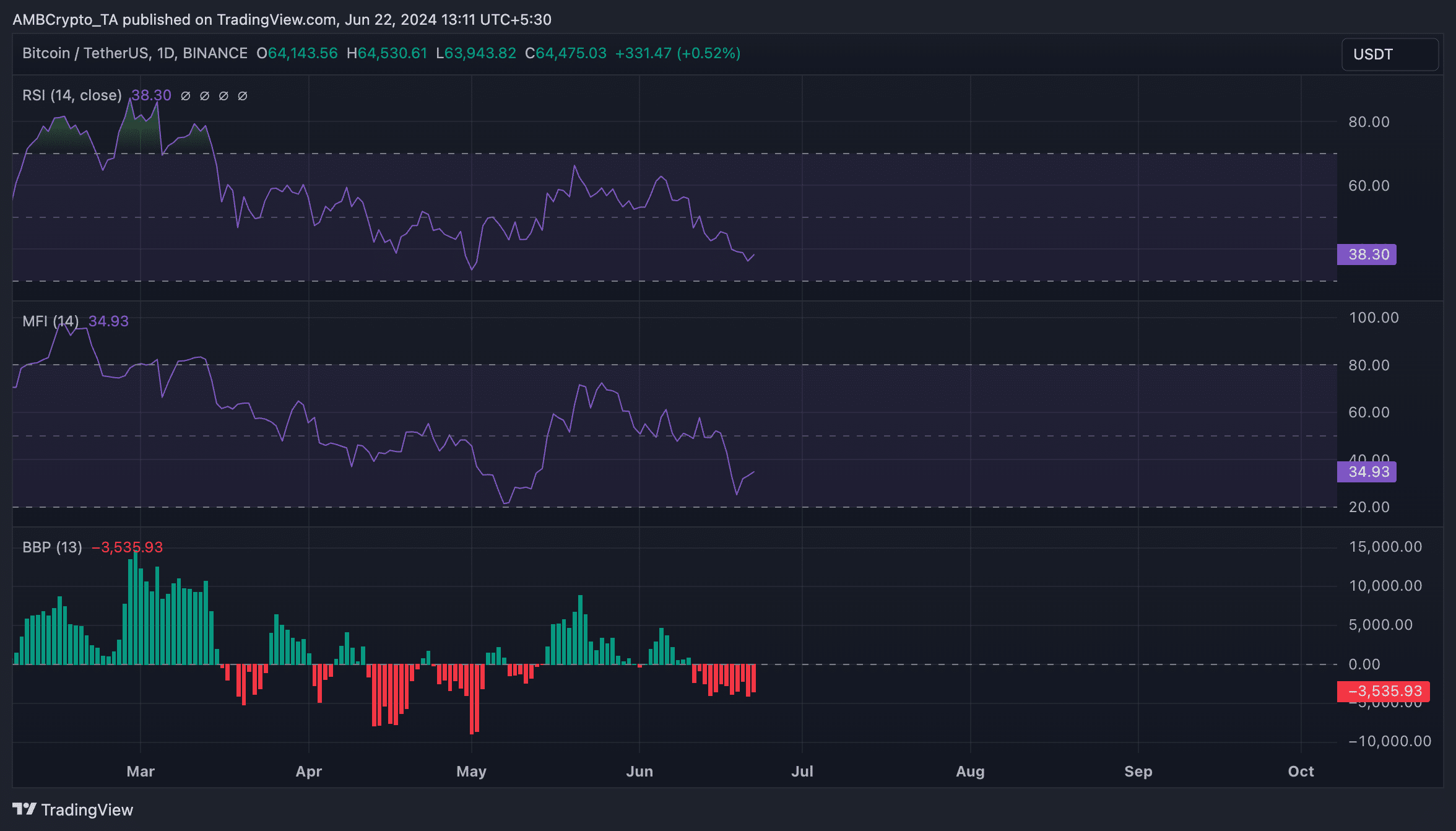

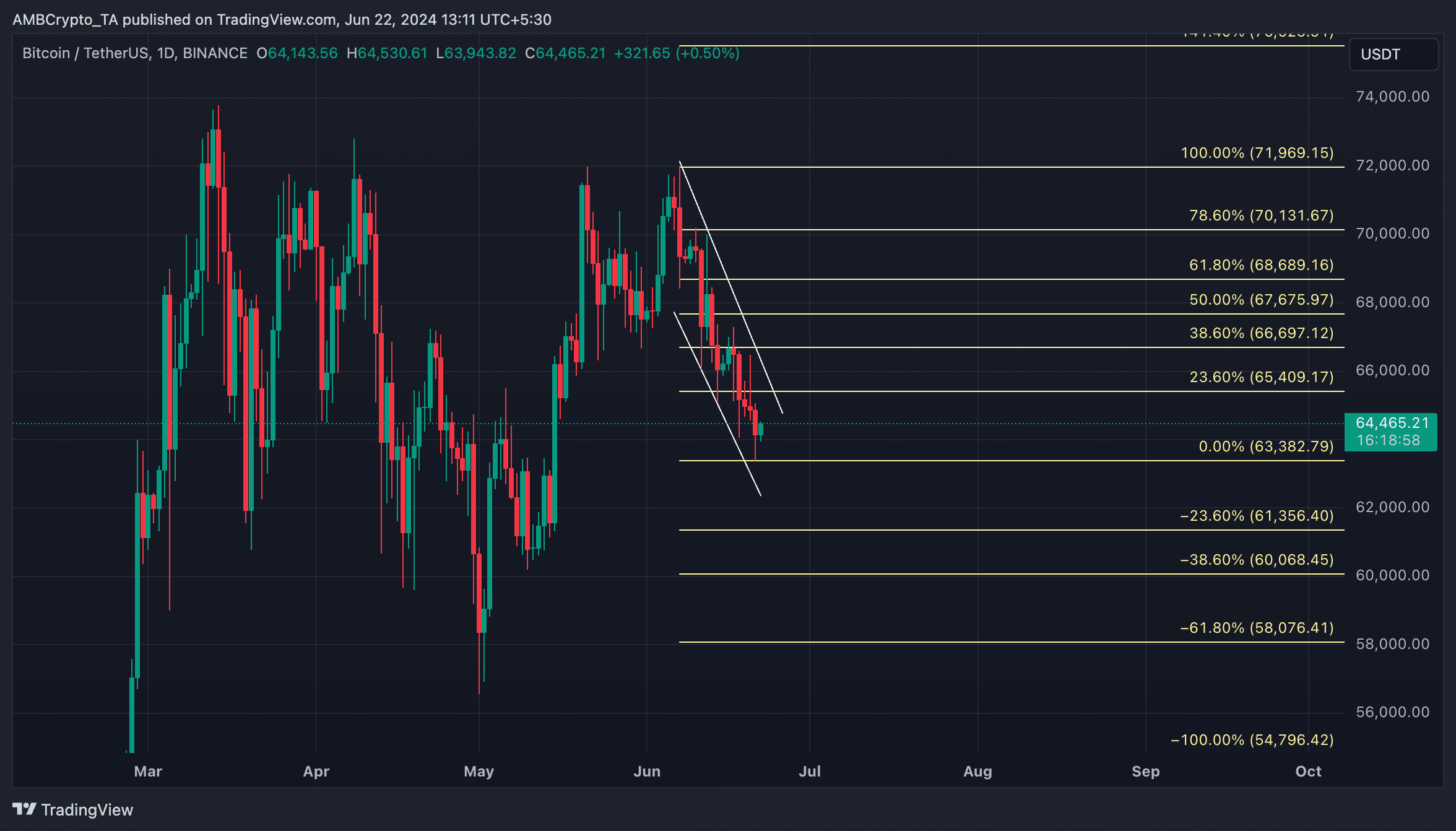

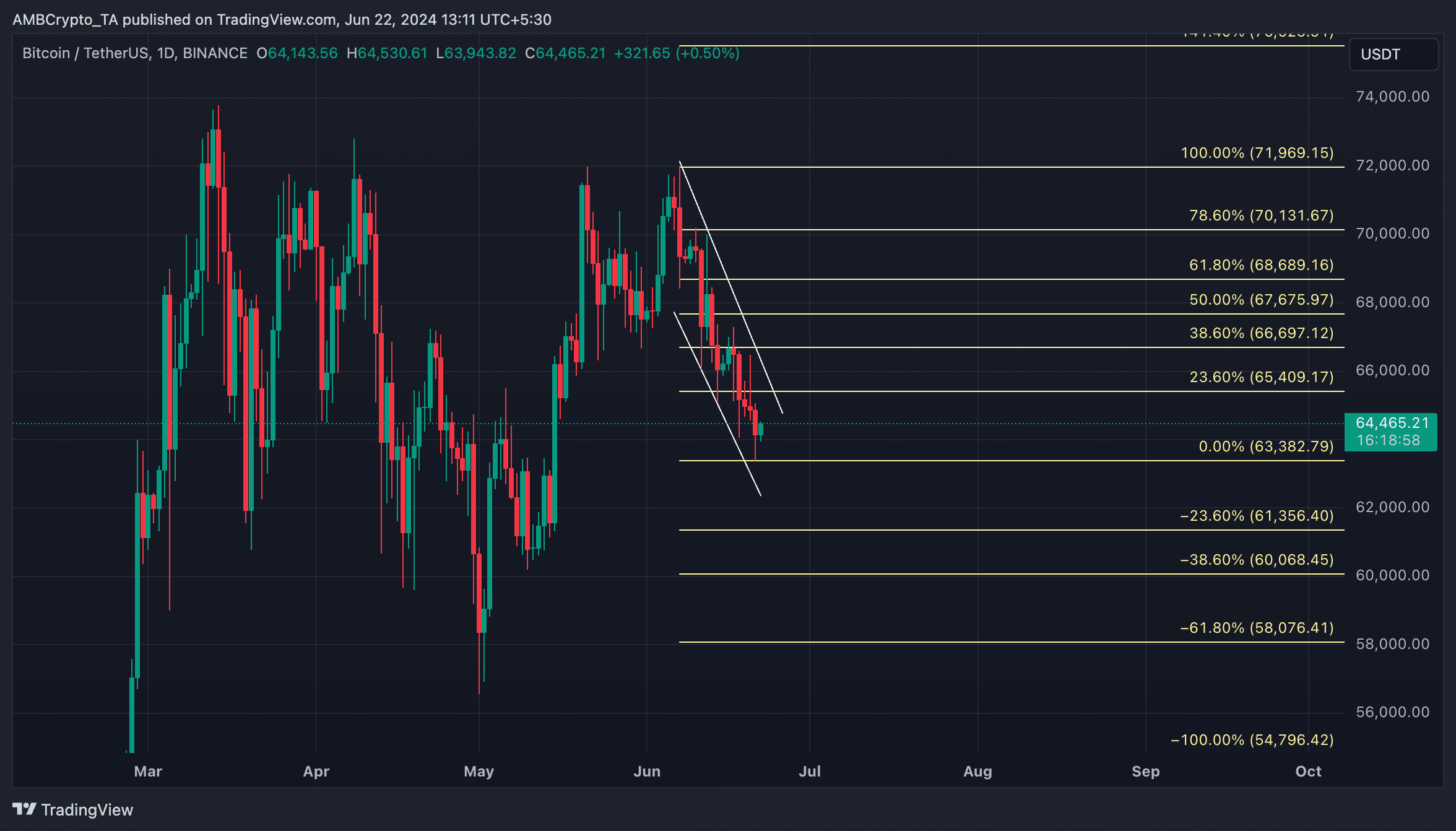

At press time, BTC was valued at $64,403. On a downtrend since 7 June, the king coin’s worth has trended inside a descending channel on the charts.

Its key momentum indicators had been positioned beneath their respective heart traces at press time. BTC’s Relative Energy Index (RSI) was 37.81, whereas its Cash Stream Index (MFI) was 34.89.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

At these values, these indicators revealed that BTC distribution outweighed accumulation amongst market contributors.

Confirming the bearish bias in the direction of the main asset, BTC’s Elder-Ray Index returned a damaging worth at press time. In actual fact, its worth has been damaging for the reason that downtrend started on 7 June.

Supply: TradingView

This indicator measures the connection between the power of patrons and sellers available in the market. When its worth is damaging, bear energy dominates the market.

Supply: TradingView

If the downtrend intensifies on the charts, BTC’s worth would possibly plunge to $63,382.