Decentralized derivatives protocol SynFutures has introduced plans to develop its market share and is contemplating a Coinbase Layer-2 community as its platform.

The corporate will allow its dedication to assist rising meme coin initiatives with incentives obtainable to the highest performers.

SynFutures Becoming a member of the Meme Coin craze

In a latest X-post, SynFutures introduced plans to develop its market attain on the Coinbase L2 community, Base. The decentralized derivatives protocol may even launch a six-week marketing campaign blitz known as ‘Memecoin Perp Summer time’.

This advertising technique focuses on increasing group asset listings. Based mostly on the submit, there are rewards or incentives for the meme communities that can enhance natural traction on Base.

“SynFutures will supply 100,000 USDC and future airdrop allocation to assist the expansion of rising token initiatives that meet eligibility necessities,” the excerpt reads.

Learn extra: 7 Finest Primary Chain Meme Cash to Watch in June 2024

The six-week marketing campaign, which began on Tuesday, June 18, will finish on July 29, 2024 and marks the tentative finish of Meme Perp Summer time. The eligibility standards stipulate that initiatives should have an ERC20 token on Base that doesn’t signify any underlying belongings. An energetic and engaged group and a monitor document of driving group traction with out the intention of pulling a rug are additionally necessities.

SynFutures got here to market as a decentralized perpetual futures protocol, permitting open and clear buying and selling. The V3 Oyster Automated Market Maker (AMM) launched the trade’s first unified AMM and permissionless on-chain order e book. SynFutures is backed by high buyers together with Pantera Capital, Polychain, Normal Crypto and HashKey.

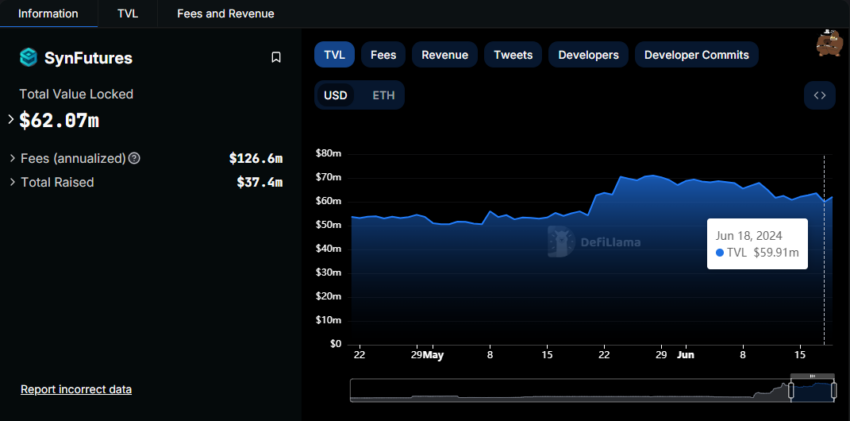

Protocol’s TVL will increase by greater than $2 million in 24 hours

This information precipitated the decentralized derivatives protocol’s Whole Worth Locked (TVL) to extend by over $2 million, from $59.91 million to $62.07 million between June 18 and 19.

The TVL metric measures the quantity of capital that customers have collectively deposited into good contracts inside a selected ecosystem. It’s a key indicator of exercise and adoption throughout the DeFi area.

Learn extra: What are perpetual futures contracts in cryptocurrency?

SynFutures TVL. Supply: DefiLlama

SynFutures’ rise to prominence got here as startups capitalized on the implosion of Sam Bankman-Fried’s (SBF) crypto empire, FTX. Particularly, this demise created the necessity for extra clear, decentralized types of crypto buying and selling.

“It is inconceivable for us to make use of a again door on the market. With every fund you can ask your self: how are the funds doing? What’s the actual value you’re buying and selling at? What’s the actual liquidity restrict,” Rachel Lin, co-founder and CEO of SynFutures, stated in a 2023 Reddit submit.

The protocol turned engaging to merchants as a result of all transactions facilitated by SynFutures happen on-chain and customers’ funds are saved in self-custodial wallets.