- Bitcoin Coinbase Premium Index is now constructive.

- This alerts a spike in coin accumulation by US-based traders.

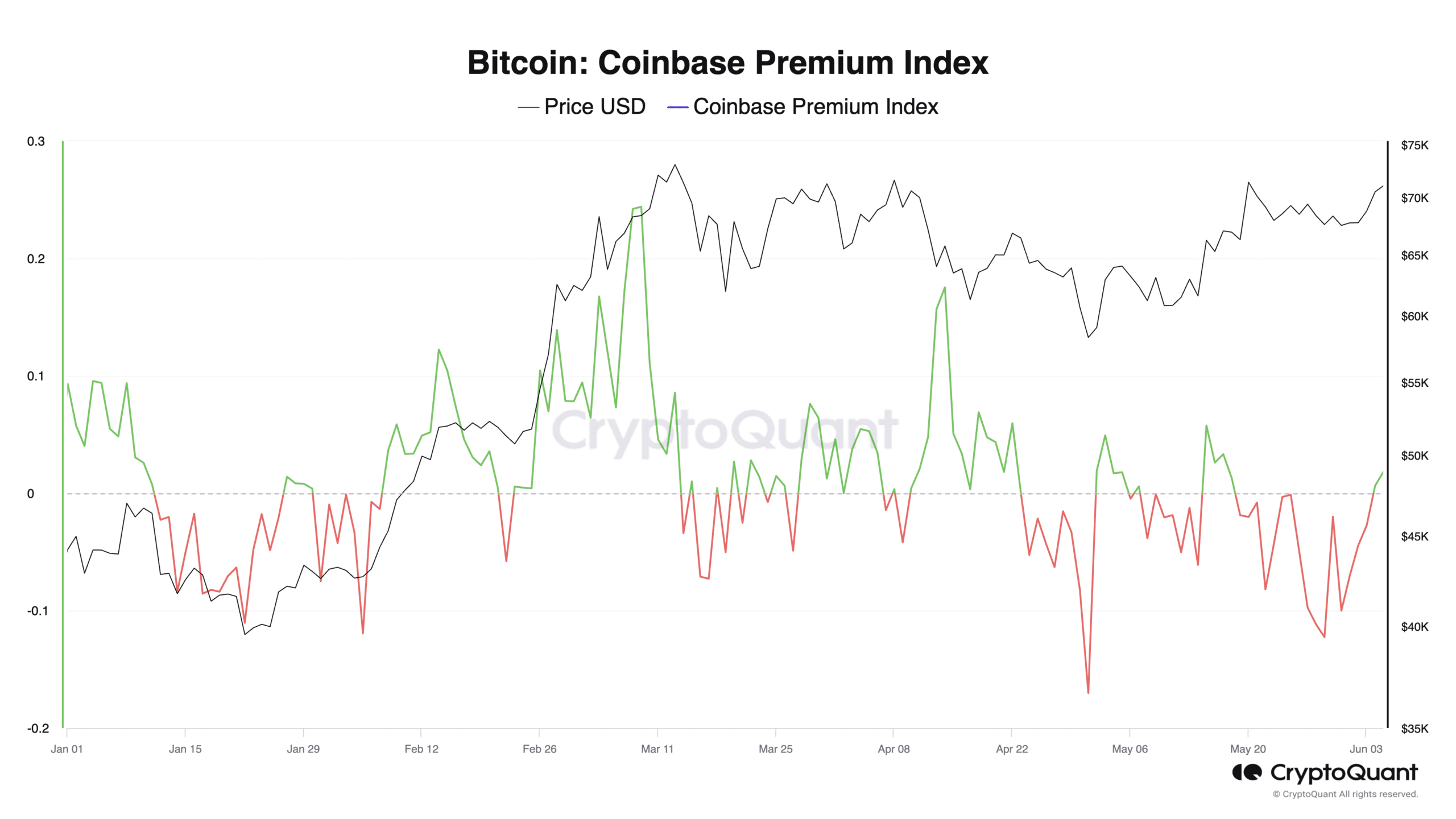

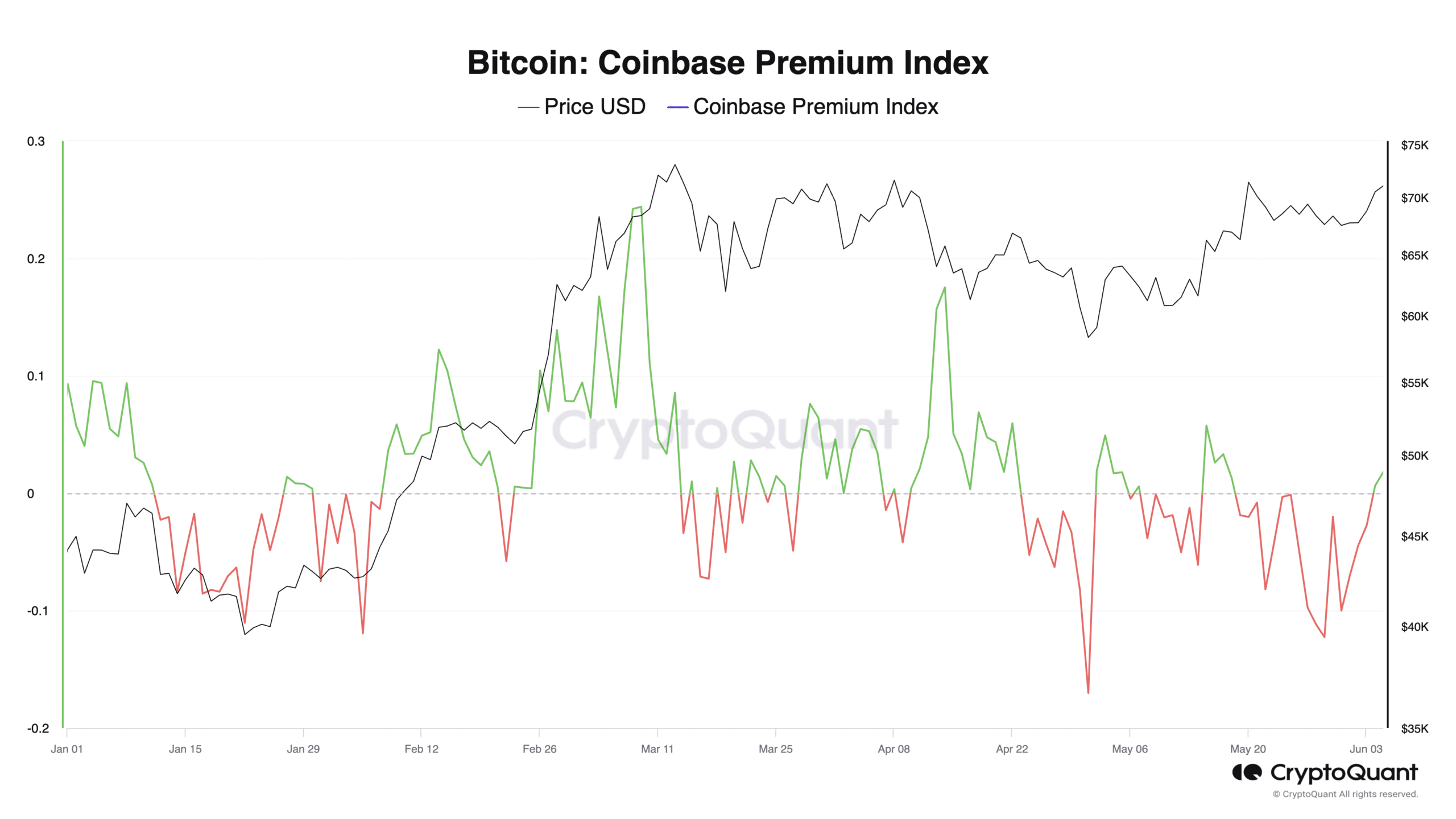

Bitcoin’s [BTC] Coinbase Premium Index (CPI) has turned constructive after returning destructive values for about ten days, pseudonymous CryptoQuant analyst BQYoutube has present in a brand new report.

This metric measures the distinction between BTC’s costs on Coinbase and Binance. When its worth is constructive, it means that the coin is priced increased on Coinbase in comparison with Binance. It’s interpreted to imply sturdy shopping for curiosity from US-based traders.

Conversely, when it declines, and its worth is destructive, it alerts much less buying and selling exercise on the US-based change.

At press time, BTC’s CPI was 0.006.

Supply: CryptoQuant

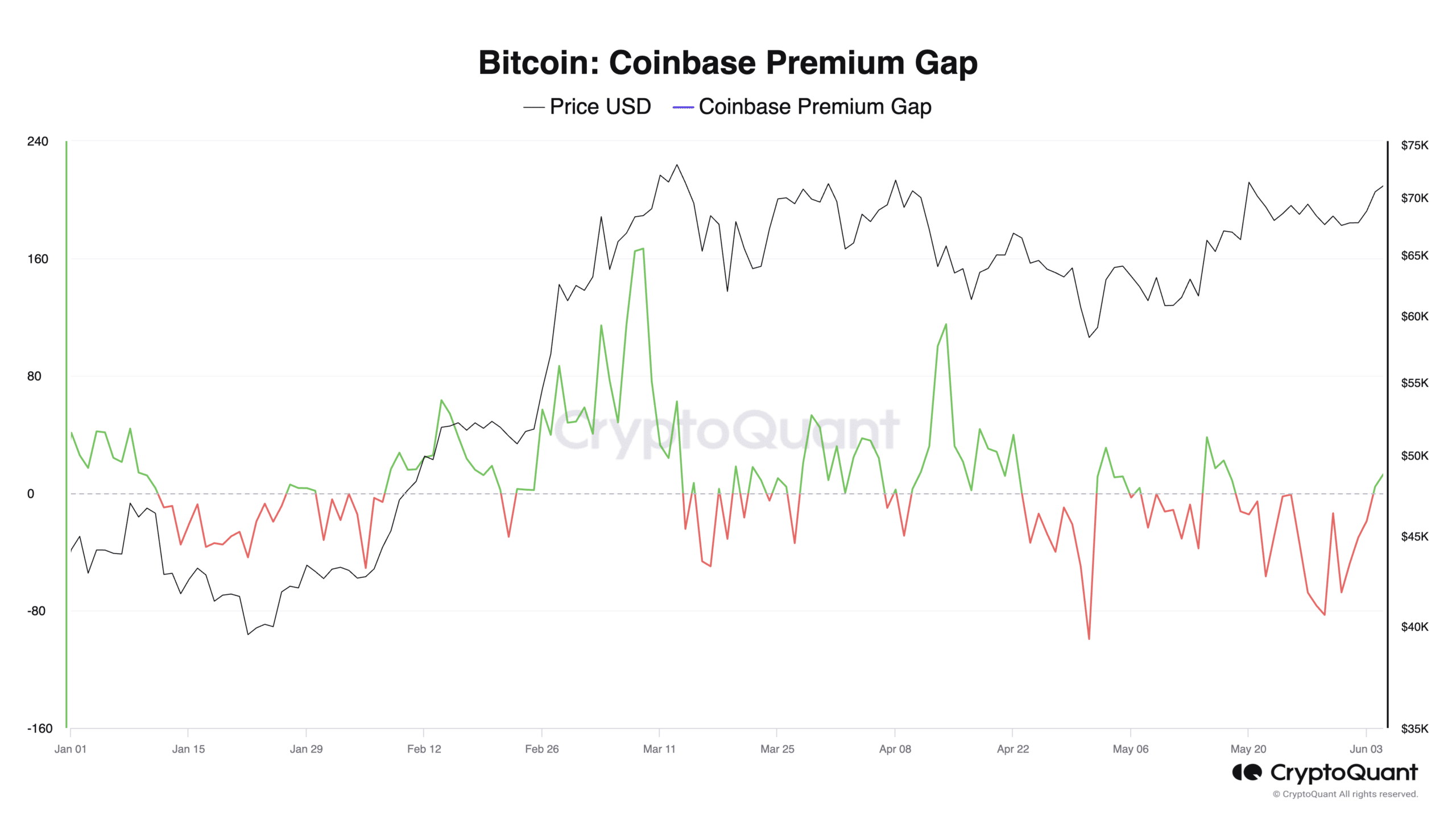

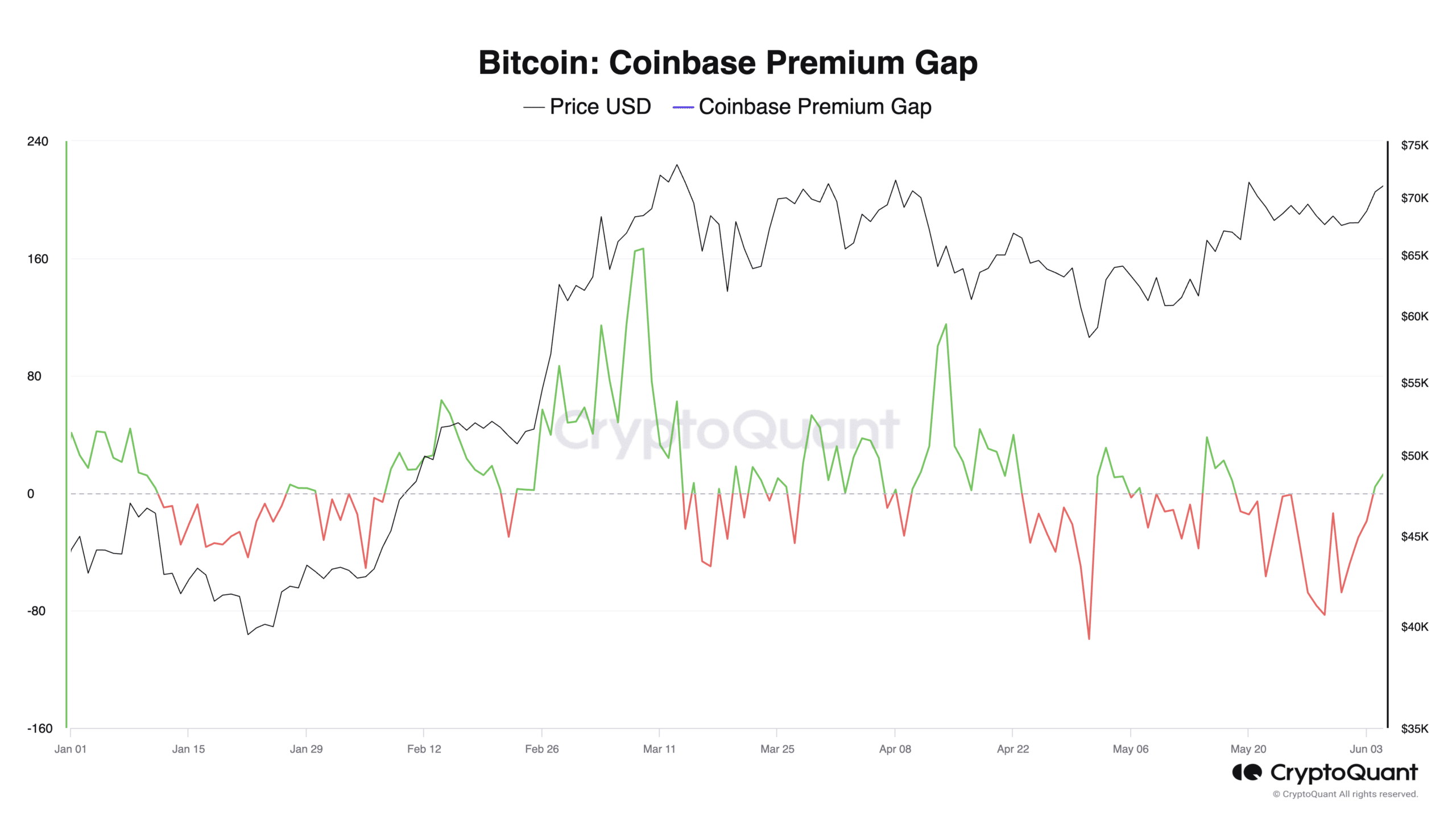

Confirming the resurgence in exercise from US-based BTC holders, BTC’s Coinbase Premium Hole was 4.48 at press time.

In line with CryptoQuant knowledge, this was the primary time the metric had returned a constructive worth since 18th Could.

Supply: CryptoQuant

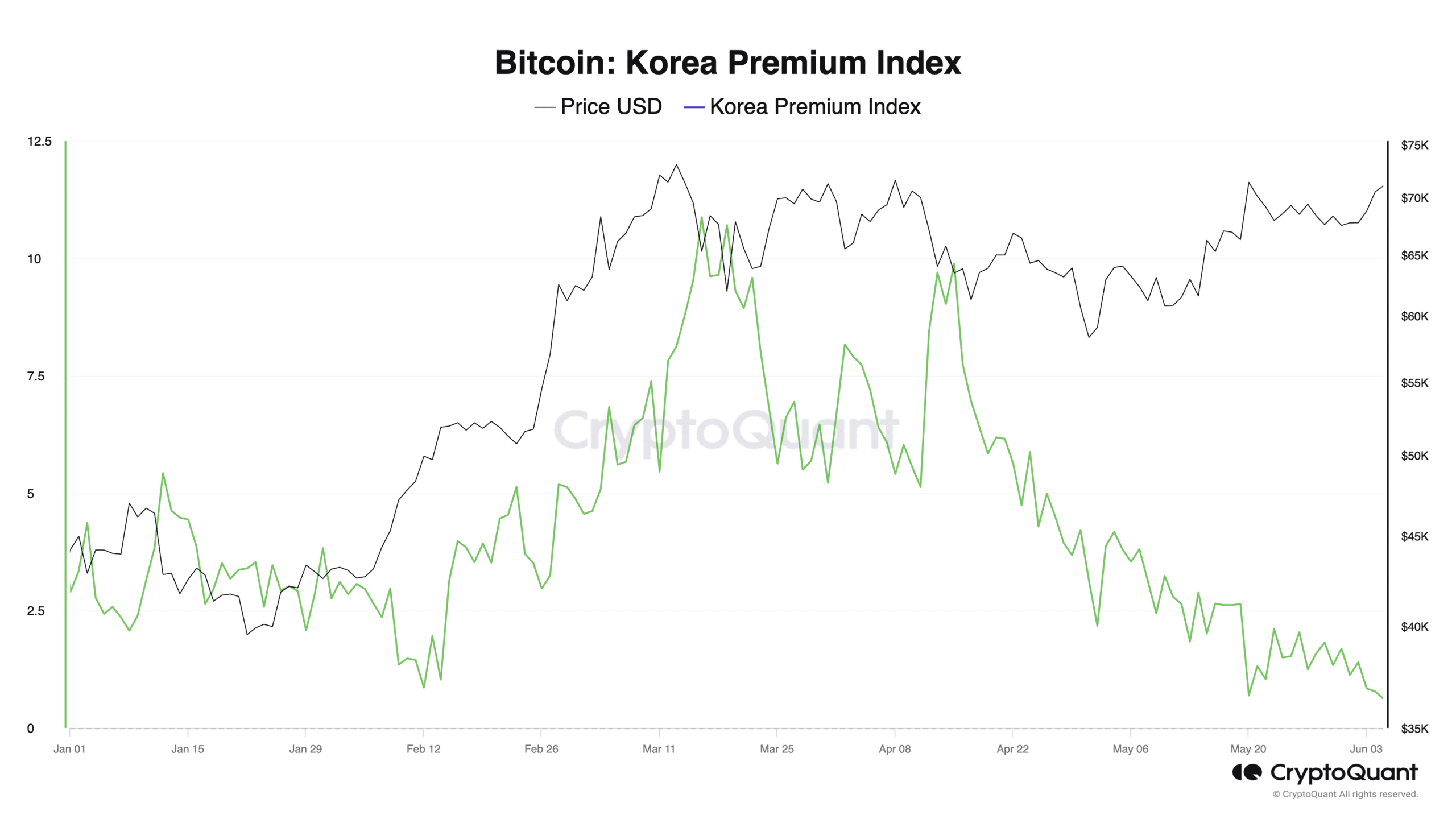

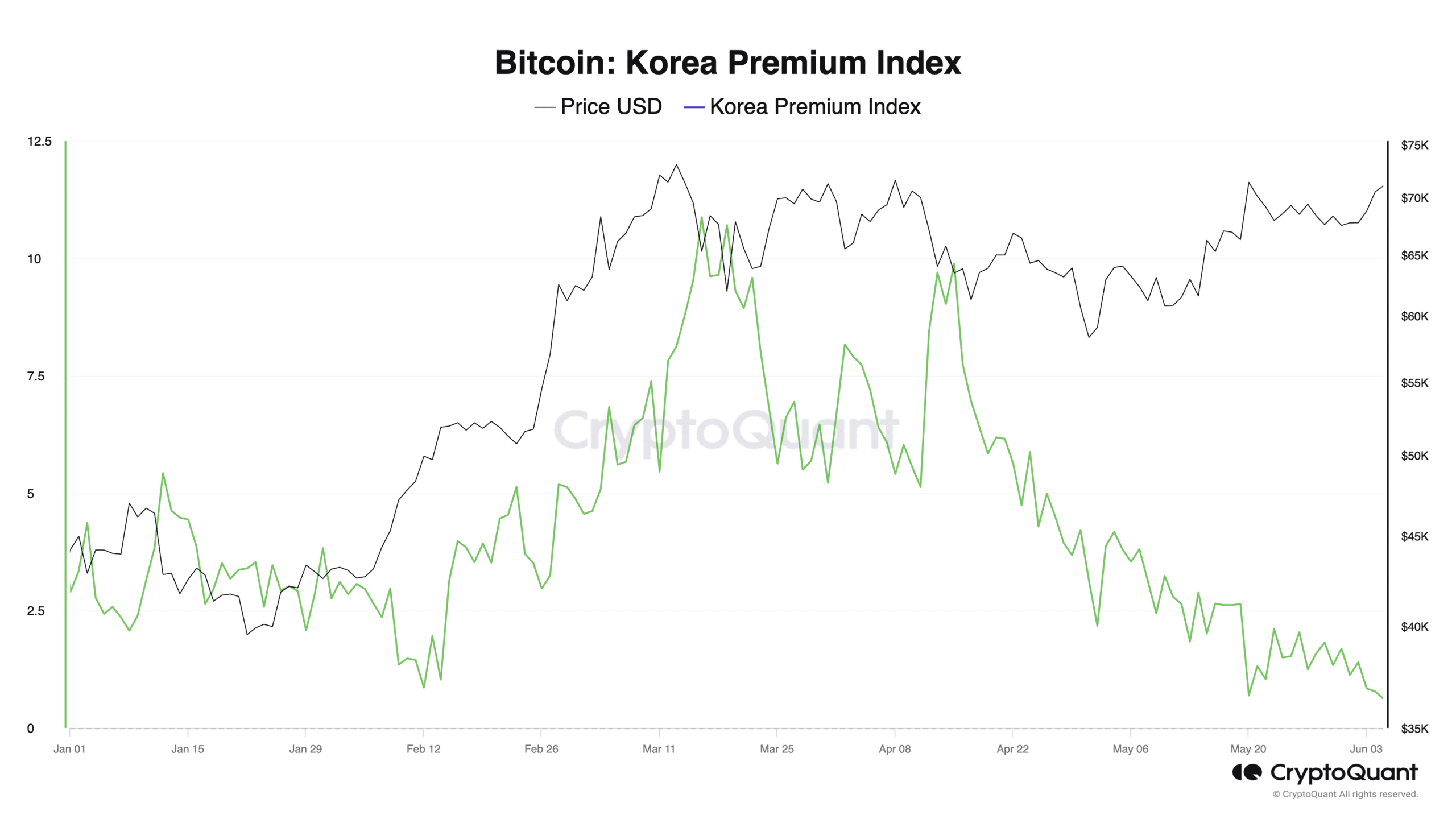

BTC merchants in Korea look away

Though BTC’s Korean Premium Index (KPI) has trended downward since fifteenth April, it stays above the zero line. Additionally known as the Kimchi Premium, this index measures the hole between BTC costs on South Korean exchanges and different exchanges.

Supply: CryptoQuant

At 0.78 at press time, BTC’s Kimchi Premium was at its year-to-date low, signaling that regional demand for the coin by Korean traders is at its lowest for the reason that starting of the yr.

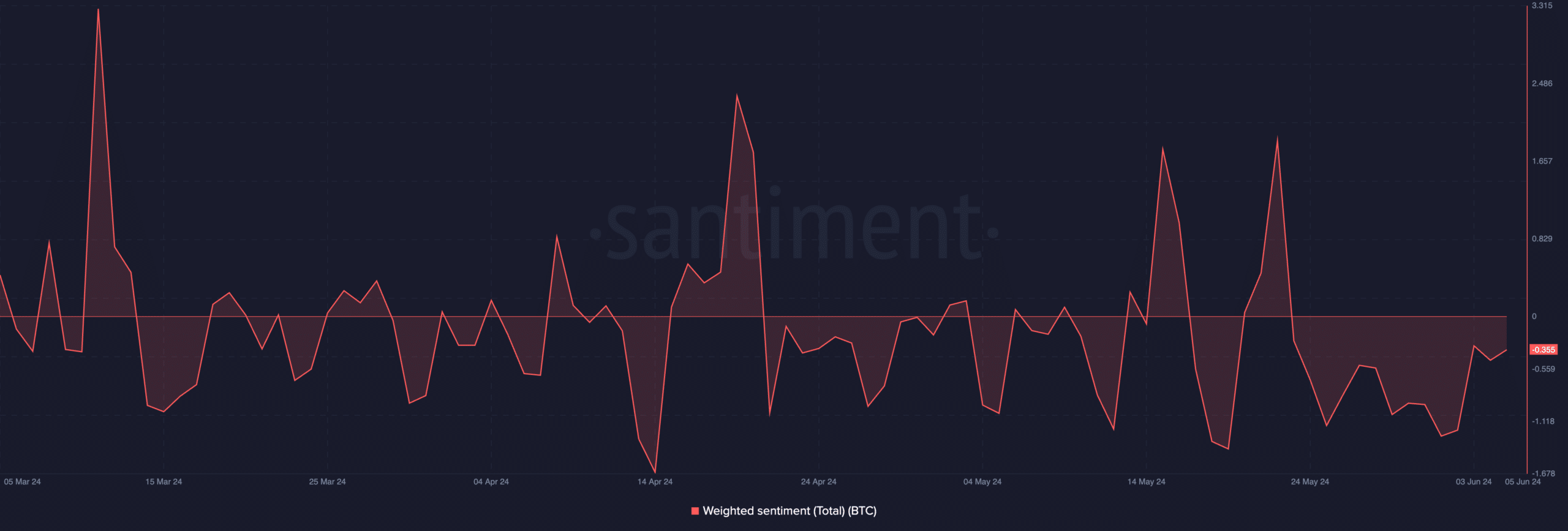

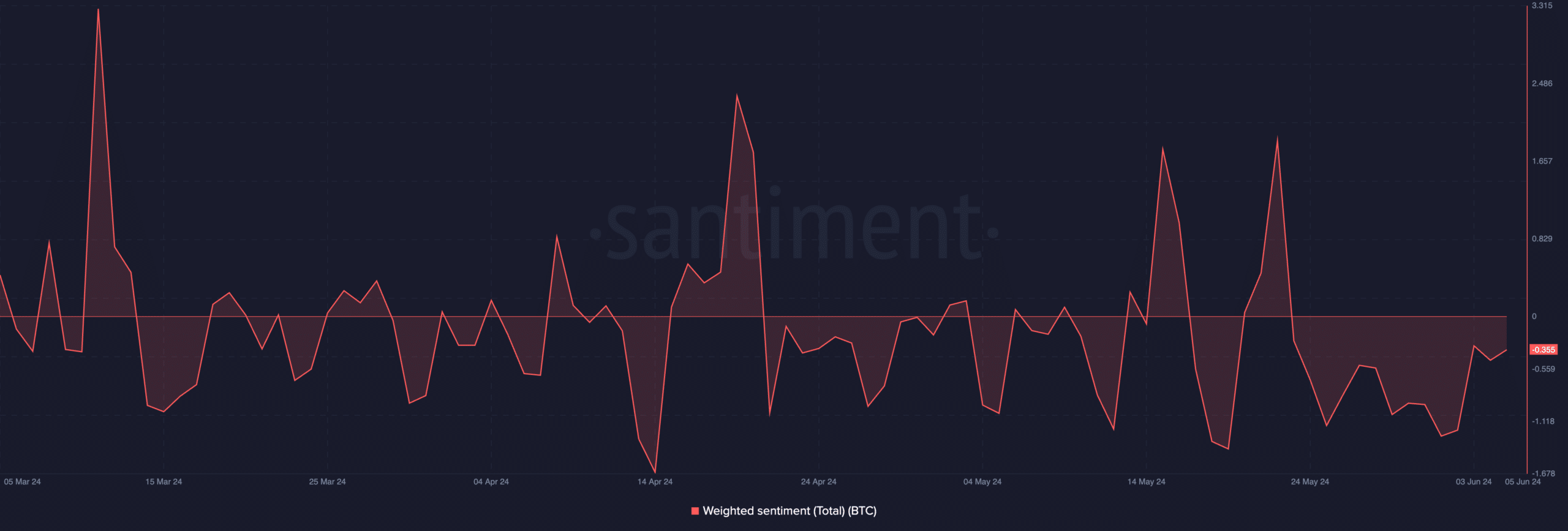

Detrimental sentiment follows the coin

At press time, BTC exchanged palms at $71,148. Its value has risen by 10% previously 30 days. Throughout that interval, the coin traded briefly at $71,315 on twenty first Could earlier than witnessing a pull again.

Nonetheless, regardless of BTC’s current value rally, destructive sentiment trails the coin. At press time, its weighted sentiment was -0.355. In reality, the worth of this metric has been destructive since twenty fourth Could.

Supply: Santiment

This means that regardless of its value rally previously few weeks, there’s nonetheless a bearish bias towards the main coin amongst market contributors.

This has been the case even with the each day earnings made by coin holders.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

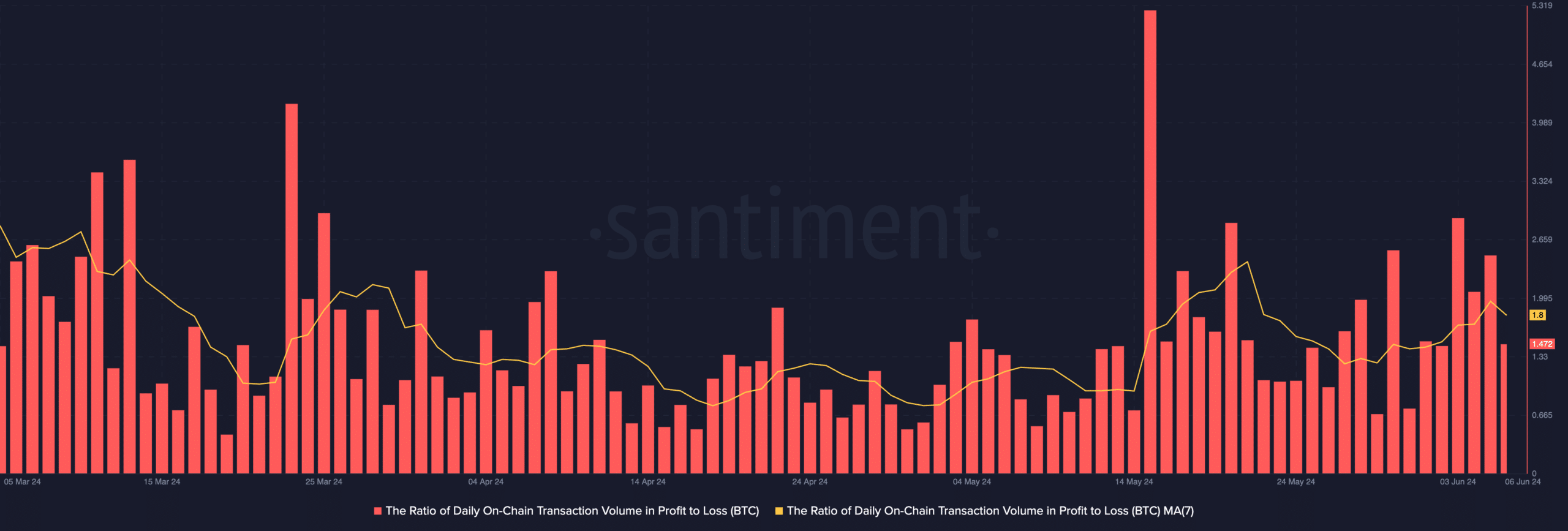

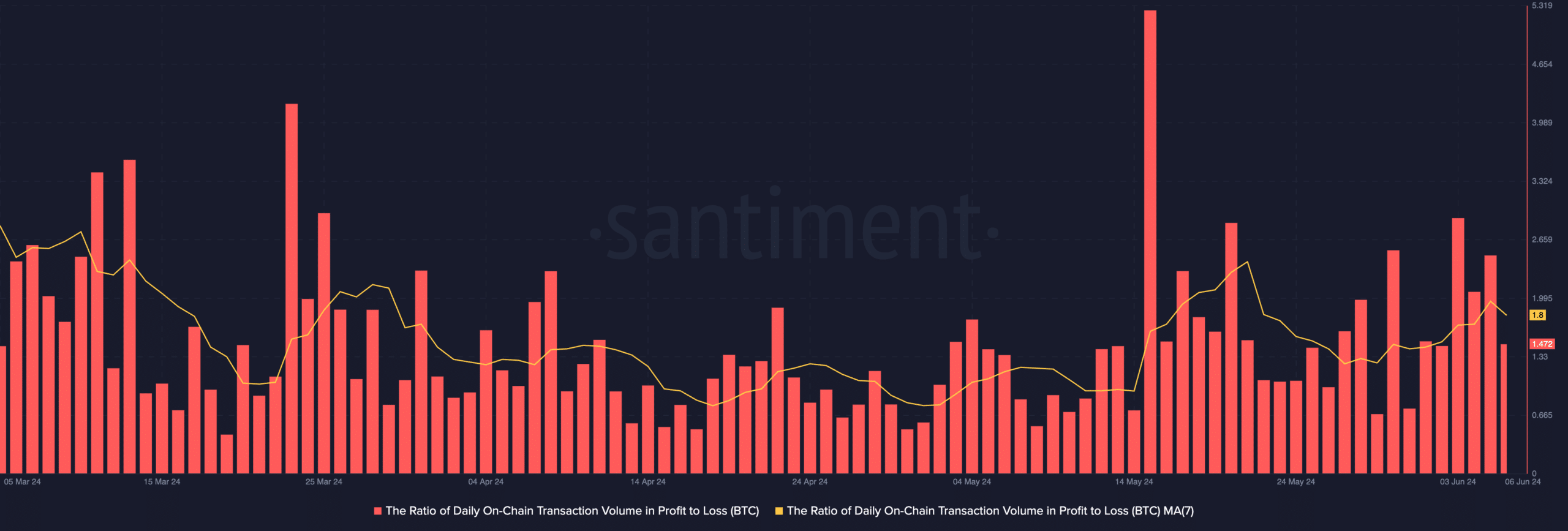

AMBCrypto assessed the each day ratio of BTC transaction quantity in revenue to loss (utilizing a seven-day) transferring common and returned a worth of 1.8.

Supply: Santiment

This confirmed that for each BTC transaction that led to a loss previously few weeks, 1.8 transactions have returned a revenue.