- Solana’s worth is more likely to attain $153 if the important thing help stage is damaged at round $159.

- Bearish momentum for Solana was confirmed by on-chain metrics and the technical indicators.

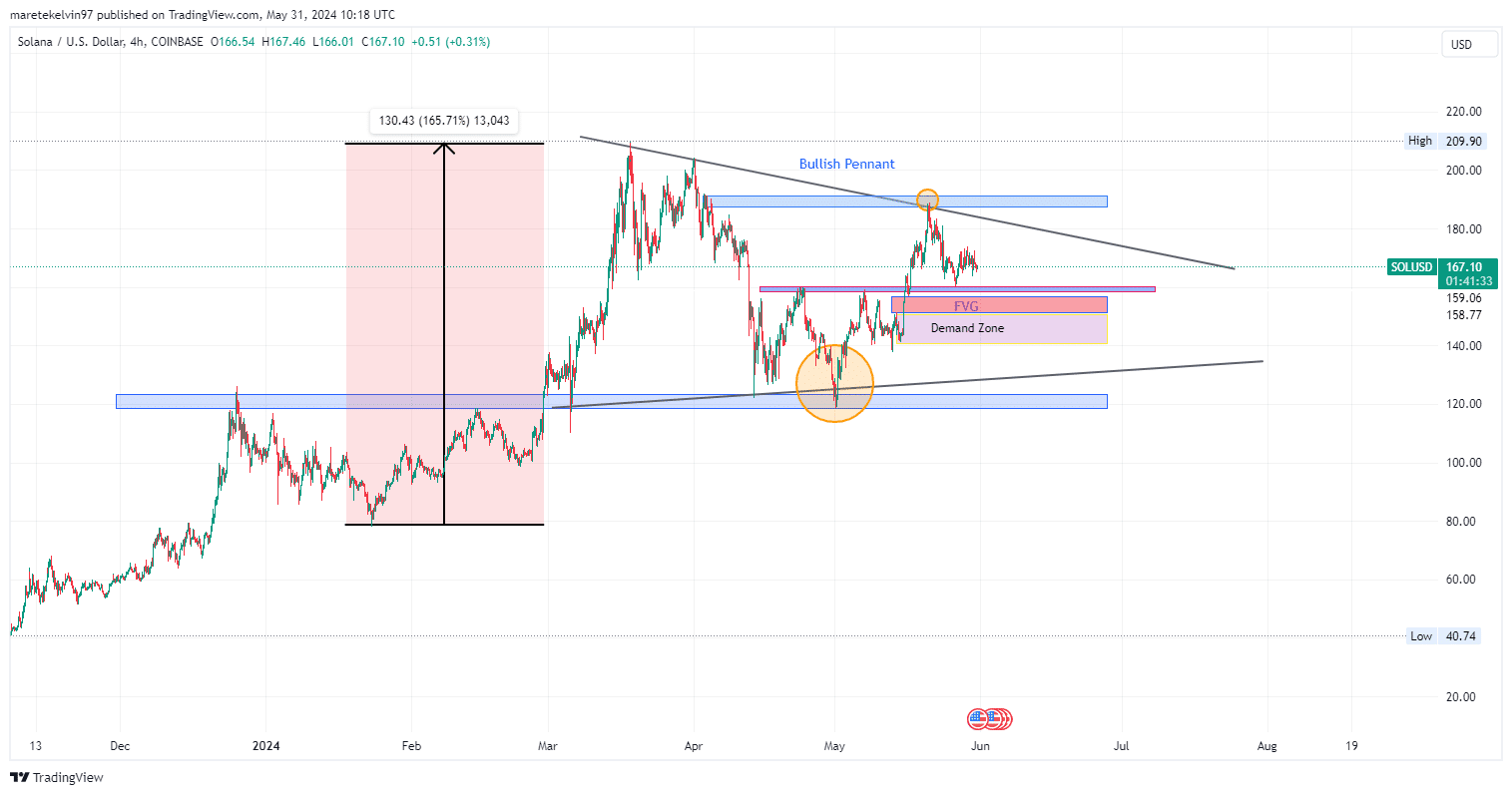

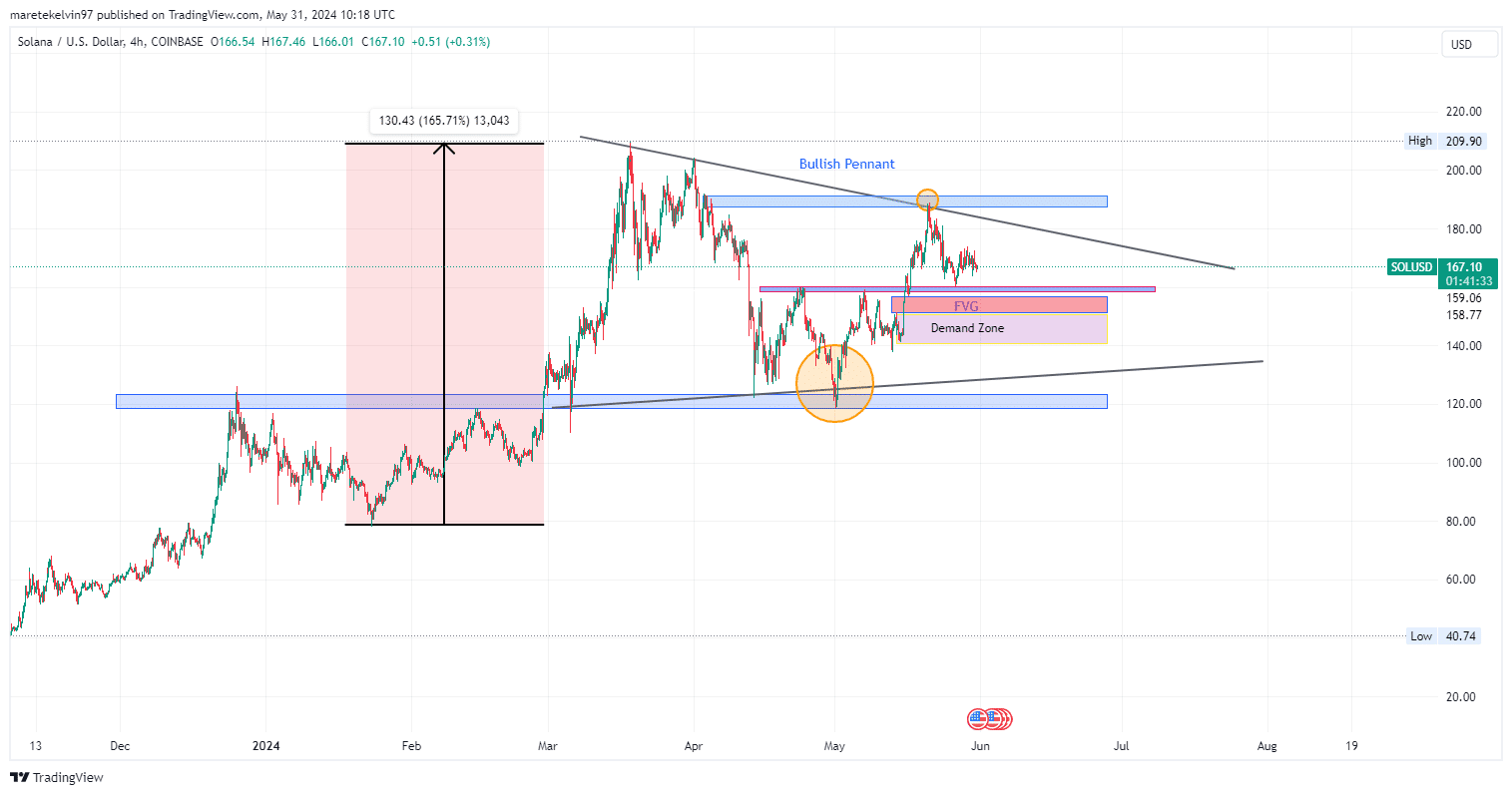

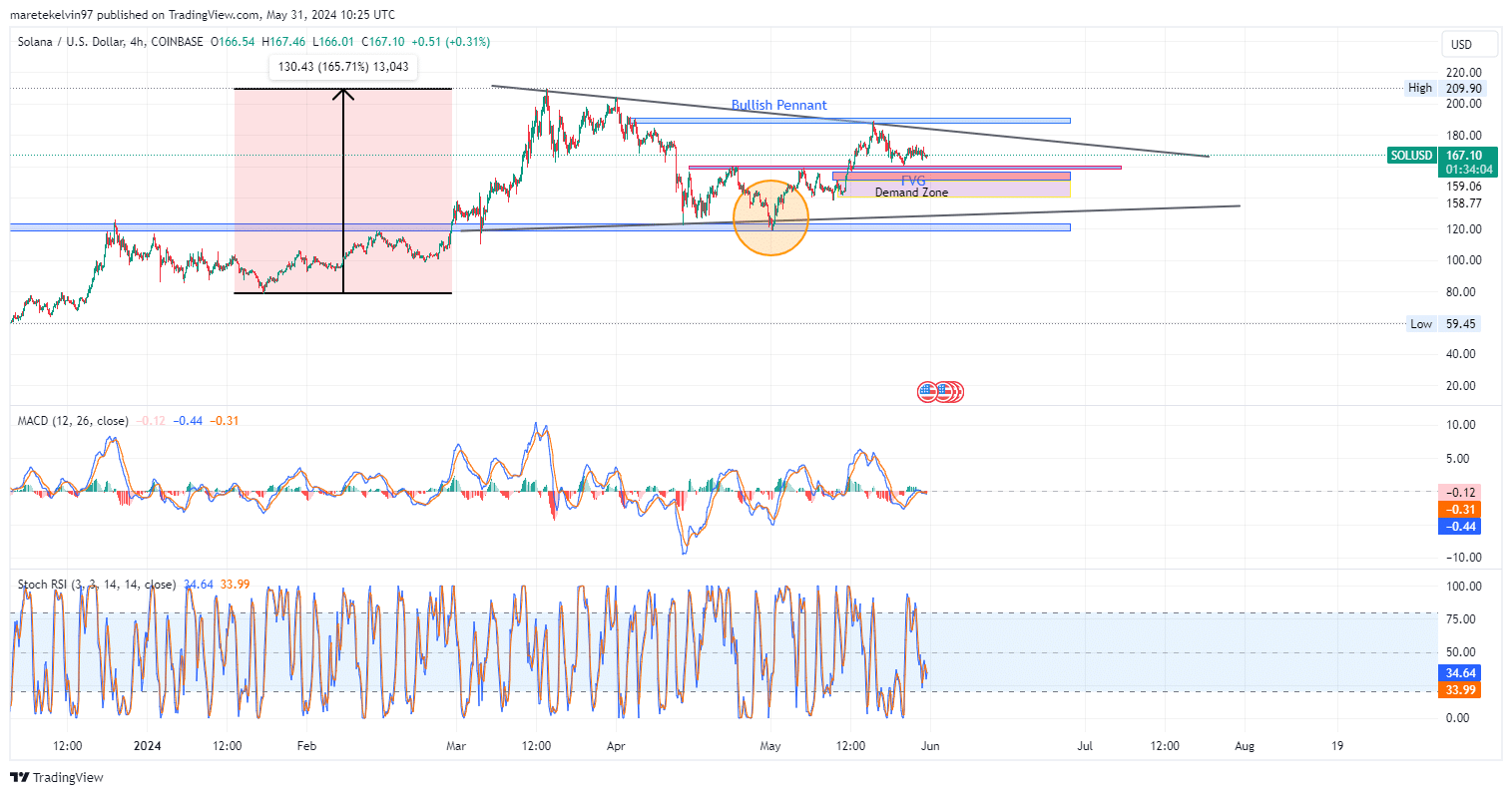

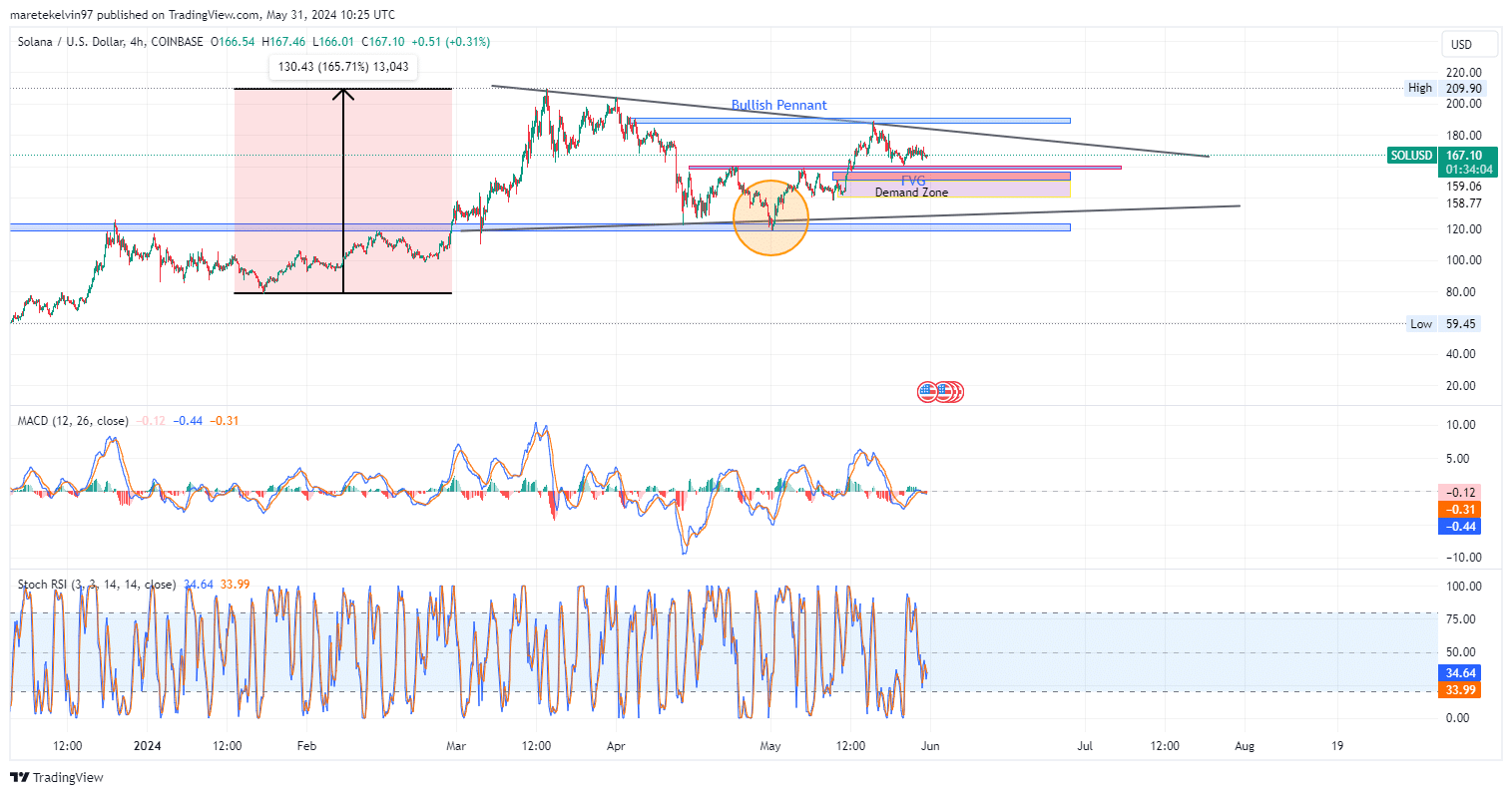

Solana [SOL] worth was consolidating at press time to type a pennant sample after a major upward surge within the final three months. Solana was exhibiting a bearish momentum regardless of the bullish sample.

The value is accumulating in a bearish motion towards the resistance stage that turned to a help at $159. If this help stage is damaged, the value may plunge additional to fill the honest worth hole at round $153.

As of this writing, in line with coinmarketcap, Solana’s worth was at $168 indicating a 0.68% enhance within the final 24 hours and a 1.3% enhance within the final seven days.

Its market cap stands at round $77 billion whereas buying and selling quantity stands at $77.2 billion, a 12.4% enhance within the final 24 hours.

Regardless of the value having a slight rise, the bullish momentum is diminishing.

Supply: Buying and selling view

Are the metrics signaling bearish sentiments?

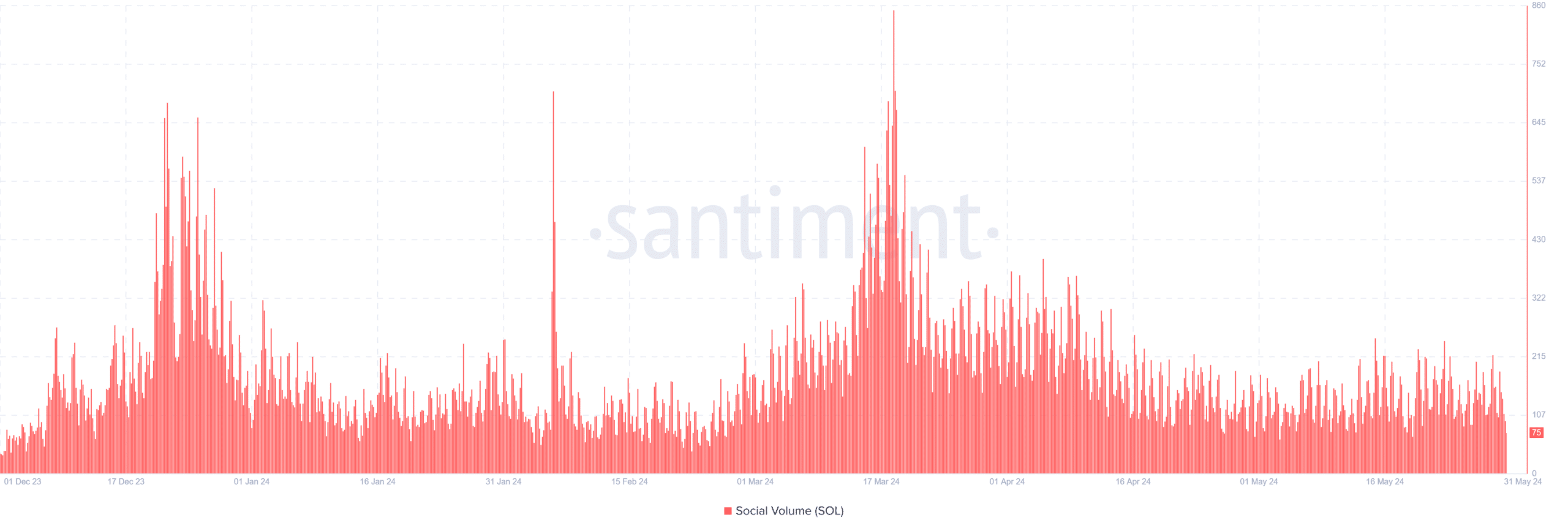

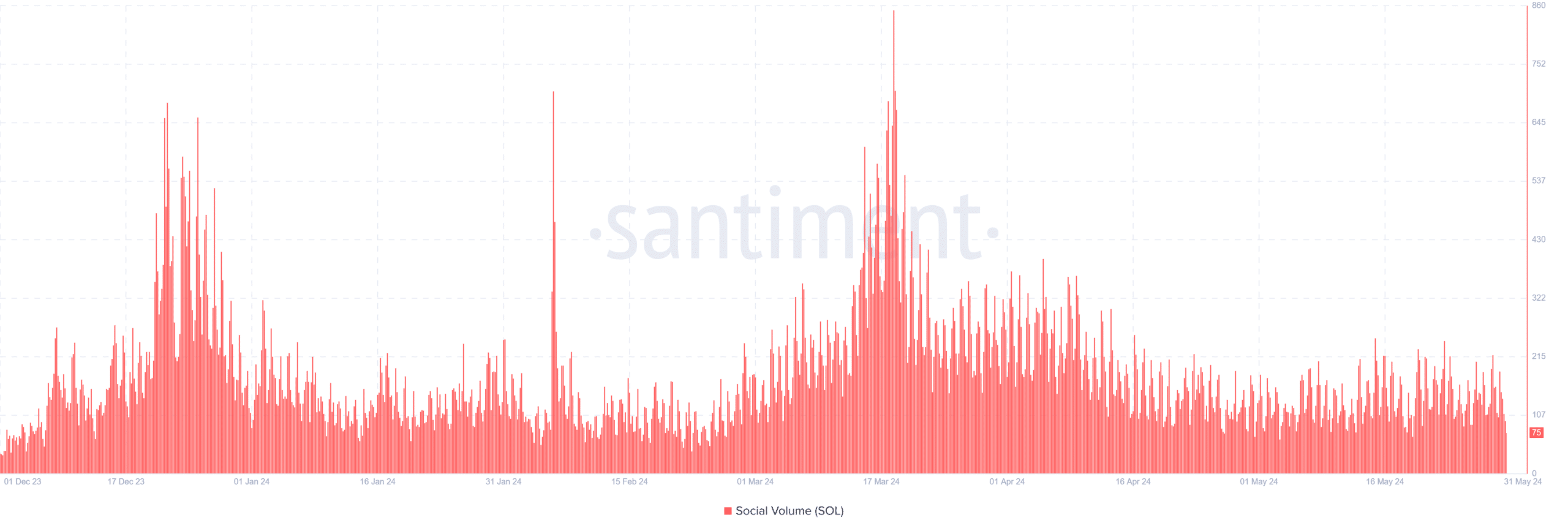

AMBCrypto analysed the Santiment social quantity indicator and located an elevated quantity within the short-term and a predominantly reducing quantity pattern. The metrics align with the bearish momentum on the SOL worth .

Supply: Santiment

AMBCrypto additional analysed the lengthy/quick ratio from coinglass which indicated extra quick positions than lengthy positions for Solana. The ratio signifies that traders are anticipating an additional plunge in worth which affirm the bearish sample.

Supply: Coinglass

Tradingview chart indicator MACD indicated a bearish momentum on SOL that might break the $159 help stage and drop to $153.

The MACD line under the sign line indicated a bearish crossover with the massive destructive histogram bars affirming the downward worth momentum.

The stochastic RSI(34.4)shouldn’t be inside the limits however it’s leaning in the direction of the the decrease sure indicating a impartial to barely oversold market.

Supply: Tradingview

Is your portfolio inexperienced? Take a look at the SOL Revenue Calculator

Technical indicators and on chain evaluation align to point a attainable bearish momentum to the honest worth hole at $153.

MACD confirmed declining momentum which was confirmed by the Stochastic RSI. Nonetheless, if the value fails to interrupt the help stage, a attainable bullish run is probably going.