On this complete evaluation, we delve into Polkadot’s current value surge, pushed by each technical and on-chain indicators

Penetrating the each day Ichimoku cloud might point out continued value appreciation in direction of $8.

Polkadot Technical Outlook: Understanding the Surge

Polkadot (DOT) has damaged above the 4-hour Ichimoku cloud. Returning to the cloud within the 4-hour timeframe might sign a pattern reversal. On the each day timeframe, the value of Polkadot is approaching the decrease boundary of the Ichimoku cloud.

Polkadot On-Chain Information: A Deep Dive

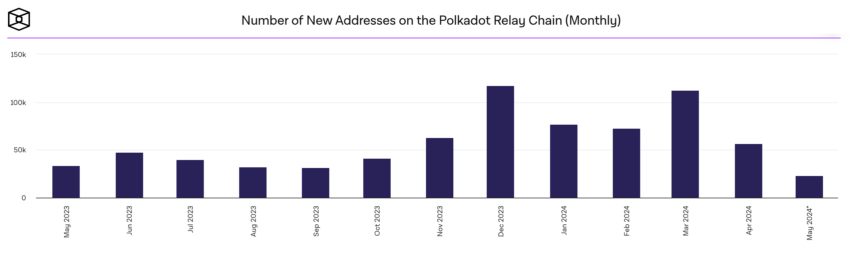

The chart illustrates that the variety of new addresses on the Polkadot Relay Chain has skilled two consecutive month-to-month declines. This pattern is a bearish indicator. Polkadot is presently struggling to draw new entrants to the community.

A sustained discount within the variety of new addresses can affect the general well being and growth of the Polkadot ecosystem.

Learn Extra: What Is Polkadot (DOT)?

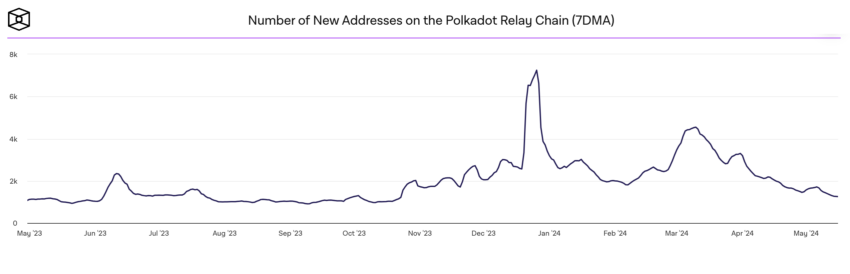

Lively addresses are a key indicator of person engagement and community well being. Within the context of Polkadot, this decline might imply a number of issues:

- First, it’d point out that current customers are much less lively, probably on account of a scarcity of compelling initiatives, updates, or incentives to keep up engagement.

- Second, it might replicate broader market developments affecting all the cryptocurrency area, the place customers have gotten extra cautious or shifting their focus to different platforms.

- Third, a lower in lively addresses on a blockchain targeted on interoperability might suggest challenges in sustaining its distinctive worth proposition in comparison with different Layer 0 or Layer 1 options.

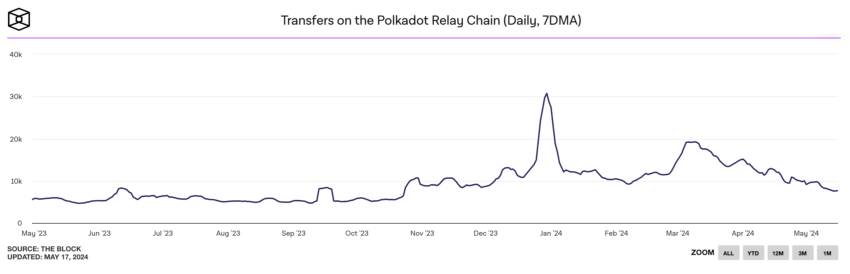

The chart beneath illustrates the 7-day shifting common (7DMA) of each day transfers on the Polkadot Relay Chain. This highlights a major downward pattern. Following a peak in January 2024, the place each day transfers almost reached 40,000, the variety of transfers has steadily declined.

This decline in switch quantity can have a number of implications for Polkadot’s value. Decreased switch exercise typically correlates with decrease general community utilization and decreased demand for the native DOT token (within the mid-term).

Strategic Suggestions and Future Worth Implications

Impartial Outlook

- Polkadot (DOT) has demonstrated an upward pattern, breaking the 4-hour Ichimoku cloud to the upside. This technical sample suggests potential bullish momentum. Nevertheless, merchants must be cautious as a pullback to the cloud within the 4-hour timeframe might sign a pattern reversal.

- The current upward pattern in Polkadot’s value is closely influenced by the broader market actions, notably the rise in Bitcoin’s value. Moreover, speculative actions round Polkadot’s derivatives contracts on centralized exchanges have contributed to the value surge.

- Whereas the technical indicators level in direction of bullish momentum, the on-chain information highlights potential dangers. The lower in new and lively addresses and decreased switch volumes sign a decline in person engagement and community exercise.

Learn Extra: Polkadot (DOT) Worth Prediction 2024/2025/2030

Entry Factors and Threat Administration

- Merchants ought to take into account getting into lengthy positions on Polkadot if it efficiently penetrates the 4H Ichimoku cloud to the draw back, concentrating on a transfer towards $8. Nevertheless, monitoring Bitcoin’s value actions is essential, as a check of the $61K degree by Bitcoin might result in a pointy correction in DOT’s value. Though the chance of such a correction has decreased, it stays a threat, notably within the occasion of macroeconomic or geopolitical components.

- Within the mid to long run, merchants ought to make use of threat administration methods, together with setting stop-loss orders beneath key assist ranges (6 – $6.4) to mitigate potential losses.

Disclaimer

Consistent with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.