Bitcoin (BTC) is evolving quickly. Though the Bitcoin community is primarily used for fee transactions, its present exercise seems to resemble that of Ethereum in the course of the top of decentralized software tasks (Dapp).

The introduction of Bitcoin Runes and BRC-20 tokens – which emerged in the course of the fourth Bitcoin halving -Has most likely led to the evolution of Bitcoin-native decentralized finance (DeFi).

The rise of Bitcoin DeFi

Rena Shah, VP of Merchandise at Belief Machines – a staff targeted on rising the Bitcoin economic system – informed Cryptonews two years in the past, Bitcoin DeFi was not a narrative the ecosystem was speaking about.

Nonetheless, Shah famous that the rise of staking platforms and lending protocols inside the Bitcoin community has sparked investor curiosity in changing property from a retailer of worth to a supply of worth.

The expansion within the Bitcoin DeFi (BTCFI) ecosystem is astounding

@ALEXLabBTC leads the cost, adopted by @Bitflow_Finance and @StackingDao.

– Knowledge from @signal21btc pic.twitter.com/87MP5hMCbL

— stacks.btc (@Stacks) Could 8, 2024

“The need to maneuver from a passive to a productive Bitcoin asset is actual in 2024,” she mentioned. “We constructed this future as a result of we are able to see that Bitcoin DeFi is engaging not solely to retail buyers, but additionally to institutional buyers.”

Establishments will present curiosity in Bitcoin DeFi

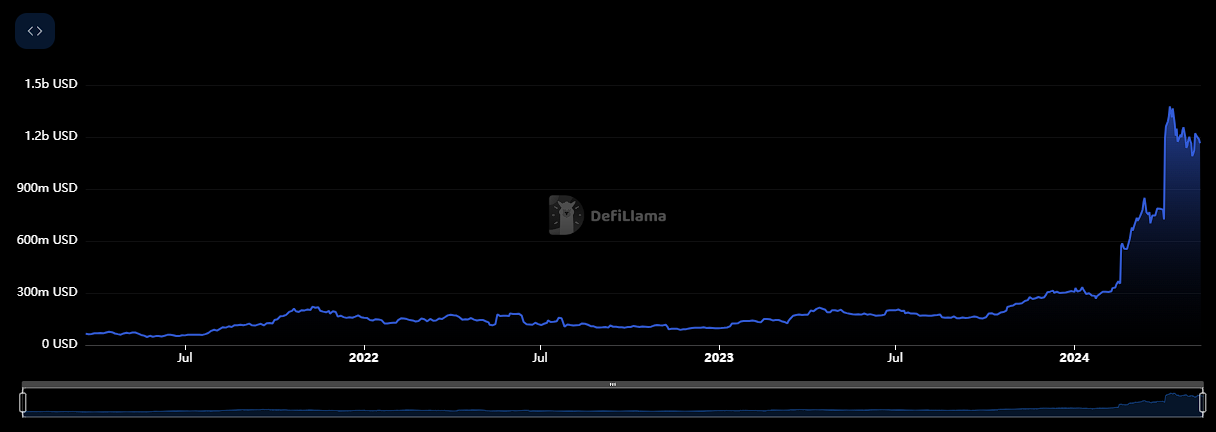

Knowledge from DeFiLlama exhibits That The entire worth of Bitcoin (TVL) is roughly $1.2 billion. But in response to Based on Shah, practically $1 trillion in capital is tied up on the Bitcoin blockchain.

“Even the smallest percentages of capital changing into productive in DeFi will create large waves within the Bitcoin ecosystem,” Shah emphasizes.

This, together with the latest approval of Discover Bitcoin Trade Traded Funds (ETFs) in america, will increase the potential for Bitcoin DeFi purposes. That is prone to be significantly engaging to Bitcoin-owning establishments and retail buyers.

Tycho Onnasch, the co-founder of Zest Protocol, informed Cryptonews that he believes BTC is a extra institutional asset than the remainder of crypto.

“That is why I anticipate establishments to play an even bigger function in utilizing and beginning up Bitcoin DeFi,” Onnasch mentioned.

Bitcoin DeFi purposes for establishments

Whereas Bitcoin DeFi continues to be a comparatively new idea, a lot of tasks are attempting to allow and advance the sector.

For instance, Onnasch defined that Zest Protocol makes a lending protocol constructed particularly for Bitcoin. He mentioned the aim behind the platform is to create a permissionless monetary infrastructure BTC lending markets.

“Zest permits customers to supply BTC as collateral to borrow different tokens comparable to stablecoins,” he mentioned. “The platform additionally permits customers to earn returns on their BTC.”

The principle use case behind Bitcoin DeFi purposes seems to be making Bitcoin a extra productive asset for buyers.

Dr. Chiente Hsu, co-founder of ALEX and XLink, informed Cryptonews that Alex is a brand new monetary layer for the Bitcoin community.

“Our aim is to seamlessly combine Bitcoin with Layer-2 (L2) options and the Ethereum Digital Machine (EVM) world,” mentioned Hsu. “This can permit us to develop the Bitcoin economic system,” Hsu mentioned.

For instance, Hsu defined that buyers can earn returns on their BTC by connecting a Bitcoin pockets to XLink. He famous that XLink is powered by ALEX’s automated market maker (AMM) and decentralized change (DEX). This permits cross-chain swaps between Bitcoin L2s and the EVM world.

“Bitcoin DeFi for establishments would be the pursuit of Bitcoin revenue-generating property,” Hsu mentioned.

Hsu thinks that is prone to be the case because of the great amount of capital on the Bitcoin community.

“There may be properly over $1 trillion of Bitcoin capital that’s ‘idle’ within the sense that its worth rises and falls relative to Bitcoin’s spot value,” he mentioned. “However not like Ethereum, Bitcoin can’t be naturally locked to generate returns. It is a resolution that ALEX is actively pursuing, permitting establishments that maintain Bitcoin to earn returns via their Bitcoin capital.”

Bitcoin DeFi is much like Ethereum counterparts

One other attention-grabbing level is that whereas Bitcoin DeFi is exclusive, purposes typically resemble DeFi tasks on Ethereum (ETH). That is necessary to think about as establishments are beginning to present curiosity in lots of present DeFi purposes.

Digital asset administration firm Fireblocks have just lately seen elevated institutional DeFi exercise on the Fireblocks platform. Based on the corporate, there was a 75% soar within the first quarter of 2024.

Fireblocks reported that a number of the hottest Dapps that institutional purchasers work together with for swapping, borrowing, staking and bridging are Uniswap, Aave, Curve, 1inch and Jupiter.

Jeff Yin, CEO of Merlin Chain – a Bitcoin L2 that allows quick, cost-effective transactions with assist for BTC Dapps – informed Cryptonews that DEXs, derivatives and lending are all areas the place BTC has realized extensively from ETH. He added that many new protocols are rising.

For instance, ‘Surf’ is a derivatives buying and selling protocol that launched on Merlin Chain and now has a each day buying and selling quantity of over $10 million. These are akin to their Ethereum counterparts,” mentioned Yin.

Yin defined {that a} particular Bitcoin DeFi software would replicate one of many largest ETH DeFi protocols, Lido – which holds $28 billion and accounts for half of Ethereum’s DeFi TVL.

“SolvBTC is at present creating an underlying BTC yield protocol,” Yin mentioned. “Moreover, Unicross has applied a Rune buying and selling protocol on a BTC L2, permitting customers to commerce Layer 1 (L1) property extra cheaply on L2. These signify the extra progressive points of the sector.”

Bitcoin DeFi might overtake Ethereum

Though Bitcoin DeFi resembles Ethereum, Shah believes that decentralized finance utilizing BTC might finally surpass Ethereum.

“Watch DappRadarEthereum has over 600 energetic apps with various quantity and exercise,” Shah mentioned. “I’ve no cause to anticipate that Bitcoin DeFi cannot rival Ethereum and finally flip it round for Dapps within the ecosystem.”

Sure options additionally make it simpler to convey Ethereum Dapps to Bitcoin.

Zack Voell, director of selling at Botanix Labs, informed Cryptonews that Botanix had created a “Spiderchain” that simply permits DeFi on Bitcoin.

“Spiderchain creates a completely EVM-equivalent surroundings the place Dapps and sensible contracts on Ethereum will be copy-pasted to run natively on Bitcoin,” Voell mentioned. “Botanix Labs is constructing the Spiderchain to mix the 2 most Lindy applied sciences in crypto – the EVM and Bitcoin – somewhat than attempting to reinvent a totally new protocol or digital machine.”

Challenges can delay adoption

Whereas it’s nonetheless too early to find out the destiny of Bitcoin DeFi, sure challenges might delay adoption.

For instance, Yin identified that liquidity fragmentation typically outcomes from the issue of deploying DeFi on an L1 community. This in flip forces most actions to unfold throughout totally different L2 options Yin famous that this might make it troublesome to pay attention liquidity.

“A potential resolution may very well be to create omnichain liquidity, much like the Stone protocol within the Ethereum ecosystem,” he mentioned. “We look ahead to future implementations comparable to M-STONEBTC and Solv Protocol that would unify the liquidity of BTC L2.”

Moreover, Shah mentioned Bitcoin’s problem is to maintain the bottom layer safe, steady and unhindered.

“That is the place scaling turns into important,” she mentioned. “A wholesome and various L2 ecosystem will finally drive Bitcoin DeFi, as a vertical, to success.”

Shah added that programming environments on Bitcoin are inherently troublesome as a result of many builders from different ecosystems are much less acquainted with Bitcoin script.

She famous that one option to fight that is to create WebAssembly (WASM) or numerous runtime environments comparable to Rust, Solidity and Cosmos with L2s.

“This strategy will doubtless assist convey new builders into the ecosystem,” she famous.