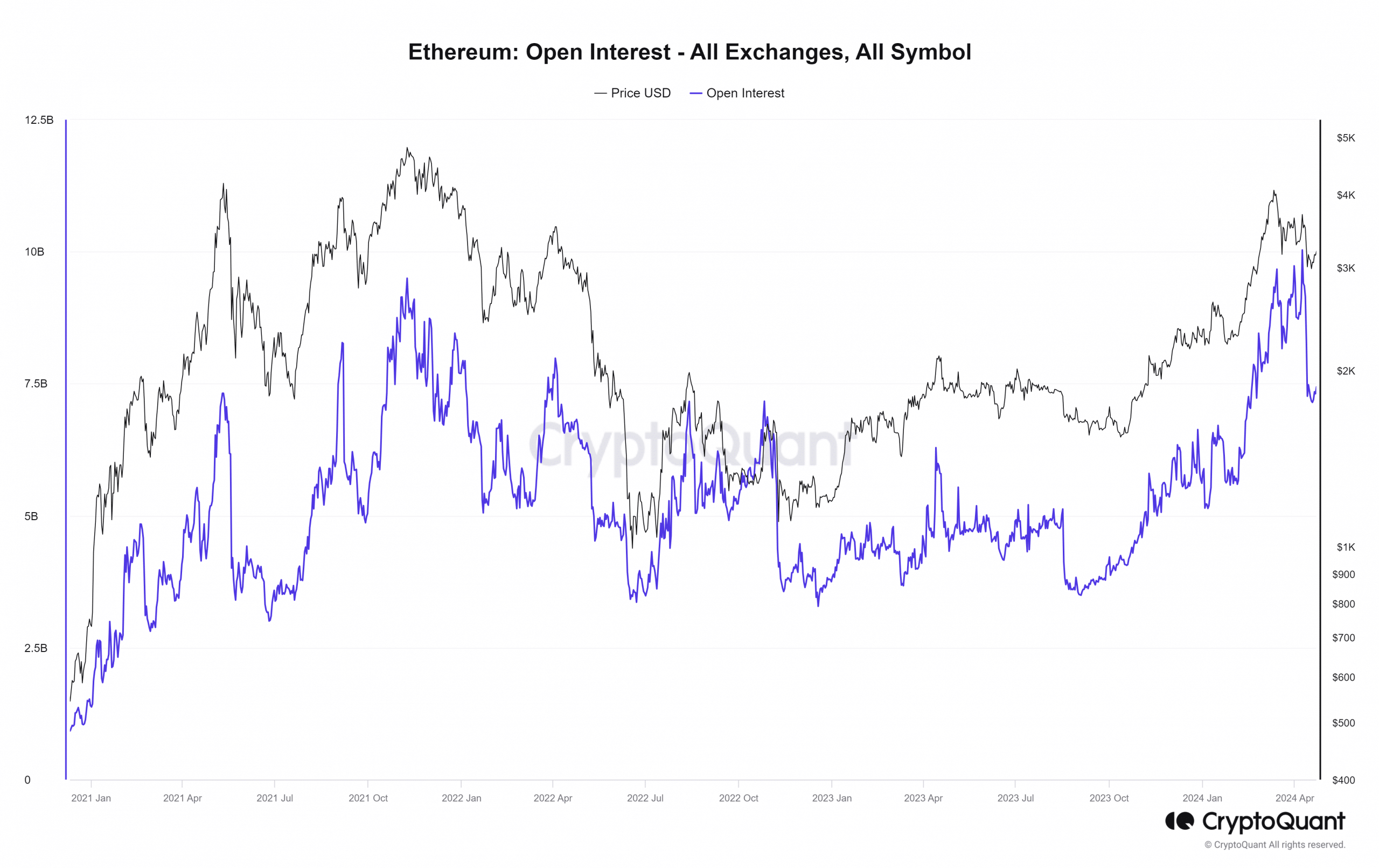

- Ethereum noticed an enormous drop in Open Curiosity in April following the rejection at $3.7k

- The on-chain metrics had been nonetheless wholesome, hinting at the opportunity of an uptrend

Ethereum [ETH] was buying and selling at $3.2k at press time. The $3k psychological stage was breached a number of instances because the thirteenth of April on the decrease timeframes, and sentiment behind the altcoin king has weakened significantly.

This was evident by the sheer drop within the Open Curiosity behind ETH. Mixed with the worth trajectory of the previous couple of weeks, it appeared {that a} downtrend was doable.

But, with $3k defended on the upper timeframes, there was additionally the opportunity of a resurgence for the bulls. AMBCrypto investigated on-chain metrics to know which path is extra possible.

Similarities to Feb 2021

Throughout the earlier bull run, in mid-February 2021, the worth of Ethereum corrected from $1.9k (an ATH at the moment) to $1.4k. It was adopted by a V-reversal, however it confirmed that there are numerous instances when the futures market will get overheated.

Impatient bulls need to make a fast buck going lengthy on leverage. This does work, however after a degree, the shortage of spot demand and the overwhelming longs within the futures market get reset.

The drop in OI from $10 billion to $7.17 billion in April was possible another such reset. It’s unclear whether or not an identical V-reversal would start, given the promoting strain behind Bitcoin additionally in latest weeks.

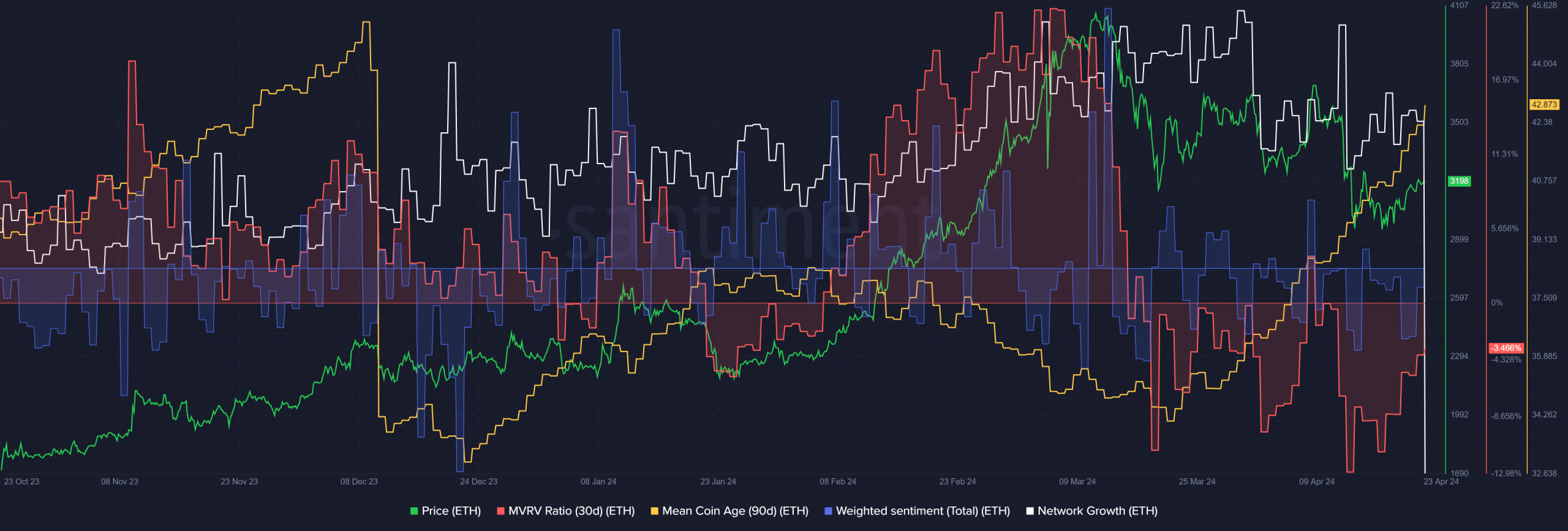

Person adoption has fallen alongside costs, sentiment

The weighted social sentiment had been strongly constructive in February and for a few days in mid-March. Since then, it has been damaging for essentially the most half as costs entered a correction. The sentiment earlier than the worth peak might additionally revolve across the excessive fuel charges on the community.

The community progress metric additionally slowed down prior to now three months. An uptick could be an indication of rising demand, however it’s going to extra possible observe an uptrend than precede it.

Is your portfolio inexperienced? Test the Ethereum Revenue Calculator

The 90-day imply coin age has trended steadily greater since twenty seventh March. This confirmed a network-wide accumulation of ETH. In the meantime, the 30-day MVRV ratio has been damaging for practically a month now, displaying holders at a loss.

It introduced a very good shopping for alternative, however some uncertainty remained. If ETH can climb again above the $3.3k resistance, swing merchants and buyers will likely be extra assured of continued good points.