- Ethereum’s metrics remained bearish.

- XRP and BNB seemed bullish, nonetheless.

Whereas all eyes stay on Bitcoin [BTC] halving, altcoins would possibly silently take the cake as they had been planning a bull rally.

As per the newest knowledge, the Altcoin market capitalization had reached a stage that was traditionally adopted by worth upticks.

Due to this fact, AMBCrypto checked high alts like Ethereum [ETH], BNB, and XRP to see whether or not historical past would repeat itself.

Altcoins are making ready for a rally

Bitcoin is anticipated to bear its fourth halving quickly. As soon as executed, it’s going to scale back the mining reward by 50%, reducing from the present 6.25 to three.125 bitcoins.

The earlier halving occurred again in 2020, when BTC’s block reward was diminished from 12.5 to six.25. At a time when everybody had a eager eye on BTC, altcoins acted apparently.

Titan of Crypto, a preferred crypto analyst, not too long ago posted a tweet highlighting altcoin market capitalization. As per the tweet, the Fibonacci retracement stage was at 61.8% on the month-to-month chart.

If historical past is to be thought-about, every time the metric reached that stage, altcoins started bull rallies within the following days. To be exact, comparable incidents occurred in 2021 and 2016.

Will ETH, BNB, and XRP lead?

At press time, altcoins had been having a troublesome time. To see whether or not the pattern may change, permitting them to begin a bull rally, AMBCrypto first analyzed ETH’s state.

Our evaluation of CryptoQuant’s data revealed that ETH’s web deposit on exchanges was excessive in comparison with the final seven-day common, suggesting shopping for strain was weak.

In truth, promoting sentiment amongst funds and belief traders was excessive, as evident from its pink Funds Premium. Derivatives traders had been additionally promoting ETH as its taker purchase/promote ratio turned pink.

Supply: CryptoQuant

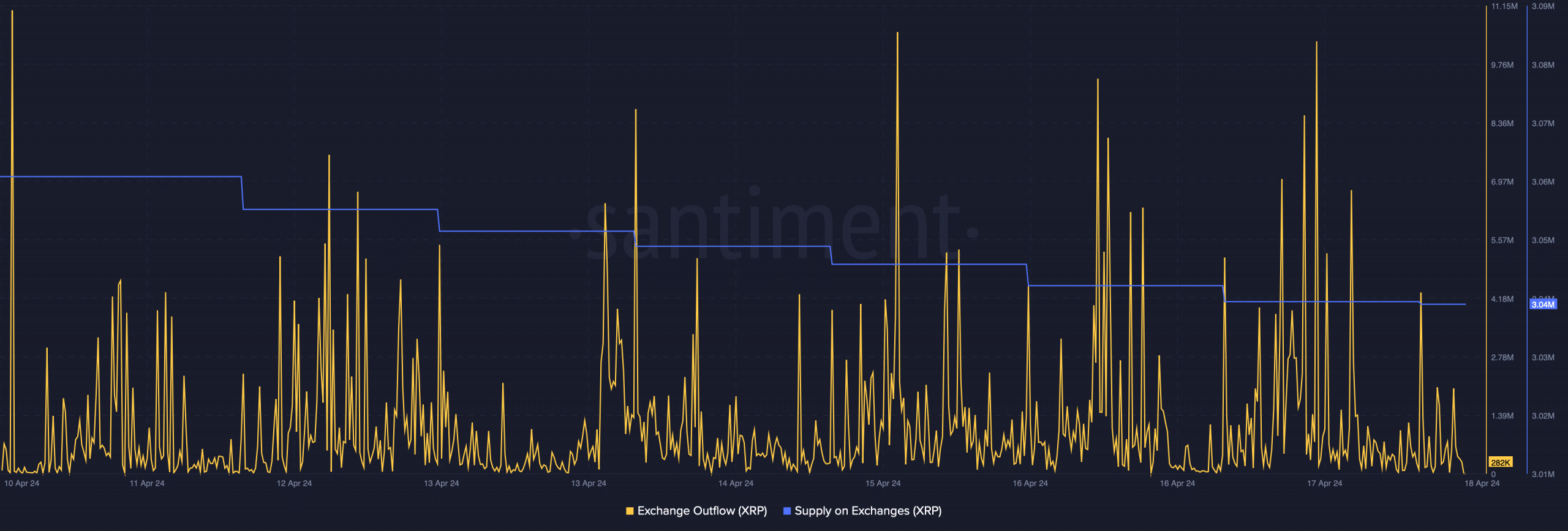

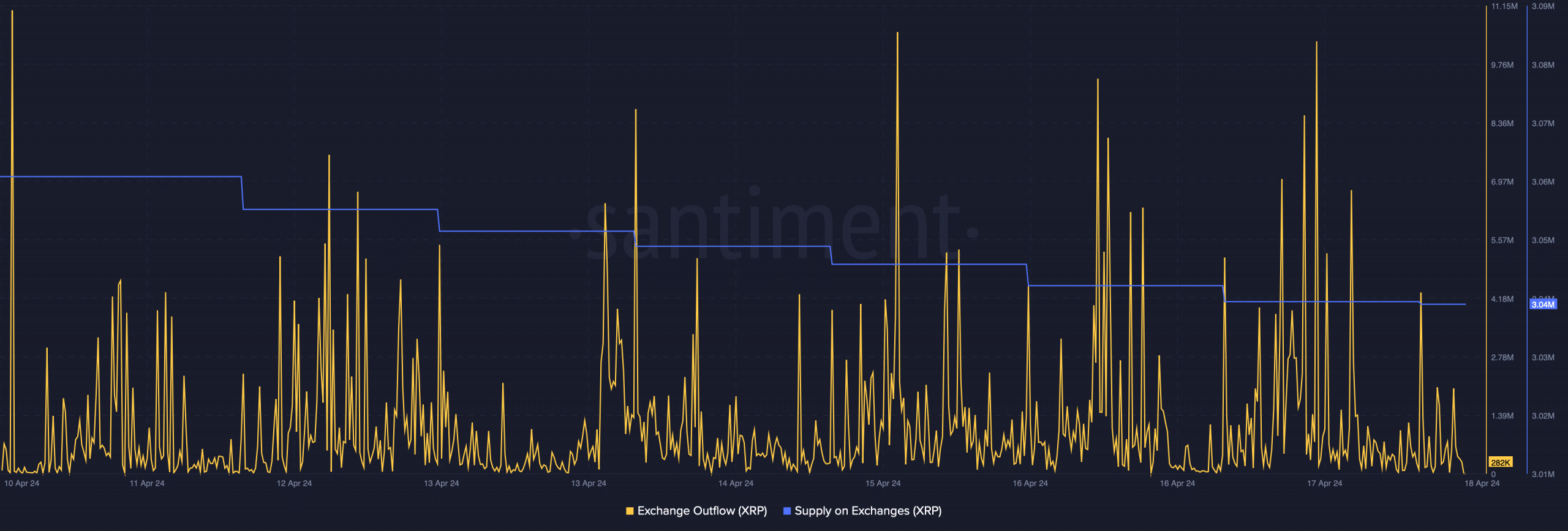

Subsequent, let’s check out how XRP has been doing. In accordance with CoinMarketCap, XRP was down by over 20% within the final seven days. The value drop triggered accumulation as shopping for strain surged.

AMBCrypto’s evaluation of Santiment’s knowledge revealed that XRP’s alternate outflow spiked. The truth that shopping for strain was excessive was additionally confirmed by its provide on exchanges, which dropped final week.

Buyers had been additionally assured in XRP, as its optimistic sentiment graph remained excessive.

Supply: Santiment

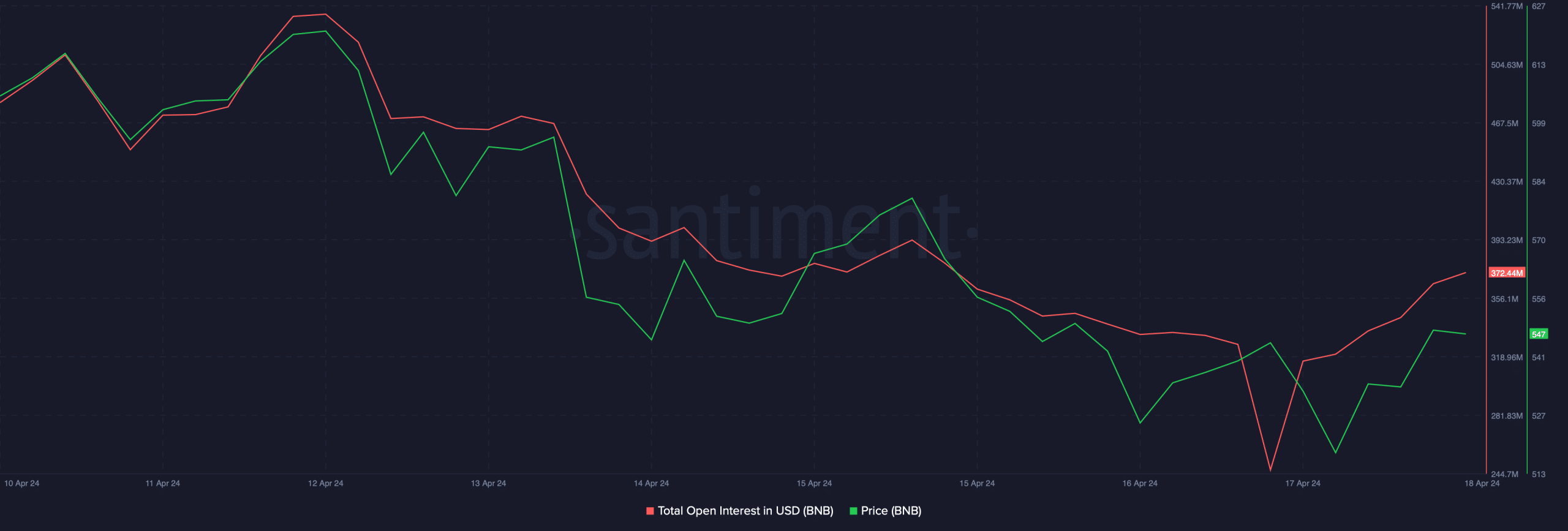

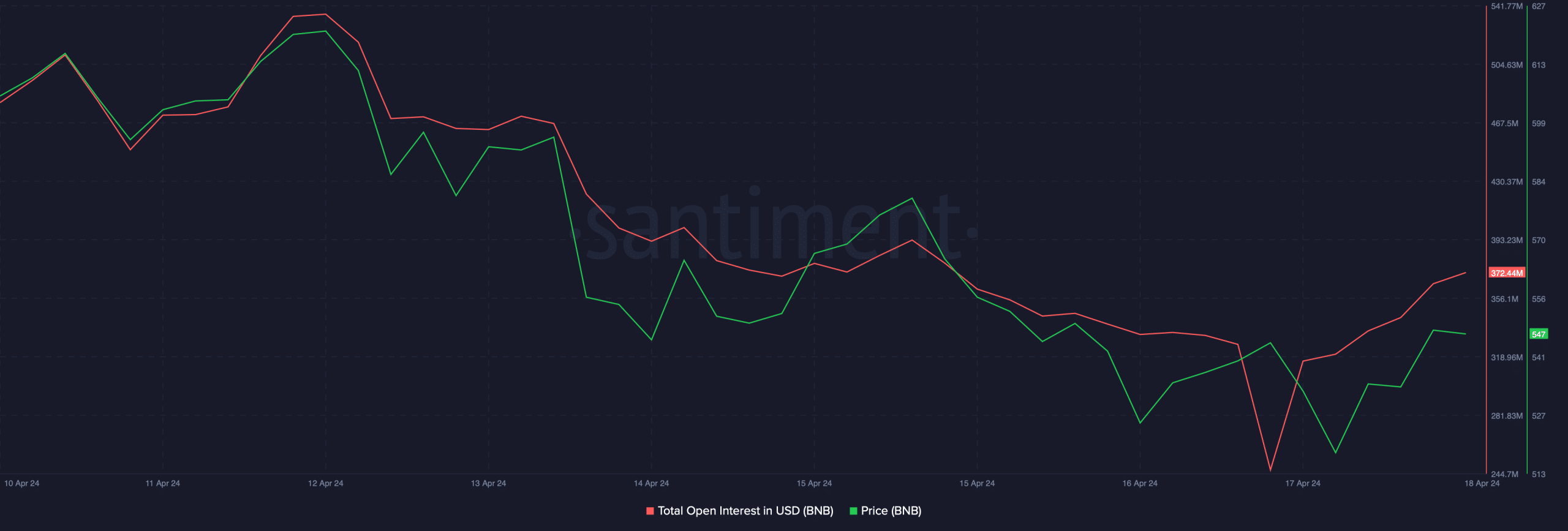

Issues for BNB additionally seemed fairly optimistic. Whereas most cryptos bled, BNB held its floor properly, as its worth surged by 1.3% within the final 24 hours.

Learn Binance Coin’s [BNB] Worth Prediction 2024-25

Whereas the coin’s worth rose, its Open Curiosity additionally elevated. A hike within the metric means that the continued worth pattern would possibly proceed additional.

Wanting on the larger image, if XRP and BNB’s metrics translate into bull rallies, then they could lead the subsequent altcoin season whereas post-Bitcoin halving.

Supply: Santiment