- ADA’s 0.14 correlation with Bitcoin locations it at additional threat regardless of latest correction

- Bulls would possibly assist the token rise in direction of $0.55 within the brief time period

Cardano [ADA] was one of many altcoins hit exhausting by the worth crash of the final 24 hours. At press time, ADA had misplaced 13.27% of its worth throughout the aforementioned interval whereas buying and selling at $0.50. This, after ADA dropped briefly to $0.46 on the charts.

Cardano’s efficiency meant that it suffered a heavier loss than different cryptocurrency within the high 10. Consequently, the variety of ADA holders in loss hiked too.

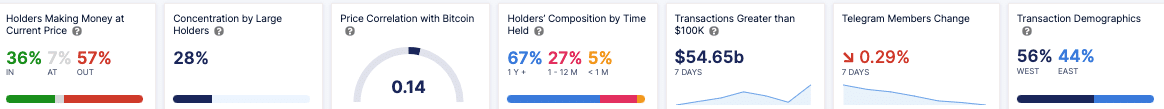

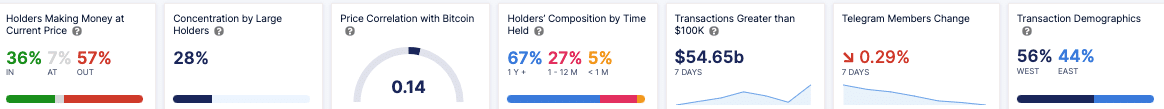

Utilizing knowledge obtained from IntoTheBlock, AMBCrypto discovered that solely 36% of ADA holders had been getting cash at its press time worth. On the other finish, a whopping 57% of holders need to cope with unrealized losses.

Supply: IntoTheBlock

BTC may not lend ADA a serving to hand

Nonetheless, this incidence can’t be attributed to the latest decline alone. For some time, the market has been in an early bull section, however Cardano has underperformed. This has sparked speculations if the altcoin would ever assist all of its holders break even this cycle.

One stumbling block right here is its correlation with Bitcoin [BTC]. When you comply with the market religiously, you’ll observe that BTC has a robust correlation with many high altcoins. Nonetheless, ADA has not been in a position to be a part of this cohort with a value correlation of 0.14. The value correlation ranges between 0 and 1. Subsequently, the studying above implies that Bitcoin’s bounce may not essentially imply ADA’s restoration.

Aside from the short-term forecast, the long-term outlook didn’t look promising for ADA both. This, due to the actions of some whales.

Decrease conviction, decrease costs?

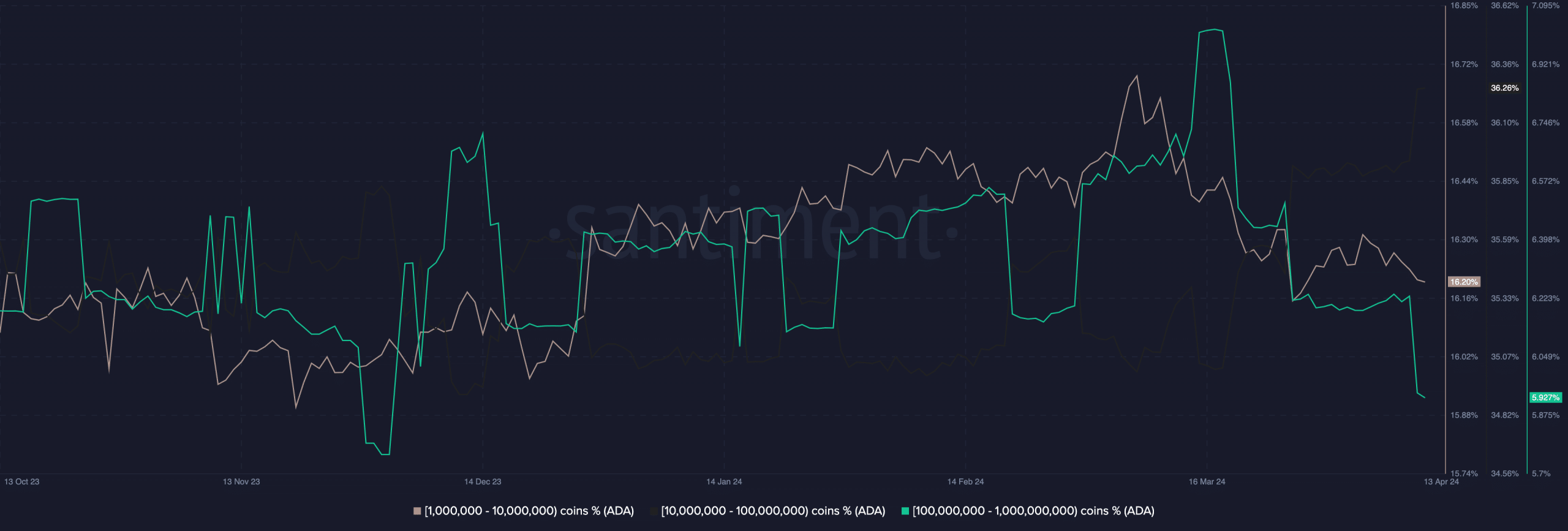

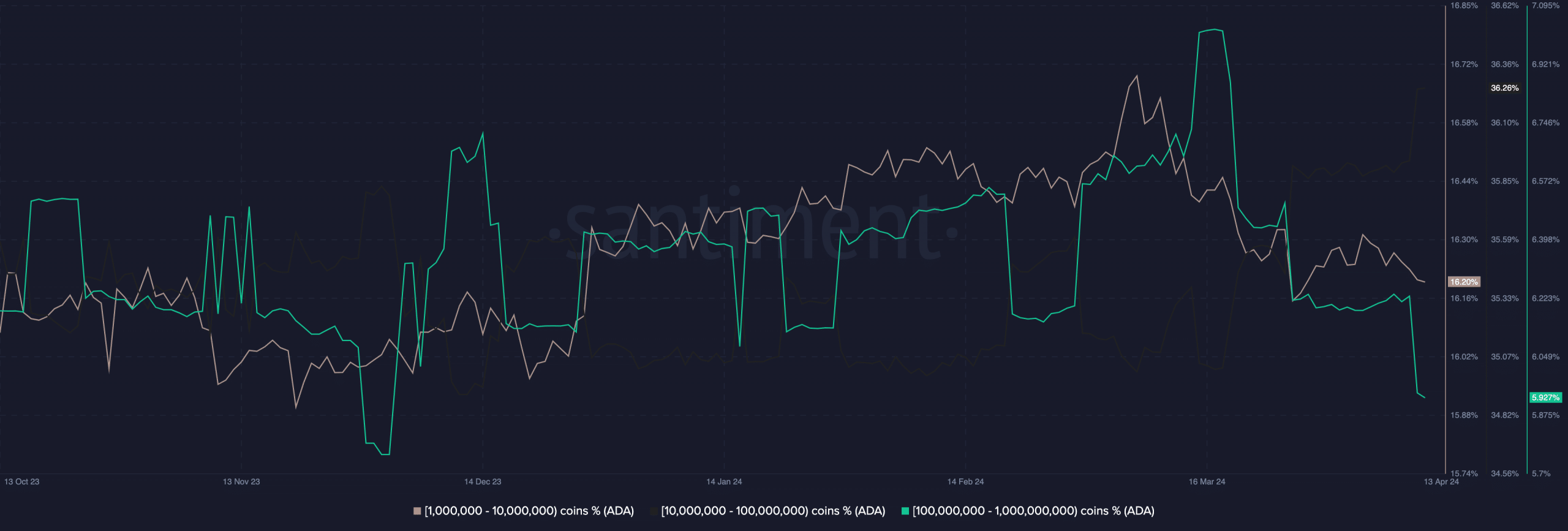

Based on AMBCrypto’s on-chain analysis, whales’ balances has been falling. As an illustration, we noticed that these holding 1 million to 1 billion tokens have liquidated among the ADA held.

On 15 March, the 1 million to 10 million cohort held simply 16.70% of the full provide. Nonetheless, at press time, that proportion had fallen to 16.20%.

It was an analogous scenario for the 100 million to 1 billion group which initially owned 7.01 % across the similar interval. Nonetheless, figures for a similar fell to five.92%, at press time.

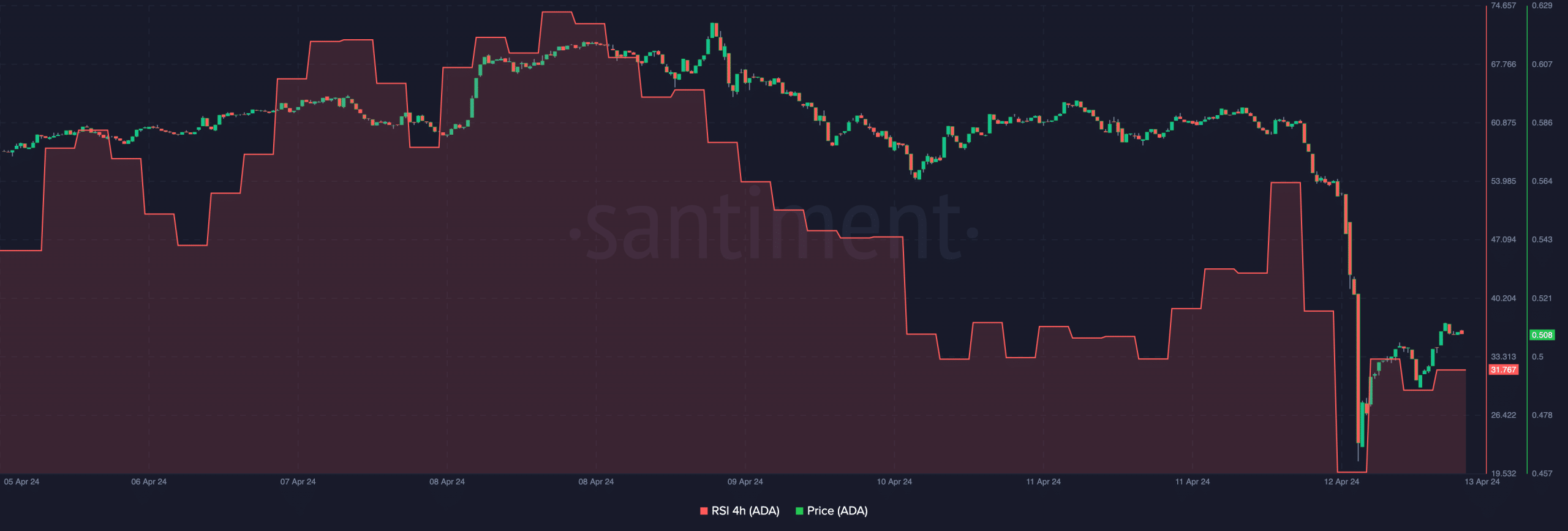

Supply: Santiment

An motion like this means reducing confidence in Cardano’s long-term potential. Within the meantime, the Relative Energy Index (RSI) was 31.76, indicating that bulls had been making an attempt to take ADA out of the oversold area. Beforehand, the worth crash despatched the RSI to 19.53, suggesting an excessive bearish momentum.

A profitable bullish try, backed by dip shopping for, may push ADA as much as $0.55. Nonetheless, insufficient firepower may invalidate this thesis, and ADA would possibly preserve swinging between $0.49 and $0.52 within the brief time period.

Supply: Santiment

Learn Cardano’s [ADA] Value Prediction 2024-2025

As well as, a number of elements excluding those talked about above would possibly influence the place ADA strikes subsequent. For the long-term prediction, the worth motion after Bitcoin’s halving would possibly decide if the token is value holding or not.