The percentages of a June Fed rate-cut have been eviscerated by this morning’s narrative-crushing CPI prints with the market now pricing a less-than-1-in-5 probability of a minimize…

Supply: Bloomberg

Morgan Stanley economist Ellen Zentner is the primary sellside to warn her June rate-cut name is in jeopardy.

“The upside shock in core CPI is shifting the inflation information additional away from the convincing proof the Fed wants to begin chopping in June. Depending on the PPI information tomorrow, this print tilts the Fed towards a later begin to the chopping cycle than our present forecast for June.”

This man acquired proper-fucked…

Somebody in the present day positioned a file measurement commerce in SOFR futures in the future earlier than CPI…baller transfer 🔥👇 pic.twitter.com/NbC0KSDGBB

— Edward Bolingbroke (@EddBolingbroke) April 9, 2024

Expectations for 2024 rate-cuts collapsed – now lower than two cuts priced in…

Supply: Bloomberg

All of which despatched shares reeling decrease…

With the S&P at nearly one-month lows…

The greenback spiked…

Gold dropped…

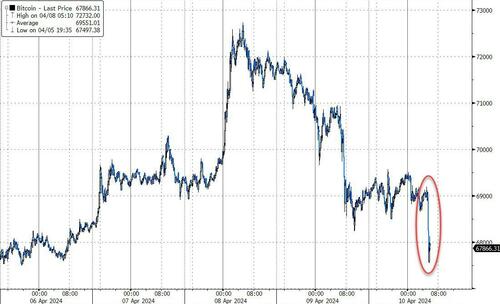

…as did crypto…

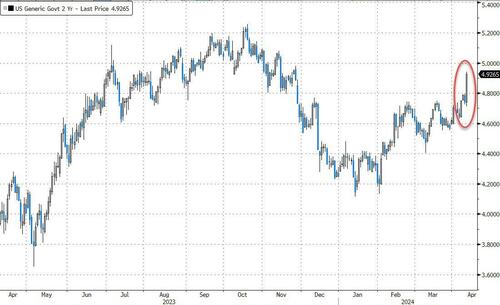

And bond yields exploded increased (2Y +19bps!)…

2Y Yield is closing in on 5.00% as soon as once more…

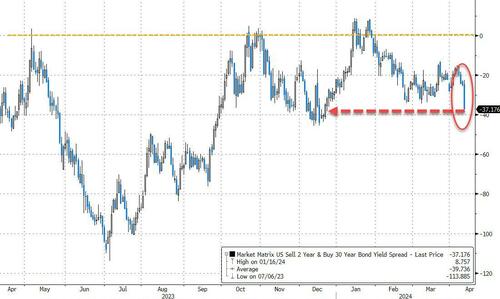

The yield curve dramatically bear-flattened to its most inverted since Dec 2023…

Now, we simply await the spin on how that is truly not so dangerous and rate-cuts are nonetheless one way or the other on the desk… hey we have now to get Biden re-elected one way or the other, proper!!

Loading…