- Bitcoin would possibly start one other bull rally earlier than its upcoming halving.

- Metrics and indicators supported the potential of a bull run.

Bitcoin’s [BTC] worth lastly confirmed indicators of a bull rally after days of being in a consolidation part. The king of cryptos’ worth motion turned bullish at a time when it was anticipating its subsequent halving simply in a couple of days.

Bitcoin turns unstable

After a number of days of sluggish worth motion, BTC bulls just lately made a transfer, permitting the king of cryptos to register positive factors.

In accordance with CoinMarketCap, Bitcoin was up by greater than 2% within the final 24 hours, serving to it inch in the direction of $70k.

On the time of writing, BTC was buying and selling at $69,497.75 with a market capitalization of over $1.37 trillion.

The hike in worth stirred up expectations from the coin, and for buyers, the potential of BTC touching its earlier ATH of $73k once more appeared prone to occur.

In truth, Mags, a preferred crypto analyst, just lately posted a tweet mentioning that BTC’s first half of the bull rally was over, and it was about to start its second innings.

If that’s true, then the BTC would possibly as nicely attain a brand new ATH earlier than its upcoming halving. As per the tweet, BTC’s ATH may be someplace close to $350k.

What the metrics counsel

Because the goal of $350k appeared fairly formidable, AMBCrypto deliberate to check out the king of crypto’s metrics to see what to anticipate within the close to time period.

Our evaluation of CryptoQuant’s data revealed that its change reserve was lowering, which means the shopping for strain on the coin was excessive.

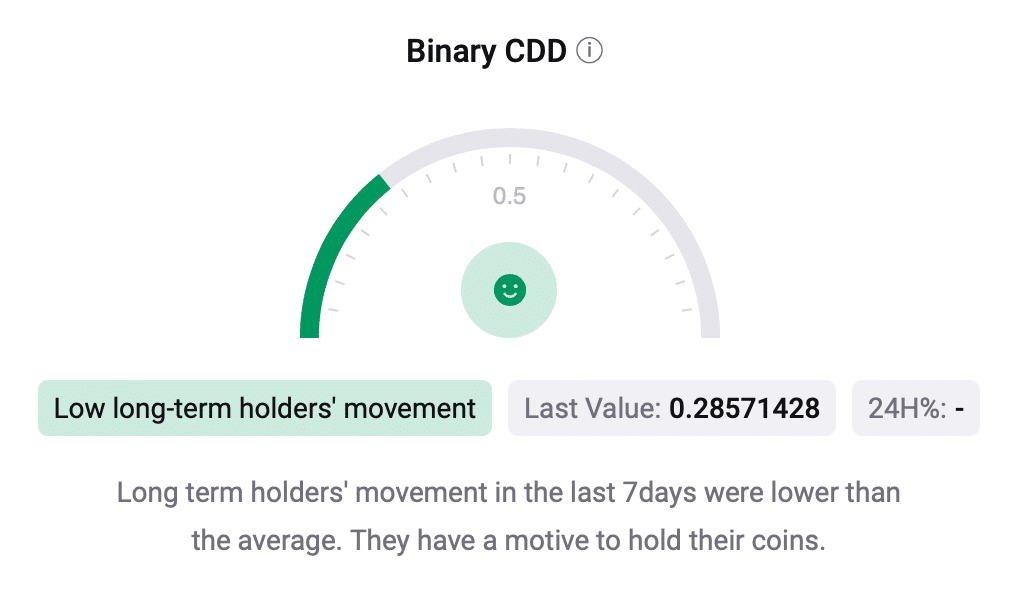

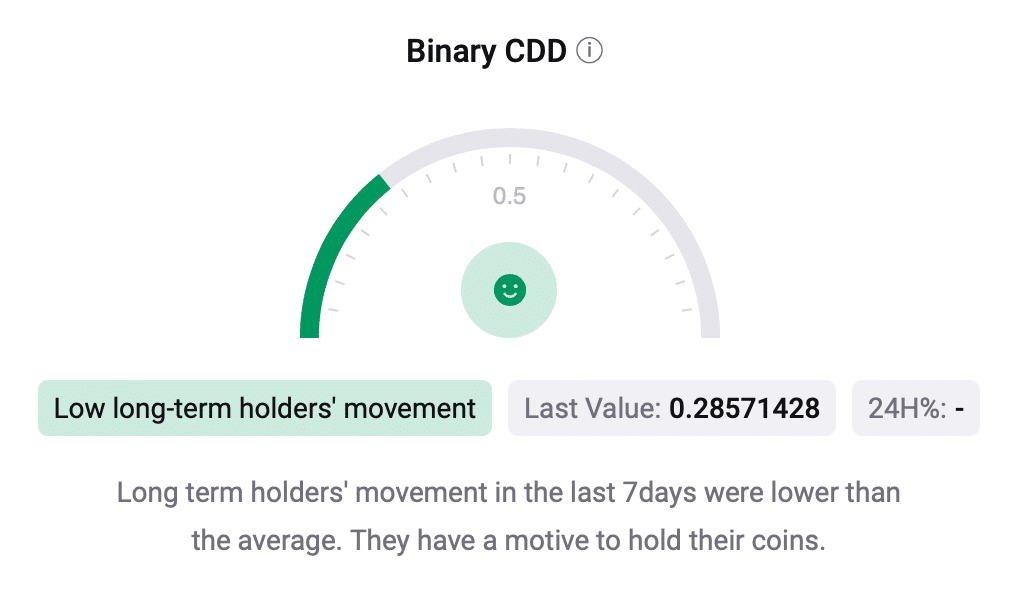

Its Binary CDD was inexperienced as nicely, which means that long-term holders’ actions within the final seven days have been decrease than common.

Supply: CryptoQuant

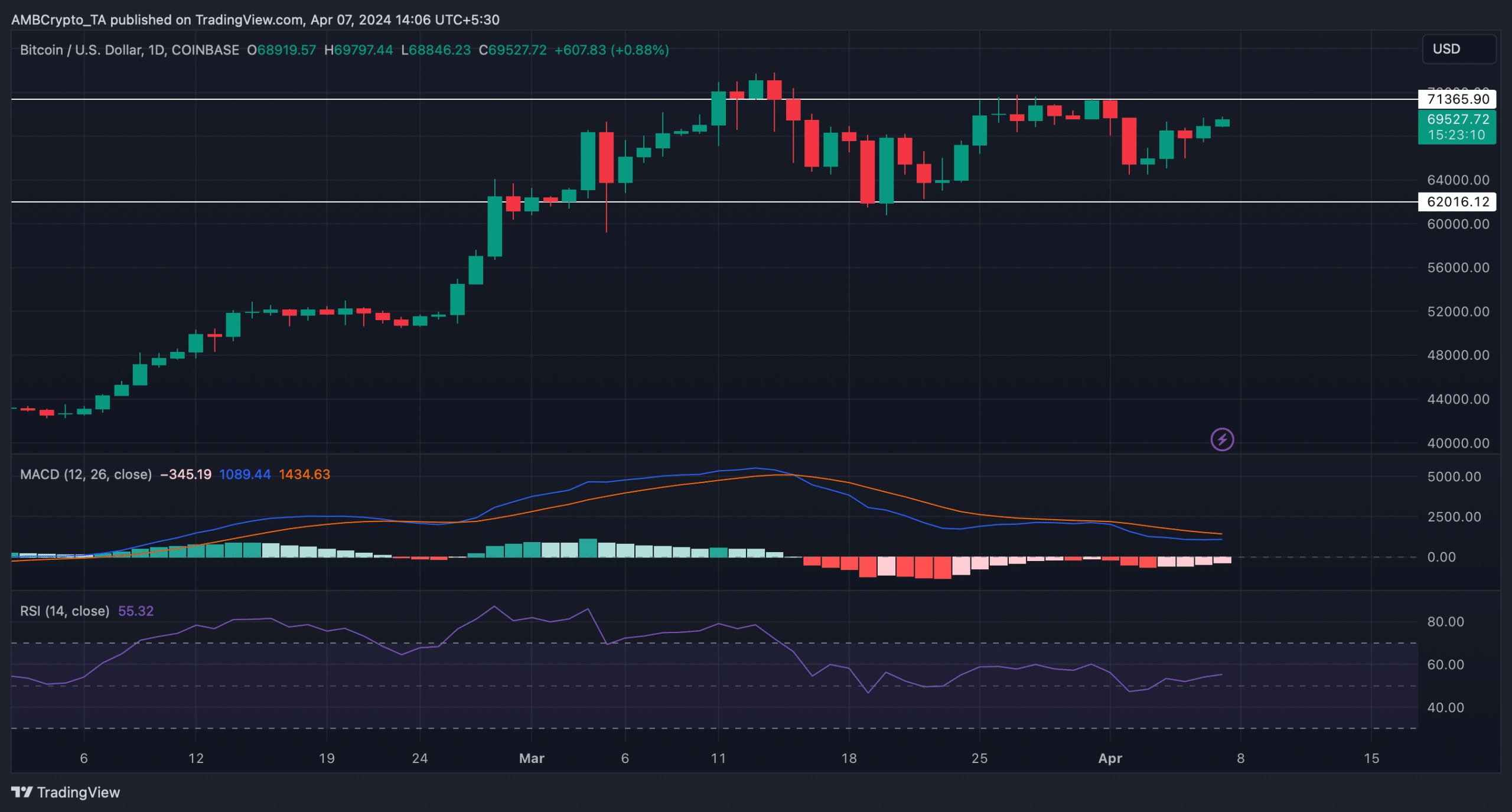

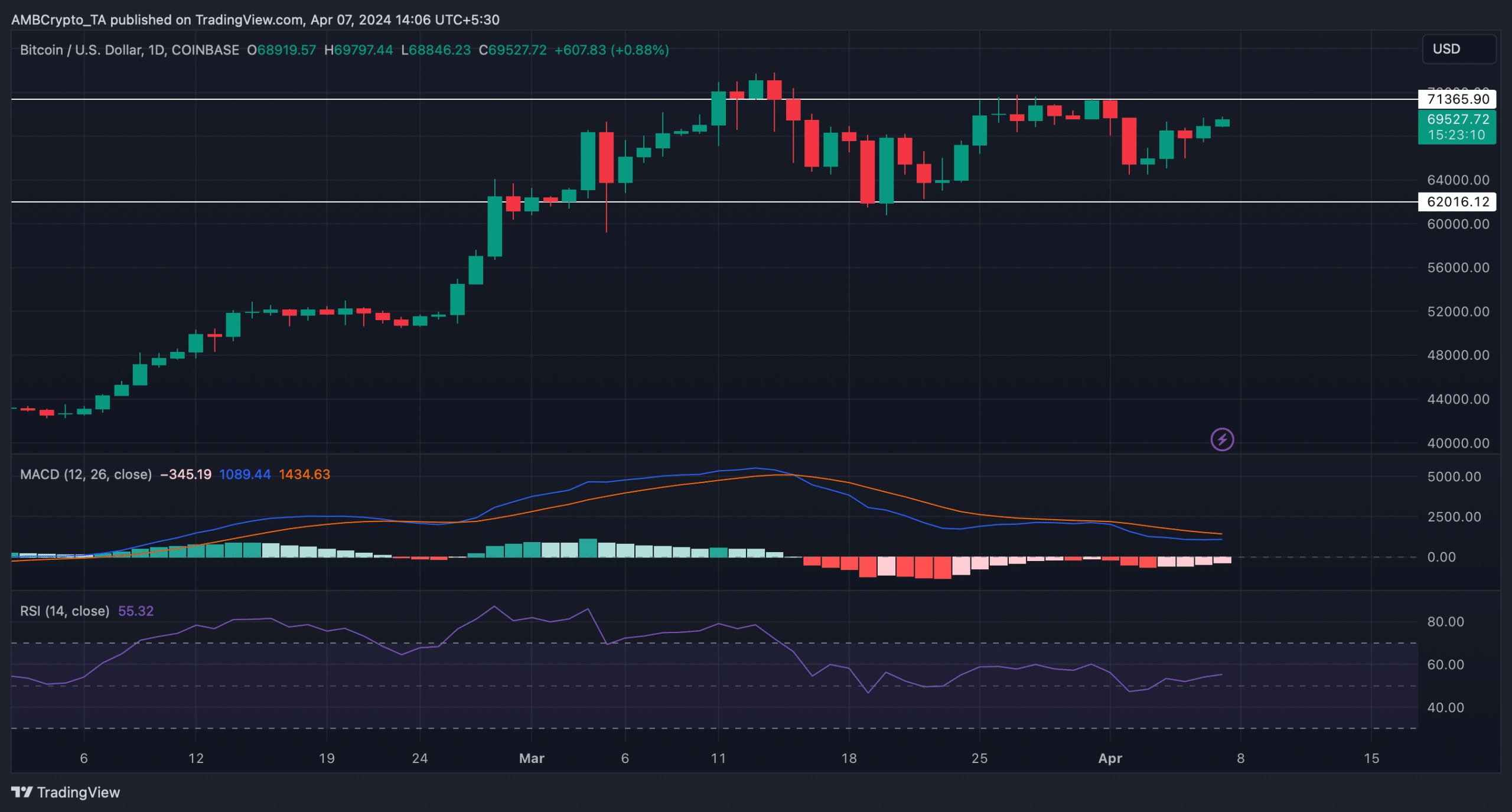

AMBCrypto then analyzed BTC’s every day chart to see whether or not an uptrend was inevitable. We discovered that BTC must go above the $71k resistance with the intention to provoke a bull rally.

The opportunity of this taking place was doubtless, because the Relative Power Index (RSI) registered an uptick. Nevertheless, nothing may be stated with certainty, because the MACD displayed a bearish benefit available in the market.

Supply: TradingView

A fast have a look at the upcoming halving

All of this was taking place at a time when BTC was anticipating its subsequent halving, which is about to occur in round 12 days from press time.

The halving will steadily scale back the accessible provide for commerce over the subsequent 4 years, with an estimated influence of ~6%.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

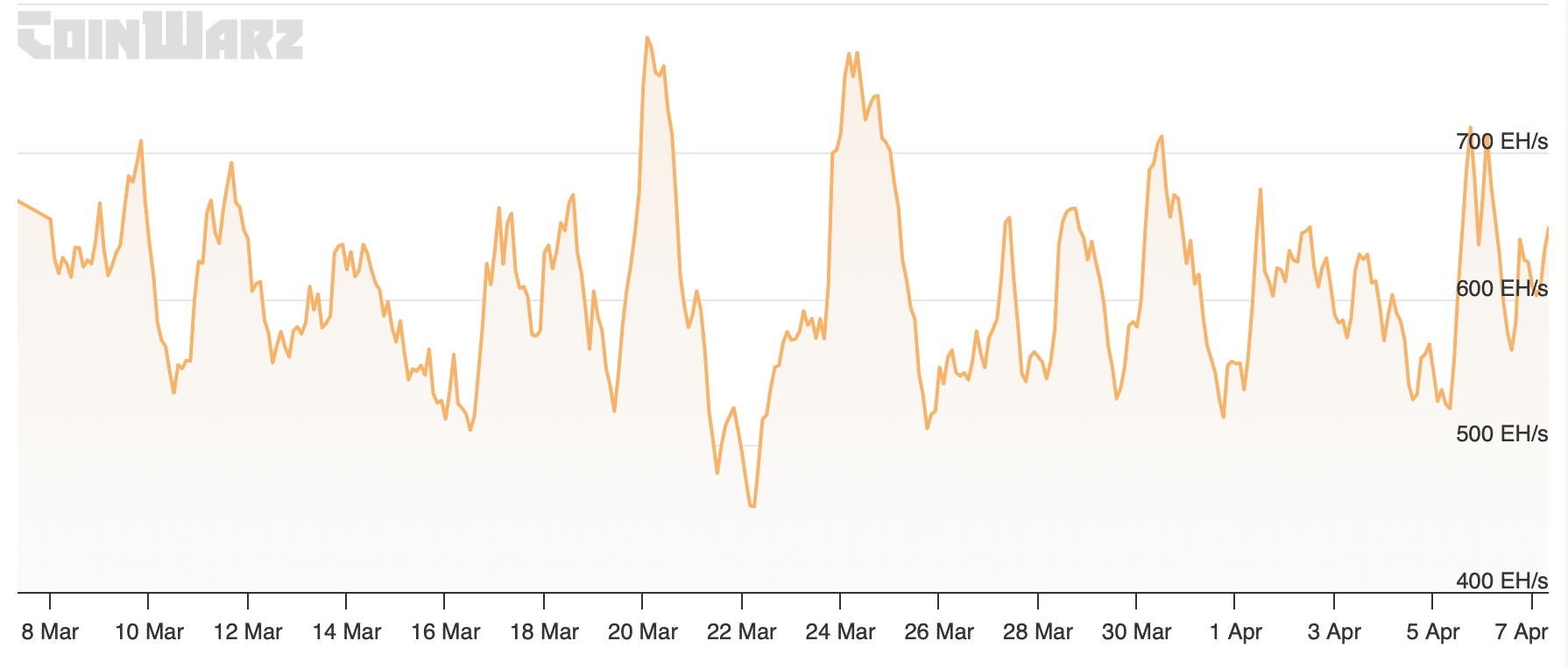

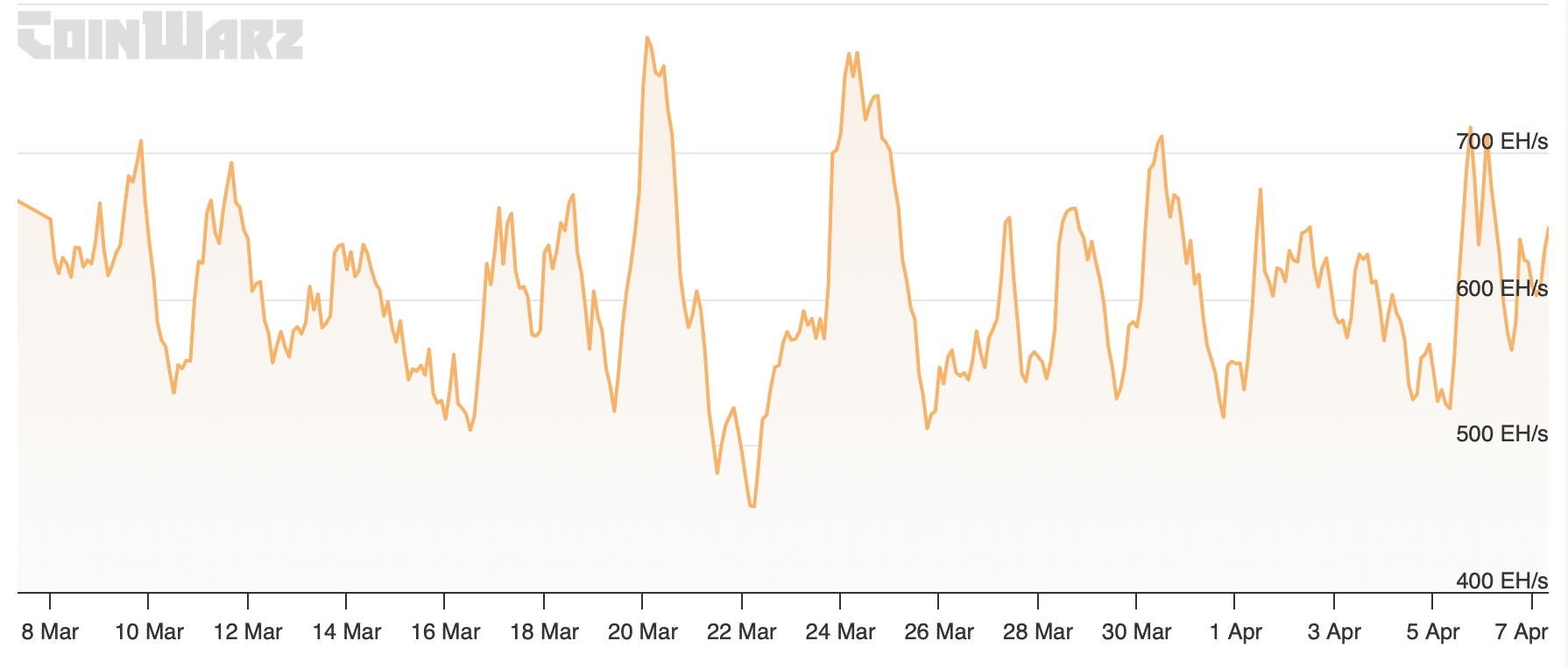

AMBCrypto then took a have a look at BTC’s mining sector to see how miners have been behaving earlier than the halving.

We discovered that BTC’s hashrate remained comparatively excessive final month, reflecting a steady variety of miners working within the ecosystem. At press time, BTC’s hashrate stood at 656.61 EH/s.

Supply: Coinwarz