The rising curiosity in decentralized finance (DeFi) displays a market shifting in direction of rationality, effectivity and better consciousness of threat, and all indicators level to a coming bullish summer time, marked by renewed confidence and a shift in direction of safer funding methods.

As soon as enamored with nothing greater than excessive returns, buyers now prioritize security over uncooked numbers.

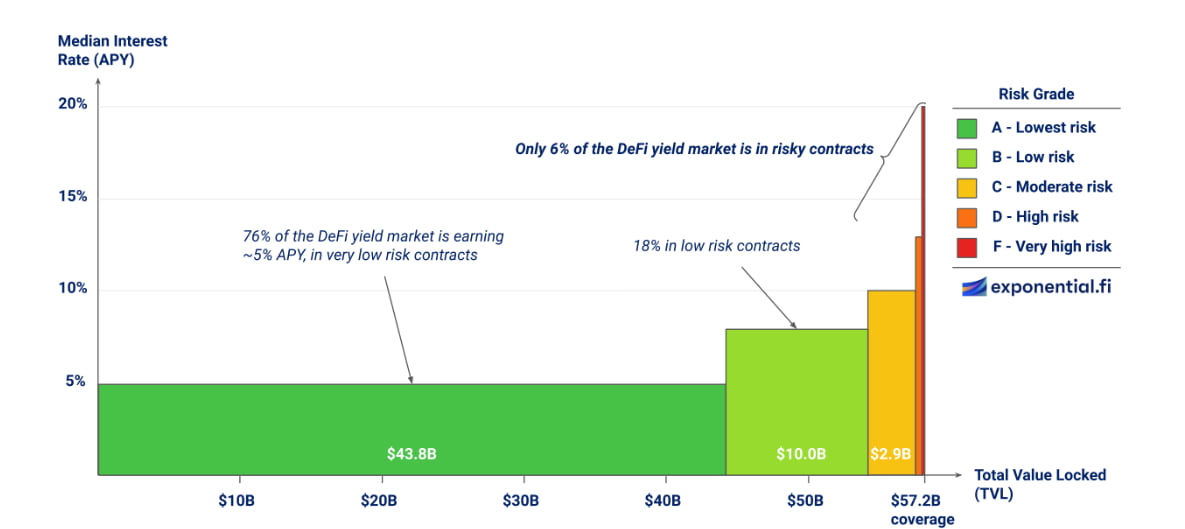

Knowledge collected by Exponential and revealed in March reveals that a good portion of DeFi funds, round 75%, are locked into swimming pools that supply conservative annual returns (APYs) starting from 0-5% (as seen under) .

Such a cautious method, particularly evident in Ethereum (ETH) stake swimming pools, displays a notable break from the times of relentless pursuit of yield.

A brand new optimism out there

A resurgence of Complete Worth Locked (TVL) throughout the yield-generating DeFi protocols alerts renewed optimism and market liquidity.

Nevertheless, curiosity in sectors resembling insurance coverage and derivatives has waned, highlighting the challenges related to integrating sure monetary actions into the DeFi framework.

Spend and borrow safely

The DeFi employment panorama can also be evolving and we’re seeing a shift in direction of low-risk actions resembling staking and secured lending.

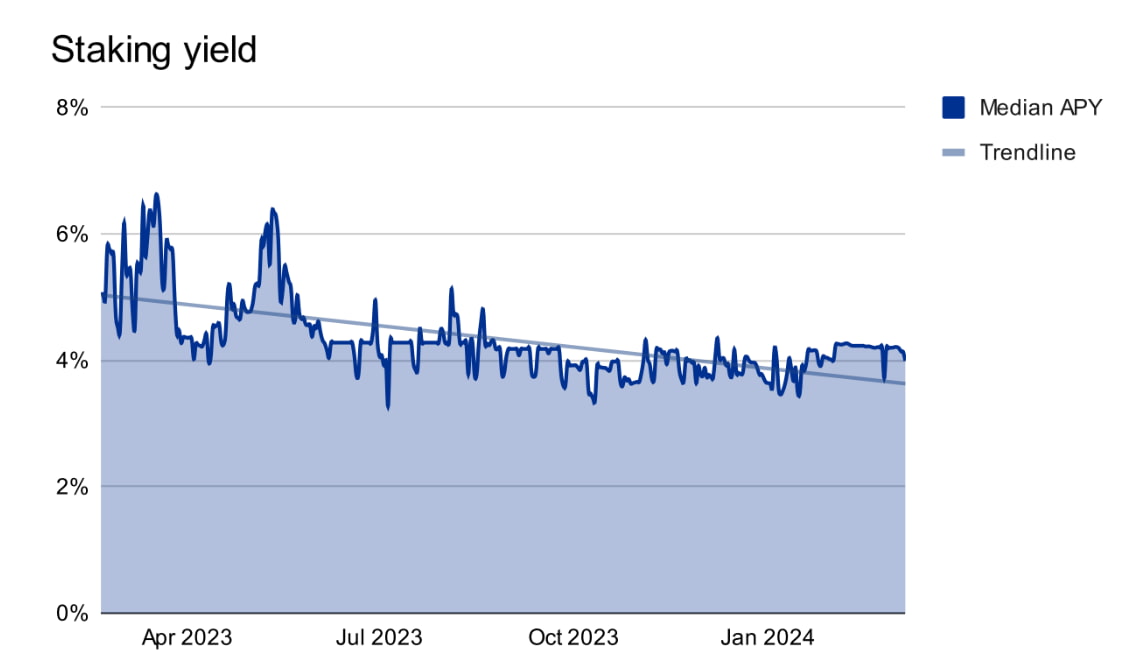

Staking is rising as a cornerstone of DeFi progress, fueled by Ethereum’s transition to a Proof-of-Stake (PoS) mannequin.

Regardless of declining returns because of elevated participation, staking now includes roughly 80% of DeFi’s TVL.

Resuming the choices now obtainable on platforms like EigenLayer additional will increase demand for Ethereum staking and guarantees increased returns (albeit with elevated threat).

The credit score sector is experiencing a revival, pushed by a collective threat angle and the will for increased returns.

Rates of interest for stablecoins on platforms like Aave (AAAVE) and Compound at the moment are within the double digits, prompting merchants to make use of stablecoins for increased returns.

Decentralized exchanges

Decentralized exchanges (DEXs) are going through subdued progress because of considerations about impermanent losses.

Nevertheless, advances in capital effectivity supply increased returns with much less capital, mitigating a number of the threat.

The bridging sector is witnessing a big enhance in TVL, pushed by the rise of Layer-2 rollups, the place dependable bridging fashions promise a extra built-in and environment friendly DeFi ecosystem.

A shift from rewards-based returns to activity-driven returns alerts a maturing DeFi market, supported by actual on-chain exercise.

Nevertheless, regardless of the shift, incentives stay a viable technique to draw new customers and lift capital.