- A portion of Bitcoins backing the prevailing fund can be used to seed the brand new ETF.

- The transfer comes amidst unrelenting outflows from GBTC since its conversion to ETF.

Digital asset supervisor Grayscale Investments plans to launch a miniature version of its flagship spot Bitcoin [BTC] exchange-traded fund (ETF).

This was revealed by way of a submitting submitted with the U.S. Securities and Alternate Fee (SEC).

GBTC’s spin-off

The so-called Grayscale Bitcoin Mini Belief would function beneath the ticker “BTC” upon regulatory approval.

It was anticipated to have a “materially decrease” charge than the bigger Grayscale Bitcoin Belief (GBTC), at the moment the world’s largest digital asset fund.

The mini fund can be a GBTC “spin-off”, that means {that a} portion of Bitcoins backing the prevailing fund can be used to seed the brand new ETF.

Grayscale acknowledged that the transfer would profit current GBTC shareholders by permitting them to get pleasure from a portion of the brand new fund at a decrease blended charge.

The opposite main benefit was that GBTC holders might purchase shares of the mini fund with out having any tax legal responsibility.

GBTC bleeds with outflows

The motivation to launch a extra reasonably priced Bitcoin funding car comes amidst huge outflows from GBTC, with the 1.5% charge cited as the first issue.

The administration charge charged by Grayscale was the very best amongst all ETF issuers. Most different gamers have been charging between 0.2% and 0.4%.

Grayscale defended the excessive charges, citing its observe report and standing out there.

Nevertheless, the excessive charges gave the impression to be impacting the fund’s efficiency.

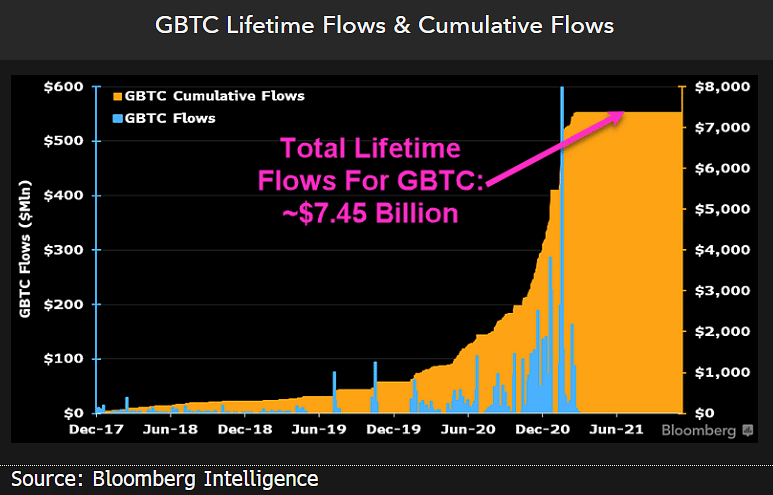

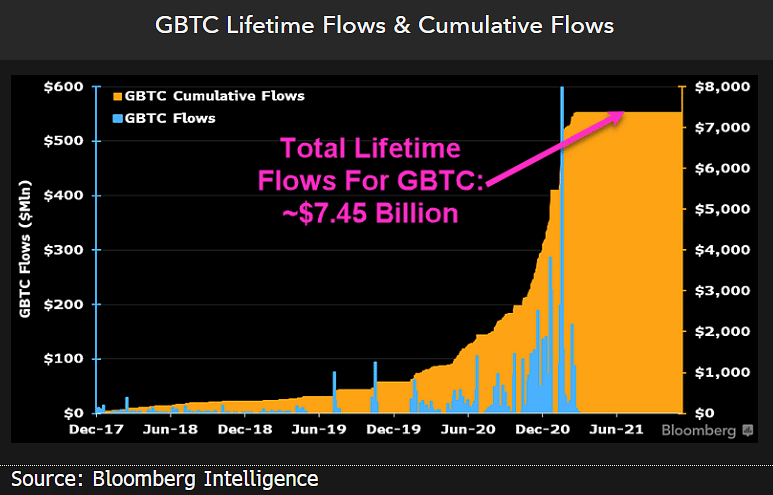

In line with Bloomberg analyst James Seyffart, GBTC skilled $11 billion in outflows since transitioning to a spot ETF, as in comparison with $7.45 billion inflows earlier than the conversion.

Furthermore, as per ETF analyst Eric Balchunas, GBTC noticed the 2nd-highest outflows of any ETF within the final 15 years.

Supply: Bloomberg Intelligence

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Many of those redeemed Bitcoins have been doubtless getting reallocated to cheaper spot ETFs. Blackrock’s IBIT, for instance, has seen greater than $11 billion in internet inflows since itemizing.

In consequence, its property beneath administration (AuM) have ballooned previous $15 billion, as per AMBCrypto’s evaluation of SoSo Value information.