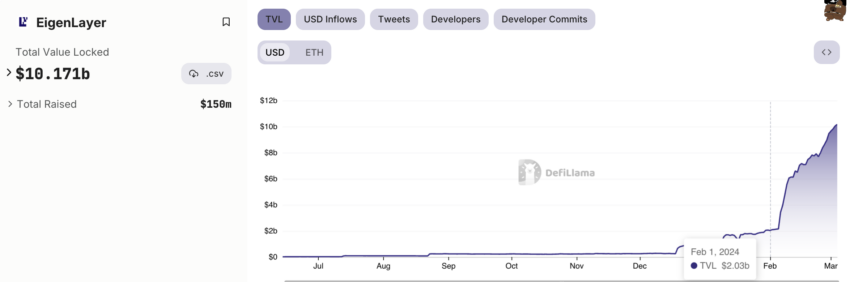

EigenLayer’s Complete Worth Locked (TVL) has elevated to $10 billion, a major improve from the $1.1 billion valuation at the start of the 12 months. This progress, which quantities to 2.93 million Ethereum (ETH), underlines the protocol’s rising affect inside the decentralized finance (DeFi) sector.

EigenLayer permits customers to deposit and withdraw ETH by way of varied liquid staking tokens. This course of goals to enhance the safety of third-party networks.

How DeFi Protocol EigenLayer’s TVL has elevated 5 instances since February

Over the previous few weeks, now we have witnessed outstanding progress in EigenLayer’s TVL, particularly within the final 30 days. On February 2, 2024, the TVL was roughly $2 billion, however has elevated fivefold since then.

This improve coincides with EigenLayer’s determination to quickly carry restrictions on token reinstatement and abolish TVL limits for every token. The protocol expects these adjustments to turn into everlasting within the close to future, signaling a strategic shift within the operational framework.

The rise of EigenLayer in TVL has made it the third largest DeFi protocol, overtaking Maker. Now it trails AAVE by a margin of about $92 million. This progress may be attributed to a constant inflow of ETH deposits, primarily enabled by liquid withdrawal protocols and the rising worth of Ethereum itself.

Learn extra: What’s EigenLayer?

EigenLayer TVL. Supply: DefiLlama

The anticipation of an EigenLayer airdrop has additionally performed a vital position and attracted important consideration from the DeFi neighborhood. Many customers deposit their Ethereum into EigenLayer to extend their possibilities of receiving airdrop advantages. At present, the protocol solely helps native re-recording with EigenPod.

EigenLayer’s strategy to retaking has acquired widespread consideration. This mannequin permits Ethereum or ERC-20 token holders to contribute to the safety of different initiatives or purposes on the community.

In return, individuals obtain extra rewards, bettering the general safety and effectivity of the Ethereum ecosystem with out the necessity to freeze extra belongings.

The success of the challenge and the revolutionary options haven’t gone unnoticed by buyers. In March 2023, EigenLabs secured a $50 million Collection A funding spherical led by Blockchain Capital.

Learn extra: Ethereum re-withdrawal: what’s it and the way does it work?

This was adopted final month by a major $100 million funding from Andreessen Horowitz in a Collection B spherical. Moreover, Binance Labs’ current funding in Renzo, a Liquid Restaking Token (LRT) and Technique Supervisor for EigenLayer, highlights the rising curiosity within the protocol’s restaking options.

Disclaimer

All data on our web site is printed in good religion and for basic data functions solely. Any motion the reader takes primarily based on the data on our web site is strictly at your personal threat.