Authored by Simon White, Bloomberg macro strategist,

Inflation is again on the radar this week after yesterday’s launch of PCE within the US. It confirmed a modest fall from the prior month within the headline print (however beneath the floor the image was extra worrying), lending credence to the larger image sign of inflation pressures constructing once more. Emblematic of how unpriced property are for this probability, volatility in gold and silver and different metals is close to decade lows.

Given how just lately inflation was at generational highs, it’s exceptional how complacent the market has change into that the inflation downside is over. Usually after an inflation shock, there’s a threat premium constructed into costs that persists for a few years. It took a very long time, and the brutal charge rises of Paul Volcker adopted by the delphic utterances of Alan Greenspan, to lastly persuade the market to convey time period premium again to the pre-Nice Inflation ranges of the Nineteen Sixties.

In the present day, the fixing-swaps market foresees that CPI will return in direction of 2% CPI by the second half of this 12 months. There isn’t any threat premium for inflation constructed into yields, and cash markets have a major bias in direction of anticipating decrease not greater charges.

On high of that, commodity volatility is becalmed. Commodities and different actual property have traditionally carried out properly in in inflation regimes, with their volatility rising too. However implied vol in a number of commodities, particularly metals and notably gold and silver, is preternaturally low.

This isn’t reflective of a market anticipating a return of inflation, or certainly pricing a lot chance of it taking place in any respect. No asset class, in reality, appears prepared for an inflation redux.

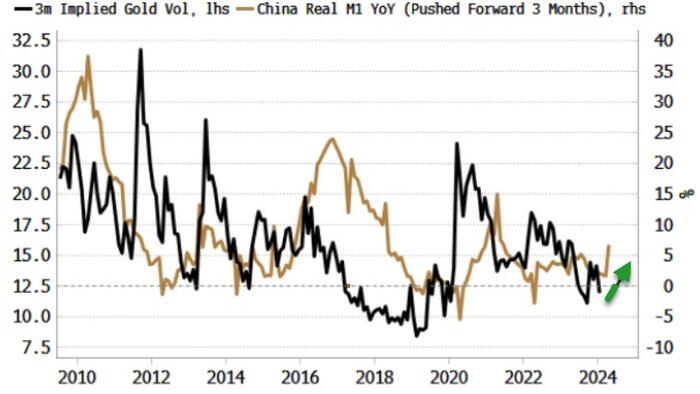

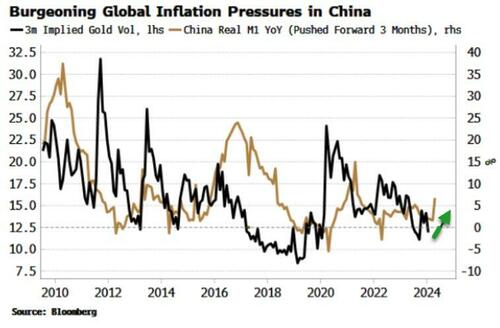

One of many largest drivers of US disinflation over the past two years has not been home financial coverage, however deflation in China. But, very slowly, main indicators of exercise and inflation are starting to choose up in China as layers of fiscal and financial stimulus begin to chunk.

An indication that China will quickly be contributing positively to international and US value pressures once more — and trigger a repricing in markets — might be seen within the nascent rise in actual slim cash (M1) progress, which has led gold volatility in recent times.

Loading…