Uniswap has surpassed Bitcoin in charges paid by crypto merchants for over every week, with the DEX surpassing Bitcoin on February 14.

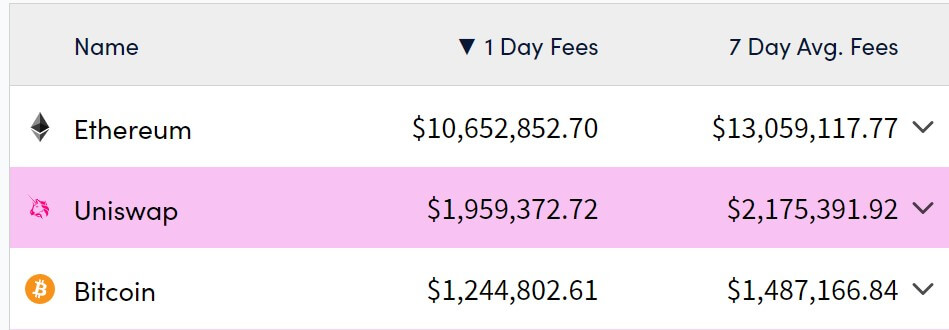

In keeping with information from Cryptofees, Uniswap raked in roughly $1.9 million in charges on February 25, surpassing Bitcoin’s $1.2 million on the identical day. This development has continued since mid-month, with Uniswap taking in a mean of $2.1 million in charges over the previous week, in comparison with BTC’s $1.4 million.

In the meantime, Ethereum is the general chief in transaction charges. The blockchain community generated $10.6 million in charges final day and a mean of $13 million per day final week. Notably, Bitcoin maintained this enviable place early this 12 months and for a number of intervals final 12 months, when neighborhood curiosity in Ordinals Inscriptions drove up community charges.

Uniswap charges

Uniswap’s profitable charges have arrived at an fascinating time, with the DEX Basis not too long ago proposing a price compensation mechanism for its UNI token holders.

As the biggest DeFi DEX platform, Uniswap processes roughly 30% of the full transactions within the decentralized finance sector, in response to information from DeFillama. Notably, all charges generated by Uniswap are owned by liquidity suppliers (LPs) that offer belongings to the platform. These charges improve when customers carry out asset swaps on the trade, indicating elevated exercise inside the decentralized ecosystem.

Nonetheless, with the brand new proposal, the DEX will allocate protocol charges to the delegated and delegated UNI token holders to reinvigorate governance participation. Erin Koen, board chief of the Uniswap Basis, highlighted the potential of this transfer to strengthen the protocol’s resilience and decentralization.

Basis Government Director Devin Walsh additional highlighted how the improve will strengthen Uniswap’s governance. Walsh added:

“If each firm constructing on Uniswap had been to vanish tomorrow, it will be as much as its delegates to make use of their powers to make sure that the Uniswap Protocol+ ecosystem continues to outlive and thrive into the long run. On this means, encouraging energetic, engaged delegation is integral to the long-term sustainability of the Protocol.”

The proposal remains to be awaiting preliminary and ultimate votes up the chain earlier than being carried out.

In response to those developments, the UNI token has seen a notable rise, rising roughly 40% over the previous week to $10.59, primarily based on Crypto Slates info.