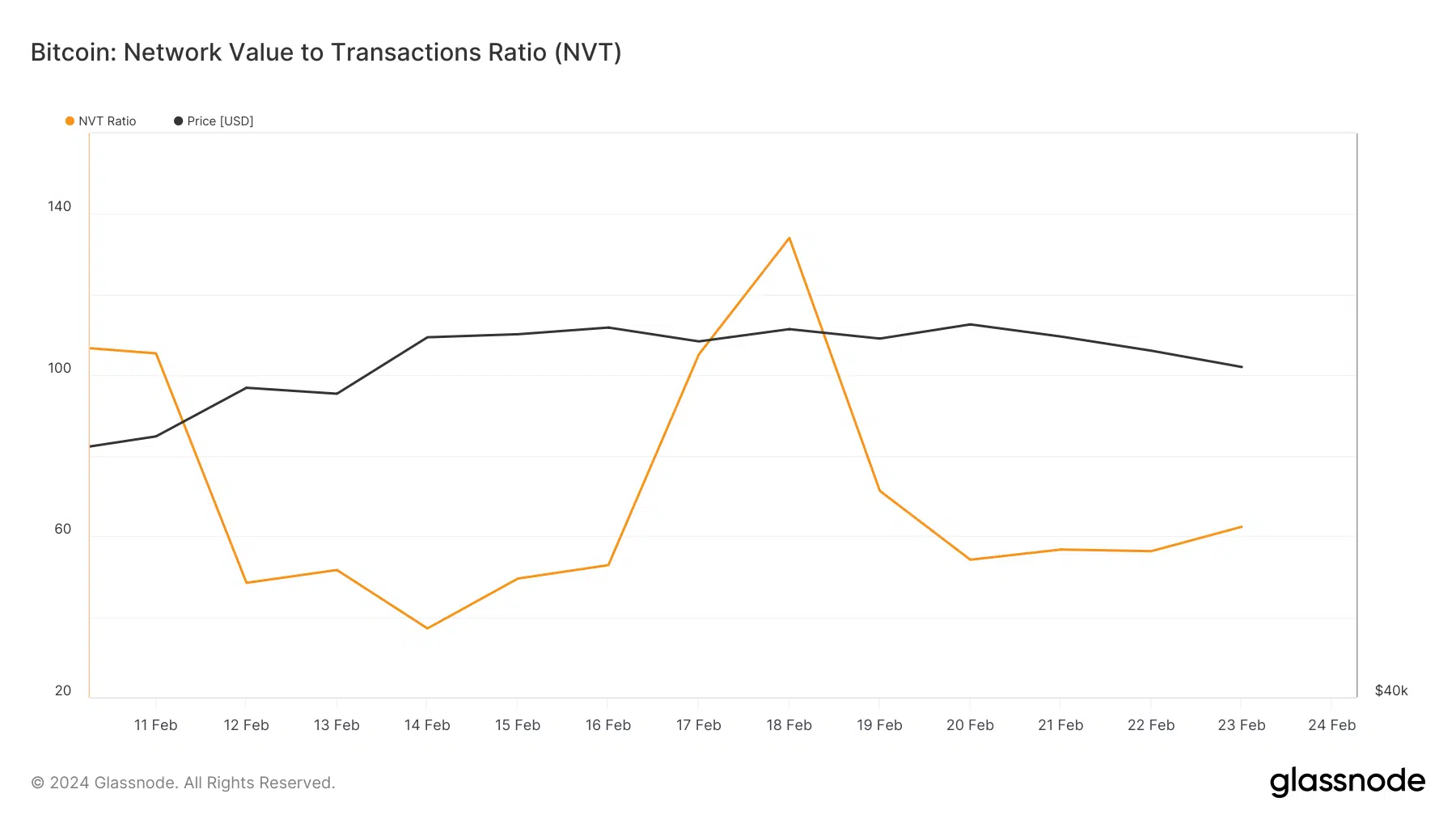

- BTC’s NVT ratio declined which meant that it was undervalued.

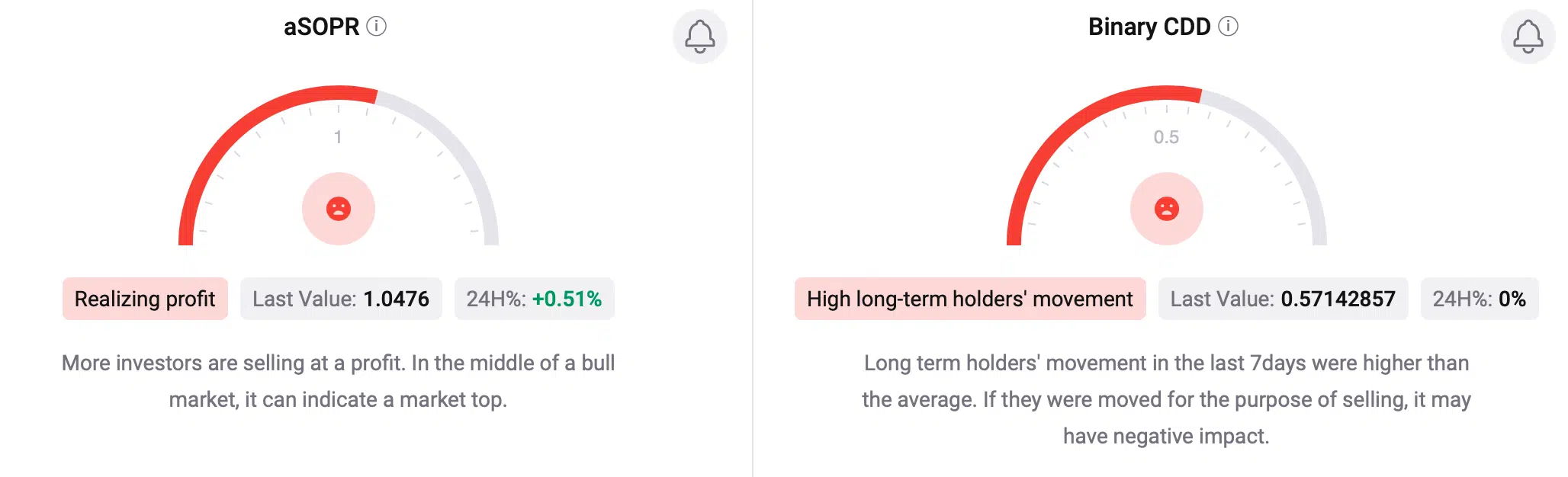

- A couple of metrics and market indicators seemed bearish on Bitcoin.

After crossing the $50,000 mark, Bitcoin’s [BTC] momentum declined once more as its worth moved sideways. In reality, the king of cryptos value was hovering in between a value band, suggesting a number of extra slow-moving days forward.

Bitcoin is slowing down

After rising by almost 30% within the final 30 days, the value motion of BTC turned sluggish as soon as once more. This was evident from the truth that its worth solely moved marginally over the previous few days.

On the time of writing, BTC was trading at $50,948.23 with a market capitalization of over $1 trillion.

Coinglass’ current tweet additionally identified that BTC’s value was transferring between the $52k and $50.5k vary. These ranges additionally acted as BTC’s resistance and help ranges, respectively.

If BTC’s value manages to interrupt out of the resistance zone, the potential for BTC touching $55,000 is excessive.

Nevertheless, if the other occurs and BTC falls under its help zone, buyers would possibly witness an extra downtrend. Due to this fact, to get higher readability, AMBCrypto checked BTC’s on-chain information.

We discovered that BTC’s Community Worth to Transactions (NVT) ratio registered a downtick over the previous few days. Each time the metric declines, it means that an asset is undervalued, indicating that there are probabilities of a value uptick.

A couple of different metrics additionally seemed bullish. For instance, as per our evaluation of CryptoQuant’s data, Bitcoin’s alternate reserve was dropping. This meant that purchasing stress on the coin was excessive.

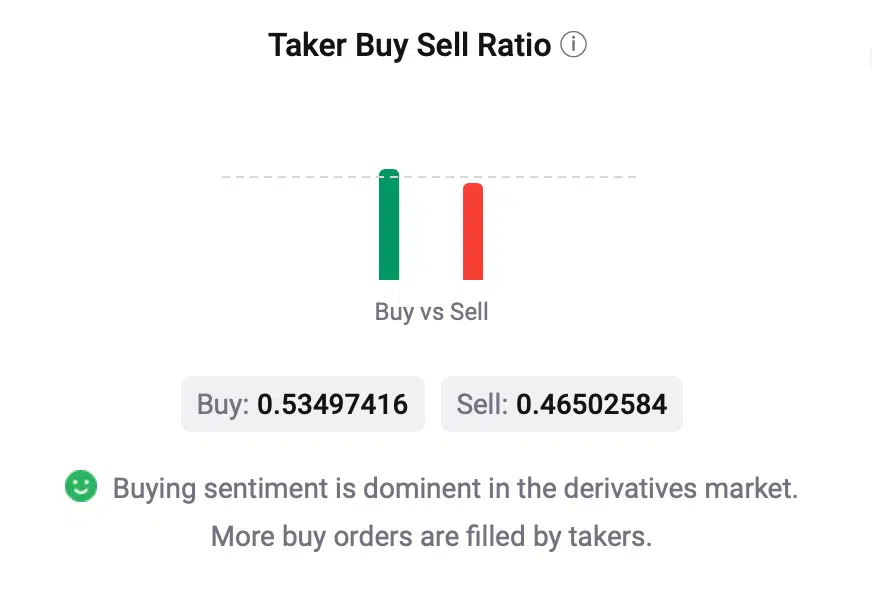

Moreover, shopping for sentiment was additionally dominant within the derivatives market, which was evident from its inexperienced taker purchase/promote ratio.

Troubles nonetheless stay for Bitcoin

Although the aforementioned metrics seemed bullish, a number of others instructed in any other case and hinted that BTC’s value would possibly as nicely attain its help degree within the coming days.

AMBCrypto reported earlier that BTC might witness a short-term value correction as there was a motion of cash from long-term holders (LTHs) to short-term holders (STHs).

The token’s Binary CDD continued to stay crimson, that means that long-term holders’ actions within the final seven days have been larger than common.

Its aSORP was additionally crimson. This instructed that extra buyers have been promoting at a revenue. In the midst of a bull market, it could actually point out a market high.

A take a look at BTC’s every day chart identified different bearish indicators. The MACD displayed a bearish crossover.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Each the coin’s Relative Energy Index (RSI) and Cash Movement Index (MFI) registered downticks. These metrics instructed that the probabilities of a drop in BTC’s value have been excessive.

Nonetheless, BTC’s value remained above its 20-day easy transferring common, as displayed by the Bollinger Bands. This may act as help and assist BTC rebound.