Authored by Simon White, Bloomberg macro strategist,

Inflation might have fallen from its peak around the globe, however within the inflationary regime through which we stay, upside surprises are extra seemingly.

That might worsen already weak liquidity in world bonds and heighten the chance of rising yields.

International bond yields have fallen virtually in every single place in latest months, however that shouldn’t distract from the truth that underlying circumstances stay flamable, and a seemingly (comparatively) benign atmosphere for yields could possibly be abruptly upended.

Bond yields are pushed by time period premium — through which we will lump all the opposite dangers inherent to proudly owning longer-term bonds comparable to liquidity and inflation — and by price expectations.

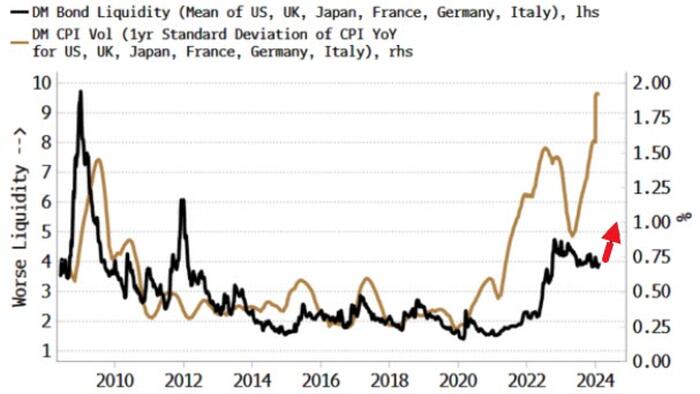

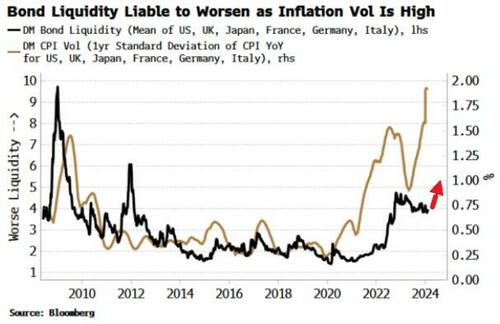

Liquidity and inflation are associated.

The volatility of inflation, which rises when inflation rises, tracks bond liquidity. Larger inflation volatility sometimes goes with poorer liquidity in bonds.

As we will see from the chart above, developed-market inflation volatility stays elevated, leaving bond liquidity liable to deteriorate.

Bonds have been buying and selling with a destructive skew, proven for the TLT (ETF of long-term USTs) beneath, which signifies that poor liquidity is extra prone to result in decrease costs, increased yields.

This comes at a time when there are compelling indicators of a cyclical upswing in world progress.

The mix of supported progress, receding US recession danger, heightened inflation uncertainty, and a deterioration in bond liquidity is an entire recipe for increased bond yields.

The danger is compounded when taking account of the rarefied view that US bond yields – which have a big affect on DM yields – will transfer a lot increased this 12 months, in keeping with financial institution surveys.

Loading…