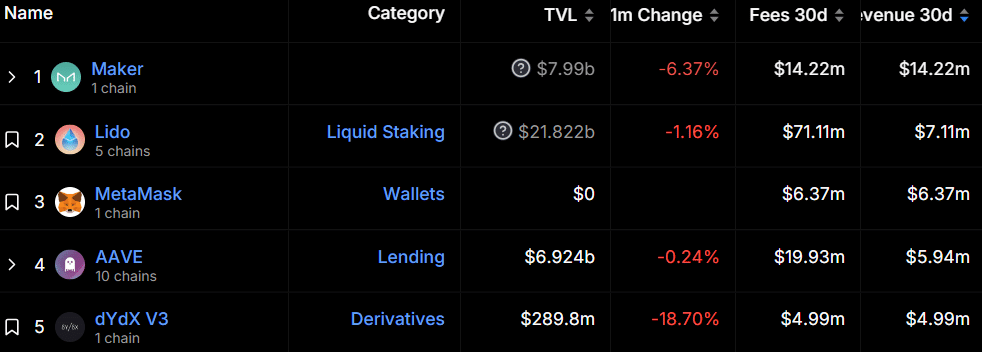

Maker Protocol tops the record when it comes to income generated over the previous month, whereas Complete Worth Locked within the protocol witnesses improve.

Based on knowledge from Defi Llama, Maker Protocol generated $14.22 million in income over the previous 30 days – and likewise collected the identical quantity in charges. Nevertheless, the DAI stablecoin generator’s TVL witnessed a decline of 6.3% in the identical timeframe, reaching $7.98 billion.

Defi Protocols Turnover – January 30 | Supply: Defi Llama

The main defi protocol, Lido Finance, with a TVL of $21.8 billion, collected $71.11 million in charges, in accordance with the info aggregator. The liquid staking protocol generated $7.11 million in income, 50% lower than the Maker Protocol.

Moreover, decentralized pockets platform, MetaMask, is available in third with $6.37 million in income and costs within the final month. Apparently, the quantity of MetaMask’s month-to-month common charges over the previous yr is $60.31 million, displaying a decline of 89.5% in January.

You may additionally like: Ripple Labs transfers 27.7 million XRP tokens to Bitstamp

The main credit score protocol, Aave, noticed its TVL rise 0.16% over the previous 30 days and is at the moment hovering round $6.91 billion whereas amassing $19.93 million in charges. Based on Defi Llama, Aave generated $5.94 million in income.

On January 18, Aave Labs, the corporate behind the defi protocol, proposed a brand new governance plan to combine the GHO stablecoin into numerous blockchains, which might probably improve the asset’s usefulness and liquidity.

In style decentralized change (DEX) dYdX made this record regardless of an 18.46% drop in its TVL over the previous 30 days – to $289.6 million. Based on Defi Llama, the DEX generated $4.99 million in income in January.

You will need to be aware that the Ethereum blockchain tops the record with $171.52 million in income within the final 30 days. Based on the info aggregator, Ethereum’s month-to-month common income over the previous yr is $119.89 million – up 43.1% this month.

The worldwide defi TVL has additionally been steadily rising over the previous week – from $54 billion on January 23 to $58 billion on the time of writing. The rise comes because the crypto market good points momentum after two weeks of regular declines that adopted the approval of the Bitcoin (BTC) ETF.

Learn extra: Bitcoin is again at $43,000, BlackRock’s BTC ETF quantity is approaching GBTC