asbe

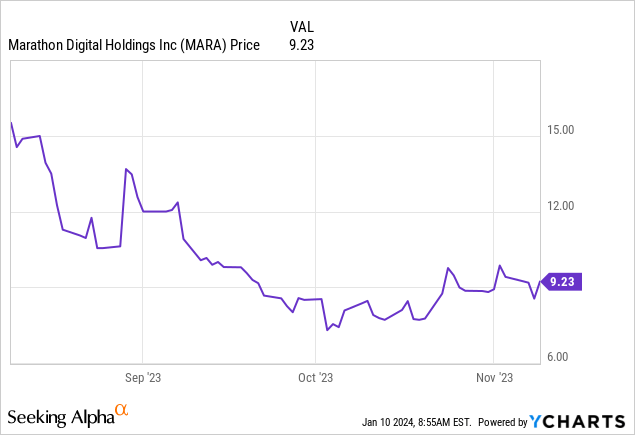

I final wrote about Marathon Digital (NASDAQ:MARA) on August 9, 2023, once I coated the Q2 earnings outcome highlights. I used to be bearish on the inventory at the moment and maintained a “promote” score. The inventory value fell by ~40% within the three-month timeframe (as seen within the chart above) after that protection however has since rebounded impressively, due to the momentum Bitcoin (BTC-USD) and different cryptocurrencies have garnered since This fall final yr, catalyzed by the anticipation of a spot Bitcoin ETF approval. On the operational entrance, Marathon has had a sequentially improved hash fee and variety of Bitcoin produced month-to-month since my final protection. Q3 outcomes confirmed MARA’s energized hash fee elevated by 8%, from 17.7 exahashes to 19.1 between Q2 and Q3. Quarterly Bitcoin manufacturing additionally went up by 19% in Q3. The improved numbers coupled with Bitcoin’s momentum have influenced MARA’s value surge these previous months.

As each Bitcoin miner prepares for the Bitcoin community halving event slated for April this yr, the main target is principally on learn how to compete effectively for the principle income supply (mined BTC) which can be reduce in half on the halving occasion. Components like available money for acquisitions to scale mining tools and hash fee and operational effectivity change into the important thing issues to evaluate miners that would dominate post-halving and take advantage of environment friendly use of working property to generate the utmost quantity of gross sales.

With spot Bitcoin ETFs lastly authorised by the SEC, and the Bitcoin halving occasion slated for April, which comes with anticipated post-halving crypto value beneficial properties, 2024 is anticipated to be a bullish yr for Bitcoin. The Bitcoin mining sector has already seen inventory costs upswing since Bitcoin gained momentum in This fall final yr. Marathon Digital had a formidable 688% inventory value acquire final yr, being the best performer amongst crypto-exposed shares of firms valued at $5 billion and above. Just lately, MARA has been breaking some manufacturing data (each internally established and industry-wide data) when it comes to the variety of mined Bitcoins, hash fee, and Bitcoins held in reserve. These components coupled with the anticipated bullish trajectory for Bitcoin in 2024 give MARA a excessive uneven upside potential and a positive risk-reward ratio amongst Bitcoin miners.

Newest Manufacturing Replace (December 2024)

Marathon Digital’s December manufacturing report features a report Bitcoin manufacturing of 1,853 BTC, which represents a major improve each YoY and MoM This manufacturing stage is a 290% YoY improve (475 BTC mined in December 2022) and a 56% sequential improve (1,187 BTC mined in November). The 1,853 BTC mined in December was a month-to-month report for the corporate, and the corporate additionally believes that December’s manufacturing is the very best month-to-month complete produced BTC ever recorded by a public Bitcoin mining firm.

Marathon’s common operational hash fee noticed an 18percentMoM improve, reaching 22.4 exahashes per second (EH/s), and the energized hash fee elevated by 4% MoM to 24.7 EH/s. The corporate’s share of obtainable miner rewards elevated by 19,700 bps YoY and 4,000 bps MoM to five.1%. The variety of blocks gained by the corporate’s foremost mining pool, MaraPool, additionally noticed important will increase, with a 217% YoY and 40% MoM development to 222 blocks in December.

Marathon Digital’s transaction charge as a share of complete income was 21.8% in December. Transaction charge income noticed a 970 bps MoM improve. As we transfer into the halving occasion and block rewards get reduce in half, transaction charges change into a comparatively extra necessary a part of a miner’s earnings.

Considerably greater transaction charges helped December’s Bitcoin manufacturing develop a lot quicker than common operational hash fee. For the month, MaraPool collected greater than 380 BTC in transaction charges or 22% of BTC manufacturing, up from 12% of manufacturing final month. Our success in capturing the sizable transaction charges presently out there to miners is straight associated to proudly owning and working our personal pool and represents a key aggressive benefit of our vertically built-in tech stack.

– Marathon Digital press launch

Marathon’s complete money, money equivalents, and restricted money elevated by 217% YoY and 31% MoM to $356.8 million, with all of it being unrestricted. The corporate’s complete BTC holdings grew to fifteen,174, marking a 24% improve YoY and an 8% improve MoM. Marathon Digital’s present money place is a number of dry powder to enterprise into strategic facility and tools acquisition and enlargement pre- and post-halving.

Marathon is concentrating on a 30% development in energized hash fee in 2024. With the anticipated closing of buying two mining websites from Generate Capital this month, the corporate expects to succeed in 50 exahashes within the subsequent 18 to 24 months. This development in hash fee is prone to improve MARA’s Bitcoin manufacturing capability, which might positively impression future income and profitability, assuming steady or favorable Bitcoin costs and mining problem charges.

Valuation

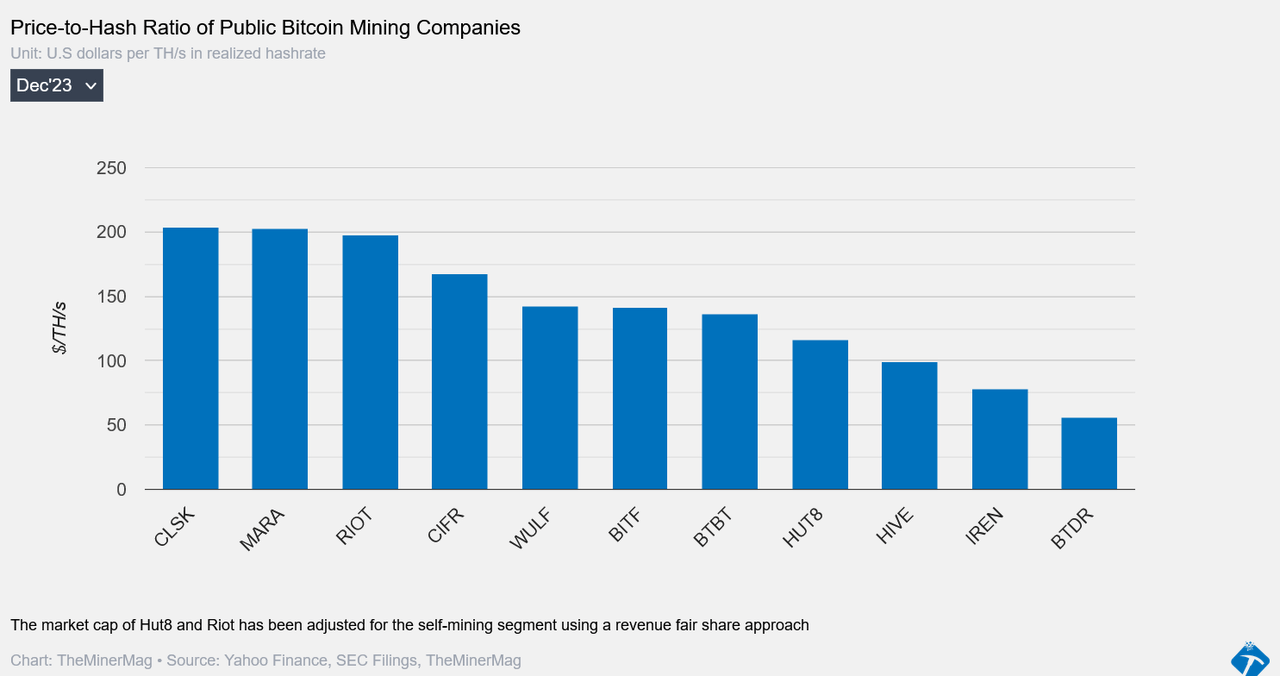

MARA and Friends Value-to-Hash Ratio (TheMinerMag)

MARA and most Bitcoin-related shares have the inherent volatility that Bitcoin and cryptocurrencies possess; therefore, they do not sometimes commerce on conventional valuation. Nevertheless, a comparability of MARA’s price-to-hash ratio to its peer common ratio reveals some over-valuation. The common price-to-hash ratio of Bitcoin mining friends is 148.8x (derived by getting the common price-to-hash ratio of miners seen within the determine above). MARA presently holds the very best market share amongst Bitcoin mining firms, based mostly on its share of BTC manufacturing relative to Bitcoin’s complete block rewards. This premium appears to be like justified due to MARA’s massive market share amongst public mining corporations. MARA’s greater market share, operational effectivity, and improved Bitcoin manufacturing numbers contribute to its perceived greater worth.

Dangers

The cryptocurrency market is characterised by speedy and typically unpredictable actions, making it difficult to foretell value actions solely based mostly on conventional valuation metrics. This presents an inherent danger for crypto mining shares. Additionally, the unpredictable actions make income projections unsure. When block rewards get reduce in half in April, miners would rely extra closely on transaction charges and the appreciation of Bitcoin’s market worth to maintain their earnings. As post-halving income projections are unsure, buyers in crypto mining shares must be ready for elevated value volatility.

Takeaway

The approval of spot Bitcoin ETFs might doubtlessly result in elevated market liquidity, elevated adoption, and a broader investor base for Bitcoin. This might result in an total greater community exercise and demand for block house, and will not directly affect Bitcoin community transaction charges. Additionally, because the BRC-20 ecosystem continues to develop, it can doubtlessly carry greater charges to miners. As acknowledged earlier, transaction charges change into a comparatively necessary a part of a miner’s earnings when block rewards get reduce in half throughout halving. MARA is well-positioned to take advantage of transaction charges post-halving as a result of it owns and operates a self-mining pool. MaraPool represented greater than 22% or about 380 BTC of MARA’s complete Bitcoin manufacturing in December. This bodes properly for MARA.

General, Marathon Digital checks the mandatory packing containers (operational effectivity, highly effective hash fee, transaction charge beneficial properties, and ample money and Bitcoin reserve) to be a high gainer within the crypto house in 2024. Bitcoin’s present momentum, the upcoming halving, and the anticipated bullish yr for Bitcoin, coupled with operational effectivity and sequentially improved numbers that Marathon has proven prompts a reconsideration of the inventory’s score, main me to regulate the advice from “promote” to a “maintain” stance. There may be excessive danger, however there may be additionally uneven upside potential.