tadamichi

By Hamish Preston

Many traders use the beginning of the 12 months to make predictions for the upcoming 12 months and to consider methods to specific views on these themes.

This endeavor will not be assured so as to add worth: predicting the future is extremely troublesome, and success requires appropriately predicting each the drivers of future efficiency and the upcoming influence of various market segments. The numerous possible scenarios imply that it’s straightforward to be wrong-footed.

Nonetheless, the inherent problem of forecasting implies that traders might want to focus their consideration on market segments the place there’s better reward for proper perception.

Dispersion supplies an initial assessment of the potential reward for such perception. The better the dispersion, the better the potential rewards for appropriately selecting the best-performing constituents in that market.

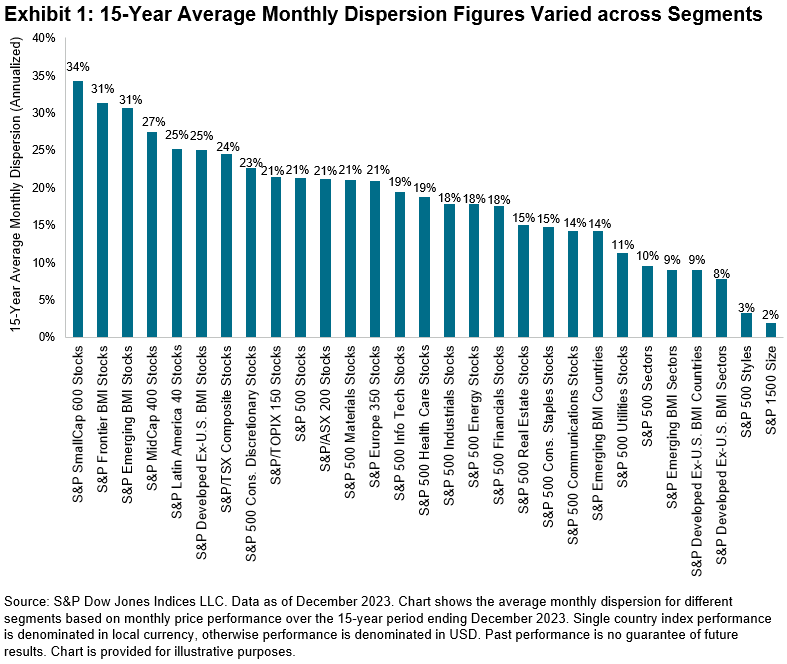

Exhibit 1 exhibits common month-to-month dispersion figures for varied segments over the 15-year interval ending December 2023.

The dispersion figures are calculated for various ranges of granularity, together with shares, sectors, nations, U.S. kinds and U.S. dimension segments.

S&P SmallCap 600® inventory dispersion was the very best, on common, greater than 3 times greater than the typical dispersion amongst S&P 500® sectors.

Decrease ranges of dispersion had been noticed between U.S. dimension or fashion segments, or between nations or sectors within the S&P Developed Ex.-U.S. BMI.

So does this imply that traders can be well-served to focus their consideration on analysis into small-cap U.S. equities as a substitute of different areas?

Not essentially: The relative worth of perception additionally depends upon the potential dimension of the positions that traders could possibly soak up totally different segments.

An investor’s skill to take energetic positions is said to the typical market capitalization of constituents.

For instance, there’s extra capability to take an energetic place in a trillion-dollar constituent in comparison with a smaller constituent.

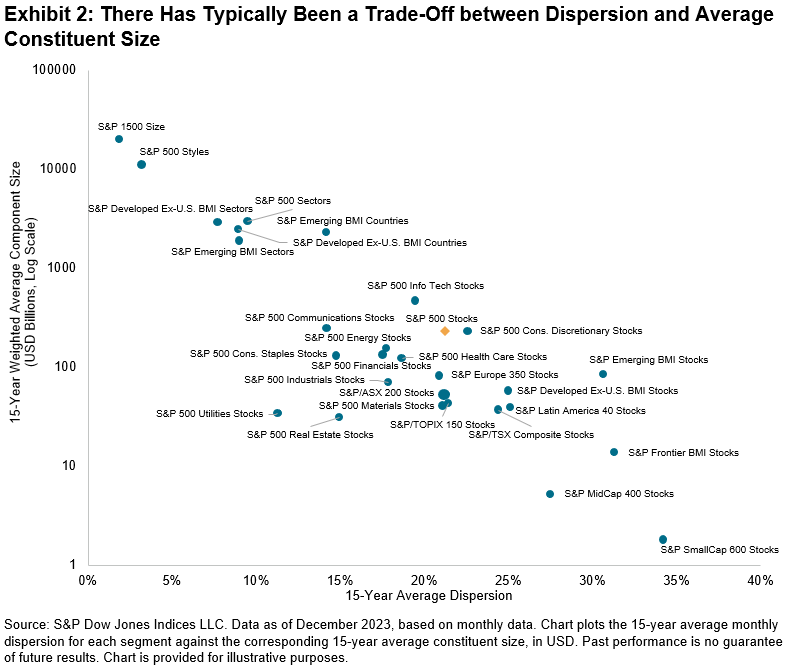

Exhibit 2 plots the typical dispersion figures from Exhibit 1 in opposition to the index-weighted common constituent dimension of the totally different segments over the identical 15-year interval (be aware the log scale on the y axis).

Clearly, there was a trade-off between dispersion and the typical constituent dimension.

Larger dispersion segments, which provide better anticipated reward for proper perception, might require smaller positions in comparison with decrease dispersion segments with bigger constituents.

Capability-Adjusted Dispersion supplies a option to account for capability when contemplating the potential worth of perception.

It’s calculated by multiplying the potential reward to appropriate alternatives (dispersion) and potential dimension of energetic positions (common constituent dimension).

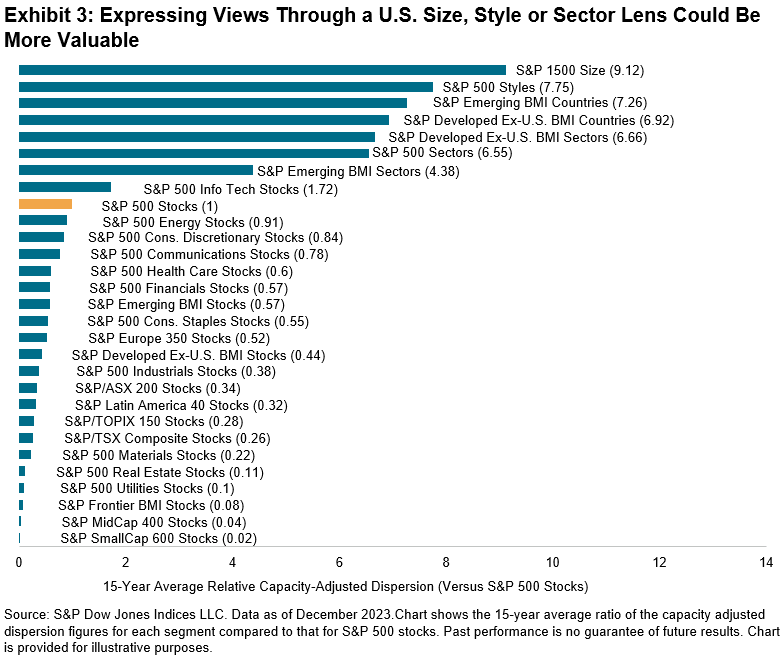

Exhibit 3 exhibits the typical ratio of capacity-adjusted dispersion measures for various segments in comparison with that of S&P 500 shares, primarily based on month-to-month knowledge over the 15-year interval ending December 2023.

Assuming that an investor’s predictions are equally useful throughout every section, Exhibit 3 means that deciding on among the many S&P Composite 1500® dimension segments – the S&P 500, S&P MidCap 400®, and S&P SmallCap 600 – might supply greater than 9 instances the potential alternative in comparison with selecting S&P 500 shares.

Equally, selecting between the S&P 500 Development and S&P 500 Worth or deciding on amongst S&P 500 sectors may have supplied comparable alternatives as selecting nation parts of the S&P Rising BMI or S&P Developed Ex-U.S. BMI.

Such is the distinction in common constituent dimension that insights into S&P SmallCap 600 shares must be 50 instances extra useful than insights into S&P 500 shares to offer the identical capacity-adjusted alternative.

Consequently, expressing views by means of a U.S. dimension, fashion and sector lens may current comparable alternatives as utilizing a rustic lens. The relative capability of those segments means they could supply better alternatives than many different segments.

Disclosure: Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P World. All rights reserved. This materials is reproduced with the prior written consent of S&P DJI. For extra info on S&P DJI please go to S&P Dow Jones Indices. For full phrases of use and disclosures please go to www.spdji.com/terms-of-use.

Editor’s Observe: The abstract bullets for this text had been chosen by Searching for Alpha editors.