Overview

Regardless of its lengthy mining historical past, beneficial regulatory local weather and secure political backdrop, Ghana stays largely neglected as an funding jurisdiction for battery metals. Located on the West African coast, the nation boasts a powerful strategic location and abundance of mineral wealth.

In 2023, the nation reclaimed its title as Africa’s number one producer of gold. And gold is not the one treasured metallic to be discovered within the nation. Ghana can be residence to vital lithium reserves, with c. 180,000 tonnes of estimated resources.

Positioned between Europe, the US and China, Ghana is completely positioned to function an essential hub for the worldwide provide of the battery metallic.

Australian lithium exploration and improvement firm Atlantic Lithium (ASX:A11, AIM:ALL, OTCQX:ALLIF) intends to leverage this chance by way of its flagship Ewoyaa mission, set to change into Ghana’s first lithium-producing mine. Atlantic intends to provide spodumene focus able to conversion to lithium hydroxide and carbonate to be used in electrical car batteries, serving to drive the transition to decarbonisation.

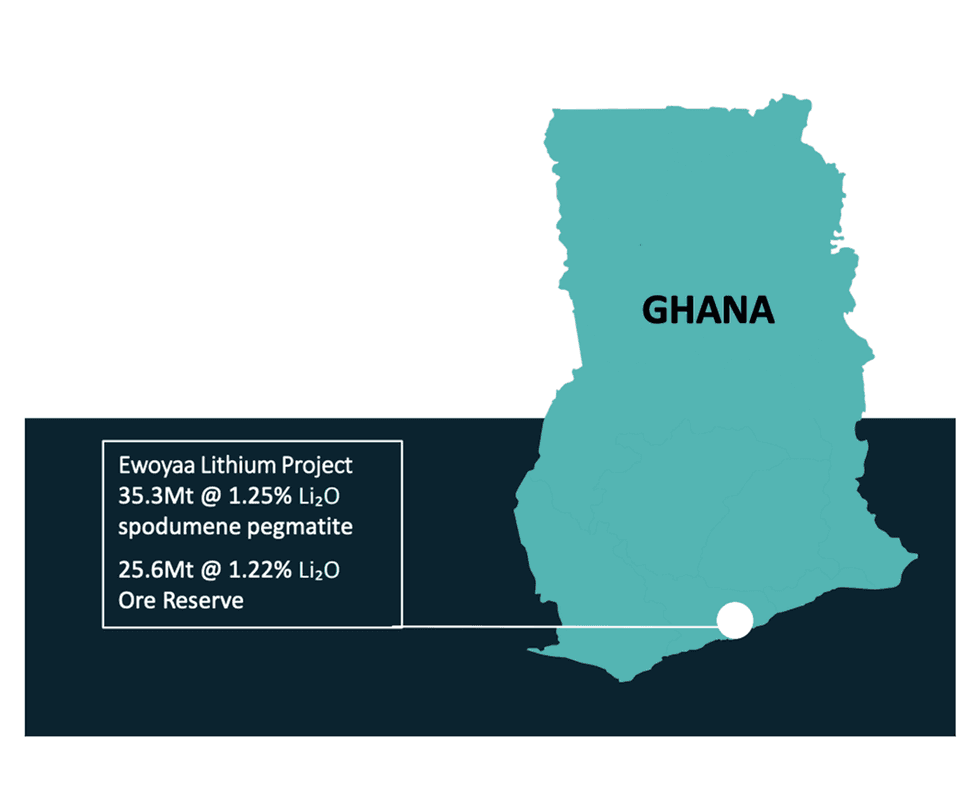

A definitive feasibility examine (DFS) launched in June 2023 exhibits that, contemplating its present 35.3 million tons (Mt) @ 1.22 % lithium oxide JORC Mineral Useful resource Estimate and conservative life-of-mine focus pricing of US$1,587/t, FOB Ghana Port, Ewoyaa has demonstrable financial viability, low capital depth and glorious profitability. By easy open-pit mining, three-stage crushing and standard Dense Media Separation (DMS) processing, the DFS outlines the manufacturing of three.6 Mt of spodumene focus over a 12-year mine life, delivering US$6.6 billion life-of-mine revenues, a post-tax NPV8 of US$1.5 billion and an inner price of return of 105 %.

Atlantic Lithium intends to deploy a Modular DMS plant forward of commencing operations on the large-scale primary plant to generate early income, which can scale back the height funding requirement of the primary plant. The mission is anticipated to ship first spodumene manufacturing as early as April 2025.

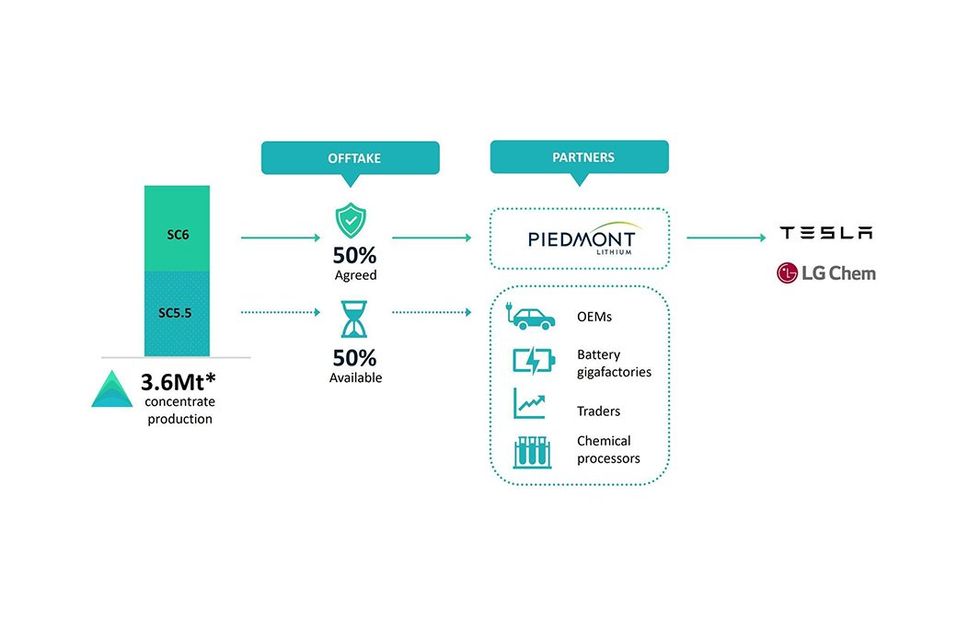

The event of the mission is co-funded below an settlement with NASDAQ and ASX-listed Piedmont Lithium (ASX:PLL), with Piedmont anticipated to fund c. 70 % of the US$185 million whole capex. In accordance with the settlement, Piedmont is funding US$17 million in direction of research and exploration and an preliminary US$70 million in direction of the entire capex. Prices are cut up equally between Atlantic Lithium and Piedmont thereafter.

In return, Piedmont will obtain 50 % of the spodumene focus produced at Ewoyaa, offering a path to customers by way of a number of main battery producers, together with Tesla. With 50 % of its offtake nonetheless accessible, Atlantic Lithium is one among only a few near-term spodumene focus producers with uncommitted offtake.

Already the biggest taxpayer and employer in Ghana’s Central Area, Atlantic Lithium is anticipated to offer direct employment to roughly 800 personnel at Ewoyaa and, by way of its neighborhood improvement fund whereby 1 % of retained earnings can be allotted to native initiatives, will ship long-lasting advantages to the area and to Ghana.

Atlantic Lithium additionally has the potential to capitalise upon appreciable further upside throughout its intensive exploration portfolio — potential it intends to leverage to the fullest because it turns into an early mover in West African lithium manufacturing.

Set to be Ghana’s first lithium-producing mine, Atlantic Lithium’s flagship Ewoyaa Venture is located inside 110 kilometres of Takoradi Port and 100 kilometres of Accra, with entry to glorious infrastructure and a talented native workforce. A definitive feasibility examine (DFS) launched in June 2023 confirmed the mission’s financial viability and profitability potential, indicating a 3.6-Mt spodumene focus manufacturing over the mine’s 12-year projected life.

Atlantic Lithium is at present within the strategy of securing a mining lease for the mission, which can allow the graduation of the allowing course of. By the deployment of a Modular DMS plant, which can course of 450,000 tons of ore as the primary 2.7-Mt processing plant is being constructed, the mine is anticipated to ship first manufacturing in 2025.

Atlantic Lithium at present has two functions pending for an space of roughly 774 sq. kilometres within the West African nation of Côte d’Ivoire. The underexplored but extremely potential area is thought to be underlain by prolific birimian greenstone belts, characterised by fractionated granitic intrusive centres with lithium and colombite-tantalum occurrences and outcropping pegmatites. The world can be extremely well-served, with intensive street infrastructure, well-established mobile community and high-voltage transmission line inside roughly 100 kilometres of the nation’s capital, Abidjan.

Administration Workforce

Neil Herbert – Government Chairman

Neil Herbert is a fellow of the Affiliation of Chartered Licensed Accountants and has over 30 years of expertise in finance. He has been concerned in rising mining and oil and fuel corporations each as an government and as an investor for over 25 years. Till Might 2013, he was co-chairman and managing director of AIM-quoted Polo Assets, a pure assets funding firm.

Previous to this, Herbert was a director of useful resource funding firm Galahad Gold, after which he grew to become finance director of its most profitable funding, the start-up uranium firm UraMin, from 2005 to 2007. Throughout this era, he labored to drift the corporate on AIM and the Toronto Inventory Trade in 2006, increase US$400 million in fairness financing and negotiate the sale of the group for US$2.5 billion.

Herbert has held board positions at a variety of useful resource corporations the place he has been concerned in managing quite a few acquisitions, disposals, inventory market listings and fundraisings. He holds a joint honours diploma in economics and financial historical past from the College of Leicester.

Keith Muller – Chief Government Officer

Keith Muller is a mining engineer with over 20 years of operational and management expertise throughout home and worldwide mining, together with within the lithium sector. He has a powerful operational background in onerous rock lithium mining and processing, significantly in DMS spodumene processing. Earlier than becoming a member of Atlantic Lithium, he held roles as each a enterprise chief and basic supervisor at Allkem, the place he labored on the Mt Cattlin lithium mine in Western Australia.

Previous to that, Muller served as operations supervisor and senior mining engineer at Simec. He holds a Grasp of Mining Engineering from the College of New South Wales and a Bachelor of Engineering from the College of Pretoria. He’s additionally a member of the Australian Institute of Mining and Metallurgy, the Board of Skilled Engineers of Queensland, and the Engineering Council of South Africa.

Amanda Harsas – Finance Director and Firm Secretary

Amanda Harsas is a senior finance government with a demonstrable monitor report and over 25 years’ expertise in strategic finance, enterprise transformation, industrial finance, buyer and provider negotiations and capital administration. Previous to becoming a member of Atlantic Lithium, she labored throughout a number of sectors together with healthcare, insurance coverage, retail {and professional} companies. Harsas is a chartered accountant, holds a Bachelor of Enterprise and has worldwide expertise in Asia, Europe and the US.

Len Kolff – Head of Enterprise Improvement and Chief Geologist

Len Kolff has over 25 years of mining business expertise within the main and junior assets sector. With a confirmed monitor report in deposit discovery and a specific concentrate on Africa, Kolff most lately labored in West Africa and was instrumental within the discovery and analysis of the corporate’s Ewoyaa Lithium Venture in Ghana, in addition to the invention and analysis of the Mofe Creek iron ore mission in Liberia. Previous to this, he labored at Rio Tinto with a concentrate on Africa, together with the Simandou iron ore mission in Guinea and the Northparkes Copper-Gold mine in Australia.

Kolff holds a Grasp of Financial Geology from CODES, College of Tasmania and a Bachelor of Science (Honours) diploma from the Royal College of Mines, Imperial Faculty, London.

Patrick Brindle – Non-executive Director

Patrick Brindle at present serves as government vice-president and chief working officer at Piedmont Lithium. He joined Piedmont in January 2018. Previous to this, he held roles as vice-president of mission administration and subsequently as chief improvement officer.

Brindle has greater than 20 years’ expertise in senior administration and engineering roles and has accomplished EPC initiatives in various jurisdictions together with the US, Canada, China, Mongolia, Australia and Brazil. Earlier than becoming a member of Piedmont, he was vice-president of engineering for DRA Taggart, a subsidiary of DRA International, an engineering agency specialising in mission supply of mining and mineral processing initiatives globally.

Kieran Daly – Non-executive Director

Kieran Daly is the chief of development and strategic improvement at Assore. He holds a BSc Mining Engineering from Camborne College of Mines (1991) and an MBA from Wits Enterprise College (2001) and labored in funding banking/fairness analysis for greater than 10 years at UBS, Macquarie and Investec previous to becoming a member of Assore in 2018.

Daly spent the primary 15 years of his mining profession at Anglo American’s coal division (Anglo Coal) in a variety of worldwide roles together with operations, gross sales and advertising, technique and enterprise improvement. Amongst his key roles had been main and growing Anglo Coal’s advertising efforts in Asia and to metal business prospects globally. He was additionally the worldwide head of technique for Anglo Coal instantly previous to leaving Anglo in 2007.

Christelle Van Der Merwe – Non-executive Director

Christelle Van Der Merwe is a mining geologist answerable for the mining-related geology and assets of Assore’s subsidiary corporations (comprising the pyrophyllite and chromite mines) and can be involved with the corporate’s iron and manganese mines. She has been the Assore group geologist since 2013 and concerned with strategic and useful resource funding selections of the corporate. Van Der Merwe is a member of SACNASP and the GSSA.

Jonathan Henry – Impartial Non-executive Director

Jonathan Henry is a senior government with vital, international listed firm expertise, primarily within the mining business, having held numerous management and board roles for practically 20 years. Henry is at present the non-executive chair of Toronto Enterprise Trade-listed (TSX-V) Giyani Metals. He has been closely concerned within the strategic administration and management of initiatives towards manufacturing, commercialisation and, finally, the realisation of shareholder worth. He has gained vital expertise working throughout capital markets, enterprise improvement, mission financing, key stakeholder engagement (together with public and investor relations), and the reporting and implementation of ESG-focused initiatives.

Henry was the chief chair and non-executive director at Euronext Progress and AIM-listed Ormonde Mining, non-executive director at TSX-V-listed Ashanti Gold, president, director and CEO at TSX-listed Gabriel Assets and numerous roles, together with CEO and managing director, at London and Oslo Inventory Trade-listed Avocet Mining PLC.

Aaron Maurer – Head of Operational Readiness

Aaron Maurer is a senior-level enterprise government with over 25 years’ worldwide multi-commodity mining expertise, overseeing strategic, operational and monetary efficiency. Over his profession, he has held a number of engineering, manufacturing, operational and senior government roles. Earlier than becoming a member of Atlantic Lithium, he served as government basic supervisor – operations at Minerals Assets, the place he oversaw the Mt Marion Lithium mine and three iron ore mines in Western Australia. He was beforehand the managing director and CEO of PVW Assets and basic supervisor (website senior government) at Peabody Vitality Australia.

His vital experience spans the event and implementation of security and cost-saving initiatives, change administration, strategic planning, enterprise improvement and worker improvement. Maurer holds a Grasp in Company Finance and a Bachelor of Engineering (Mining).

Roux Terblanche – Venture Supervisor

Roux Terblanche is a mineral useful resource mission supply specialist with confirmed African and Australian expertise working for house owners, EPCMs, consultants and contractors. He has a variety of commodity experiences, together with lithium, gold, copper, diamonds and platinum. He has confirmed so as to add worth and ship initiatives safely, on time and inside finances.

Terblanche has labored within the UAE and throughout Africa, together with Ghana, the DRC, Burkina Faso, Zambia, Rwanda, Botswana and Senegal. He was instrumental in growing the working footprint of a world development firm throughout Africa and was integral to the constructing of the Akyem, Tarkwa Section 4 and Chirano mines in Ghana.

Terblanche holds a nationwide diploma in mechanical engineering, a diploma in mission administration and a Bachelor of Commerce from the College of South Africa.

Iwan Williams – Exploration Supervisor

Iwan Williams is an exploration geologist with over 20 years’ expertise throughout a broad vary of commodities, principally iron ore, manganese, gold, copper (porphyry and sed. hosted), PGE’s, nickel and different base metals, in addition to chromitite, phosphates, coal and diamond.

Williams has intensive southern and west African expertise and has labored in Central and South America. His expertise consists of all features of exploration administration, mission technology, alternative opinions, due diligence and mine geology. He has intensive research expertise having participated within the supply of a number of mission research together with useful resource, mine design standards, baseline environmental and social research and metallurgical test-work programmes. He’s very aware of working in Africa having spent 23 years of his 28-year geological profession in Africa. Williams is a graduate of the College of Liverpool.

Abdul Razak – Nation Supervisor

Abdul Razak has intensive exploration, useful resource analysis and mission administration expertise all through West Africa with a powerful concentrate on data-rich environments. He has intensive gold expertise having labored all through Ghana with AngloGold Ashanti, Goldfields Ghana, Perseus and Golden Star, in addition to worldwide exploration and useful resource analysis expertise in Burkina Faso, Liberia, Ivory Coast, Republic of Congo, Nigeria and Guinea.

Razak is an integral member of the crew, managing all website actions together with drilling, laboratory, native groups, geotech and hydro, neighborhood consultations and stakeholder engagements and was instrumental in institution of the present improvement crew and defining Ghana’s maiden lithium useful resource estimate. He’s based mostly on the mission website in Ghana.