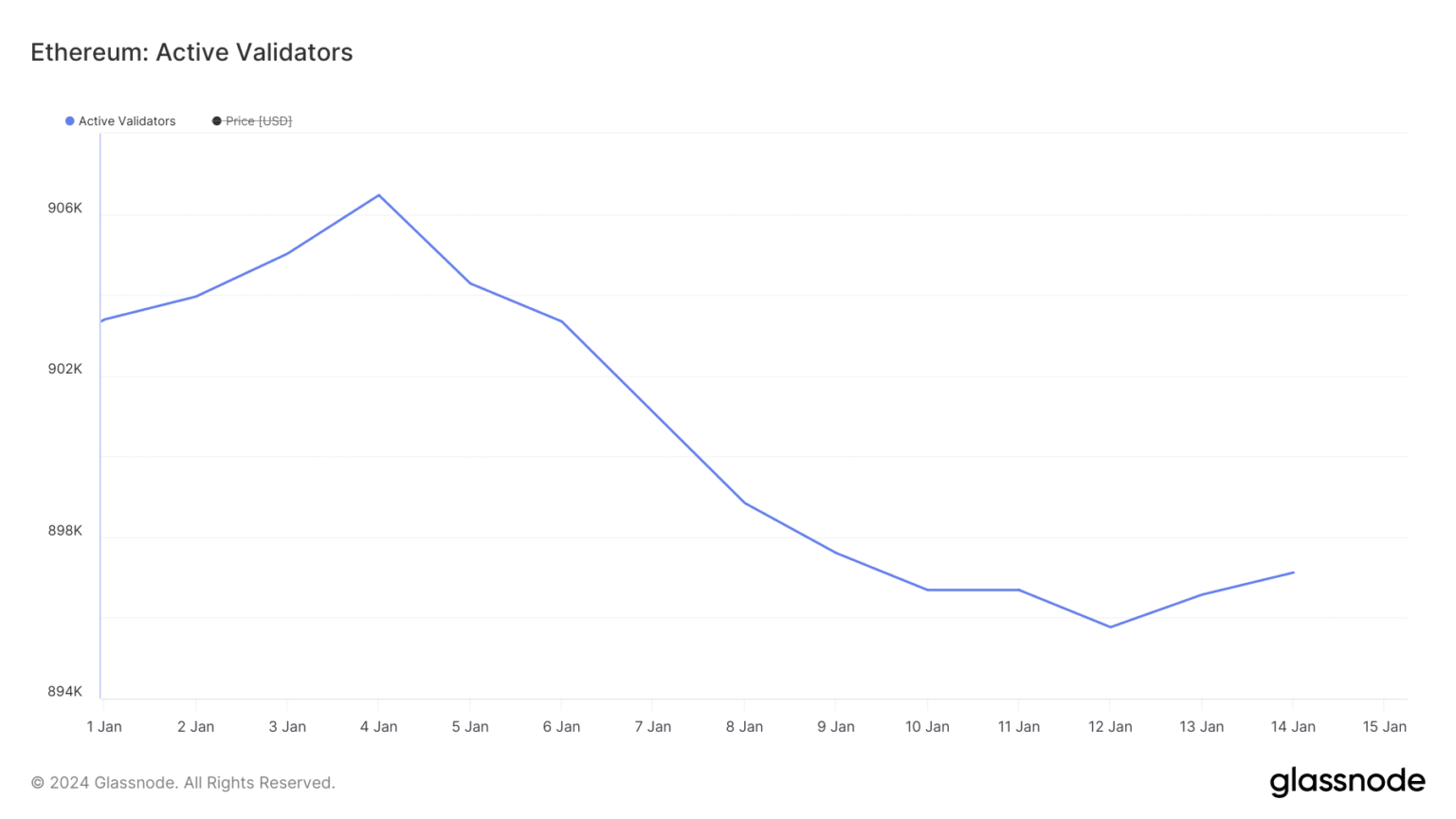

- There was a gentle fall in energetic validator depend on Ethereum because the 4th of January.

- ETH accumulation persists amongst coin merchants.

The Ethereum [ETH] Proof-of-Stake (PoS) community has witnessed a pointy drop in energetic validators, hitting a year-to-date low on the twelfth of January, in accordance with knowledge from Glassnode.

Supply: Glassnode

AMBCrypto discovered that the decline started on the 4th of January, the identical day that the whole variety of validators that exited the community’s validator pool voluntarily climbed to an all-time excessive of 17,821.

Supply: Glassnode

This pattern emerged only a day after Matrixport, a outstanding crypto funding providers supplier, predicted a possible rejection of all Bitcoin ETF functions by the U.S. Securities and Alternate Fee (SEC).

Following the report’s publication, the costs of main property plummeted, inflicting over $500 million in liquidations.

Many feared that Matrixport’s predictions is perhaps correct and end in a extreme market decline, therefore the surge within the every day depend of validators that left the Ethereum community on the 4th of January.

Whereas the every day energetic validator depend on the PoS chain has begun to rise, it nonetheless sits at low ranges recorded in December.

As of the 14th of January, the energetic validator depend on Ethereum totaled 897,121. Likewise, with the rise in ETH’s worth post-ETF approval, voluntary exits from the chain have lowered.

On the 14th of January, solely 124 validators left the community, knowledge from Glassnode confirmed.

Bullish momentum intensifies

At press time, ETH exchanged palms at $2,517, in accordance with knowledge from CoinMarketCap. The coin’s worth has risen by 15% within the final week.

Its worth actions assessed on a weekly chart revealed that bullish stress endured. This was gleaned from ETH’s momentum indicators, displaying that merchants have continued accumulating the altcoin.

For instance, the coin’s Relative Energy Index (RSI) and Cash Movement Index (MFI) indicators had been noticed at 70.37 and 87.02, respectively. These ranges prompt that purchasing stress exceeded coin sell-offs regardless of the latest uptick.

Supply: TradingView

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

It’s, nevertheless, key to notice that these RSI and MFI values sometimes point out an overheated market. Therefore, a minor disadvantage in ETH’s worth needs to be anticipated.

ETH’s Chaikin Cash Movement (CMF) remained in an uptrend and positioned above the zero line at press time. Returning a worth of 0.16, ETH’s CMF confirmed a gentle provide of liquidity required to maintain a worth rally.