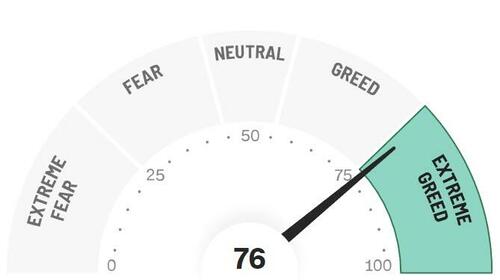

Markets closed 2023 with the strongest rally for equities, bonds, gold, and cryptocurrencies in years. The extent of complacency was apparent, registering an “excessive greed” degree within the Greed and Fear Index.

2023 was additionally an unbelievably dangerous yr for commodities, notably oil and pure gasoline, one thing that only a few would have predicted in the course of two wars with related geopolitical influence and vital OPEC+ provide cuts. It was additionally a poor yr for Chinese language equities, regardless of slower-than-expected however sturdy financial progress and strong earnings within the massive elements of the Cling Seng index.

Markets rallied resulting from a mixture of optimistic expectations for inflation and aggressive charge cuts from central banks. The query now’s, what can buyers count on in 2024?

The yr of disinflation can solely come from a recession. The market expectations of a large discount in inflation can not come from what economists name a delicate touchdown. The rationale we have now not seen a recession in 2023 is as a result of the worldwide cash provide didn’t fall under $103 trillion and ended nearly on the file degree of $107 trillion, in response to Citi. Moreover, governments in developed international locations have continued to spend as if inflation and charge hikes didn’t exist. Fiscal coverage has been exceedingly aggressive, whereas financial coverage has been restrictive. As such, the decline in financial aggregates and the influence of charge hikes have fallen on the shoulders of the non-public sector.

Inflation declined in step with financial aggregates, however we have now not but seen the true influence on the economic system due to the lag impact. We’re more likely to see the full-scale influence of 2023’s financial contraction in 2024. If the economic system weakens and personal sector mixture demand slumps, inflation will decline as anticipated. Nevertheless, it’s nearly not possible to see the sort of goldilocks economic system that many buyers predict and obtain 2% inflation.

Central financial institution charge cuts will solely come from a really weak economic system. Central banks by no means act preemptively. In the event that they find yourself reducing charges by 150 foundation factors, it is going to be as a result of the slowdown within the economic system is extreme. We can not wager on one factor or the opposite. If you happen to imagine in a delicate touchdown, you shouldn’t count on six charge cuts. Alternatively, in case you imagine central banks will minimize charges 5 – 6 occasions, you need to put together your portfolio for a tough touchdown—a really dangerous one, in actual fact.

Commodities could bounce as geopolitical danger creates a flooring and marginal demand from China picks up. Markets have ignored the power of the Chinese language economic system, which is able to develop by not less than 4.5% in 2023, as a result of the inventory market has not carried out. Nevertheless, an economic system that grows at this tempo regardless of the actual property sector’s immense challenges shouldn’t be ignored. It’s possible that marginal demand in vitality commodities picks up simply as geopolitical danger maintains a flooring on the worth, resulting in a bounce within the commodity advanced because of China’s marginal demand and India’s speedy progress. As extra of the newly created foreign money goes to comparatively uncommon property, a looser financial coverage may assist this restoration in commodities.

Latin America and Europe will proceed to disappoint, whereas Asia leads in progress. Attributable to expectations that the worst is over and a relative bounce within the euro in opposition to the US greenback, markets have purchased European shares and bonds. The identical is going on with LatAm’s dangerous property. Nevertheless, the issues are deeper and extra advanced. The euro could bounce, however its place as a world reserve foreign money is weakening relative to the US greenback and rising contenders just like the yuan. Europe’s lack of progress shouldn’t be resulting from exogenous elements however, like most of LatAm, self-inflicted. The euro space ended 2023 in recession regardless of low commodity costs and the EU Subsequent Era Fund. The issue within the euro space and most Latin American international locations is the fixed implementation of insurance policies that harm progress and bloat governments. With a view to undo the nightmare that collectivist interventionism has created, Argentina will most likely undergo a detox yr.

As a result of financial destruction that central banks have carried out, fairness markets could proceed to carry out satisfactorily, however volatility will doubtless rise as market optimism clashes with financial actuality. Though 2024 will most likely not be the yr of central financial institution digital currencies, they’re within the pipeline, and this implies much more financial debasement. On this surroundings, Bitcoin and gold could proceed to assist the struggle in opposition to the destruction of the buying energy of currencies. We can not ignore bitcoin’s excessive volatility and danger, however we can not overlook that it has began to separate itself from different cryptocurrencies to be an asset class of its personal.

As central banks put together the way in which for digital currencies, that are the closest factor to surveillance disguised as cash, reserves of worth are extra wanted than ever earlier than. Gold is more likely to be a superb de-correlated asset that protects in opposition to the debasement of sovereign bonds and home currencies.

2024 is probably going going to be a yr of great slowdown within the main economies contemplating the present tendencies within the non-public sector and a yr of rising public debt, which governments will attempt to disguise with the destruction of the buying energy of the foreign money. In that state of affairs, betting on the swift finish of the inflation burst could also be untimely. If inflation declines as predicted, it is going to be a results of the economic system’s deterioration and the overspending of the federal government. If debt and authorities deficits proceed to rise, inflation could shock on the damaging aspect. Both approach, the important thing in 2024 can be to guard ourselves from foreign money destruction. Thus, investing shouldn’t be merely necessary however essential to outlive on this gradual finish of cash as we all know it.

Loading…