Panuwat Dangsungnoen/iStock by way of Getty Photographs

With Congress ratcheting down saber-rattling over broader healthcare reforms into 2024, Morgan Stanley has taken a extra constructive view on the managed care and retail pharmacy house, primarily as a result of biosimilar/GLP-1 alternative.

Nonetheless, the analysts led by Erin Wright highlighted the implications of rising healthcare utilization charges and cited the alternatives/ dangers associated to the upcoming superior 2025 Medicare Benefit charge discover.

Regardless of price traits as seen with rising utilization charges into 2024, “election cycle danger may even be entrance and middle,” MS analysts wrote, issuing their 2024 outlook for healthcare providers.

Election danger

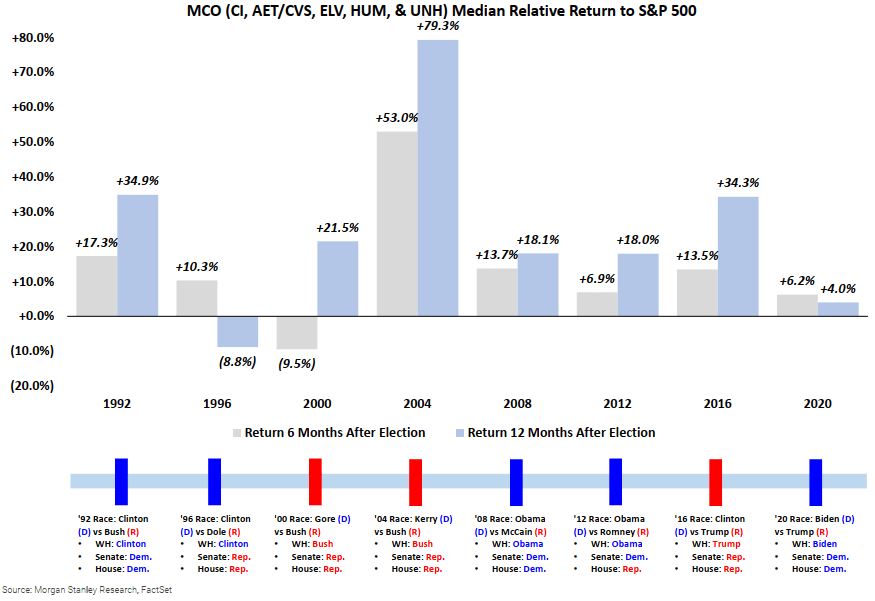

MS pointed to the sector’s underperformance this yr, noting that managed care organizations dropped 15% whereas pharmacies fell 49% YTD. In response to the agency, managed care organizations have traditionally shed a median of ~31% in the course of the previous six election cycles till a mid-March trough.

Nonetheless, after the poll, managed care has traditionally outperformed the S&P 500, resulting in a median relative outperformance of ~12% and ~20% over the six and 12 months following the election day, respectively.

In comparison with earlier elections, the agency cites a scarcity of assist amongst lawmakers for broader healthcare reforms, or Medicare for All. “President Biden declaring a run for reelection largely derisked Medicare for All as an overhang by maintaining extra progressive Democrats on the sidelines,” MS analysts added.

“Whereas previous expertise tells us to keep away from managed care into US presidential elections, we really view it is going to be a comparatively benign cycle from a healthcare perspective,” the analysts wrote, noting that proudly owning MCO shares this yr forward of potential troughs “will not be as punitive, if in any respect.”

GLP-1/biosimilar alternative

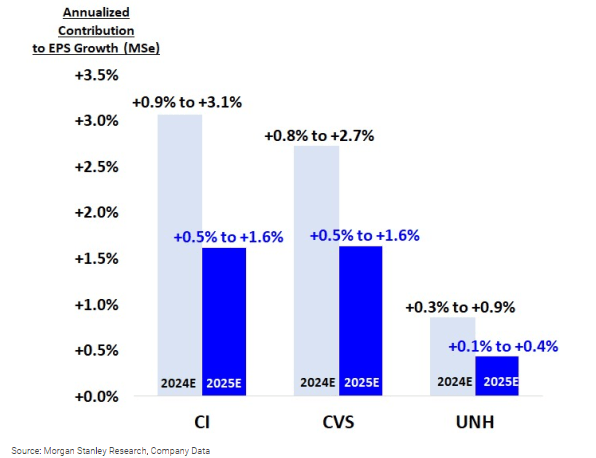

The agency highlights Pharma Profit Managers as a key MCO theme within the sector, noting their potential to learn from the GLP-1 class of weight reduction medicine and biosimilars.

Regardless of regulatory headwinds, Morgan Stanley sees worth and progress prospects within the PBM house. The group performing as intermediaries between well being plans, pharmaceutical producers, and pharmacies has just lately come beneath intense congressional scrutiny over their position in rising healthcare prices.

MS additionally initiatives PBM’s potential to learn from GLP-1 medicine, a brand new class of weight problems medicine marketed by Eli Lilly (LLY) and Novo Nordisk (NVO) (OTCPK:NONOF).

In response to the agency, the rising demand for GLP-1s can enhance the 2024E and 2025E EPS of three main PBMs, specifically the Caremark unit of CVS (CVS), UnitedHealth’s (NYSE:UNH) OptumRx, and Cigna’s (NYSE:CI) Evernorth, by ~26 bps–~307 bps and ~13 bps–~163 bps, respectively.

There might be extra alternatives from the tip of U.S. market exclusivity for AbbVie’s (ABBV) blockbuster arthritis drug Humira, given the $38B market dimension and upcoming biosimilars, together with ones with interchangeable designations.

In January, Amgen (AMGN) launched its Humira biosimilar, Amjevita, the primary of many off-patent variations launched within the U.S. towards the bestselling injectable this yr.

Rising healthcare utilization

Moreover, Morgan Stanley pointed to rising price traits within the MCO house after UNH stated in June that the corporate’s medical care ratio, the portion of premiums spent on healthcare prices, will come beneath strain amid a post-COVID spike in medical exercise.

Whereas increased healthcare utilization, a key investor concern in 2023, “will stay elevated into 2024, it’s encouragingly not worsening, a dynamic that we’ll monitor however is appropriately embedded in expectations for MCOs,” the analysts opined.

MA superior charge discover

Commenting on the 2025 Medicare Benefit superior charge discover anticipated in late January or early February, the analysts argued that MCOs have been bracing for a post-pandemic normalization within the charge setting.

MS estimated that the MA superior charge discover for the 2025 calendar yr might come at +0.2%, in step with the pre-pandemic ranges. The analysts additionally wrote that any weak spot in MCO shares following the announcement might be a compelling shopping for alternative.

In current historical past, 2022 and 2023 noticed the biggest hikes to Medicare Benefit closing charges earlier than the 2024 closing charge got here flat.

Medicaid redeterminations

MS thinks that the continued Medicaid eligibility evaluations, which it expects to proceed till a minimum of 2024, might be among the many key MCO themes to be careful for subsequent yr.

The analysts argue that business insurer Cigna (CI) will develop into a serious beneficiary of the continued redeterminations, which resumed in April after a pandemic-era pause previously few years.

“CI doesn’t take part in MDCD managed care applications and MDCD redeterminations represents an upside alternative for its business/employer sponsored plans and the change market which isn’t at present embedded into steering,” the analysts wrote.

Rankings

The Bloomfield, Connecticut-based firm is a key Chubby for MS on its biosimilar alternative and minority funding in healthcare supplier VillageMD, which is majority-owned by Walgreens (NASDAQ:WBA). Its worth for CI stands at $365 per share.

Nonetheless, Walgreens (WBA) has develop into a key Underweight for MS, and its worth goal, adjusted to $22 from $27, displays a softer progress outlook for FY24. The agency cites macro challenges, decrease COVID-19 vaccine and check volumes, a weaker respiratory season, and ongoing adjustments to the corporate’s retail footprint as causes for its bearish outlook.

Given its scale and diversification, UnitedHealth (UNH) was topped Morgan Stanley’s high decide within the MCO house. Citing its progress prospects and diversified enterprise mannequin, the agency raised UNH’s worth goal to $618 from $579 per share with an Chubby ranking.

Different listed MCOs embrace Centene (CNC), CVS Well being (CVS), Elevance Well being (ELV), Humana (HUM), Molina Healthcare (MOH), Alignment Healthcare (ALHC), and Clover Well being Investments (CLOV).