alvarez/E+ by way of Getty Photos

We beforehand coated MercadoLibre, Inc. (NASDAQ:MELI) in September 2023, discussing its strong prospects over the subsequent few years, due to its well-diversified vertically-integrated choices throughout on-line retail, logistics, fintech, and promoting.

Mixed with the administration’s efforts to aggressively develop market share profitably, we had confidently reiterated the inventory as a long-term purchase, ideally after a reasonable pullback to $1.1K.

On this article, we will focus on why our earlier Purchase in level has confirmed to be wonderful, with the MELI inventory rallying immensely by over +30% because the dip after the earlier article, due to its double beat FQ3’23 earnings name and wonderful efficiency throughout all segments.

With the inventory simply breaking out of its 50/100/200 day shifting averages, we consider that the subsequent ground could very properly be on the $1.45K stage, permitting traders to watch there for an improved margin of security.

The MELI Funding Thesis Stays Sturdy For Lengthy-Time period Traders

For now, MELI recorded double beat FQ3’23 earnings name, with revenues of $3.76B (+10.2% QoQ/ +39.8% YoY) and GAAP EPS of $7.18 (+38.7% QoQ/ +180.4% YoY).

The stickiness and growing mindshare of its choices have been demonstrated by the sustained progress in its Distinctive Energetic Customers to 120M (+10% QoQ/ +36.3% YoY).

The identical has been noticed within the firm’s rising Market ARPU of $225.84 (+2.3% QoQ/ +11.3% YoY), based mostly on its Gross Merchandise Quantity of $11.36B (+8.1% QoQ/ +31.9% YoY) and its Complete Distinctive Patrons of fifty.3M (+5.6% QoQ/ +18.3% YoY).

This naturally contributed to MELI’s wonderful efficiency within the logistics phase, with it reporting a record high of 48% for in-house cargo achievement (+2 points QoQ/ +8 YoY) by the most recent quarter.

Its earlier capex investments have additionally paid off extraordinarily properly, with the corporate capable of ship 80% of its shipments inside 48 hours (inline QoQ/ YoY) regardless of the better quantity of 116.3M (+4.6% QoQ/ +22.2% YoY).

Moreover, MELI has reported better fintech penetration, due to the introduction of PIX, the Prompt Cost System launched by the Brazilian authorities in November 2020.

Regardless of the comparatively younger platform, PIX has already recorded an incredible growth in complete variety of month-to-month transactions to 4.08T (+5.6% MoM/ +67.9% YoY) by October 2023 and distinctive PIX accounts to 686.93M (+1.8% QoQ/ +27.9% YoY) by November 2023, with no indicators of deceleration to date.

On account of the elevated fintech adoption, it’s unsurprising that MELI has benefited with a rising Complete Cost Quantity of $47.25B (+12.3% QoQ/ +46.8% YoY) and a formidable sequential enhance in its Distinctive Fintech Energetic Customers to 48.8M (+3.5M QoQ/ +7.2M YoY) by the most recent quarter.

This additional exemplifies its well-diversified technique throughout bodily retail by way of Service provider Providers/ POS and e-commerce providers by way of Digital Wallets, amongst others.

Whereas these could have been promising developments certainly, readers should nonetheless observe that MELI faces sure headwinds in its Credito phase, with its complete portfolio’s overdue 90 days nonetheless elevated at 20.3% (-4.8 factors QoQ/ -3.6 YoY) by the most recent quarter, although notably improved on a QoQ/ YoY foundation.

Nevertheless, issues seem like reasonably enhancing with the phase reporting more healthy Web Curiosity Margin After Losses [NIMAL] of 37.4% (+0.6 factors QoQ/ +7.7 YoY), up drastically from the 24.4% reported in Q1’22. This means the administration’s improved capability to cost dangers due to its “credit score scoring fashions leveraging the AI.”

Most significantly, due to its monetary establishment license, MELI has been capable of consolidate its credit score portfolio throughout bank cards, instore/ on-line service provider lending, and shopper lending.

This naturally improves its profitability flywheel and cross-selling to its different fintech choices, due to the administration’s laser give attention to the low-to-mid threat segments with out over exposing itself to Non-Performing Loans.

On account of these promising developments, we aren’t shocked that MELI has generated a sturdy general earnings from operations of $685M (+22.7% QoQ/ +131.4% YoY) and margins of 18.2% (+1.9 factors QoQ/ +7.2 YoY) by the most recent quarter.

A lot of the tailwinds are attributed to the wonderful efficiency in Brazil and Mexico, which have charted double-digit progress on a YoY foundation at +40% and +66%, respectively.

That is due to the attractively-priced relaunched loyalty program in late August 2023, which provides free delivery, free content material subscriptions to Disney+ and Star+ platforms, and a free music subscription to the Deezer platform, amongst others.

It’s a testomony to the extremely competent administration staff certainly, which continues to maximise the corporate’s progress alternatives throughout a number of channels whereas attracting new customers.

The accelerating top-line and improved value effectivity have immediately contributed to MELI’s improved stability sheet as properly, with an growing money/ short-term investments stability of $5.49B (+66.3% QoQ/ +130% YoY) and moderating long-term money owed of $2.14B (-12.2% QoQ/ -20.7% YoY) by the most recent quarter.

Mixed with its moderating share rely to 50.21M (-0.94M QoQ/ -1.11M YoY), it’s no surprise that the inventory’s worth continues to rise to date, regardless of the pessimism within the inventory market and the region’s raging inflation.

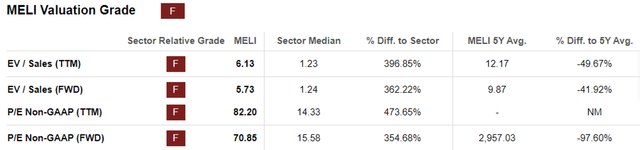

MELI Valuations

In search of Alpha

On the one hand, MELI trades at a FWD P/E of 70.85x, notably moderated from its pre-pandemic imply of 98x, although considerably elevated in comparison with most of its diversified e-commerce friends, similar to Amazon (AMZN) at 56.01x, Shopify (SHOP) at 112.81x, and Sea Restricted (SE) at 26.67x.

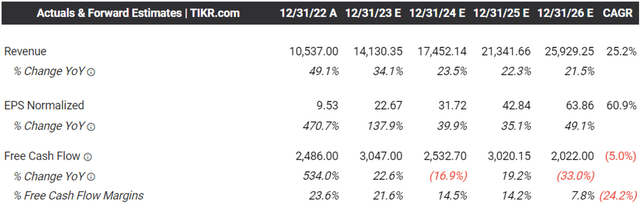

The Consensus Ahead Estimates

Tikr Terminal

Then again, due to the wonderful FQ3’23 outcomes as mentioned above, the consensus have additionally reasonably raised their estimates, with MELI anticipated to generate an improved prime and backside line growth at a CAGR of +25.2% and +60.9% by way of FY2026.

That is in comparison with the earlier estimates of +22.5%/ +57.1% and historic progress of +52.3%/ +19.2% between FY2016 and FY2022, respectively.

If something, MELI’s projected prime/ backside line progress properly exceeds AMZN’s at +11.3%/ +31.4%, SHOP’s at +10.2%/ +40.6%, and SE’s at +21.4%/ +37.9% over the identical timeframe, implying that the previous could deserve its extremely worthwhile progress premium in any case.

So, Is MELI Inventory A Purchase, Promote, or Maintain?

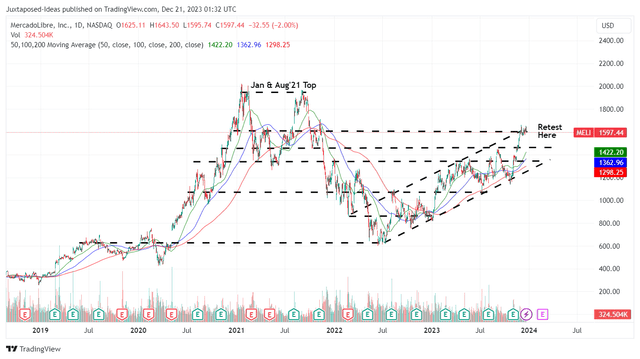

MELI 5Y Inventory Worth

Buying and selling View

For now, MELI has risen tremendously by +34.5% because the October 2023 backside, with it presently retesting its earlier resistance ranges of $1.6K whereas simply breaking out of its 50/100/200 day shifting averages.

Assuming that this momentum holds, it seems that the inventory could very properly discover its subsequent ground at $1.45K, additional sustaining its upward rally forward.

In consequence, traders could think about ready for a reasonable pullback to these ranges, implying a -9.3% draw back from present ranges for an improved margin of security.

We keep our Purchase ranking, since MELI stays extremely enticing for long-term traders looking for excessive progress, with an amazing upside potential of +88.9% to our long-term value goal of $3,035, based mostly on the consensus FY2025 EPS estimates of $42.84 and the FWD P/E valuation of 70.85x.