Janina Steinmetz

Funding overview

My advice for Olo Inc. (NYSE:OLO) is a purchase ranking, as I imagine it will probably proceed to develop on the present low-20% charge given the sturdy secular tailwind, worth proposition, and Olo Pay development potential. The present valuation is additionally engaging, as it’s close to the bottom OLO has ever traded at. As OLO proves to the market that churn just isn’t a problem and development momentum can proceed, I see a risk for valuation to tick upwards (I didn’t mannequin this for conservative sake).

Enterprise overview

OLO is a vertical software program options supplier to the F&B {industry}, significantly eating places. In essence, OLO is a two-sided community connecting eating places to varied know-how and channel companions, together with 3P digital ordering platforms like DoorDash. This permits eating places to facilitate their digital technique (e.g., on-line meals supply, digital kiosks, analytics, and many others.). The complexity will increase exponentially for eating places that have a number of models (franchise mannequin); as such, they give the impression of being to OLO for an answer. OLO is a fast-growing firm that has compounded its income at a 46% CAGR since 2018 to LTM3Q23, scaling income from $31.8 million to $215.1 million. Notably, the expansion was not fueled by M&A or debt; OLO has had a clear stability sheet (web money) over the previous few years. As of 3Q23, OLO had a web money place of ~$360 million.

Robust secular tailwind

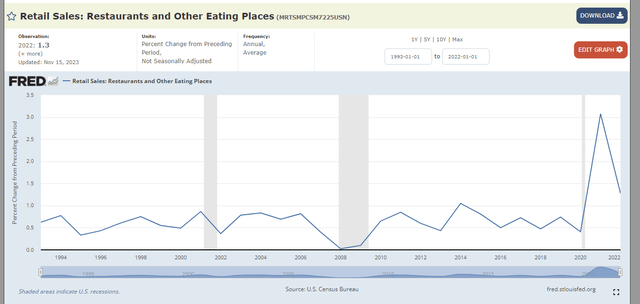

I imagine OLO is effectively positioned to profit from the longer-term secular development of digital gross sales penetration in eating places, with COVID having been a key catalyst. To present a primary background, digital orders consult with orders which can be executed by means of a digital platform. As an illustration, a buyer who orders meals by way of the DoorDash app is inserting a digital order. The identical applies to a buyer ordering from a digital kiosk within the retailer. These orders will stream from these consumer-facing digital fronts to the OLO platform, to the restaurant point-of-sale system, after which to the back-of-house to satisfy the orders as per regular. I imagine digital ordering adoption accelerated throughout COVID, and this large shift in consumer behavior is right here to remain. Taking on-line meals supply providers as a gauge for digital order penetration, digital orders are anticipated to develop to excessive teenagers within the coming decade. This far outpaces restaurant {industry} development as an entire, which has usually grown at 0.5% over the previous few many years.

FRED

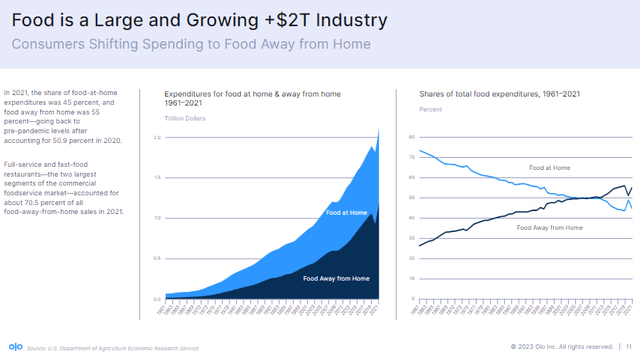

Furthermore, there may be one other tailwind that’s driving the whole {industry} and advantages OLO. Extra customers are shifting their consumption habits away from dwelling. This could proceed to drive optimistic development within the restaurant {industry}, which, coupled with growing digital adoption, will improve the entire addressable marketplace for OLO.

OLO

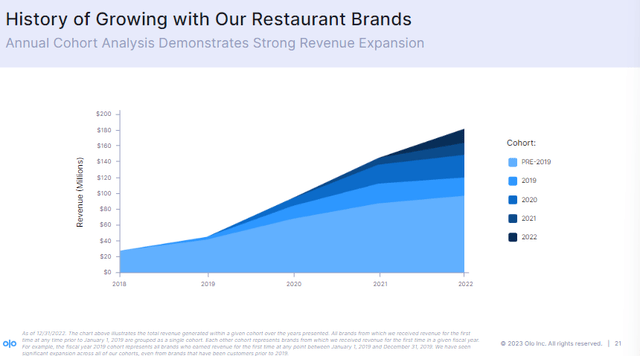

Robust worth proposition to complete worth chain

OLO presents a really sturdy proposition to its customers throughout the whole worth chain. Clients are in a position to order meals digitally from their favourite eating places, both by way of the restaurant’s web site or 3P meals supply platforms. For eating places, OLO permits them to faucet into the rising digital desire of customers and in addition enhance their order execution metrics, akin to order accuracy and time to completion, because the OLO platform facilitates all the information stream behind the scenes. All of those result in a extra optimistic buyer expertise, which drives recurring orders. At a deeper degree, eating places would even have a greater understanding of their prospects (order frequency, style preferences, location knowledge, and many others.). All of those allow extra environment friendly buyer focusing on, which interprets to higher unit/retailer economics. I feel it’s evident in OLO’s annual cohort evaluation that it’s making big enhancements to eating places which can be utilizing its platform.

OLO

As such, I imagine OLO is a platform that’s right here to remain. In 3Q23, the inventory reacted very negatively to the information that Wingstop (WING) will likely be leaving OLO platform as soon as its contract expires on the finish of 1Q24. That is massive information as it’s the 2nd time WING misplaced an enormous buyer (1st was Subway), which means that:

- WING can proceed its digital technique with out OLO. Which suggests OLO won’t be as mission-critical or sticky because it appears.

- Massive enterprise eating places can create their very own platform, which will increase the danger of additional churn.

Though additional churn amongst bigger enterprises is a priority, my view is that the OLO worth proposition stays very engaging. Keep in mind that WING is a enterprise that’s rising at a fast charge with ample monetary capability and sources to construct its personal know-how platform. Additionally, digital technique is a core a part of WING’s enterprise technique. Therefore, I feel it is sensible for them to construct their very own know-how platform for long-term profit. Nevertheless, this logic doesn’t apply to all of the eating places. The truth that the OLO web retention charge accelerated to 119% (from 115% in 2Q23 and 107% in 3Q22) is a robust indication that churn just isn’t a serious challenge. Furthermore, as OLO continues to roll out extra product modules (and efficiently upsell them), I feel it’s going to make it extra sticky and tougher to tear out. As such, I don’t see this growth as one thing that has structurally impaired my view of OLO’s aggressive benefit.

Olo Pay gaining traction

One underappreciated facet of OLO is its fee module, Olo Pay. I imagine this may change into a big income driver within the medium time period. From $49 million in gross fee worth [GPV] in 2Q22, OLO has managed to drive it as much as $347 million in 3Q23, implying a GMV penetration of 5.5%. This clearly signifies the sturdy underlying demand, and administration highlighted that it’s on observe to exceed $1 billion GPV in FY23. This means a 4Q23 GPV of at the least $280 million, or ~2.8x the 4Q22 degree. Chances are high that OLO will outperform this $280 million given the festive season (extra meals away from dwelling events). Administration choice to extend its Olo Pay outlook to $25 million from the low $20s in 2023 was a robust signal, I imagine, that the adoption of Olo Pay continues to outperform expectations. I count on adoption to proceed growing, as solely 15% of industry-wide transactions are digital, implying a possible greater than 6x addressable market as soon as OLO rolls out its card-present performance in 2H24.

“the $23 billion of GMV that we quoted final yr being processed over the platform and also you assume that, name it, 15% of transactions {industry} broad are digital, which means as card-present involves market, we even have a, name it, 6x alternative”

Valuation

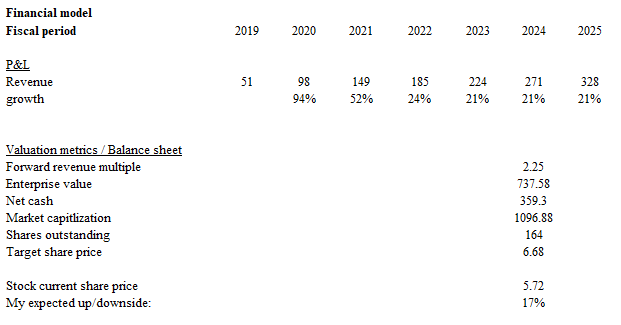

Could Investing Concepts

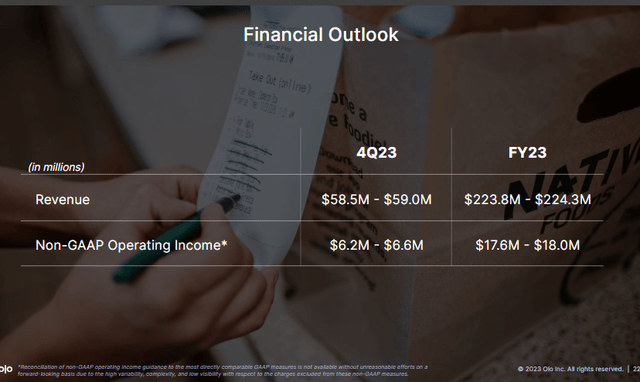

With my view on the {industry}, OLO worth proposition, and OLO pay development potential, I feel OLO can simply maintain its present development momentum of low-20%. I’m basing my FY24 and FY25 21% development charge towards administration’s FY23 income steering. For valuation, I’m utilizing OLO’s present ahead income a number of of two.25x in my mannequin, which interprets to a goal worth of $6.68 (17% upside). I notice that my valuation assumption is to mirror the destructive sentiment across the inventory right now, given the churn of WING on OLO’s platform. It’ll take a while for the market to understand that the OLO worth proposition stays sound and that churn just isn’t a problem (keep in mind, the web retention charge is 119%). From a margin of security perspective, 2.25x ahead income is close to the bottom OLO has ever traded. Even at this a number of, the upside is engaging.

OLO

Threat

The churn of WING might sign a deeper challenge than I anticipated. If WING is ready to recreate a know-how stack with a decrease value of capital that works completely fantastic, It might be a blueprint for different eating places to finally observe. This can be a long-term danger that OLO wants to handle by constantly rolling out extra product modules (making itself extra sticky). As long as OLO doesn’t give the eating places a purpose to depart, I feel it will likely be fantastic.

Conclusion

In conclusion, I give a purchase ranking for OLO. I imagine its sturdy place within the rising digital gross sales penetration throughout the restaurant {industry}, coupled with a strong worth proposition and the potential of Olo Pay, ought to help its present development momentum of low-20%. Importantly, the present valuation, close to its historic low, presents a gorgeous entry level, particularly contemplating the potential upside as market sentiment aligns with the corporate’s true worth proposition.