metamorworks/iStock through Getty Photos

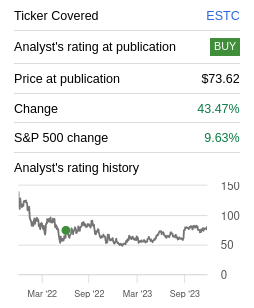

We first wrote about Elastic (NYSE:ESTC) a bit of over a 12 months in the past, ranking it a ‘Purchase’ primarily based on its sturdy aggressive moat derived from its community results ensuing from its open supply mannequin and from excessive buyer switching prices. Not all the pieces was good, although, as development had slowed and there have been excessive ranges of stock-based compensation. The corporate simply introduced wonderful Q2 2024 outcomes, which made the shares soar previous $100, which means that it has greater than quadrupled the efficiency of the market since we printed our Elastic article. Given the change in share worth, and the current outcomes, we’ll analyze the corporate to find out if a change in ranking is warranted.

SeekingAlpha

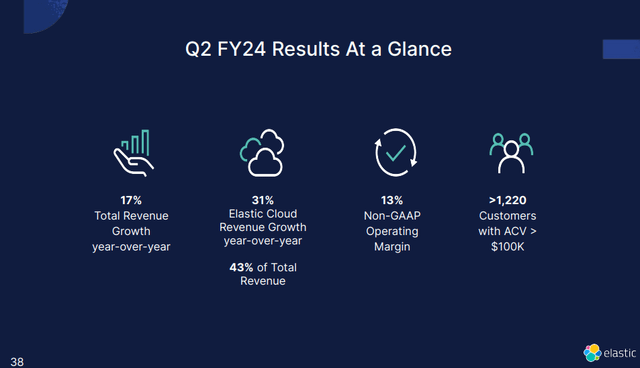

Q2 2024 Outcomes

Second quarter 2024 outcomes have been encouraging, with income rising 17% 12 months over 12 months, and Elastic Cloud rising significantly quick with 31% 12 months over 12 months development. The corporate attributed development in Cloud to enchancment in cloud consumption in addition to some influence from its success in generative AI. Elastic believes that search is a essential a part of the infrastructure for AI, and that they stand to profit from this essential pattern. Nonetheless, the corporate admits it would take a while for generative AI spend to develop into a big driver of its income, and so they see it largely as an thrilling long-term alternative.

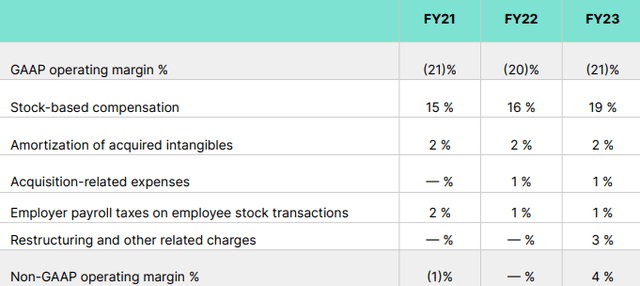

Elastic reported a report non-GAAP working margin of 13% for the quarter, and diluted earnings per share of $0.37. You will need to do not forget that these numbers are non-GAAP, and that the corporate stays loss-making utilizing GAAP accounting. Subscription as a share of complete income was roughly 93%.

The corporate shared a number of pleasure round AI purposes, together with excessive expectations for its Elasticsearch Relevance Engine, or ESRE, to construct generative AI purposes. There have been additionally a number of essential wins within the quarter the place they displaced opponents. For instance, Elastic shared that they signed a multiyear market take care of DocuSign (DOCU), and so they closed a multiyear 8-figure take care of a number one world wealth administration firm.

Elastic Investor Presentation

Financials

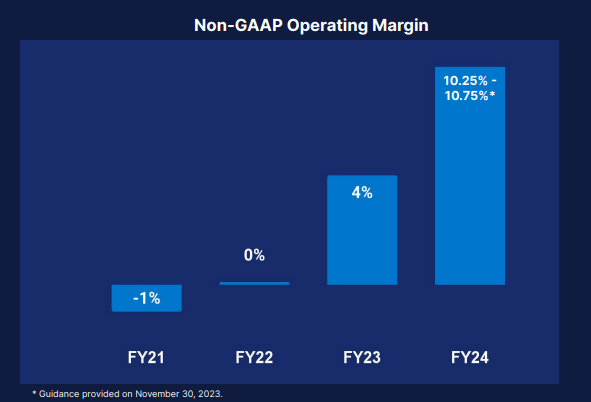

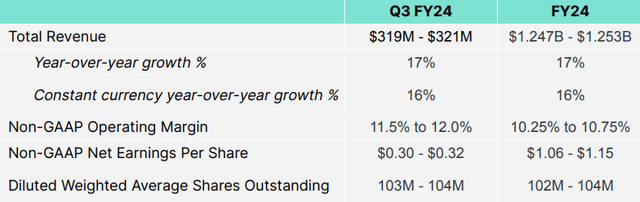

We consider a part of the joy, and why shares are up greater than 30% as we speak, is that the corporate is forecasting important profitability enchancment for FY2024. As might be seen within the graph beneath, steering is for the Non-GAAP working margin to be round 10% for fiscal 12 months 2024.

Elastic Investor Presentation

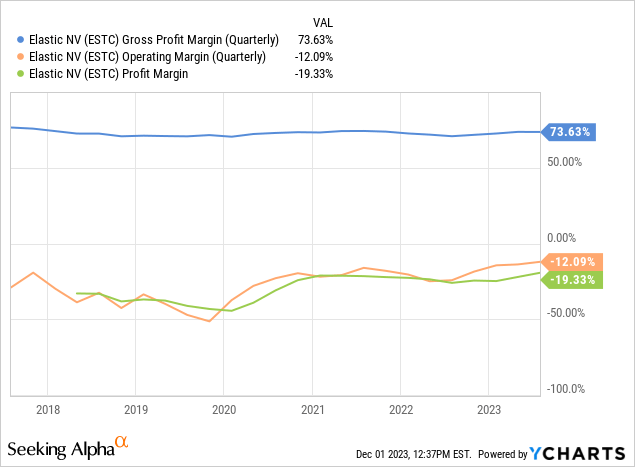

The profitability enchancment is unquestionably excellent news, however we wish to warning readers that issues don’t look as rosy when utilizing GAAP accounting. This may be seen within the graph beneath, and whereas Elastic has a beautiful gross working margin, it has but to succeed in GAAP profitability. As we’ll see beneath, one key purpose is the numerous quantity of inventory primarily based compensation the corporate makes use of.

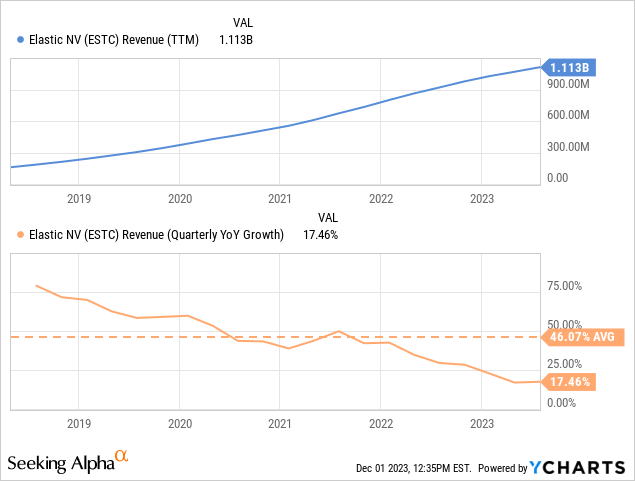

Development

Elastic has a number of totally different development vectors, which embody new buyer acquisition, buyer knowledge development, clients adopting extra of Elastic’s options, clients shifting to the cloud and adopting increased subscription tiers, and clients adopting extra use instances. Elastic has been engaged on all these fronts, which has resulted in important income development, surpassing $1 billion in trailing twelve months income. Sadly, income development has been shortly decelerating, though it will seem many traders consider that the generative AI tailwind will begin to reverse this pattern.

Aggressive Moat

We consider Elastic does have a robust aggressive moat, largely derived from excessive buyer switching prices. As soon as clients spend the time to combine Elastic, they are going to be very reluctant to spend the effort and time, plus the operational danger, emigrate to an alternate. It additionally advantages from scale, as classes discovered from working with one buyer can then be used to additional enhance its algorithms within the subsequent model. The best way Elastic likes to phrase that is “Elastic allows everybody to search out the solutions that matter. From all knowledge. In actual time. At scale”. In any case, it’s true that the quantity of information that’s being generated, and which must be searched, is continually growing and reaching spectacular numbers. Which means that search options should be actually environment friendly, making it more and more tough for corporations to construct their very own in-house search expertise.

Elastic Investor Presentation

Even Reserving (BKNG) with all its assets appears to choose utilizing an exterior resolution, as a substitute of constructing one internally. Elastic talked about them as one among their clients, serving to them handle the roughly 100 terabytes of information per day they ingest to assist clients. One other instance of a buyer shared was BMW (OTCPK:BMWYY), which has the problem of permitting clients to seek for an enormous variety of totally different automobile configuration choices. To additional enhance their moat, Elastic not too long ago purchased a small firm referred to as Opster, which develops merchandise for monitoring, managing and troubleshooting Elasticsearch and OpenSearch. They’re the creators of AutoOps, a strong platform that gives deep perception to detect and resolve points with cluster well being, improved search efficiency and scale back {hardware} prices. Elastic believes this acquisition will assist them of their street in direction of full server-less choices, and that it’ll make their platform much more resilient and simpler to make use of.

The AI tailwind

A whole lot of the present pleasure comes from expectations that generative AI might be a big contributor to Elastic’s development. Elastic for its half maintains that search is a essential part within the generative AI worth chain, and its options give builders a strong set of machine studying instruments to construct AI-powered search purposes that combine with massive language fashions.

Elastic Investor Presentation

There may be one other profit to Elastic from generative AI, and that’s making its merchandise simpler to make use of. An excellent instance is the chat capabilities with SQL integration utilizing their AI Assistant. This enables clients to make use of pure language to elucidate a question and have the AI Assistant present the question syntax, clarify what the question does, and supply a immediate to run the requested question.

Elastic Investor Presentation

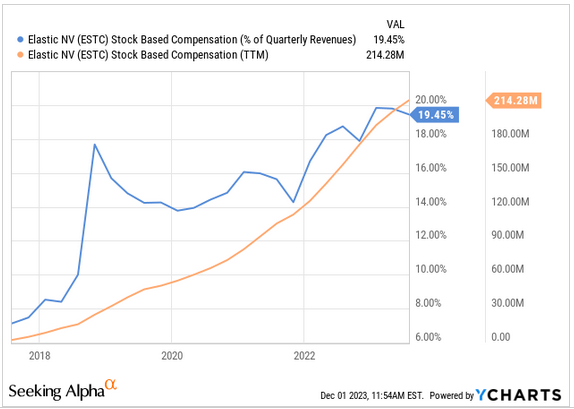

Inventory-based Compensation

Whereas we’re massive followers of Elastic’s expertise and enterprise mannequin, we’re disenchanted with its lack of self-discipline relating to stock-based compensation. It has been rising a lot sooner than revenues, and it has now reached roughly 20% of trailing twelve months revenues.

YCharts

This is without doubt one of the predominant causes the corporate stays unprofitable utilizing GAAP accounting. That is clear when wanting on the GAAP to Non-GAAP reconciliations for its working margin.

Elastic Investor Presentation

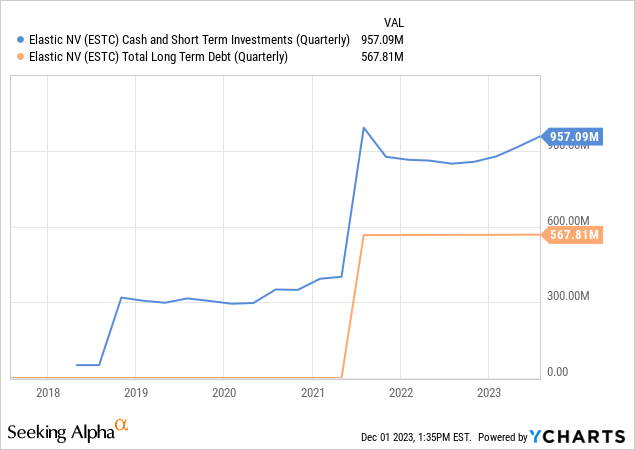

Stability Sheet

Elastic reported ending the quarter with money, money equivalents, and marketable securities of $966 million, and long-term debt of $568 million. This implies the steadiness sheet stays fairly strong, and confirmed little change in comparison with the earlier quarter.

Outlook

Elastic raised its FY2024 outlook, now anticipating income within the vary of $1.247 billion to $1.253 billion, this may symbolize 17% y/y development. It expects non-GAAP working margin within the vary of 10.25% to 10.75% and non-GAAP earnings per share within the vary of $1.06 to $1.15.

Whereas this appears to mark an inflection level for the corporate, it’s nonetheless too early to be satisfied that the deceleration the corporate had been seeing to its development is over, and it stays to be seen how a lot of an actual influence generative AI could have on its future development.

Elastic Investor Presentation

Valuation

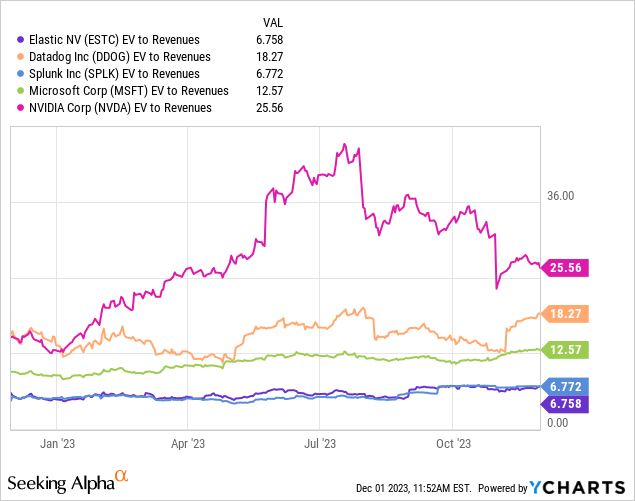

Whereas we’re optimistic that Elastic will certainly expertise tailwinds from the generative AI pattern, we consider shares to be costly. Maybe not as costly as different AI corporations, however we’re reluctant to pay an nearly 7x EV/Revenues a number of for the shares.

Nonetheless, shares don’t look that costly on a relative foundation in comparison with opponents equivalent to Information Canine (DDOG), or Splunk (SPLK) which acquired an acquisition supply. Elastic even seems low-cost in comparison with Microsoft (MSFT) or NVIDIA (NVDA), however we do consider the AI sector to be fairly overvalued in the meanwhile.

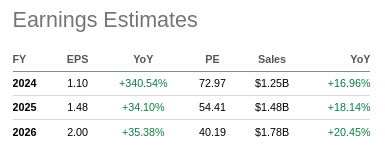

Analysts anticipate earnings per share to develop considerably for Elastic within the coming years, however these are non-GAAP estimates, and even wanting as far out as FY26, the ahead P/E a number of stays a dear ~40x.

SeekingAlpha

Dangers

We consider the most important danger for traders in Elastic is that the share worth displays excessive development expectations. Development had been decelerating for a number of quarters, nevertheless it seems traders now consider the corporate has reached an inflection level. Particularly, there are excessive hopes that generative AI will re-accelerate income development.

Earlier this 12 months the corporate disenchanted traders when it mentioned it will lengthen its $2 billion income goal timeline, giving tough macro circumstances as one of many causes. One analyst requested throughout the Q&A session of the earnings name whether or not the generative AI tailwind would imply that the timeline could possibly be moved ahead once more. CFO Janesh Moorjani gave what appears like an optimistic reply, however with out committing to carry the goal ahead.

So, you understand, we have been via that $2 billion purpose someday again, however the way in which we take into consideration this essentially is that we have a big alternative forward of us, and we’re working arduous to prosecute that chance. You have seen super momentum right here from the standpoint of the general enterprise, and significantly when it comes to cloud development as we handle that chance. And all of that’s moreover fueled by the momentum that we’re seeing in generative AI.

So, we do not need to get too far forward and begin to predict future income development past this 12 months at this stage. However there is not any query in our minds that we’re working arduous to construct a multi-billion greenback Firm at scale sooner or later. And we’ll offer you applicable updates as we go on that. However for now, we’re centered on executing on this 12 months and really feel superb in regards to the again half of the 12 months.

Conclusion

There have been a number of positives in Elastic’s Q2 2024 outcomes, and traders seem significantly excited in regards to the generative AI potentialities and the potential for an elevated goal addressable market within the long-term. Nonetheless, the corporate reminded traders that clients stay price acutely aware, and that the generative AI influence remains to be not very important, even when it makes the long run look extra promising. We proceed to consider Elastic has a really distinctive expertise and aggressive moat, and do consider some advantages from generative AI will materialize sooner or later. Sadly the corporate has an enormous stock-based compensation expense, making it unprofitable on a GAAP foundation. Given this, we now not discover the shares significantly engaging and are subsequently downgrading them to ‘Maintain’. Nevertheless, we stay optimistic a couple of potential development inflection and consider that they’re much less overvalued in comparison with many different AI corporations.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.