libre de droit

Introduction

Shares of Akero Therapeutics (NASDAQ:AKRO) fell to 52-week lows earlier in October after reporting poor early outcomes from a crucial part two NASH cirrhosis research; efruxifermin (EFX) didn’t hit the fibrosis major endpoint in that trial. Since then, the inventory has rallied by roughly 40%, rising from ~$11.30 a share on the low to about $15.50 a share right now. Buyers appear to be betting that HARMONY – one other part two trial however for F2-F3 NASH sufferers – will report optimistic leads to Q1’24.

Furthermore, plainly the market is beginning to achieve confidence that EFX can nonetheless turn into an FDA accredited and commercially profitable drug to deal with NASH. Based mostly on the present information, I’d agree with the previous level. On the latter level, it’s tougher to say. Though EFX seems to work at face worth, it’s a lot much less obvious that EFX has the mandatory qualities to differentiate itself amid a posh remedy panorama.

Thesis

As a result of future uncertainty and the aggressive benefit that Madrigal’s (MDGL) Resmetirom enjoys, I’d assign Akero Therapeutics a promote ranking. The problem for Akero is to show that EFX is differentiated. And the present information doesn’t help this differentiation.

The Information Does Not Appear Unhealthy

The explanation for the precipitous drop within the inventory value earlier in late October was that 36-week data from SYMMETRY – a part two trial evaluating EFX as a remedy for F4 NASH sufferers with compensated cirrhosis – was unveiled. No statistical significance was achieved on both the 28 or 50-milligram dose for the first endpoint of a minimum of a one-stage enchancment in liver fibrosis with out the worsening of NASH vs placebo; the important thing secondary endpoint of NASH decision was statistically important for each dosages. It must be famous {that a} favorable dose-dependent development in the direction of fibrotic discount was proven by EFX, despite the fact that this was not statistically important. Therapy was well-tolerated with no main security flags being reported. (Aside from delicate to average gastrointestinal occasions main to some discontinuations.)

At face worth, the info doesn’t appear so dangerous. On the very least, you’ll assume that it could not warrant a ~60% drop in market capitalization. Keep in mind that this information is coming from a NASH inhabitants that has a really late stage of the illness (F4 sufferers with compensated cirrhosis.) At this stage, sufferers are on the verge of decompensated cirrhosis, the place sufferers have an average survival of ~2 years and not using a liver transplant; the hurdle is kind of excessive to start with.

Furthermore, this can be a 36-week evaluation of a 96-week lengthy research. It might be true that it merely takes extra time for fibrotic discount to point out separation from placebo. For the evaluation to already present statistically important reductions in NASH decision (p<0.01 for each dosages) is spectacular. The decision charges of 63% and 60% for the high and low dosage respectively on this affected person inhabitants is unprecedented.

The research met its major endpoint for each the 50mg and 28mg EFX dose teams, with 41% and 39% of EFX-treated sufferers, respectively, experiencing a minimum of a one-stage enchancment in liver fibrosis with no worsening of NASH by week 24, in contrast with 20% for the placebo arm… As well as, 41% and 29% of sufferers handled with 50mg and 28mg, respectively, achieved each endpoints (NASH decision and fibrosis enchancment ≥1 stage), in contrast with 5% for placebo.

Supply: HARMONY Press Release, 9/13/22

Think about too that EFX achieved statistical significance in each NASH decision and fibrosis discount in one other part two trial, HARMONY: The important thing distinction between HARMONY and SYMMETRY is that the previous evaluated EFX as a remedy for the F2-F3 illness inhabitants. (That is the standard method to judge a NASH remedy.) MAESTRO-NASH, the profitable part three trial Madrigal carried out to evaluate Resmetirom as a NASH remedy, enrolled no F4 patients. When you think about this context, SYMMETRY’s failure just isn’t as dangerous because it appears.

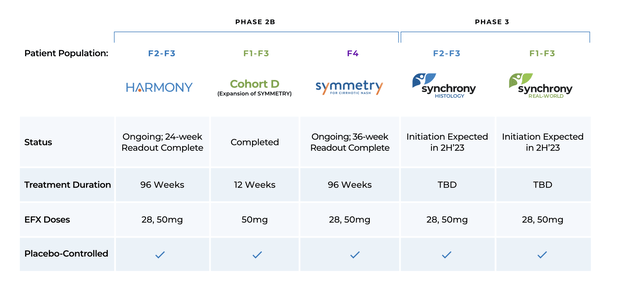

Akero Therapeutics’ Medical Trials (Akero Therapeutics’ Investor Relations Materials)

Akero’s method of conducting a number of scientific trials for various affected person subgroups is sensible when you think about the heterogeneous nature of NASH illness. A slim miss on F4 sufferers doesn’t preclude the FDA from granting accelerated approval to EFX primarily based on the result of Synchrony and HARMONY.

Differentiation and Complexity

Nevertheless, the problem for Akero is that they should not solely get EFX previous the end line but in addition reveal superiority in a sophisticated remedy panorama. Because of this the 36-week readout of SYMMETRY mattered a lot; traders wished to see if EFX might differentiate itself by anti-fibrotic impact. The first endpoint miss at this juncture means that EFX won’t fulfill these excessive expectations as soon as SYMMETRY concludes at week 96.

Such a excessive bar is important due to Resmetirom’s huge head-start. The FDA already accepted Madrigal’s NDA for Resmetirom and set a precedence evaluation date of March 14, 2024. If accredited, which I imagine it will likely be, Resmetirom could have an enormous head-start in defining itself as the only real remedy for NASH. If SYNCHRONY HISTOLOGY is initiated in December, and the remedy length is identical as HARMONY and SYMMETRY, then it could take ~22 months earlier than major completion. Then, it’s a must to add within the time it takes for Akero to place collectively an NDA bundle and the time for the FDA to evaluation it. If the NDA timing for EFX matches Resmetirom’s, it could add on one other ~15 months. All in all, Akero is behind Madrigal by ~3 years.

Bear in mind, Resmetirom already demonstrated its anti-fibrotic impact and NASH decision in Maestro-NASH; the oral supply mechanism of Resmetirom can also be way more handy than the subcutaneous injections wanted for EFX. As soon as accredited and given the chance to turn into the usual of look after NASH, it would turn into troublesome to unseat except a extra compelling possibility comes ahead. With the latest fibrosis endpoint miss, it turns into tougher to promote EFX over Resmetirom. EFX additionally must, on the minimal, show itself in SYNCHRONY and HARMONY. And exceeding expectations in SYNCHRONY is not any assure, given the massive graveyard of different NASH medication that failed in phase three trials.

The trail ahead for EFX is sophisticated by the altering remedy paradigm of NASH too. There exists a palpable chance that GLP-1 therapies might shrink the full NASH inhabitants by decreasing the upstream overweight inhabitants. (Obesity is by far the highest root explanation for NASH.) It is usually true that GLP-1s themselves might deal with NASH immediately. A key readout in February from Eli Lilly (LLY) evaluating Tirzepatide as a NASH treatment will present the readability wanted on this concern.

One other complexity is that NASH decision and fibrotic discount are surrogate endpoints, so EFX will face an uphill battle in opposition to insurers in achieving protection. The latest ICER report NASH articulates the reasoning behind why insurers could be resistant completely:

Though there’s a super want for disease-modifying remedy for NASH, given the dearth of scientific consequence information, the spontaneous enchancment of histology in 25% of untreated sufferers, the dearth of long run security information, and that it takes a mean of seven years to progress one fibrosis stage, it will likely be affordable for payers to make use of prior authorization as a part of protection for NASH therapies. Payers ought to cowl intensive weight administration applications that embrace nutritionists and drug remedy on condition that decision of NASH has been noticed in as much as 84% of sufferers inside one yr of bariatric surgical procedure. Way of life interventions with a sustained physique weight discount of a minimum of 10% result in NASH decision in as much as 90% and regression in fibrosis in as much as 45% of sufferers.

Take into consideration how complicated the business panorama could also be in 2026. EFX could also be competing in opposition to Resmetirom, GLP-1s and insurers who would like to have step remedy previous to protecting any medication. With out demonstrating clear superiority and differentiation from the usual of care, commercialization might show itself to be troublesome. This explains why the preliminary response to SYMMETRY was so stark.

Financials And Valuation

One stable facet of Akero is that they haven’t any scarcity of liquidity to fund their trials and operations. As of their last quarter, they’ve ~$554 million in money, money equivalents and short-term marketable securities. In addition they have one other ~$60 million in long-term marketable securities, bringing their complete liquidity to ~$610 million. In distinction, their long-term debt stands at ~$20 million.

Averaging their internet loss for the previous 4 quarters yields a quarterly money burn price of ~$30 million. Assuming it holds regular at that degree, Akero should not have any downside protecting the price of EFX’s growth to approval. Nevertheless, it would probably want to boost extra money from both a partnership or shareholder dilution if it needs to commercialize EFX.

As of the time of writing, every share of Akero trades at ~$16.50, yielding a market capitalization of ~$920 million. With an enterprise worth of ~$330 million, it’s clear that the market just isn’t assigning a lot worth to EFX. Valuing EFX itself is troublesome, as there may be nonetheless quite a lot of uncertainty relating to its scientific profile, not to mention in comparison with Resmetirom. Even much less sure is how GLP-1s will modify the NASH panorama by 2026 or the impact of insurers pushing again in opposition to protection. Such quite a lot of uncertainty makes it troublesome to seek out the true worth of EFX.

In any occasion, I’m skeptical that EFX can carve out a distinct segment or efficiently compete in opposition to Madrigal’s Resmetirom. The primary-mover benefit is troublesome to beat, and the superior comfort provided by Resmetirom’s oral supply can’t be overcome. (Bear in mind, most NASH and NAFLD patients are asymptomatic, so guaranteeing ease of use to take care of compliance shall be a high concern for these prescribing remedies.) Consequently, the issue of assigning any worth to EFX compels me to assume that Akero’s appropriate valuation could be money worth; this implies a value per share of ~$11 and a draw back of ~40 p.c from the present valuation.

Conclusion

The sophisticated path ahead for Akero is lengthy and cloaked in uncertainty. Akero is behind by three years on the very least and nonetheless wants EFX to go by part three trials. And though EFX exhibits therapeutic promise, it’s troublesome to find out from the present information if it may well outshine Resmetirom. Because of the magnitude of the uncertainty, I’d assign a promote ranking to Akero.

Dangers To Thesis

1) The bull thesis just isn’t far-fetched. The bank-shot lies with a profitable 96-week readout of SYMMETRY. If EFX manages to hit on the first endpoint of fibrosis discount in F4 sufferers with decompensated cirrhosis, then that will meaningfully differentiate it from Resmetirom. Or, if it manages to reveal clearly higher endpoint and/or outcomes information by HARMONY/SYNCHRONY.

2) Madrigal might obtain a whole response letter (CRL) from the FDA in response to its NDA for Resmetirom. There was some speculation from bears that Madrigal engaged in a sleight of hand by altering its fibrosis endpoint in MAESTRO-NASH earlier than the readout. Such a situation wouldn’t be with out precedent too, as Intercept’s OCA NDA for NASH died in regulatory limbo following its CRL from the FDA. Though I discover FDA rejection unlikely, it might delay Madrigal wherever from 6 to 24 months relying on the character of the CRL. This consequence would propel the bullish thesis behind EFX by decreasing the chance from competitors.