Posted:

- BNB’s 60-day correlation with Bitcoin plunged from 80% in 2022 to 60% in 2023.

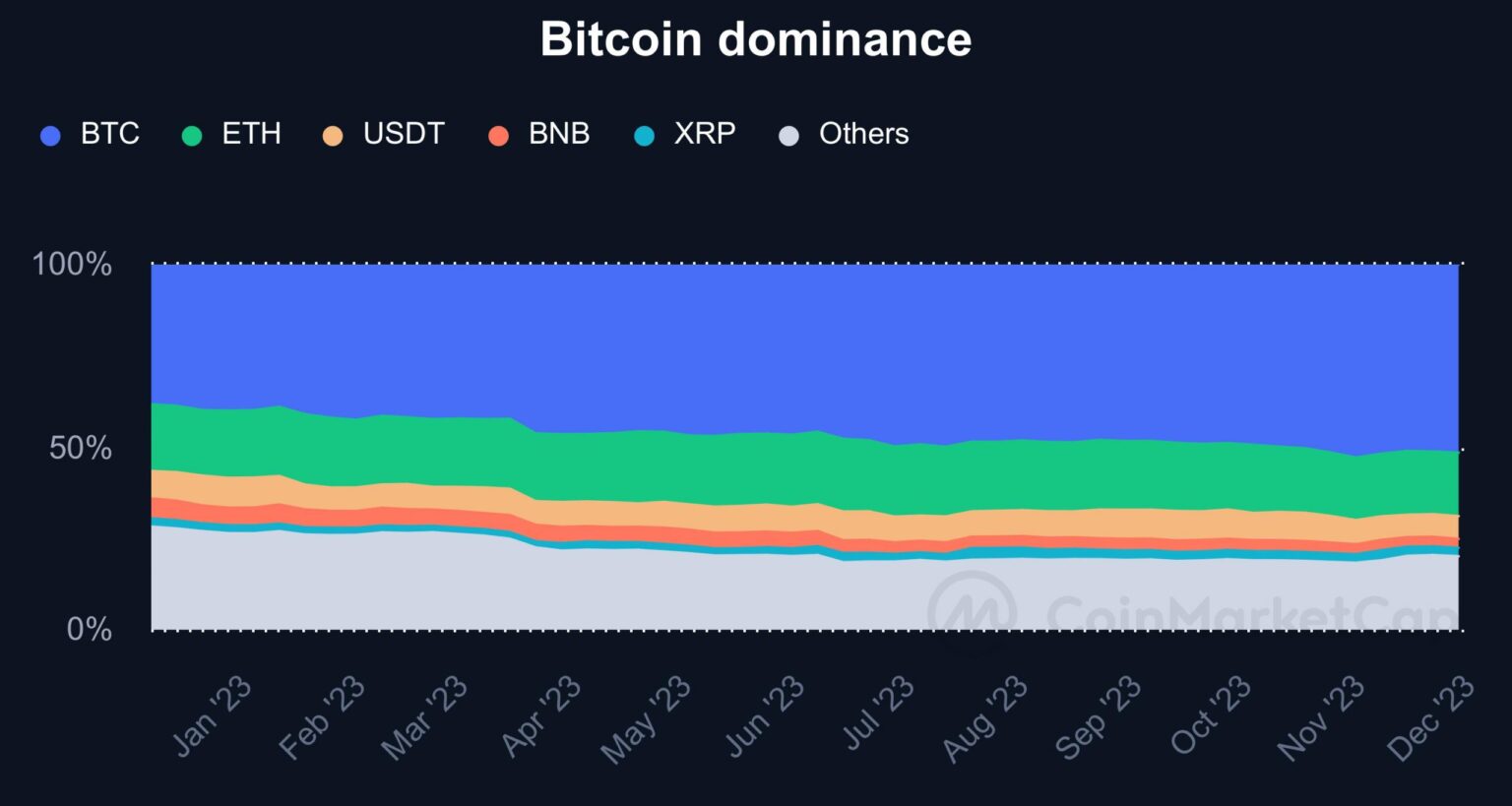

- Bitcoin’s market cap expanded from 39% at first of the yr to 51% at press time.

Bitcoin [BTC] has been driving excessive on the keenness surrounding potential spot ETF approvals over the previous couple of months. The optimism resulted in a gentle improve in institutional investments into the king coin, in line with digital asset supervisor Coinshares.

Bitcoin strikes forward unscathed

The world’s largest digital asset has more than doubled in worth because the starting of the yr, leaving the horrors of the crypto winter properly behind.

A better examination revealed that the coin has been rock regular in 2023, unfazed by developments impacting different cryptos out there.

Actually, even the most recent Binance/Changpeng Zhao (CZ) fiasco failed to offer an enormous scare to BTC. The same story unfolded earlier within the yr when the prized asset managed to remain resilient regardless of U.S. regulators’ scrutiny of different altcoins.

Based on AMBCrypto’s evaluation of CoinMarketCap’s information, Bitcoin’s market cap has expanded from 39% at first of the yr to 51% on the time of writing. On the identical time, the market share of some widespread cash like BNB shrunk significantly.

Bitcoin detaches from the remainder of the market

The explanation lies in Bitcoin’s elevated decoupling from altcoins in 2023, as per a report by crypto market information supplier Kaiko. The de-correlation helped in boosting Bitcoin’s picture as a portfolio diversifier.

As evident from the graph under, main altcoins just like the BNB, Ripple [XRP], and Solana [SOL] had been probably the most indifferent from the king coin.

Whereas BNB’s 60-day correlation with BTC plunged from 80% in 2022 to 60% in 2023, XRP tumbled 75% to 45%. Then again, Cardano [ADA] and Dogecoin [DOGE] nonetheless maintained a powerful relationship with the king coin.

Good concept to purchase Bitcoin?

When an asset stops reacting strongly to the worth motion of different comparable property, it makes monetary sense to incorporate them in a single’s portfolio. Good traders unfold their investments throughout totally different cryptos, decreasing their publicity to anybody kind of asset.

How a lot are 1,10,100 BNBs worth today?

Within the present situation, having Bitcoin in a portfolio could help in mitigating losses if different cryptocurrencies plunge. Furthermore, traders will giant holdings of Bitcoin may very well be tempted to not purchase extremely correlated property.

All stated and performed, the above deductions shouldn’t be taken as funding recommendation. Merchants and traders had been suggested to DYOR.