Filmstax

Funding Thesis

BRC Inc. (NYSE:BRCC) is an American espresso firm that sells espresso and coffee-related merchandise and equipment, headquartered in Salt Lake Metropolis, Utah. Since my final evaluation, the corporate has corrected 21%. On this report, I’ll analyze its third quarter outcomes and its future development prospects. BRCC is working in direction of turning into worthwhile, and it’s counting on the wholesale channel to attain this. It will assist the corporate to chop prices within the brief time period, however it may have an effect on its future development. I’m upgrading my score to a maintain for BRCC.

Firm Overview

BRCC is a veteran-operated espresso firm established in 2014 by former US Particular Forces members. It presents a spread of espresso merchandise, together with complete bean, floor, and single-serve espresso choices. Along with its core espresso merchandise, BRCC additionally supplies a collection of gear and merchandise. The corporate sells its merchandise by wholesale, direct-to-consumer (DTC) and company-owned shops. Wholesale accounts for almost all of the revenues, adopted by DTC and company-owned shops.

Q3 FY23 Outcomes

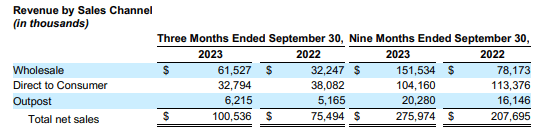

BRCC posted sturdy quarterly outcomes with vital income development and increasing gross and working revenue margins. The wholesale section proved to be the outperformer, contributing 61% of the entire income. The corporate determined to transition in direction of wholesale gross sales channels because it was incurring vital buyer acquisition prices within the DTC section. Within the coming quarters, the corporate plans on rising its publicity to wholesale as it’s placing emphasis on turning worthwhile and chopping down its prices. I imagine this transfer will assist in bettering profitability within the brief time period. Nevertheless, this may compromise its long-term income and revenue development as a result of the DTC section supplies the best revenue margins as soon as the model is established, and it could actually retain prospects. With merchandise like espresso, the repeat price and frequency is kind of excessive, and its sale from the DTC channel supplies one of the best margins.

BRCC: Investor Relations

BRCC reported total revenue of $100.5 million, up a major 33% in comparison with $75.5 million within the corresponding quarter the final 12 months. As per my evaluation, the enlargement of the wholesale section throughout the US resulted on this enhance. The corporate elevated its presence in retail shops by 21.5% and the quantity of its merchandise at these shops by 42%. The corporate has partnered with 14 new meals, drug, and mass (FDM) retailers together with Walmart and Albertsons. The income from the wholesale section stood at $61.5 million, an enormous rise of 91% in comparison with $32.2 million in the identical quarter final 12 months. The DTC section, then again, witnessed a decline of 14% to $32.8 million, in comparison with $38.1 million within the corresponding quarter final 12 months. The minimize in commercial spending and the shift of focus from the DTC to the wholesale section resulted on this decline. Going forward, the share of the wholesale section within the revenues is anticipated to witness an extra enhance. BRCC managed to convey down its working loss from $15.6 million in Q3 FY22 to $6.9 million in Q3 FY23. It has introduced down its headcount to be able to convey down the working bills, which is the primary motive behind this fall in working loss. BRCC reported a internet loss per share of $0.05, in comparison with the online lack of $0.08 in the identical quarter final 12 months.

Now, allow us to take a look on the firm’s stability sheet. As of 30 September 2023, it reported money and money equal of $6.6 million against long-term debt of $70 million. The corporate noticed a major rise in long-term debt from $47 million to $70 million. The rising obligation is leading to larger curiosity funds for the corporate, limiting its revenue margins. The curiosity bills in Q3 elevated to $3.5 million from $0.47 million. I believe the administration ought to tackle this concern because the rates of interest usually are not anticipated to go down anytime quickly, particularly after the current commentary by the Federal Reserve.

General, the corporate reported sturdy Q3 outcomes, however the future outlook stays muted. BRCC offered FY23 income steerage within the vary of $400-$440 million. The administration anticipated to finish the 12 months within the decrease vary of this steerage. The adjusted EBITDA is anticipated within the vary of $5-$20 million. Nevertheless, the adjusted EBITDA is a non-GAAP accounting measure, in order per GAAP accounting, the corporate is anticipated to finish FY23 with internet loss. I imagine the corporate is on the trail to profitability, however there are nonetheless many points that the corporate wants to handle with respect to transitioning into the wholesale section. Contemplating these components, I’d suggest traders to not provoke a contemporary shopping for place within the firm. Present traders can maintain the inventory, however further shopping for is just not advisable.

Valuation

BRCC is at the moment buying and selling at a share worth of $4, a YTD decline of 37%. It has a market cap of $864 million. The corporate has improved its twelve-month trailing worth/gross sales ratio to 0.64x, in comparison with 1.2x the final time I analyzed it. I believe the corporate is pretty valued at this a number of. Nevertheless, contemplating the long run steerage, there is not a lot room for enchancment. Additionally, profitability stays a priority for the corporate, and there are higher funding alternatives out there.

Conclusion

BRCC skilled increasing margins and stable income development. Its transition from DTC to wholesale has helped the corporate cut back prices and helps it flip worthwhile. However the long-term impact of this transition may not be as anticipated and in reality, may hamper the corporate’s development. Contemplating all the expansion and threat components, I assign a maintain score for BRCC.