sasacvetkovic33/iStock through Getty Photos

Funding thesis

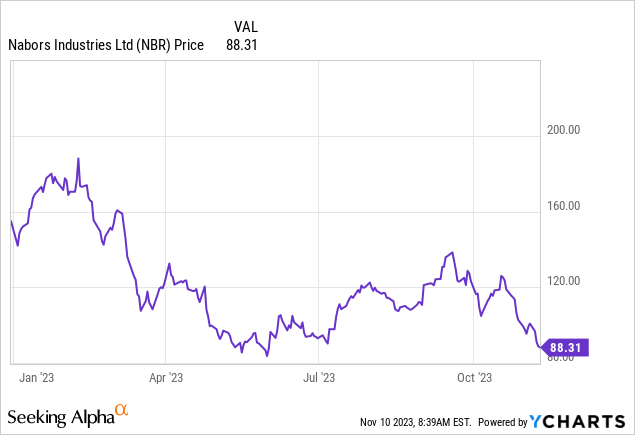

Nabors Industries (NYSE:NBR), a significant supplier of land drilling providers within the U.S. and internationally, hasn’t had good YTD efficiency. A lot of that hasn’t been because of the firm’s explicit outcomes however fairly due to “macro” considerations.

I wrote about this earlier than, after I really useful Nabors as a purchase at $86 on the finish of Might:

Nabors began ascending shortly after and virtually received to $140, earlier than reversing route and is now at $88, just about again in the identical purchase zone. It is in fact not potential to time precisely the bottoms and tops, so I ended up buying NBR at a mean value of $87 and promoting at common value of $116, which nonetheless made for a 33% achieve.

When Nabors received under $90, I began accumulating shares once more on primarily the identical thesis I specified by my prior article:

- U.S. headline rig counts are trending down, however internationally rigs aren’t falling; Nabors is a worldwide participant.

- Even throughout the U.S., the business dynamics drive a desire for higher-end gear the place Nabors has an edge.

- Q3 wasn’t that unhealthy so the reverse journey from $140 to $88 has once more extra do with macro perceptions than Nabors specifics. Oil (CL1:COM) went up so much on the Center East geopolitical premium after which overshot in the other way, now that it appears we cannot see additional escalation.

Primarily based on present analyst expectations about 2024 EBITDA, we at the moment are at a 4x enterprise worth to EBITDA a number of which is not costly. The skilled analyst targets (summarized by In search of Alpha) additionally indicate first rate upside:

In search of Alpha

I feel we’re fairly prone to bounce off the present lows over the subsequent 3-6 months because the “over-correction” reverses. I do not see NBR as a long-term purchase and maintain till the macro image stabilizes. For that we’d like peak long-term yields, the Fed formally shifting from tightening into easing, and maybe even getting previous the 2024 elections which will in any other case invite extra oil market interventions. Nevertheless, in the event you do not thoughts a shorter buying and selling horizon and are actively monitoring your positions, Nabors could also be a guess value contemplating.

What’s going on with rig counts?

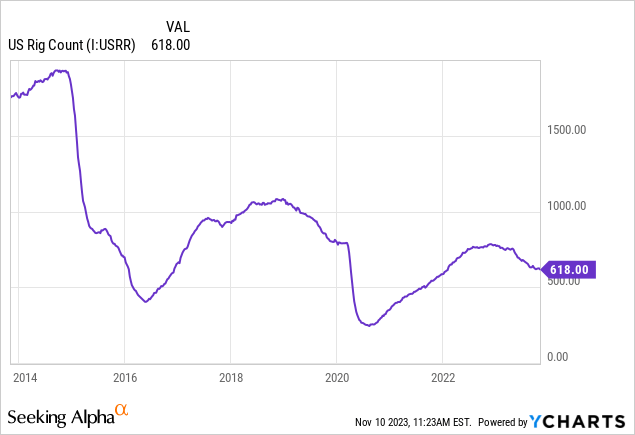

Everybody is aware of that U.S. rig counts are dropping and that metric is the one most frequently quoted within the media:

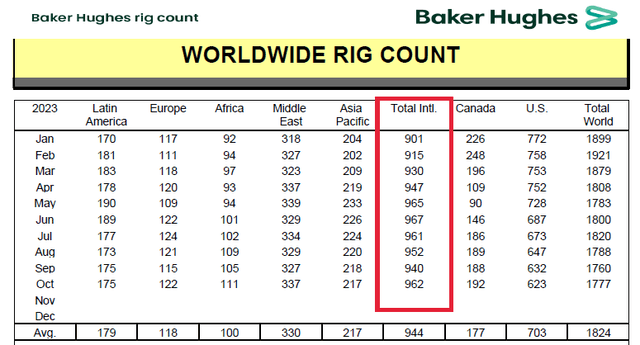

Nevertheless, international rig counts aren’t falling:

Baker Hughes

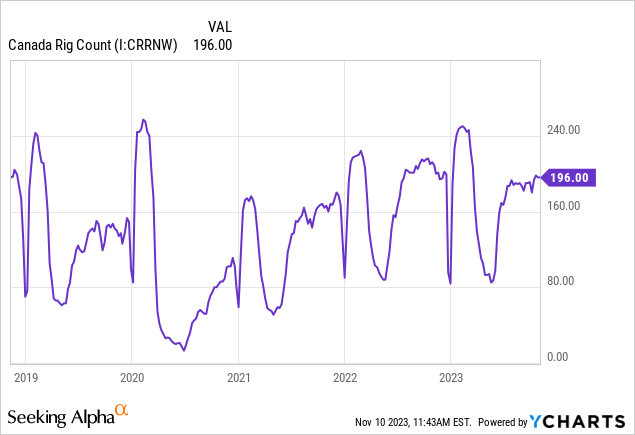

Canadian exercise can be good, conserving in thoughts the stronger seasonality:

This “two-speed” view of the world can be confirmed by the earnings calls of oilfield service majors SLB (SLB), Halliburton (HAL) and Baker Hughes (BKR). All Huge 3 have highlighted continued energy in offshore and worldwide markets in parallel to near-term weak spot within the U.S.

Why that’s the case is an extended story and I’ve laid out my ideas in a couple of of my macro-oriented articles:

Oilfield Companies Replace: Offshore And Worldwide Make Up For North America Weak point

3 Issues To Take into account Earlier than Shopping for Oil Shares

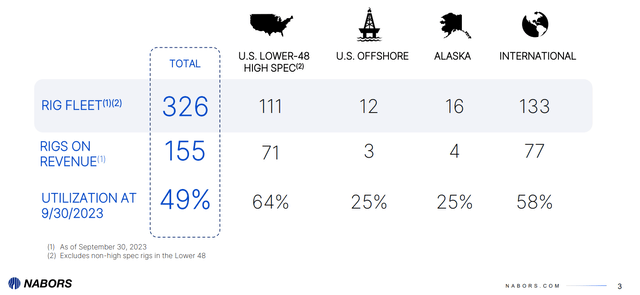

For Nabors’ functions, although, that is merely a reality we have to cope with. The excellent news (from NBR perspective) is that Nabors is not a home driller; virtually half of its exposure is worldwide (working rigs):

Nabors Presentation

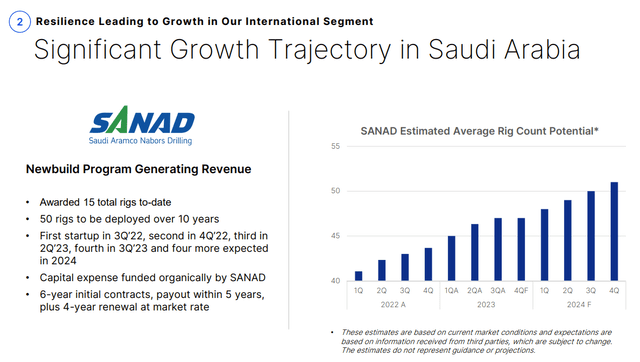

Actually, Nabors is anticipating important development from Saudi Arabia, the place it has a three way partnership with Saudi Aramco; this may increasingly add 50 rigs over the subsequent 10 years (in comparison with 77 working worldwide rigs proper now):

Nabors Presentation

This issues as a result of worldwide exercise targets decrease value, decrease decline manufacturing and is extra sturdy. In comparison with U.S. shale, these developmental efforts are longer cycle in nature and can proceed even with decrease oil costs. Shale is the excessive marginal value producer susceptible to stop-and-go cycles.

So are North American onshore providers executed?

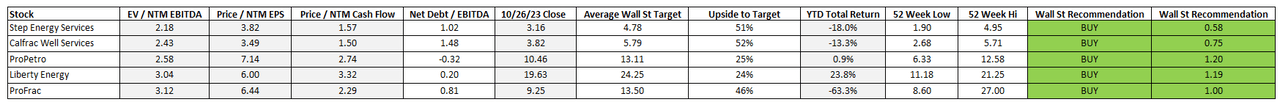

That is what the market appears to assume if in case you have adopted these shares throughout 2023. Valuation multiples are nonetheless fairly low, particularly amongst completion companies that present strain pumping providers:

Creator’s Calculations (Refinitiv Information)

Amongst this group, I beforehand made (appropriate) bullish calls on ProPetro (PUMP) and Liberty Power (LBRT), however I’m at present extra bullish on the Canadian gamers Calfrac (OTCPK:CFWFF) and STEP Power Companies (STEP:CA).

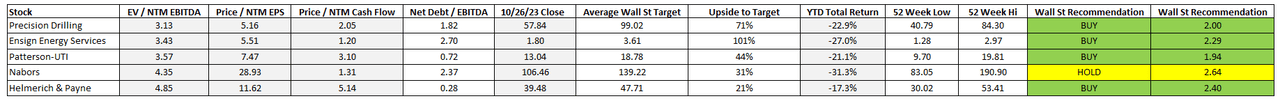

Nabor’s drilling peer group is a bit much less discounted, however nonetheless appears like a cut price until you assume drilling will utterly collapse:

Creator’s Calculations (Refinitiv Information)

Apart from Nabors, I additionally like Precision Drilling (PD:CA) and Ensign Power Companies (ESI:CA) for his or her Canadian publicity. Each Canadian drilling and completions corporations are emphasizing the optimistic affect from LNG Canada, the Coastal GasLink and TMX.

For instance, STEP Power says:

STEP will use the moderating of exercise in This fall 2023 to finish extra intensive upkeep on gear to arrange it for the extraordinarily intensive utilization anticipated for Q1 2024… Exercise in 2024 is predicted to extend, with a number of purchasers signaling that their 2024 capital budgets will likely be increased than 2023. The self-discipline in world oil markets and anticipated completion of the Trans Mountain pipeline challenge and the Coastal Gasoline Hyperlink pipeline/LNG Canada tasks are creating a chance for Canada to materially enhance manufacturing in 2024.

What about U.S. shale although? One puzzle proper now could be that rig counts are falling, however U.S. manufacturing is holding up and will have even damaged information though HFI Analysis warns that U.S. manufacturing could also be overstated resulting from flaws within the EIA methodology.

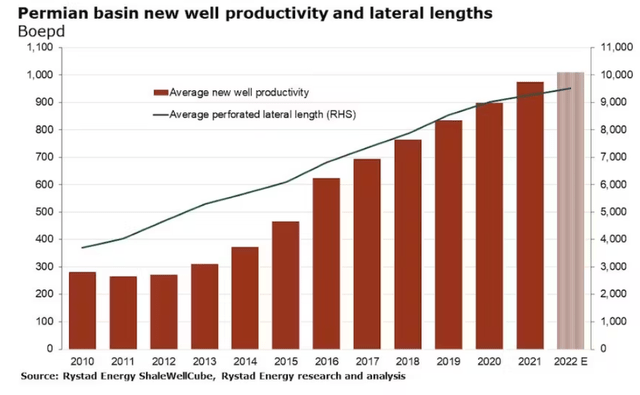

A part of the reply could also be shale corporations drilling longer lateral wells. In case you personal any shale shares and observe their calls, you will have heard a number of instances administration speaking about how longer their wells preserve getting. This brings some effectivity from the operator’s perspective as you will get more production out of the identical drilling rig:

Oil & Gasoline Journal

Seemingly, that is unhealthy information for Nabors, however that is not the complete story because the pattern additionally drives the necessity for increased specification gear the place NBR has the sting. As defined by administration in the course of the earnings name this may increasingly assist Nabors achieve market share from rivals:

You’ve got really seen a few of the massive guys discuss that rising lateral size as a lot as 5 miles and that form of stuff advantages Nabors, as a result of we have pre-invested in that transfer.

We constructed the M 1000 rig, which was the successors to the X-ray a pair years in the past, has a million-pound hook load that is completely designed for these longer lateral lengths. We additionally launched to the market a brand new prime drive that has the pious torque accessible that may really deal with a five-mile lateral. So, the corporate’s positioned itself to seize that second.

Add to that Harold Hamm’s recent comments on shale going after “Technology 3” rock, and it will get clear it is too early to put in writing off onshore providers. Quite, what I discover extra seemingly is that the rising technological challenges for shale manufacturing will outcome within the bifurcation of suppliers into high- and low-spec, and people with premium gear, whether or not it’s drilling or fracking, will likely be extra wanted. So even when the U.S. onshore providers (OIH) pie shrinks completely, it does not imply Nabors’ enterprise will accomplish that too.

Highlights from the Q3 earnings

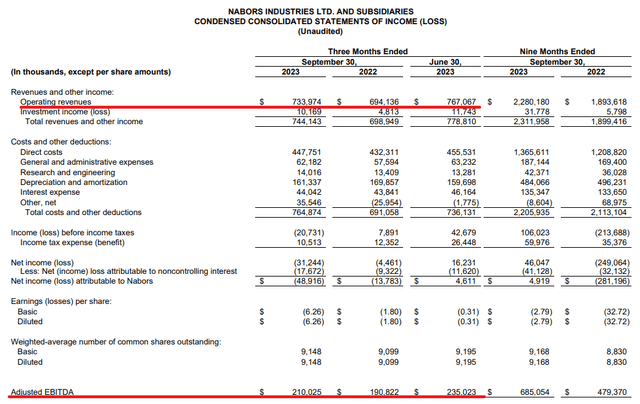

Income and EBITDA in Q3 have been down a bit sequentially, however nonetheless up year-on-year:

Nabors Press Launch

I do not assume this was a nasty quarter even when free money move solely broke even. Administration defined:

Free money move for the third quarter at just below breakeven fell under our goal, primarily resulting from increased capital expenditures of $33 million, which mirrored the accelerated timing of investments in Saudi Arabia and the US..

These sound like timing points that may reverse in 2024. I did not see something notably detrimental from Nabors’ facet, and this confirms my view that the selloff was in all probability extra associated to the macro story round oil costs.

Valuation and targets

Proper now, many of the skilled analysts overlaying the inventory are forecasting near $1 billion in 2024 EBITDA:

| Analyst | 2024 EBITDA |

| Evercore | $934 m |

| Benchmark | $918 m |

| ATB Capital Markets | $931 m |

| Tudor Pickering | $952 m |

Supply: Refinitiv

Even a 4 to 5x enterprise worth to EBITDA ratio can simply take you to a $150-$200 share value given the excessive leverage.

Dangers to contemplate

NBR is not a a lot adopted ticker right here, so in the event you’re studying this text you are in all probability already conscious of the overall danger that oil costs pose for shares on this sector. So no have to harp on that.

Extra particular to Nabors, the debt is excessive, however I’m not seeing indicators of explicit misery but. The biggest excellent maturities are in 2027 and the unfold on these is about 430 bps; it’s up from 300 bps in September however I’m not involved thus far.

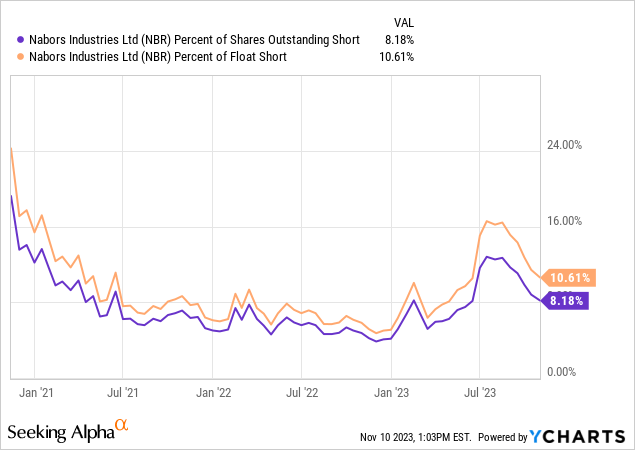

The brief curiosity peaked not too long ago however remains to be excessive:

The saying is that brief sellers are the sensible cash, however, based on this text, the most shorted stock within the S&P 500 final month was Exxon (XOM), so I’m not certain about that any longer both.

Backside line

Oil costs could also be down from the $90 to the $70s, however Nabors’ enterprise is not over. First, the corporate is half worldwide and the capex cycle there’s shifting forward at full velocity. Second, even throughout the maturing U.S shale world, the continued traits might find yourself making Nabors a winner resulting from its technological edge.

I feel the truth that the inventory is revisiting its Might lows has extra to do with macro sentiment and presents one other shopping for alternative. I would not name it a long-term purchase and maintain as a result of the seesaw motion will seemingly proceed till we obtain extra sturdy macro stability, however I’m betting that the subsequent massive transfer is increased.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.