Bruce Bennett

Recap

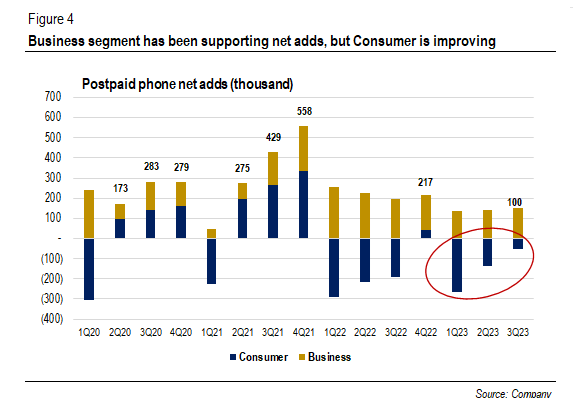

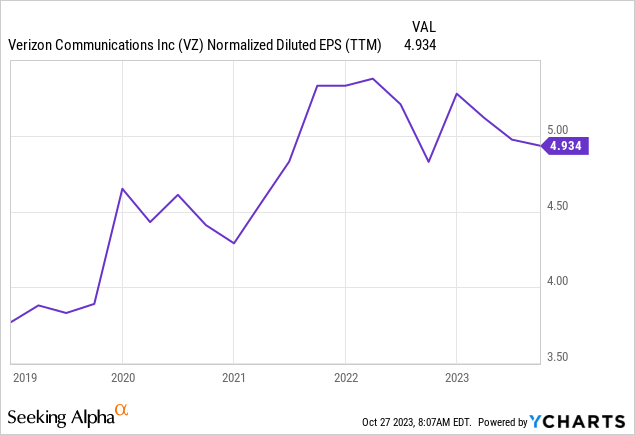

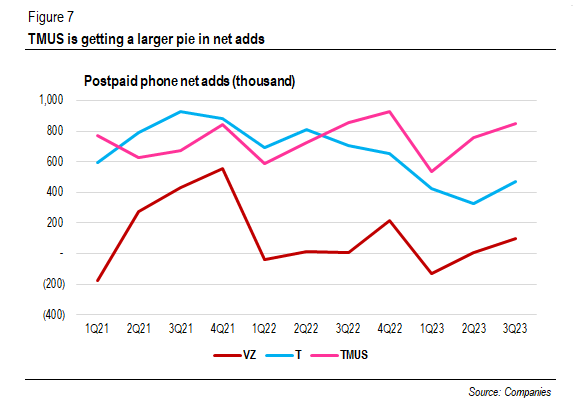

Since our final article in September, Verizon (NYSE:VZ) shares had dropped to as little as $30/share earlier than rebounding by nearly 10% following the discharge of the 3Q23 earnings report. We beforehand identified that Verizon’s lack of prospects within the Shopper phase was a contributing issue to the inventory’s decline. But, within the final quarter, we witnessed promising indicators of enchancment within the postpaid cellphone web provides. Moreover, cellular operators raised their free money movement steering as capital expenditures continued to say no. We nonetheless keep our BUY name as a result of the important thing drivers for the inventory, together with bettering Shopper postpaid cellphone web provides and better free money movement attributable to decrease Capex, stay intact, however shares stay at a decade-low degree.

3Q23 Earnings Outcomes

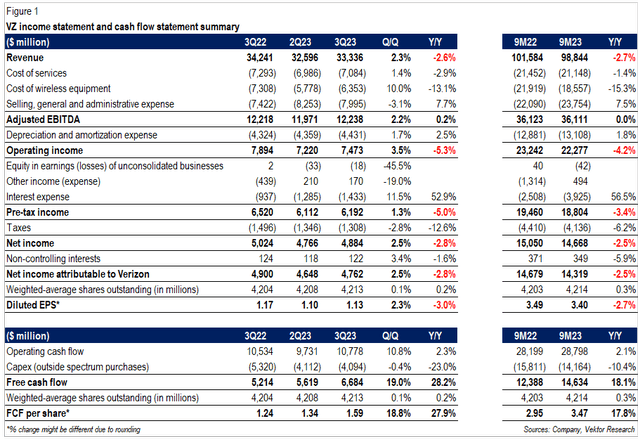

Please see the figures under for the 3Q23 earnings abstract:

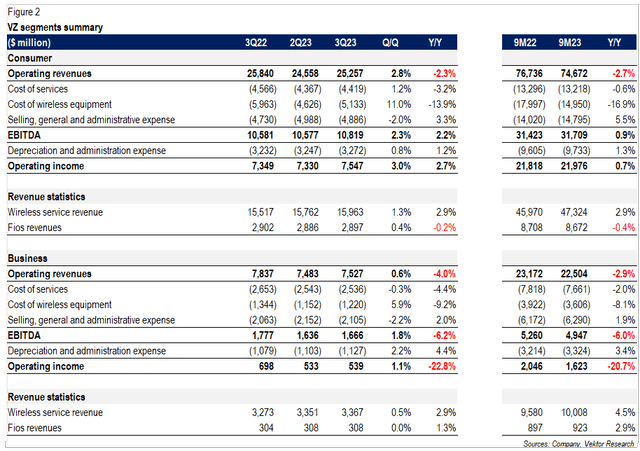

VZ 3Q23 earnings assertion and money movement assertion abstract (Firm, Vektor Analysis)

VZ segments abstract (Firm, Vektor Analysis)

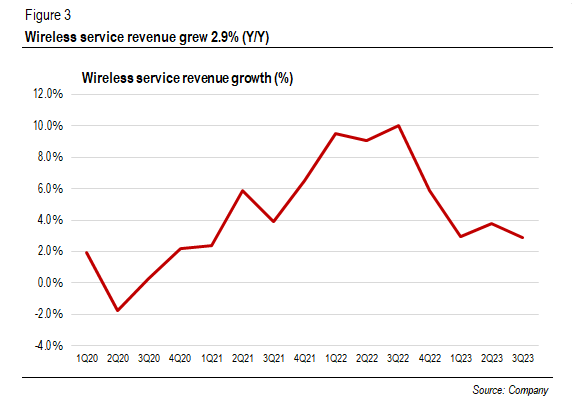

Revenues have been down 2.6% (Y/Y) to $33.3 billion. But when we glance extra carefully, wi-fi service income truly grew 2.9% (Y/Y), and the consolidated determine was dragged down by wi-fi tools income (-12% Y/Y) attributable to decrease postpaid upgrades. On the 3Q23 earnings name, the administration attributed the expansion to pricing actions, plan upgrades, and stuck wi-fi entry (FWA). A 3rd-tier Final Limitless is claimed to have pushed premium combine and ARPA development. In the course of the quarter, retail postpaid ARPA elevated 4.2% (Y/Y) to $156.

VZ wi-fi service income development (Firm)

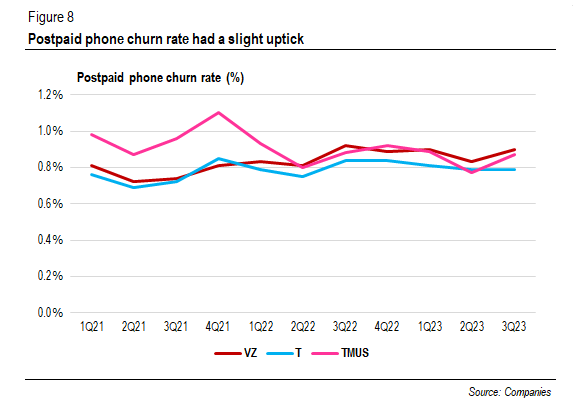

Bettering postpaid cellphone web provides additionally helped. Postpaid cellphone gross provides stood at 2.6 million (+0.8% Y/Y). However on a web foundation, the determine improved from 8,000 to 100,000. The postpaid cellphone churn charge barely rose to 0.9% from 0.92% a 12 months earlier. Certainly, within the Shopper facet, Verizon just isn’t out of the woods but, for it’s nonetheless dropping prospects. But, we be aware a major enchancment from the earlier quarters (see Determine 4).

Postpaid cellphone web provides (thousand) (Firm)

Adjusted EBITDA rose solely 0.2% (Y/Y) to $12.2 billion, and its margin expanded by 100 bps. Curiosity bills elevated 11.5% (Q/Q) attributable to decrease capitalized curiosity from the not too long ago cleared C-band spectrum. Administration expects one other incremental $0.03 to $0.04 curiosity prices within the fourth quarter. Moreover, adjusted EPS got here in at $1.22, beating consensus estimates by $0.04. Verizon has overwhelmed consensus estimates in 14 out of the final 15 quarters.

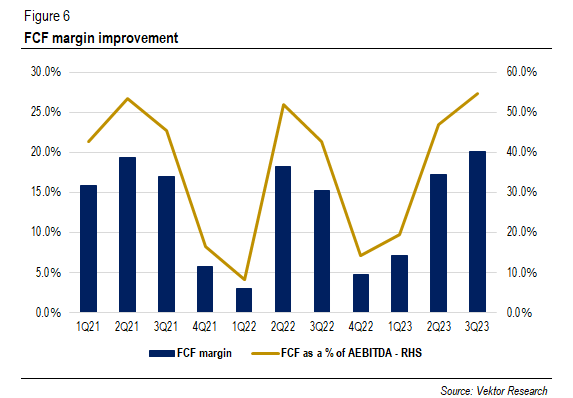

Lastly, free money movement stood at $6.7 billion, up by greater than 28% (Y/Y). Free money movement margin was over 20%. This was primarily brought on by decrease working capital attributable to fewer upgrades and decrease stock ranges. Moreover, Verizon is popping out of its high-capex cycle, leading to greater free money movement. Capex as a share of income was 12.3%, down from 15.5% in 3Q22.

VZ FCF margins (Vektor Analysis)

Extra Rational Aggressive Panorama

Whereas Verizon has proven notable enhancements in postpaid cellphone web provides, it was nonetheless properly under its opponents: T-Cell (NASDAQ:TMUS) with 850,000 and AT&T (NYSE:T) with 468,000. Verizon and T-Cell had a slight uptick in churn charge. However given most Individuals already have telephones, the place do these web provides come from? Regular switchers, broader age teams utilizing telephones, sturdy demand from enterprises, and migration from pay as you go to postpaid assist clarify the discrepancy.

Postpaid cellphone web provides (thousand) (Corporations)

Postpaid cellphone churn charge (%) (Corporations)

In accordance with T-Cell CEO Mike Sievert through the 3Q23 earnings name:

And there is a number of issues driving that. You see enterprises carrying two traces, typically on the identical cellphone, typically on separate telephones. You see postpaid rising on the expense of pay as you go. That pattern continues, though T-Cell continues to develop our pay as you go base throughout all varieties of connections.

As Verizon CFO Tony Skiadas mentioned:

We noticed an incredible cellphone web provides within the quarter, 151,000 and over 430,000 year-to-date. And we noticed wholesome demand throughout the board. That might be enterprise public sector and small medium biz.

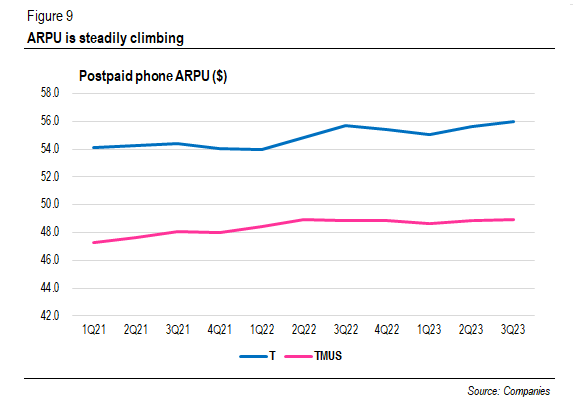

Moreover, the business is getting extra rational regardless of aggressive moves from cable firms. For instance, some gamers like Verizon and AT&T elevated costs for older plans, to not point out pricing actions final 12 months. As well as, Verizon additionally raised its FWA choices by $10 per 30 days. Certainly, it is sensible for operators to demand greater returns for the huge investments they made within the final couple of years.

We imagine T-Cell will nonetheless take a bigger pie in web provides due to its 5G management, whereas Verizon and AT&T will retain their prospects and encourage them to improve their plans. As well as, T-Cell introduced they have been main the share achieve in smaller markets and rural areas, outlined as 40% of the nation. As we famous in our article printed in February 2022:

“In our view, we predict that T-Cell might appeal to extra subscribers a minimum of within the foreseeable future, due to its early mid-band spectrum deployment. However, Verizon will encourage extra of its subscribers to improve to a limiteless premium tier, which might assist drive development.”

John Stankey on the 3Q23 earnings name:

…however from the perfect of what I can glean in our sensing mechanisms which might be out of the market, we’re sort of again right into a ratable share place and I feel that is truly a most popular place as a result of the best way we take into consideration that is I am truly extra taken with rising our share of revenues versus simply our share of uncooked variety of prospects. And I feel we’re doing pretty much as good a job of that within the business as anyone, we’re bringing on extremely accretive prospects and we proceed to see our share of business revenues enhance at a greater charge than the share of our precise subscriber counts, which tells me that I feel we’re targeted on these worthwhile prospects and bringing in the suitable prospects.

Postpaid cellphone ARPU ($) (Corporations)

Certainly, Verizon has access to its remaining C-band spectrum (a mean of 161 MHz nationwide) bought for greater than $52 billion. On the 3Q23 earnings name, Hans Vestberg mentioned the extra C-band was allotted straight to city areas and would begin deploying in suburban and rural areas subsequent 12 months. AT&T additionally has an averaged 120 MHz in mid-band spectrum.

However T-Cell nonetheless has one thing in its sleeve: the two.5 GHz spectrum, largely in rural areas, from Public sale 108 (nonetheless inaccessible); C-band and three.45 GHz spectrum planned to be deployed in 2024; and potential AWS re-farming. T-Cell covers 300 million folks in mid-band two months forward of the schedule and goals to succeed in 200 MHz by the top of the 12 months.

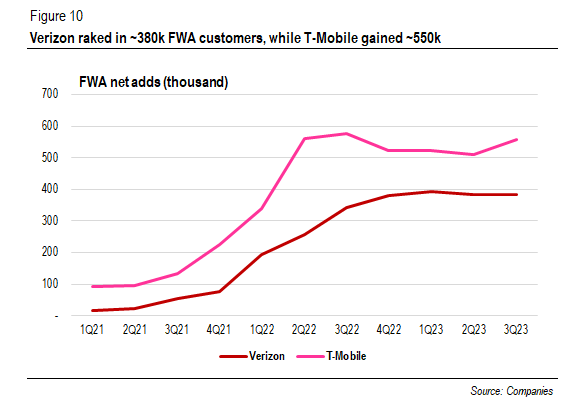

Nonetheless, in our view, the remaining C-band spectrum will assist Verizon strengthen its aggressive place within the FWA house. As well as, the corporate has witnessed a discount in churn in C-band markets in comparison with non-C-band ones. Verizon raked in 384,000 FWA prospects in 3Q23, a quantity that has remained pretty constant within the final 4 quarters. At this tempo, the variety of subscribers might surpass 6 million subscribers, far exceeding the 4-5 million targets by 2025.

FWA web provides (thousand) (Corporations)

Nonetheless, AT&T not too long ago launched its newest FWA product, Web Air, and has gained 25,000 subscribers. AT&T’s main technique is like different two gamers, using extra capability. However the scope is barely completely different. AT&T will target prospects in areas the place copper community has been decommissioned and stuck infrastructure is unavailable.

We view that FWA development will decelerate, but it surely shouldn’t be till extra capability runs out and cable firms full their DOCSIS 4.0 community upgrades, which is able to allow them to make higher advertising claims. FWA operators have factored in wi-fi cellphone development and nonetheless stay assured of their short-term targets. Comcast (NASDAQ:CMCSA) has started rolling out DOCSIS 4.0 in chosen areas, however the growth will happen step by step within the subsequent few years. Constitution (NASDAQ:CHTR) may delay the completion of its community upgrades by six months to mid-2026 attributable to its aggressive rural buildout.

Verizon Revised Its FCF Steering

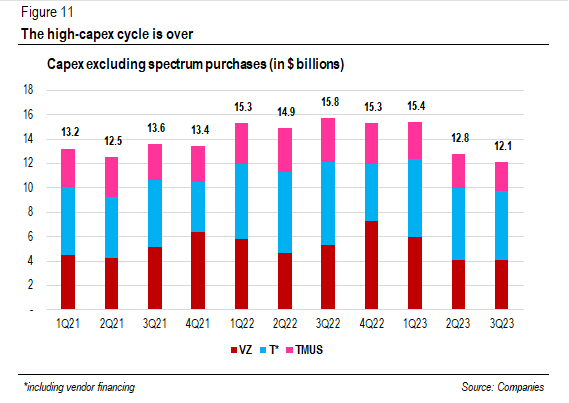

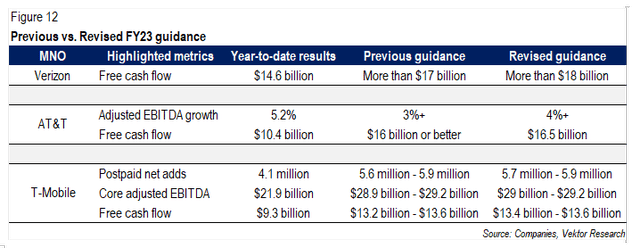

Because the 5G mid-band buildout is nearing completion, operators are step by step winding down their capital expenditures. In comparison with a 12 months in the past, capital spending by three gamers in 3Q23 was down between 3% and 6% as a share of income. Quarter-on-quarter foundation, the decline was between 0.3% to 1.9%. This ends in them tweaking their full-year steering, after which shares jumped.

Capital spendings by the massive three ($ billions) (Corporations)

Change in FY23 steering (Corporations, Looking for Alpha)

Verizon has offered steering of over $18 billion in free money movement for the complete 12 months, making an allowance for that Capex shall be on the higher finish of the steering vary at $19.25 billion. As expenditures will revert to the business-as-usual ranges of $17 billion to $17.5 billion subsequent 12 months, we estimate that Verizon will be capable to pay $11 billion dividend and scale back its debt by $8 billion per 12 months.

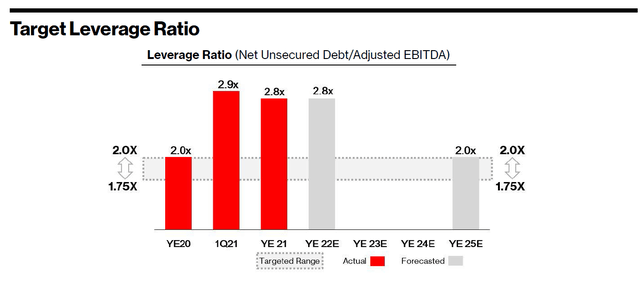

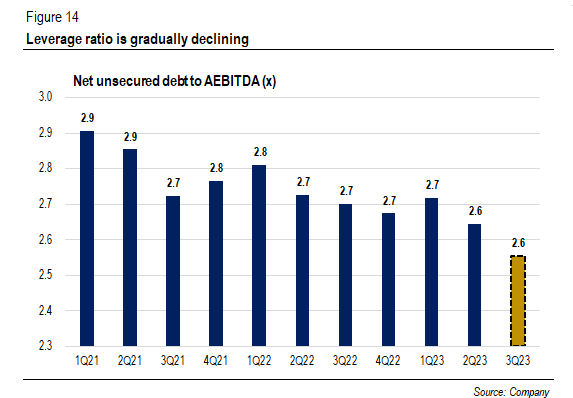

In 3Q23, Verizon’s web unsecured debt declined from $126.6 billion within the earlier quarter to $122.2 billion after Verizon had paid down $2.6 billion in debt. The discount ends in a leverage ratio of two.6x. Share buybacks come after dividends and deleveraging within the pecking order. However we is likely to be speaking about buybacks as soon as the leverage ratio reaches 2.25x.

VZ goal leverage ratio (Firm (Investor Day 2022))

To scale back the leverage ratio from the present degree to 1.75x to 2.0x adjusted EBITDA, Verizon would want to pay down roughly $26.5 billion to $38.5 billion. However to succeed in a 2.25x ratio, it will “solely” want to cut back $14.6 billion from its steadiness sheet. We must be listening to discussions about share buybacks in two years, assuming an annual $8 billion debt discount. The administration has indicated that this could not be a one-time occasion:

However we wish to do buybacks not that one-off or one thing. It needs to be a consecutive program on a regular basis. So, however we’re not there but. However the group is doing nice job. Tony talked concerning the 2.6 billion they we lowered debt this quarter with the tenders have been down. So we’ll proceed to do this with the money movement. That is the place we’re yielding proper now.

VZ web unsecured debt to AEBITDA ratio (x) (Firm)

Funding Danger: How Lengthy Till the Subsequent Excessive-Capex Cycle Begins?

Estimates recommend that 6G is prone to be launched in 5-7 years. The brand new spectrum band, starting from 7 GHz to twenty GHz, is said to be the “candy spot” for 6G, however it’s also prone to have restricted sign propagation, like millimeter wave bands. Which may require extra cell websites and thus extra {dollars} to spend, resulting in greater capital necessities. This poses the query of whether or not prospects shall be keen to spend extra for 6G companies. Will there be any compelling use circumstances for the brand new expertise?

Valuation

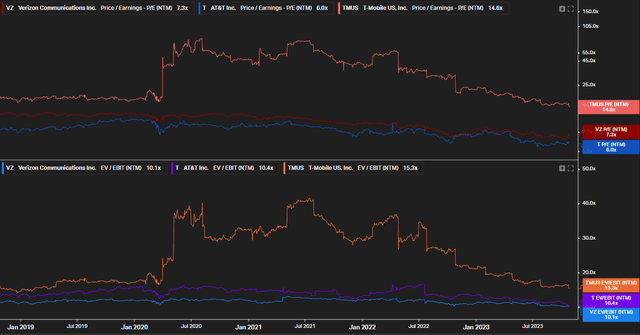

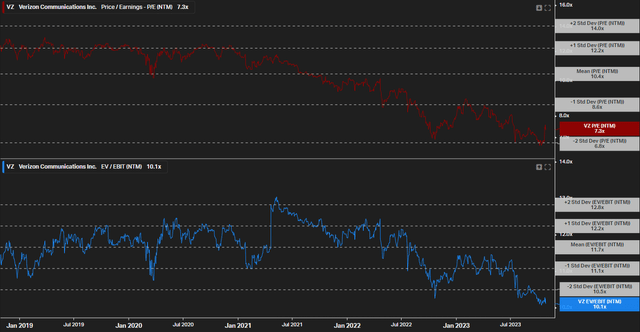

Verizon is buying and selling at 7.3x ahead earnings and 10.1x ahead EBIT. Understandably, T-Cell is buying and selling at a better a number of attributable to its 5G management and better anticipated earnings development in comparison with Verizon and AT&T. Once we take a look at historic multiples, Verizon shares are buying and selling round -1.5 normal deviation.

We imagine this was brought on by a number of elements. First, excessive capital expenditures have put strain on free money movement. Moreover, its steadiness sheet is burdened with large debt, however it’s essential to compete with T-Cell. Second, Verizon is dropping prospects within the Shopper phase. However we’re already seeing indicators of enhancements in these areas. This may recommend that shares are undervalued.

The large three a number of valuations (Koyfin)

VZ 5-year common historic valuations (Koyfin)

Conclusion

Wi-fi service income grew almost 3% (Y/Y) due to rising ARPA and strong demand from enterprises. With capital expenditures anticipated to be down subsequent 12 months, free money movement must be accessible for dividends and deleveraging. Competitors is extra rational as gamers are step by step elevating costs, regardless of aggressive strikes from cable firms. We nonetheless anticipate T-Cell to take a bigger pie in web provides due to its in depth mid-band spectrum.

From a valuation perspective, Verizon shares are buying and selling at a reduction relative to historic multiples. However we like the place that is going: decrease Capex means ample room for dividends and deleveraging, which ought to finally result in share buybacks after reaching a sure leverage ratio. Moreover, we have now witnessed an enchancment in postpaid cellphone web provides within the Shopper phase. Preserve BUY. In case you have any ideas, please don’t hesitate to remark under.