Joe Raedle/Getty Photographs Information

Stanley Black & Decker (NYSE:SWK) on Friday rose 2.1% in premarket buying and selling after the instrument maker reported third-quarter earnings that beat estimates.

Internet earnings fell to $4.7 million, $0.03 a share, within the three-month interval from $844.6 million, or $5.50 a share, a 12 months earlier.

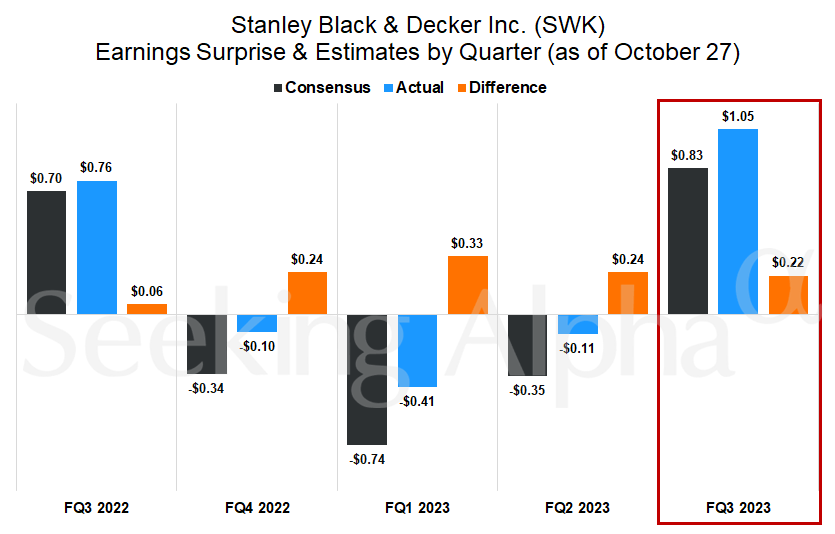

Earnings adjusted for gadgets reminiscent of acquisitions have been $1.05 a share, forward of the typical estimate amongst Wall Road analysts of $0.83 a share.

Income fell 4.1% from a 12 months earlier to $3.95 billion within the quarter ended September 30, in contrast with the consensus estimate of $3.97 billion.

Gross sales in its instruments and out of doors enterprise fell 4% on decrease unit volumes and pricing, reminiscent of reductions on cordless instruments. Its industrial enterprise additionally noticed a 4% decline in gross sales.

Revised Steering

Administration revised its year-end outlook for earnings. It expects a loss per share of $1.45 to $1, in contrast with its earlier steerage of a loss per share of $1.25 to $0.50.

The corporate additionally elevating its forecast of adjusted EPS to a spread of $1.10 to $1.40 from a earlier span of $0.70 to $1.30, in contrast with the consensus of $1.08.

We’re planning for the working backdrop to stay dynamic,” Donald Allan, president and chief government of Stanley Black & Decker (SWK), mentioned in an announcement. “Due to this fact we’re maximizing price efficiencies in our management and specializing in innovation-led share acquire alternatives with our highly effective manufacturers.”