By Chunzi Xu, Bloomberg Markets Reside reporter and strategist

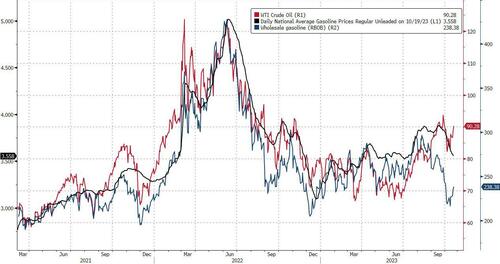

US gasoline costs have been insulated from oil’s surge to date amid comfortable demand and comparatively excessive inventories. But when oil persists at $90/barrel, pump costs are poised to climb.

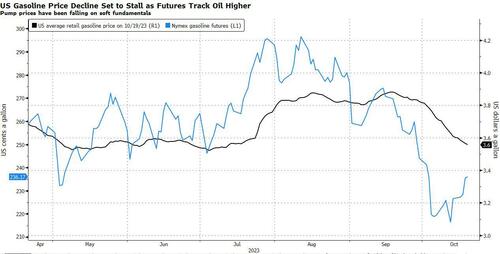

WTI has rallied about 8% up to now two weeks, with gasoline futures not far behind. But pump costs have declined greater than 4% in the identical interval. The bodily spot market has been secure or decrease in New York and Houston.

It is because implied gasoline demand within the US is about 3% under what it was this time final 12 months and 6% under the five-year common. In the meantime, inventories have gathered above seasonal norms. This pattern of weak consumption and rising provide is prone to persist into the winter as US refiners emerge from upkeep subsequent month.

However gasoline costs will ultimately catch as much as the futures market, which is delicate to grease’s volatility, particularly given escalating tensions within the Center East. And it doesn’t take a lot for any affect on the pump to succeed in shoppers — common gasoline costs at present stand at $3.558 a gallon, that’s under this time final 12 months however far above than another 12 months within the final decade.

Loading…