Dontstop

“Emotions. Nothing greater than feeeelings,” the aptly named “Emotions” music by Morris Albert croons.

In case you don’t know what I’m speaking about, right here’s how the lyrics proceed from there:

“Making an attempt to neglect my emotions of affection

Teardrops

Rolling down on my face

Making an attempt to neglect my emotions of affection.

Emotions

For all my life I’ll really feel it

I want I’d by no means met you, woman

You’ll by no means come once more.”

There’s extra to it than that, however you get the gist.

It’s not a peppy sort of music.

The lyrics are a relatable (although maybe insipid) expression of a typical battle: attempting to downplay an emotion as a result of that emotion is simply too overwhelming.

However is that actually one of the best ways to deal with how you are feeling?

Psychologists would doubtlessly say no.

And I can’t assist however agree.

Earlier than you accuse me of selling some state of whiny indulgence, I’m not.

I don’t consider in letting feelings dictate selections.

If I did, I’d nonetheless be sitting in a car parking zone, staring brokenly at a diminished buying heart I used to personal.

As an alternative, I’ve very a lot moved on from there.

I’ve acquired my new enterprise now scouring the inventory marketplace for promising portfolio picks.

In some methods, recommending REITs and different dividend-paying shares is a particular swap from my business actual property improvement days.

Then once more, I’m nonetheless evaluating property potentials and crunching numbers.

So, actually, I’ve to say, the most important change I needed to make was to my mindset.

“How Does That Make You Really feel?”

Like I said above, emotions are actual.

During which case, it’s silly to fake in any other case.

Do a Google search on “why feelings matter,” and also you may discover a e book by Tristen Okay. Collins with that title.

For the document, this isn’t an endorsement; I do know nothing concerning the precise work.

However I do like its description, which reads:

“For some, feelings are overwhelming and all-important. For others, they’re bothersome and irrational. Regardless of the place you fall on the emotional spectrum, one factor is for positive: God designed you as an emotional being.”

Don’t consider in God?

Like I mentioned, I’m not selling the e book. However the truth is all of us do have emotions no matter how we interpret the world. Even sociopaths need to really feel one thing, in any case.

Happily for us, these:

“… feelings have function, they usually’re value dealing with with curiosity, respect, and knowledge. What may it seem like so that you can have a wholesome relationship with feelings? Might you study to discern them and use them properly?”

The e book apparently covers:

- “How feelings work as indicators in your physique’s inside dashboard

- Why feelings are invaluable (even when they’re disagreeable)

- What to do when your feelings don’t match the scenario

- Useful instruments and habits to domesticate emotional well being over the long-term

- The ins and outs of disgrace, worry, anger, disappointment, jealousy, and happiness.”

I convey all this up as a result of it very a lot applies to investing.

Whenever you discover ways to management your feelings, you find out how to make more cash.

If I had acknowledged that again earlier than the housing market crash of ’08, I might have been significantly better off.

However I let the glamour of success run my enterprise and private spending alike.

These emotions felt nice… proper till they didn’t anymore.

(A Average Quantity of) Greed Is Good

Fairly some time in the past, my colleague Chuck Carnevale wrote an article on this very subject: how feelings decide market value.

However solely within the quick run.

I plan to cite it rather more extensively in a follow-up article titled “Earnings Decide Market Value within the Lengthy Run.” However for now, right here’s a really related passage:

“… though the correlations between earnings and value are extraordinarily profound long-term, there can be events when buyers will see a short-term separation between earnings and value over or below.

“These are instances when feelings equivalent to worry or greed or hype or hysteria take maintain, and buyers throw warning to the wind and behave irrationally.”

Sounds acquainted, doesn’t it?

“My thesis on the significance of earnings doesn’t deny this. As an alternative, it acknowledges this and makes use of this recognition as a chance to make clever (not good) purchase, promote, or maintain investing selections, thereby aiding the investor in avoiding apparent errors.”

I utterly agree with Chuck’s evaluation.

And so does each profitable investor I do know of.

To cite Michael Douglas’ Gordon Gekko in Wall Avenue, “Greed is nice!”… to a sure extent. The will (i.e., emotion) to earn money can push us to take calculated probabilities that actually repay.

If we didn’t care in any respect about being profitable, most of us who aren’t jack-of-all-trades would starve to dying fairly rapidly. Then once more, permitting our greed to go unchecked leaves us within the lurch too.

Or take worry. A managed quantity retains you protected; an unfettered quantity can price you fairly a bit.

The emotional intelligence that acknowledges the dividing line between these two positions is an edge you actually need to have. It lets you higher keep away from what must be averted and to pounce on belongings that greater than repay.

Medical Properties Belief (MPW)

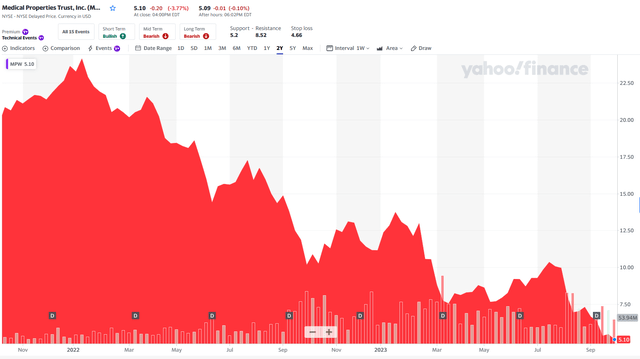

Does this chart under spark worry or greed?

Yahoo Finance

As you’ll be able to see, MPW shares have declined by over 74% within the final two years – from round $24.00 to $5.10 per share.

Sadly, I participated within the greed as I’ve amassed shares in that interval that has resulted in paper lack of ~40%.

I do not need to bore you with the main points as my final article was lower than thirty days in the past (learn it right here) and the battlefield was break up pretty even with bulls and bears (slightly below 1,000 feedback).

Within the article, I defined that MPW’s payout ratio (based mostly on AFFO per share) was 96.67% and “I might not be stunned in any respect to see a dividend lower within the close to future”.

Quick ahead to now…

MPW has introduced a dividend lower of round 50%, from $.29 per share to $.15 per share with a focused preliminary payout ratio of lower than 60% of AFFO.

The annualized run fee is now $.60 per share.

Shares are down over 27% for the reason that dividend lower announcement – a lot for pricing in a dividend lower.

It’s clear that many buyers have bailed on MPW, as the shortage of administration belief continues to linger. Just a few days in the past, the CEO posted a video on the MPW web site hoping to enhance communications with buyers.

(Higher late than by no means)

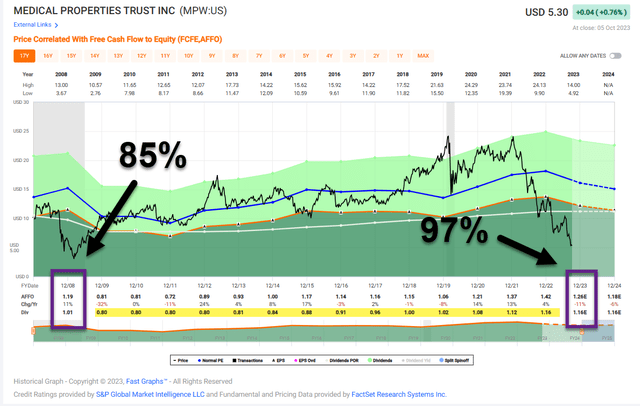

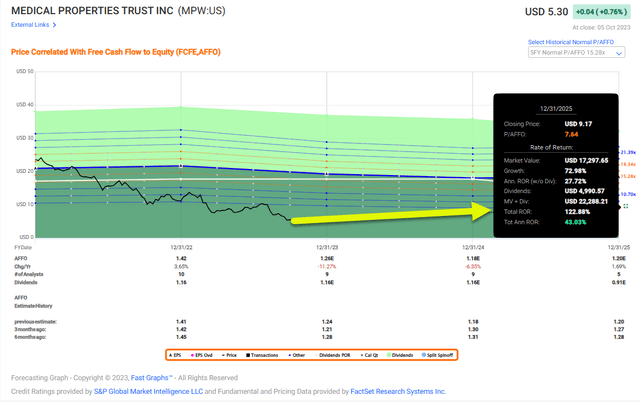

Quick Graphs

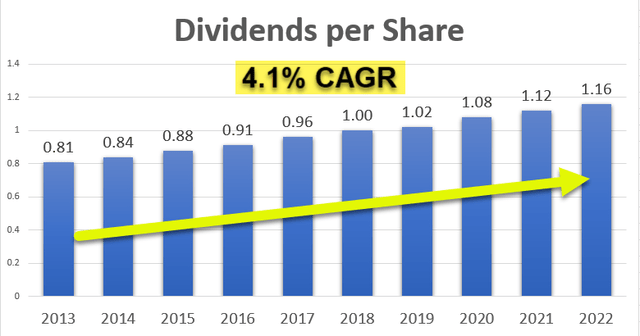

As seen above, MPW lower its dividend in 2008 – through the Nice Recession – from $1.01 to $.80 per share and didn’t develop the dividend from 2009 to 2013.

When the corporate started to develop its dividend in 2013 by way of 2022, it did so by round 4.1% per yr.

iREIT®

We observed the elevated payout ratio in 2023 at which era we downgraded shares to a spec purchase.

In hindsight, we must always have downgraded to a SELL recognizing the likelihood of a dividend lower.

Moreover, MPW’s sub funding grade stability sheet was a priority that we identified in earlier articles.

So right here we’re at this time, with MPW shares buying and selling at $5.30 with a P/AFFO of 4.1x. Now that the dividend lower is within the document books, the payout ratio is a a lot more healthy 48%.

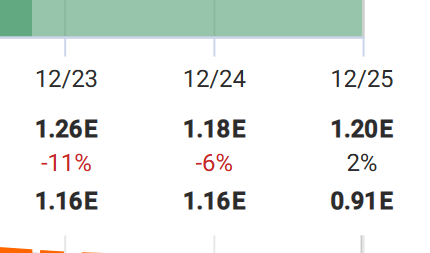

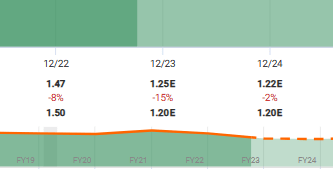

AFFO per share

FAST Graphs

Nonetheless, earnings usually are not shifting in the precise route, as analysts forecast -11% development in 2023 and -6% in 2024.

Even out to 2025, analysts are forecasting modest development of simply 2% (5 analysts within the 2025 pool).

As I discussed earlier than, feelings decide market value within the quick run, and the title of my subsequent article explains, “earnings decide market value in the long term” would be the cause I determine to purchase, promote, or maintain.

Given the present and future development forecast for the corporate, catalysts might want to unfold permitting the corporate to return to historic valuation ranges (10-year common of 12x). These catalysts embrace:

1) Monetizing the Prospect managed care enterprise

2) Audited financials by Steward

3) Continued diversification

4) Enhancing the stability sheet (dividend lower helps)

5) Enhance investor relations (video is an efficient step ahead)

Now the great factor is that we maintained a Spec Purchase which suggests we have now been underweight the title. Nonetheless, given the muted development over the following yr or two, we don’t anticipate a full restoration for a while.

Nonetheless, as low cost as shares are actually, a return to 7x would end in 40% annual returns.

FAST Graphs

Gladstone Business (GOOD)

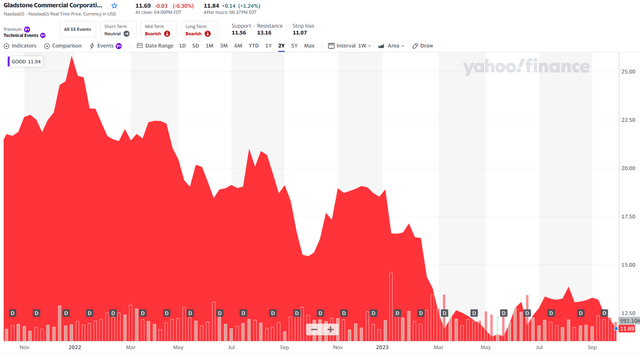

Does this chart under spark worry or greed?

Yahoo Finance

As you’ll be able to see, GOOD shares have declined by over 48% within the final two years – from round $25.77 to $11.69 per share.

Happily, I used to be on the precise facet of this commerce.

In December 2022 I wrote an article explaining,

“This earnings profile is flat as a pancake. Why would you put money into any firm that’s not rising?

In 2021, I identified the harmful payout ratio:

“Much more regarding is the truth that GOOD’s payout ratio is strikingly harmful: 104% in 2021 and 111% based mostly on analyst AFFO per share estimates.”

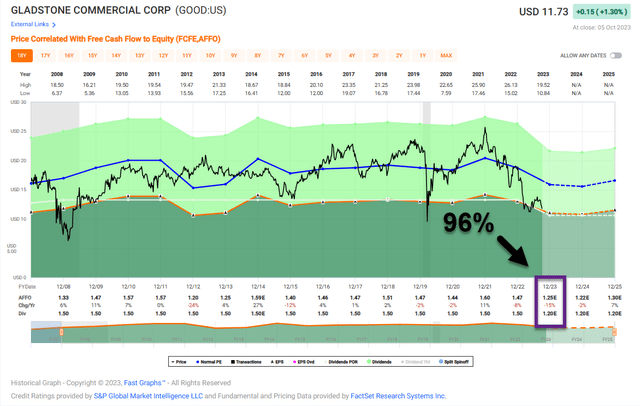

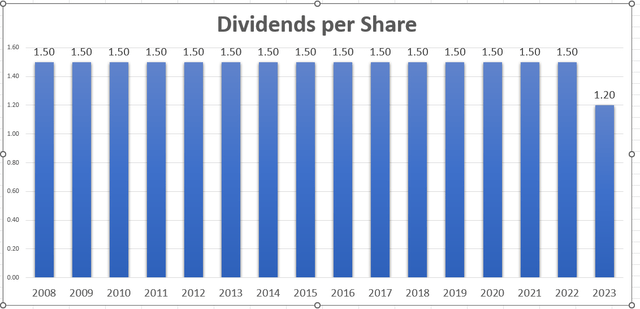

In February 2023, GOOD lower its dividend from $.13 per share to $.10 per share, 20% haircut ($1.20 per share), and the payout ratio is stall alarmingly excessive at 96%:

FAST Graphs

What do you suppose is incorrect with this image?

iREIT®

You guessed it…

Zero dividend development!

As soon as extra, analysts forecast unfavourable earnings (AFFO per share) development in 2023 and 2024:

FAST Graphs

Which suggests the corporate is teetering on one other dividend lower.

The ten.2% dividend yield is tempting…

However it’s a “sucker yield”…

W. P. Carey (WPC)

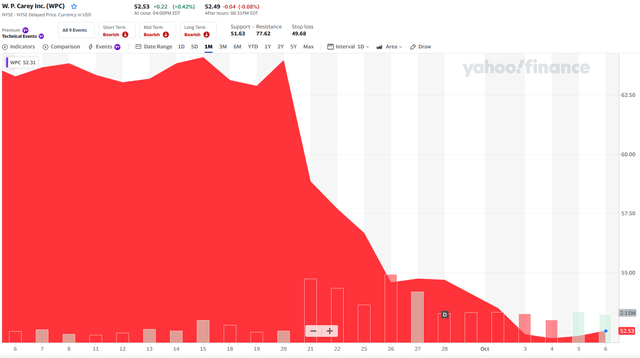

Does this chart under spark worry or greed?

Yahoo Finance

Most know what occurred a number of days in the past when WPC determined to “throw away a 24-year dividend development streak, only one yr shy of changing into a dividend champion (and ultimately an official dividend aristocrat)”.

As I identified in an article (with over 739 feedback) “the market reacted with fury and rage on the announcement that the corporate would exit its workplace properties, slash its dividend (doubtless 20%) and reset the payout ratio to between 70% to 75%.”

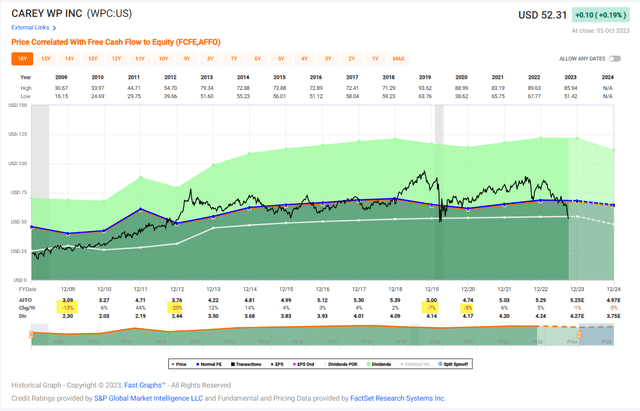

Assessing WPC by way of the rear-view mirror, we will see pretty wholesome fundamentals, which is why we gave the corporate a reasonably first rate high quality ranking.

Earnings development was spotty – unfavourable 4 out of 10 years – however the underlying enterprise mannequin seemed to be sound (web lease properties).

FAST Graphs

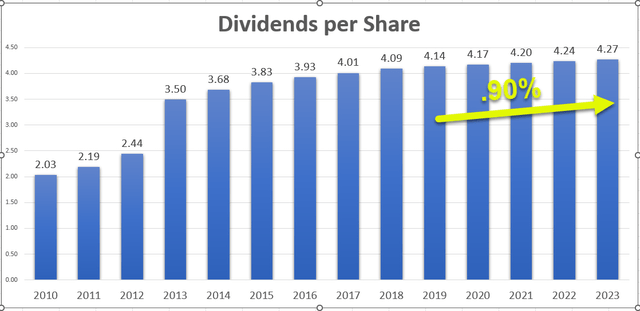

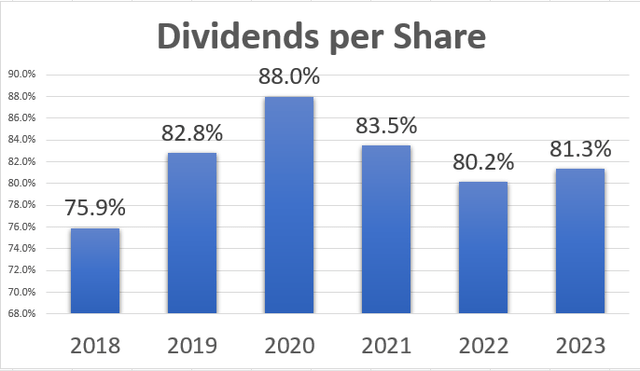

Fastidiously dissecting the dividend development over the least 5 years we will see that the corporate generated modest (sub 1%) development of .90% CAGR.

iREIT®

As soon as once more, in hindsight, it’s straightforward to see that WPC’s payout ratio was greater than most friends, and particularly in danger, given the excessive workplace publicity.

iREIT®

I feel the dividend lower caught many individuals (together with me) off guard, and naturally the market response was fairly fearful.

Earnings Decide Market Value (In The Lengthy Run)

Now, I hope you loved studying this text, Feelings Decide Market Value (In The Brief Run), through which I detailed 3 REITs which have lower their dividends.

Keep tuned for my subsequent article titled Earnings Decide Market Value (In The Lengthy Run).

Particular shout out to my good friend and proprietor of FAST Graphs, Chuck Carnevale, whose mentorship offered me with inspiration to jot down this text and the following one within the collection.

Lastly, yesterday I revealed an replace on Hannon Armstrong (HASI), one other beaten-down REITs (quickly to covert to C-Corp). I didn’t embrace HASI right here as a result of I owe to members to soak it in first.

As at all times, thanks for the chance to be of service.

Be aware: Brad Thomas is a Wall Avenue author, which suggests he isn’t at all times proper together with his predictions or suggestions. Since that additionally applies to his grammar, please excuse any typos chances are you’ll discover. Additionally, this text is free: Written and distributed solely to help in analysis whereas offering a discussion board for second-level considering.