sturti

The Firm

Kelly Companies, Inc. (NASDAQ:KELYA) is a $660-million market cap agency that provides workforce options throughout numerous industries via 5 segments:

- Skilled & Industrial (P&I) – 30.9% of complete gross sales in Q2 – gives staffing and placement providers in workplace, skilled, mild industrial, and phone middle fields;

- Science, Engineering & Know-how (SET) – 24.7% of complete gross sales in Q2 – gives comparable providers in science, engineering, know-how, and telecommunications;

- Schooling – 17% of complete gross sales in Q2 – focuses on staffing, placement, and govt seek for early childhood and better training;

- Outsourcing & Consulting Group (OCG) – 9.3% of complete gross sales in Q2 – gives recruitment course of outsourcing, payroll course of outsourcing, expertise advisory, and managed providers; and

- Worldwide – 18.5% of complete gross sales in Q2 – gives staffing, RPO, and placement providers in Europe and Mexico.

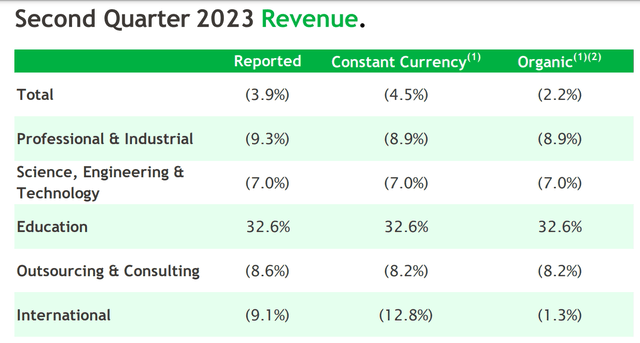

In Q2 2023, Kelly Companies reported a 3.9% lower in income to $1.2 billion (down 4.5% in fixed forex), with declines in 4 of its 5 segments. The Schooling phase was a vibrant spot, displaying important development of ~33% YoY, whereas the SET phase decreased by 7%, the OCG phase was down 9%, and the P&I phase noticed a 9% drop. Worldwide phase income additionally declined by 9% (13% in fixed forex).

Kelly’s IR supplies

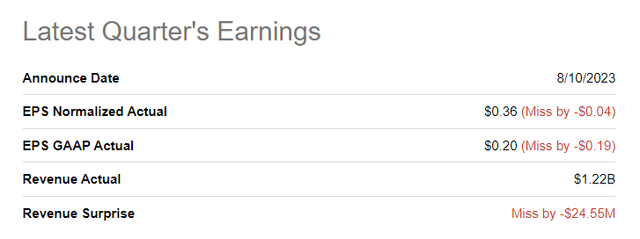

Gross revenue was additionally down 8.3% YoY, and SG&A bills decreased by 3.4%. Earnings from operations have been $6.2 million after accounting for transformation-related expenses. Adjusted EPS, excluding these expenses, was $0.36, down 20% in comparison with Q2 2022, lacking the consensus for Q2 considerably:

Searching for Alpha, KELYA’s Earnings

The corporate ended Q2 2023 with $125 million in money, and no debt, and executed a share repurchase program of ~980,000 shares for $69.5 million. Maybe that is why the inventory was capable of survive the consensus misses on each gross sales and EPS numbers.

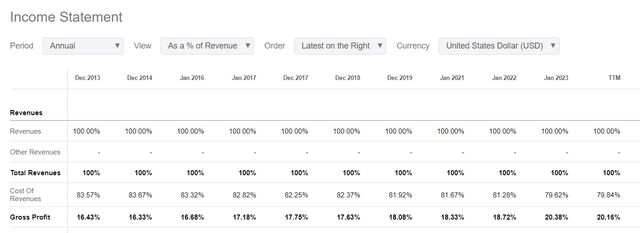

Through the newest earnings name, we came upon the administration expects the agency’s 2H FY2023 income to remain flat or improve by as much as 50 foundation factors year-over-year. They anticipate sustaining a gross revenue fee above 20% however foresee a decline in everlasting placement charges and ARPU as a consequence of mushy demand for full-time hiring. On the whole, I feel the >20% gross revenue margin forecast is fairly sturdy, given trade adjustments and the inevitable slowdown in hiring – in any case, just a few years in the past Kelly could not get above 17-19%:

Searching for Alpha information

Adjusted SG&A bills are projected to be 5% to six% decrease than the identical interval final 12 months, reflecting value optimization measures and workforce discount actions. Adjusted EBITDA margin for 2H FY2023 is estimated to be ~2.4% within the mid-range, with an exit fee of ~3% in FY2023. So Kelly cannot escape the downturn within the labor market.

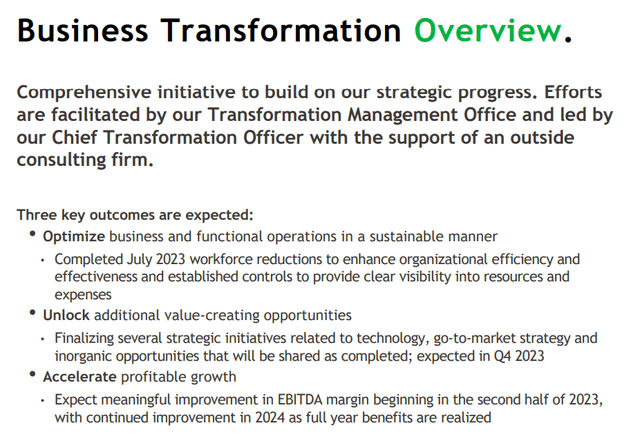

Lately, Kelly Companies has undertaken restructuring and effectivity initiatives to drive profitability. They’ve streamlined the organizational construction, renegotiated provider agreements, and made workforce reductions to align assets with new methods of working. The agency is now centered on accelerating worthwhile development via numerous initiatives, together with a complete go-to-market technique, know-how enhancements, natural and inorganic development alternatives, and a sharper concentrate on driving free money move.

Kelly’s IR supplies

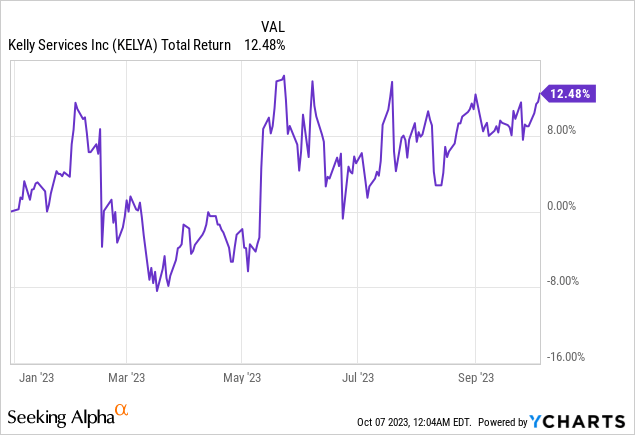

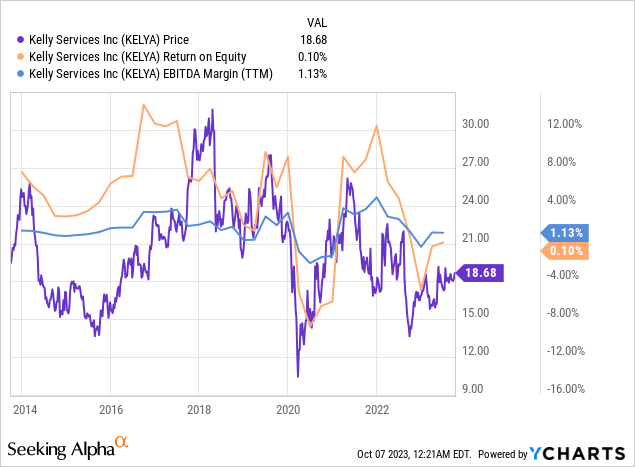

Within the historic context, Kelly inventory returns are strongly correlated with the conduct of the corporate’s margins and profitability. That is clearly seen after we superimpose the dynamics of the corresponding indicators on the inventory worth chart:

So all the things will rely on how a lot profitability the corporate’s enterprise will generate for its traders per unit of invested capital within the foreseeable future.

The administration mentioned that the development in EBITDA margin is a key objective of their transformation efforts, however they haven’t offered particular steerage for EBITDA margin past the exit fee talked about for FY2023.

The most important problem for the corporate, in addition to for the trade as a complete, is the prevailing uncertainty. There’s a lack of exact information about when the unemployment fee might rise considerably and what actual impression this can have on the enterprise panorama.

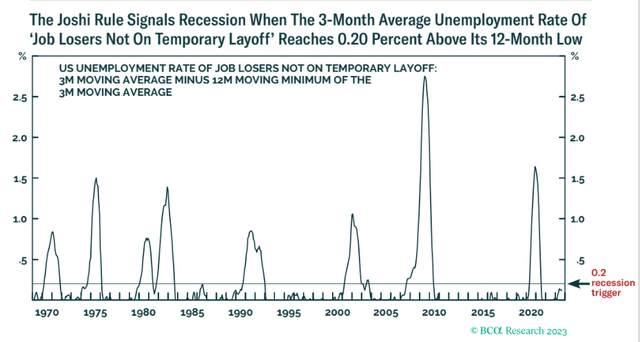

In economics, numerous indicators have historically been used to foretell financial downturns, and a few of these indicators are carefully associated to the unemployment fee. BCA Analysis [October 2023, proprietary source] steered a modernized model of “Sahm Rule” – the “Joshi Rule,” which is a real-time recession indicator, is activated when the three-month transferring common of the unemployment fee amongst ‘job losers not on momentary layoff’ will increase by 0.20 proportion factors from the earlier 12-month low, indicating the onset of a recession in the USA. If we have a look at what this rule exhibits us now, we now have little or no time left earlier than the recession triggers:

BCA Analysis

I imagine that the labor market continues to be at its worst, which will certainly have a destructive impression on Kelly Companies inventory, no matter what number of of its shares the corporate is keen to purchase from the market. The backdrop is fairly murky now, so far as I can see.

However what about valuation?

The Valuation

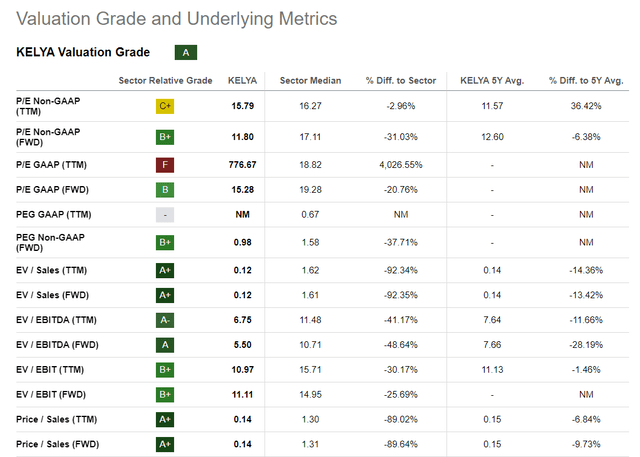

In response to Searching for Alpha Quant System, KELYA inventory has a powerful “A” ranking as most of its multiples are nicely beneath trade multiples:

Searching for Alpha, KELYA

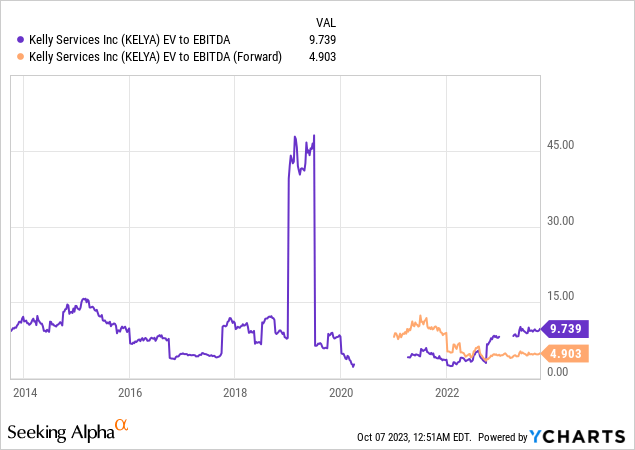

Almost certainly, the market is already seeing the dangers in KELYA inventory that I described above – a weakening EBITDA margin and a continued income decline that’s already taking place. Subsequently, the ahead EV/EBITDA is at an especially low degree in comparison with the long-term norm and the TTM a number of:

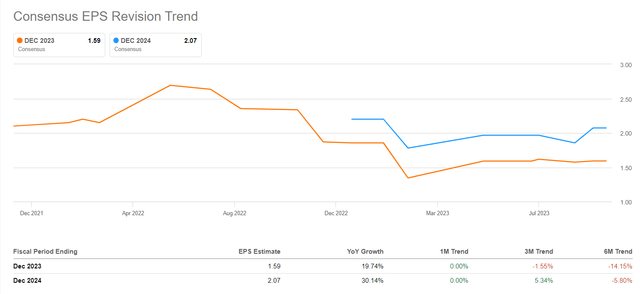

However on the similar time, the market is projecting 30% EPS development in its FY024 estimate, based mostly on the most recent information:

Searching for Alpha

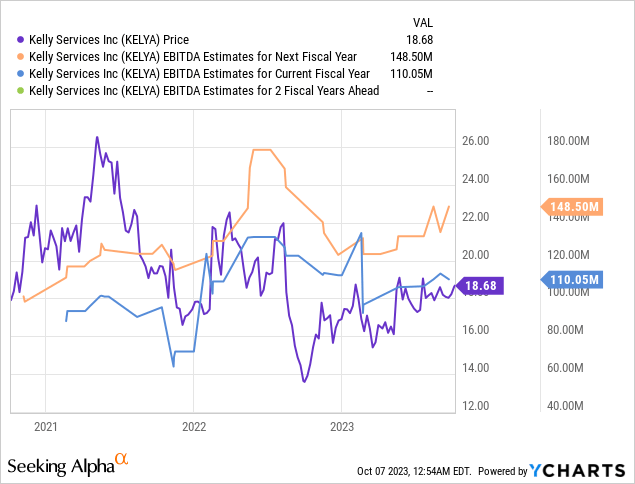

Forecast FY2024 EBITDA can also be a lot larger than this 12 months [FY2023], in keeping with YCharts information:

If KELYA actually earns $148.5M in EBITDA in FY2024, then returning to its standard EV/EBITDA ratio of ~7x, the corporate ought to have a market cap of practically $1.1B [taking net debt into account], which is 65.9% greater than what we have been coping with thus far.

However how shut will this EBITDA forecast be to actuality subsequent 12 months if the labor market continues to deteriorate?

The Backside Line

I just like the transformation in KELYA’s enterprise that the corporate continues to undergo – the concentrate on high quality improvement and margin enlargement is unquestionably serving to the inventory develop larger, and as we are able to see from the corporate’s present valuation, that development could be even larger. Nonetheless, Kelly Companies faces a significant macroeconomic impediment that may stop the corporate from doing what it’s making an attempt to do. So I’d be cautious with KELYA at present – maybe we must always look ahead to extra certainty.

Thanks for studying!