- BTC holders proceed to see income on their investments.

- This has remained regardless of the coin’s slender worth actions.

A brand new report by Glassnode discovered that Bitcoin [BTC] holders have continued to carry unrealized income regardless of the main coin’s slender actions up to now few weeks.

At press time, BTC exchanged arms at $65,625. Trending inside a horizontal channel, the coin has confronted resistance at $71,656 and has discovered assist at $64,825. Nevertheless, regardless of this “sideways worth motion,” BTC’s “investor profitability stays sturdy.”

In accordance with the on-chain information supplier:

“BTC costs are consolidating inside a well-established commerce vary. Buyers stay in a usually favorable place, with over 87% of the circulating provide held in revenue, with a price foundation beneath the spot worth.”

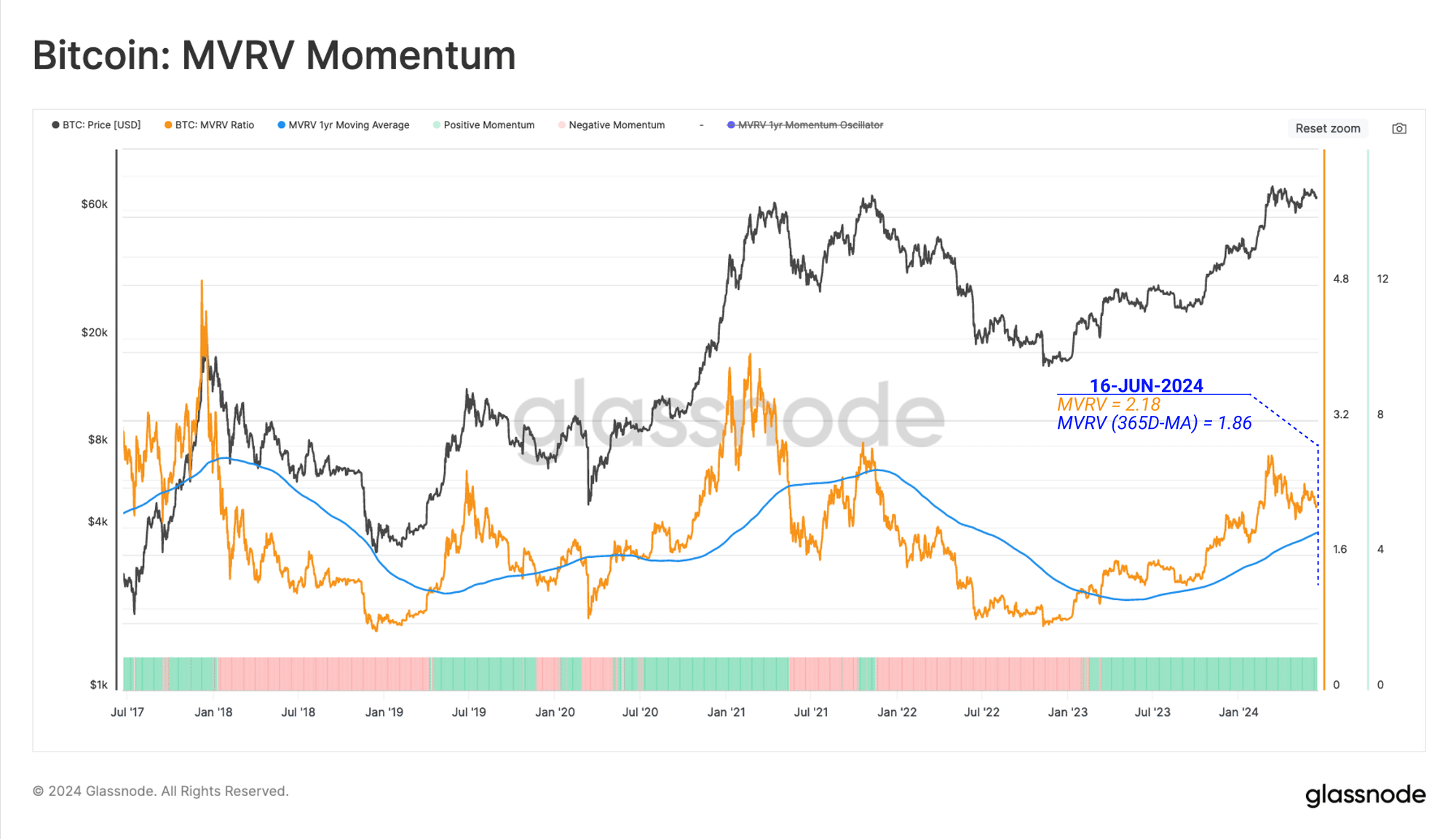

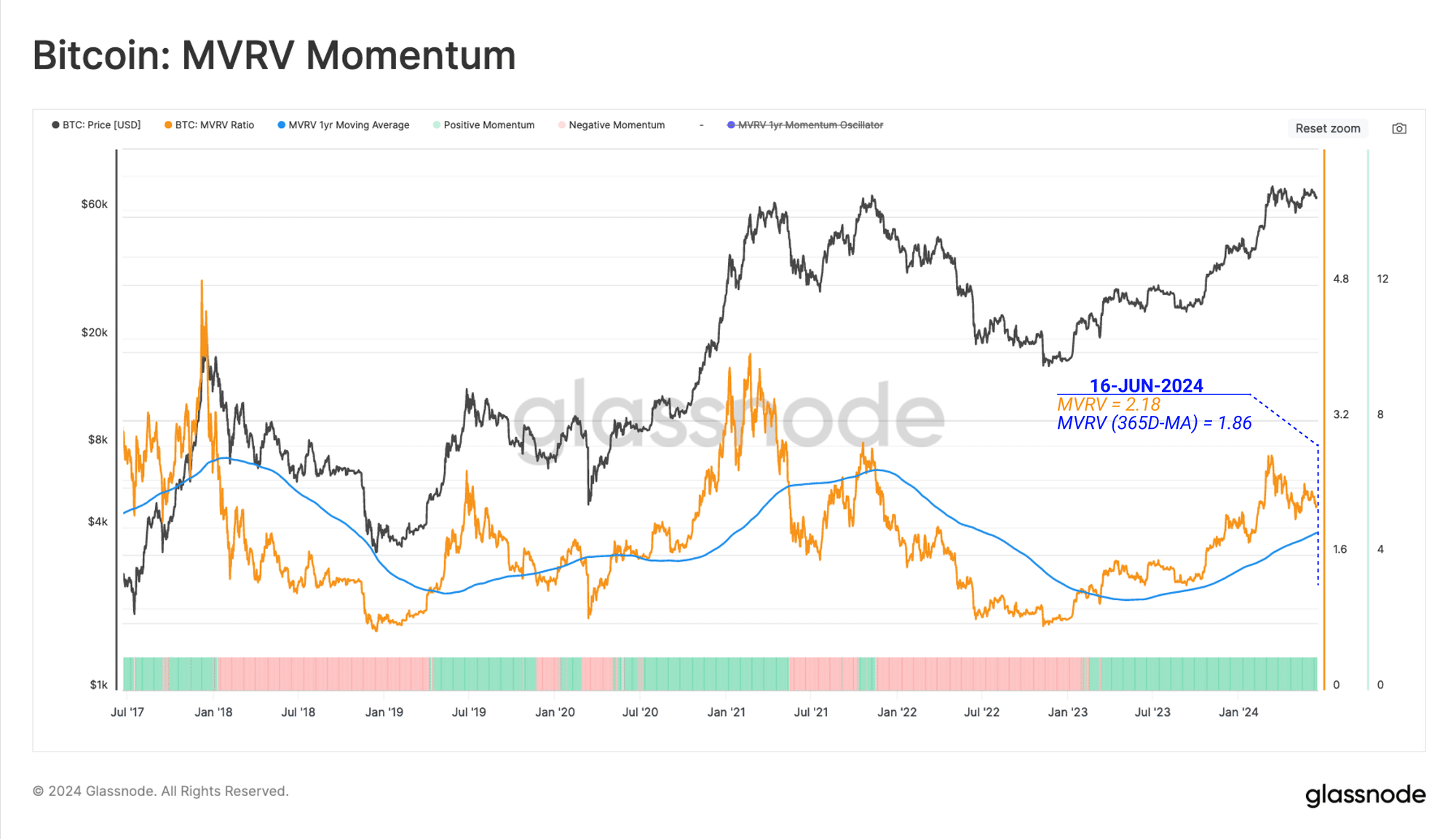

Glassnode assessed the coin’s Market Worth to Realized Worth (MVRV) ratio and located that the typical BTC coin in circulation holds an unrealized revenue of over 120%.

Supply: Glassnode

Curiously, regardless of how worthwhile BTC holders are, the quantity of cash being processed and transferred on the Bitcoin Community since March’s all-time excessive (ATH) has declined considerably,

Glassnode famous that this decline “underscores a diminished urge for food for hypothesis and heightened indecision out there.”

Low trade exercise

BTC’s worth consolidation has additionally led to a decline in BTC trade flows. Glassnode discovered that BTC’s short-term holders (STHs) presently ship roughly 17,400 BTC (valued at $1.13 billion at present market costs) to exchanges each day.

These traders have held their cash for a comparatively quick interval, sometimes lower than 155 days.

Their present trade inflows symbolize a 68% decline from 55,000 BTC despatched to exchanges by this cohort of traders when the coin climbed to an all-time excessive of $73,000 in March.

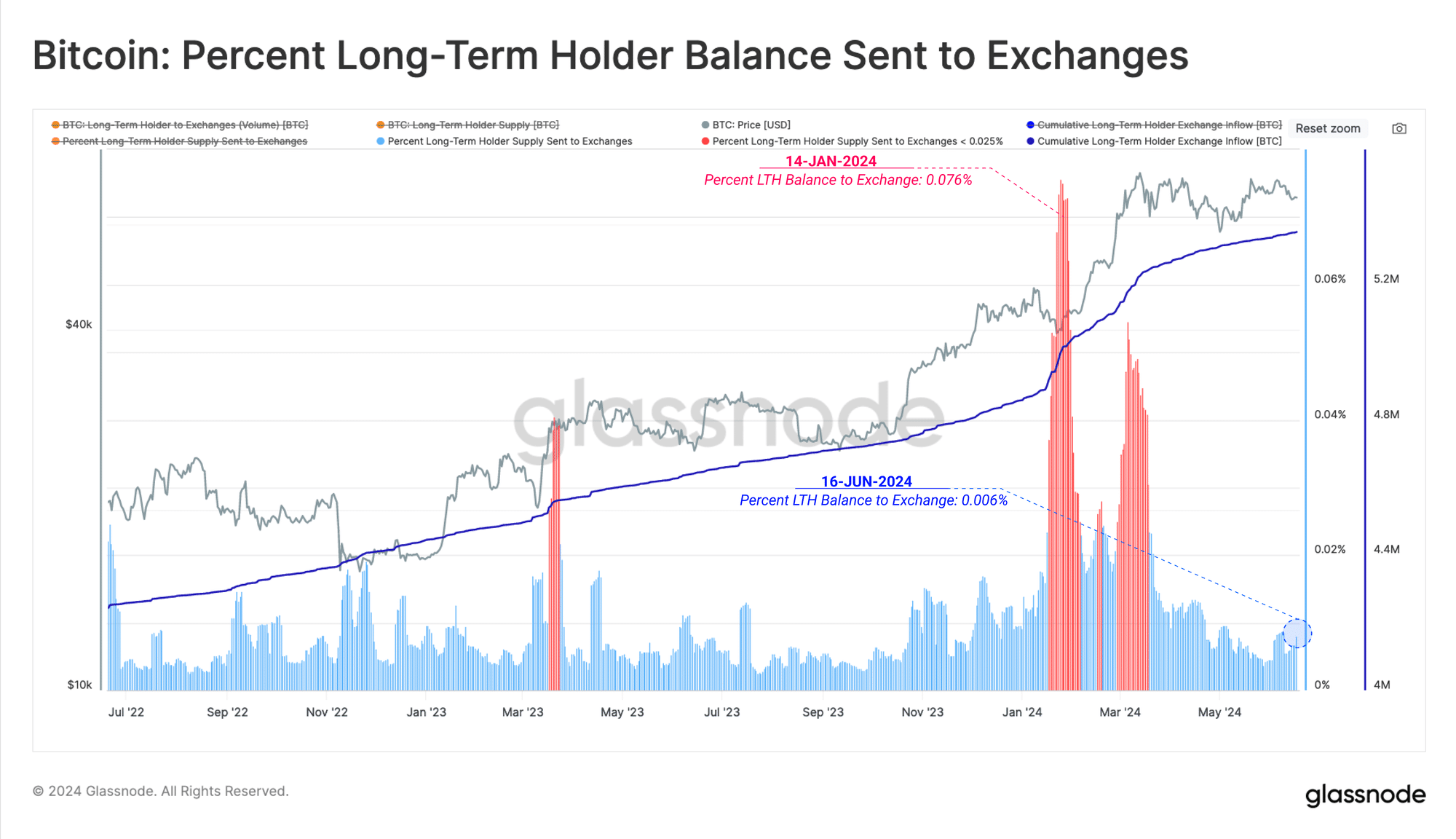

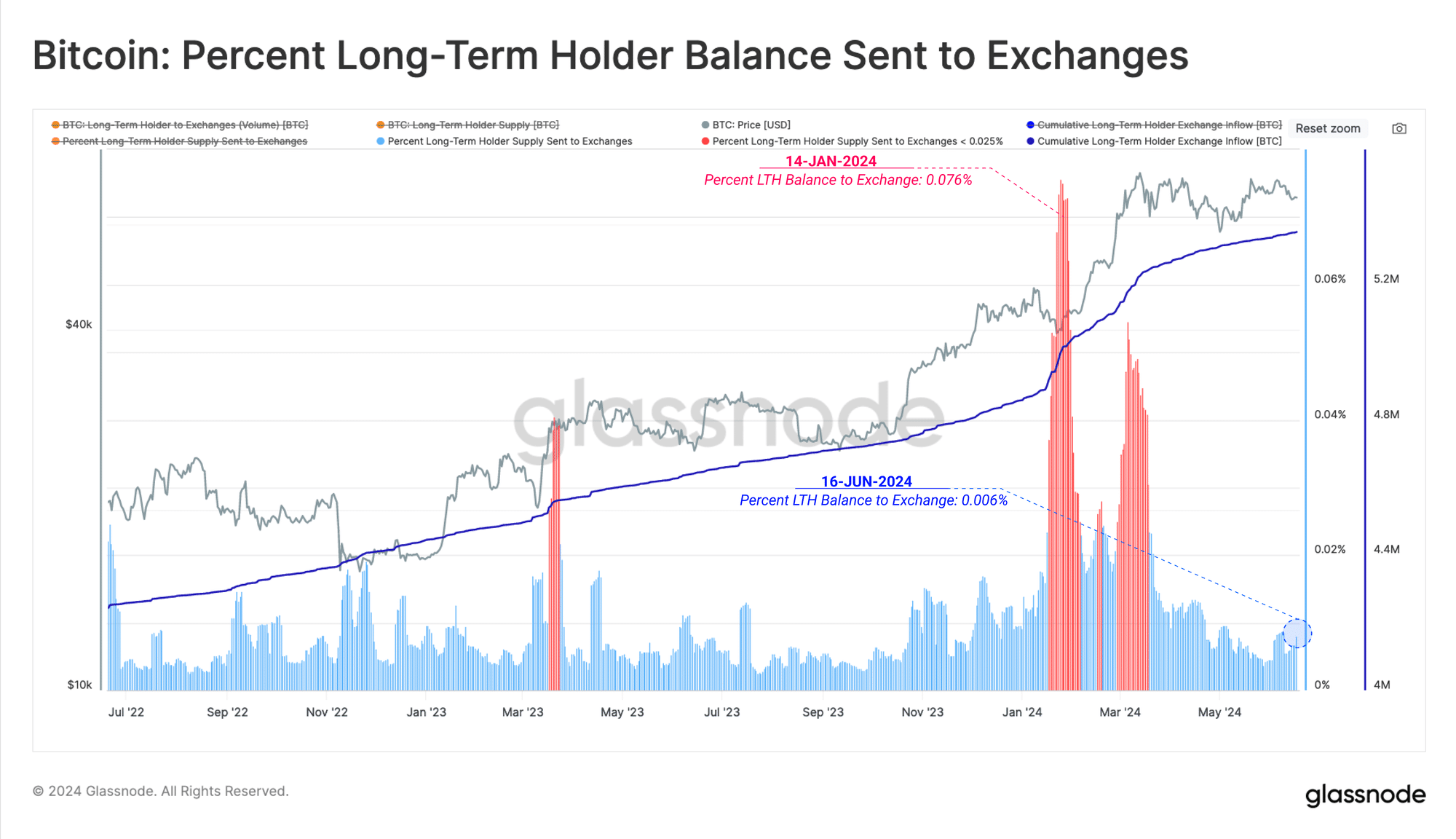

As for long-term holders (LTHs), their “distribution into exchanges is comparatively low, with solely a marginal 1k+ BTC/day in inflows presently.”

Supply: Glassnode

Glassnode stated:

“LTHs are sending lower than 0.006% of their complete holdings into exchanges, suggesting that this cohort has reached equilibrium and that greater or decrease costs are required to stimulate additional motion.”

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The typical BTC despatched to exchanges generates a revenue of round $5,500. This has prompted some traders who’ve held for lengthy to promote for revenue.

Because the market anticipates a rally to the $73,750 ATH, there may be sufficient demand to soak up the promoting strain. Nevertheless, it’s “not massive sufficient to push market costs greater.”