DianeBentleyRaymond

Introduction

Over the previous few months, I’ve observed that there are two areas of actual property that folks actually dislike (to place it mildly). These areas are deep-blue cities like San Francisco and New York and workplace actual property.

Boston Properties (NYSE:BXP) combines each of this stuff!

On this article, I will dive into this firm, assessing the chance/reward in gentle of macroeconomic challenges.

The Larger Image

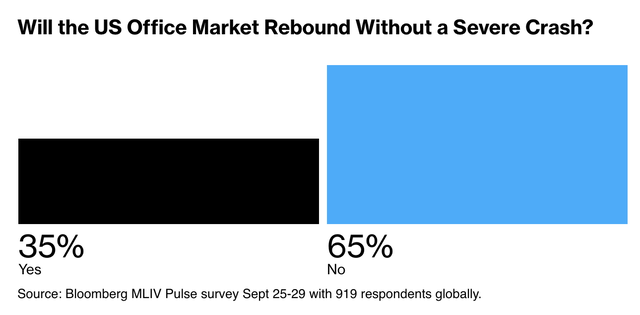

In line with the current Bloomberg Markets Stay Pulse survey, there is a looming crash anticipated in workplace costs within the U.S., and the industrial actual property market is anticipated to face continued declines for not less than 9 extra months.

A majority of the respondents, roughly two-thirds out of 919 surveyed people, consider that the U.S. workplace market will solely begin to recuperate after a big collapse.

Bloomberg

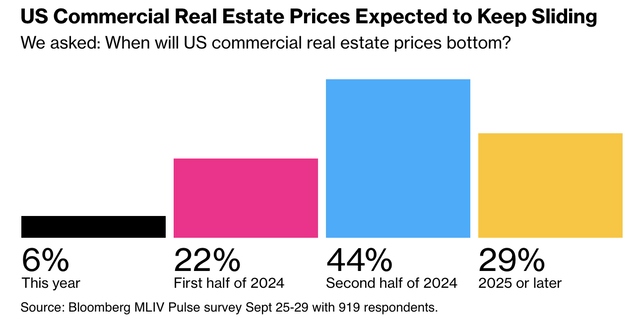

Furthermore, a big majority predict that U.S. industrial actual property costs won’t attain their lowest level till the second half of 2024 or past.

Bloomberg

This example poses a big problem for the $1.5 trillion value of business actual property debt due by the tip of 2025. Refinancing this debt, particularly for round 25% of business property within the type of workplace buildings, can be significantly tough.

In line with Bloomberg, the Inexperienced Road index, measuring industrial property costs, has already skilled a 16% decline from its peak in March 2022.

Moreover, Wells Fargo information exhibits that workplace emptiness charges preserve rising whereas hire progress is declining. The web absorption charge stays unfavourable. These are very poor developments.

Wells Fargo

As everyone knows, the Federal Reserve’s aggressive tightening marketing campaign, resulting in elevated financing prices, is hitting industrial property values exhausting.

That is amplifying the decline available in the market. Sadly, discovering keen consumers at this stage is proving to be a problem, as confidence available in the market’s proximity to its backside is missing.

Consequently, many property holders are reluctant to promote their properties at a big loss, resulting in delayed gross sales. Regional banks, holding a considerable portion of workplace constructing debt, are going through stress. Roughly 30% of workplace constructing debt is held by these regional banks.

Usually, CRE transaction volumes are very low.

Wells Fargo

Subsequent yr’s maturities could set off a significant repricing pattern in numerous CRE segments. That is my concern, not less than.

Having stated all of this, let’s take a better have a look at Boston Properties.

What To Make Of Boston Properties?

The corporate behind the BXP ticker is America’s largest publicly traded developer, proprietor, and supervisor of workplaces. It owns properties just like the Salesforce Tower in San Francisco, which is one among my favourite buildings.

Boston Properties

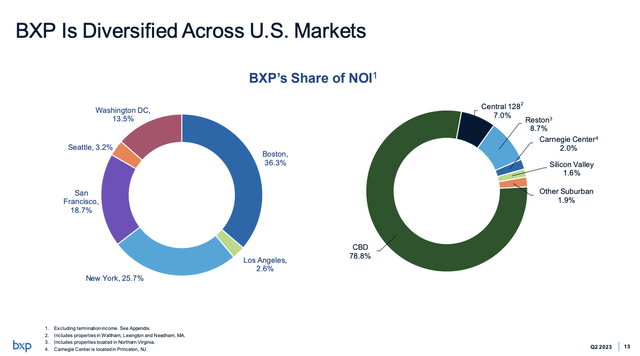

As of 2Q23, the corporate owns 222 premier buildings. Most of those are positioned in Boston, San Francisco, and New York.

Near 80% of those belongings are in central enterprise districts.

Boston Properties

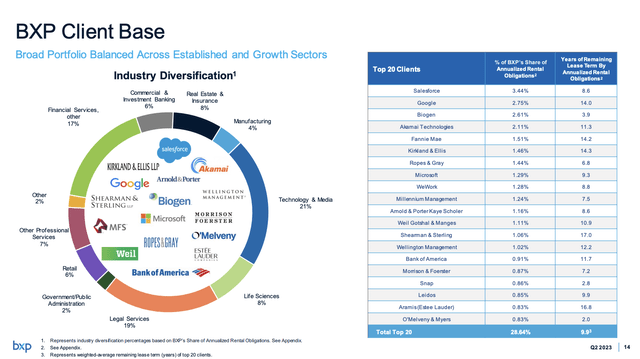

What’s attention-grabbing is that the corporate leases its buildings to a few of the largest firms in America. This contains expertise, healthcare, and monetary giants like Salesforce (CRM), Alphabet (GOOGL), and Biogen (BIIB). It additionally has important publicity to authorized providers. These individuals are usually extremely depending on workplaces.

Its high 20 tenants account for 29% of its annual hire. The common remaining lease is 9.9 years, which could possibly be rather a lot worse.

Boston Properties

Nonetheless, it must be stated that large tech is not what it was. Throughout final month’s Barclays International Monetary Companies Convention, the corporate famous that conventional monetary establishments and personal capital had been driving the demand for workplace house in San Francisco, whereas giant tech firms like Salesforce, Amazon (AMZN), Microsoft (MSFT), and Google had been now not the dominant pressure available in the market, resulting in sublet house turning into obtainable.

Primarily based on this context, regardless of its dimension, the corporate is holding up fairly nicely.

Within the second quarter, BXP reported above-expected working efficiency.

FFO (funds from operations) per share exceeded market consensus and the midpoint of the corporate’s forecast.

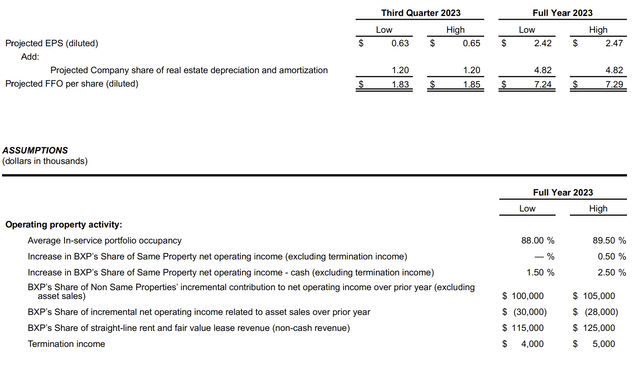

The corporate raised its full-year 2023 FFO steerage to a variety of $7.24 to $7.29 per share. They anticipated that almost all advantages from decrease upkeep bills can be deferred to later within the yr.

Furthermore, the corporate revised assumptions for same-property NOI progress and money NOI progress, foreseeing enhancements in internet curiosity bills, primarily by way of rate of interest swaps and advantageous bond issuances.

Occupancy is anticipated to remain above 88.0%, with not less than 1.5% year-on-year progress in NOI.

Boston Properties

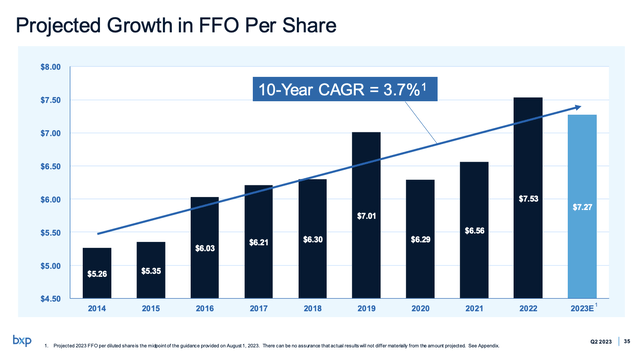

Taking a look at FFO per share steerage, 2023 is anticipated to be barely worse than 2022 however stronger than all pre-pandemic years (aside from 2019).

Boston Properties

Additionally, regardless of difficult leasing market situations, BXP accomplished 938,000 sq. toes of leasing with an 8-year common lease time period.

It is also attention-grabbing that in its earnings name, the corporate famous that there are two competing theories concerning the U.S. financial outlook.

- One suggests managed inflation and a wholesome economic system with sturdy labor markets and GDP progress.

- The opposite predicts an excessively aggressive Federal Reserve, doubtlessly resulting in a recession later within the yr.

In anticipation of potential dangers, BXP maintains a powerful liquidity place of $3.1 billion, pursues capital-raising alternatives, and manages capital expenditures cautiously.

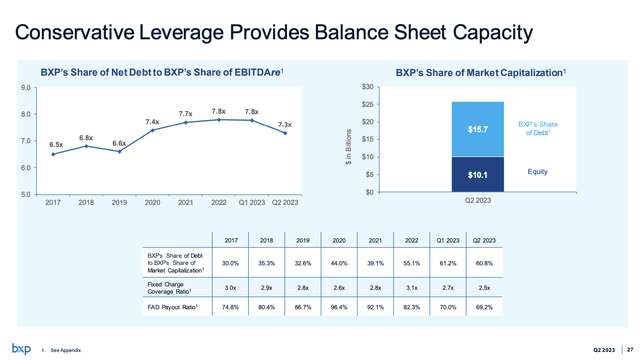

Roughly half of its liquidity consists of money. Moreover, the online leverage ratio has declined to 7.3x EBITDAre, which continues to be elevated in comparison with different REITs. Nonetheless, the corporate enjoys a BBB+ credit standing, which is one step under the A-range.

Boston Properties

The issue is that even when the steadiness sheet is wholesome, the corporate is likely to be compelled to refinance debt yielding 3.8% debt at 6.5%, which is an instance the corporate gave throughout its earnings name. This goes for all REITs, as we’re now in a extremely unfavorable financing surroundings.

Moreover, regardless of the prevailing unfavourable sentiment, BXP stays optimistic concerning the workplace market, as evidenced by regular leasing exercise and inspiring traits (in line with the corporate).

Whereas this can be the case in BXP’s portfolio, the overall market shouldn’t be seeing enhancements, as we mentioned within the first a part of this text.

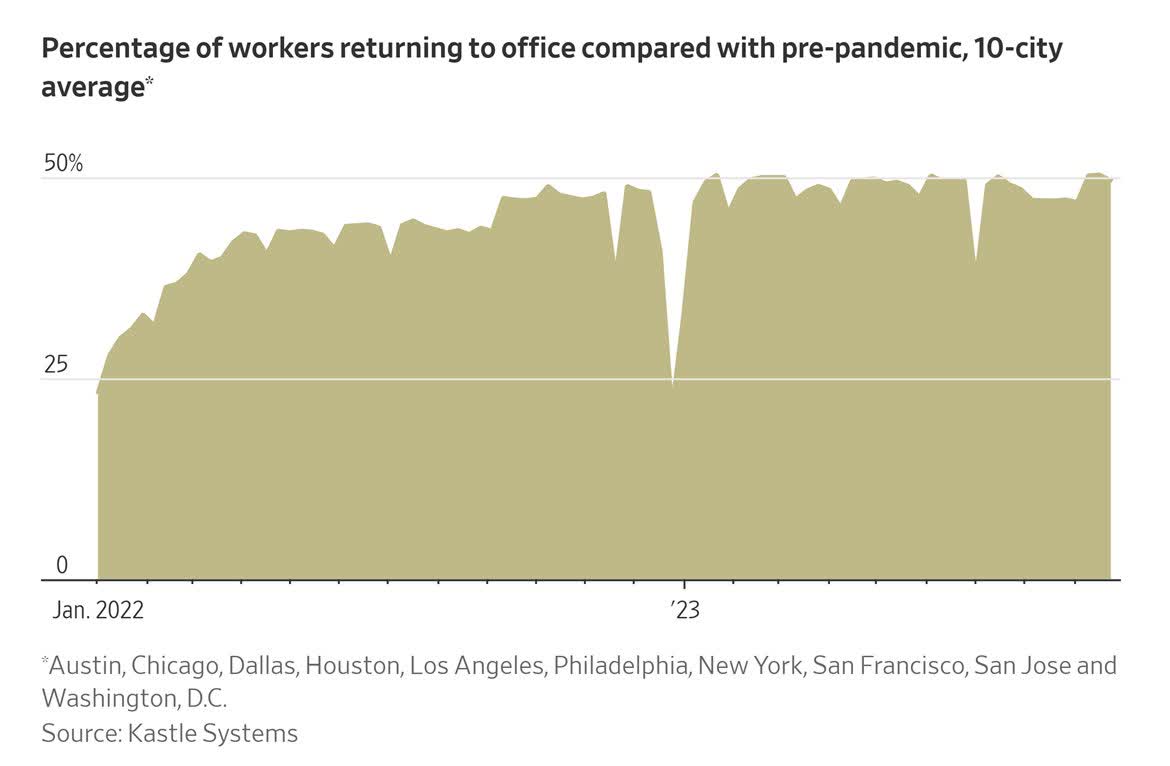

Additionally, information from main cities, we see that the return to the workplace has stalled utterly.

Wall Road Journal

BXP is seeing that some tenants have given up on making an attempt to return to pre-pandemic situations, as most workplaces enable for versatile work between residence and the workplace. I count on that this may preserve a lid on absorption.

Nonetheless, in gentle of the challenges, it helps that CRM has top-tier belongings. The worst performers are firms with previous buildings. On this market, staff have excessive calls for for good workplaces, which causes a shift towards higher-quality workplaces, benefiting Boston Properties.

Whereas this is not a large game-changer, it is one of many the reason why BXP continues to be holding up fairly nicely, given the circumstances.

Dividend & Valuation

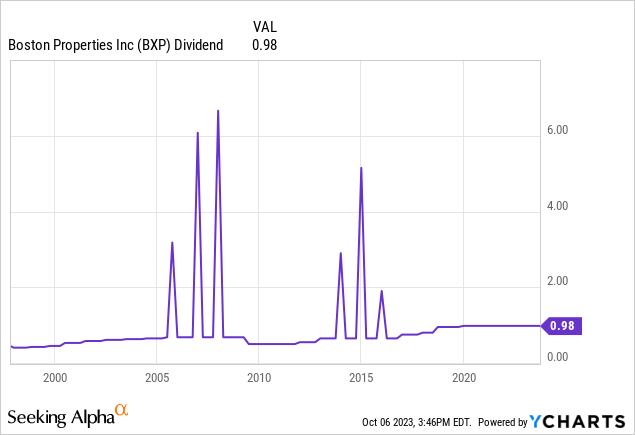

BXP presently pays a $0.98 per share per quarter dividend. This interprets to a yield of seven.3%.

Because the chart under exhibits, the dividend hasn’t been raised because the pandemic. The chart additionally exhibits the BXP has a historical past of issuing particular dividends, which makes the payout even sweeter.

Nonetheless, on this surroundings, particular dividends are off the desk.

Now, it is all about dividend security.

Throughout final month’s Financial institution of America 2023 International Actual Property Convention, the corporate was requested about dividend security. I added emphasis the place wanted.

Unknown Analyst

And possibly 1 last query earlier than Rapidfire. Mike, may we get your ideas on dividend, the way you’re enthusiastic about that? You have seen a variety of your friends minimize. So what may make you alter your evaluation there.

Michael LaBelle

Effectively, I feel that we’ve got — we cowl our dividend fairly nicely, very constantly. So we’re very comfy with the money flows of the group. I feel the outlook for the dividend would change if the restrictions — the power of ourselves to boost capital by way of the debt or fairness markets, both personal fairness or debt markets change considerably in order that we’re very uncomfortable that we may increase capital sooner or later. We do not really feel that method proper now.

We truly are feeling higher about that proper now as a result of we have been fairly profitable. Our dividend, we do have — I discussed on a name a few quarters in the past, there may be room in our dividend as a result of the taxable earnings from our operations are decrease than our dividend. However we have been in a position to fill that with asset gross sales very constantly yearly such that we’re paying out the complete quantity or much more.

So I really feel very assured. We have maintained our dividend. I feel it differentiates us considerably from a lot of our friends. It is one of many many issues that differentiate our firm from our friends, not solely our dividend, however the high quality of our belongings and the soundness of our earnings stream and the variety of our earnings stream. So I feel that proper now, our view is we are going to preserve our dividend as we’ve got.

The corporate’s statements are backed by its steadiness sheet, excessive anticipated occupancy charge, and powerful steerage.

Utilizing the corporate’s FFO steerage ($ 7.27 midpoint), the corporate has a dividend payout ratio of 54%, which provides it one of many healthiest payout ratios in your complete REIT house. So, that is positively a cause to love BXP – particularly in gentle of its elevated yield of seven.3%!

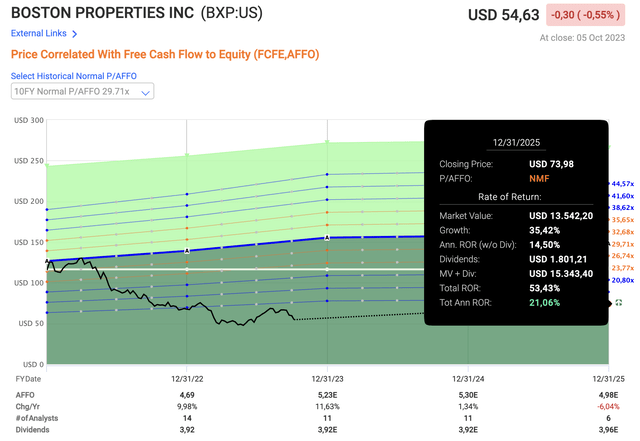

Valuation-wise, we’re coping with an attention-grabbing improvement. Over the previous ten years, the corporate has traded near 30x adjusted FFO. Now, the corporate trades at 10.7x AFFO. Even a return to 14.9x AFFO would point out an annual compounding return of 21% by way of 2025. Additionally word that analysts count on the corporate to develop AFFO by 11.6% this yr, adopted by a 1.3% enhance in 2024.

FAST Graphs

Please word that I’m NOT making the case that BXP will return 21% per yr.

What we’re seeing right here is that the market shouldn’t be believing that issues will go as deliberate. A valuation this low cost exhibits that the market expects the Fed to do far more injury than we’re anticipating proper now.

My standpoint is that this is likely to be appropriate.

So, whereas I extremely respect the corporate’s capacity to navigate this surroundings, its wholesome dividend payout ratio, and its stable steadiness sheet, I can not make the case that BXP is a purchase.

I consider that we’re nonetheless confronted with an excessive amount of financial threat, which may result in a lot decrease workplace actual property costs. When including the dangers of extended elevated charges, rising curiosity bills are prone to preserve a lid on earnings.

Therefore, my score stays a Maintain.

Takeaway

Regardless of the prevailing headwinds within the industrial actual property market, BXP stays resilient. With top-tier belongings and a various tenant portfolio, it is holding up nicely.

The corporate’s stable steadiness sheet and powerful dividend payout ratio make it interesting with a 7.3% yield, however market skepticism retains its valuation low.

Whereas BXP’s stability and fundamentals are commendable, the broader financial dangers and the potential for decrease workplace actual property costs lead me to take care of a Maintain score.

The market’s cautious outlook means that we should still face important challenges forward, and I agree with that.