Nvidia (NVDA) accounts for 34% of the 14% SPX year-to-date acquire, and 5 shares have accounted for 60% of the S&P 500 whole YTD return; MSFT, NVDA, GOOGL, AMZN, and META have collectively surged by 45% and now comprise 25% of the S&P 500 fairness cap.

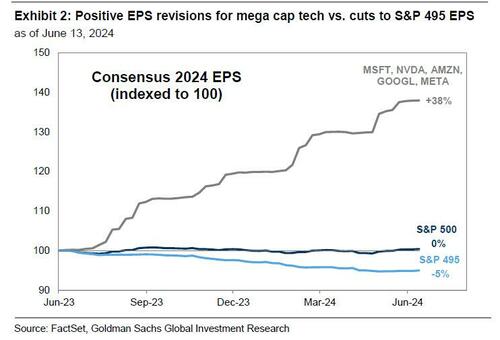

A key cause for this unprecedented outperformance is that these 5 corporations posted Q1 EPS progress of 84% YoY vs 5% for the standard S&P 500 inventory. Moreover, robust outcomes for the previous 4 quarters have prompted analysts to boost their 2024 EPS forecasts by 38% for these 5 Tech shares. In distinction, the revenue forecast for the opposite 495 shares within the index have been decreased by 5%.

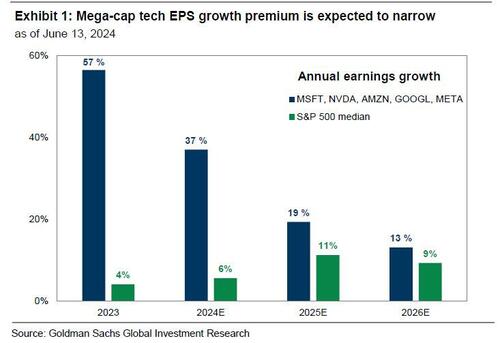

That stated, whereas consensus 2024 forecasts indicate a 31% hole between EPS progress for these 5 shares and the median S&P 500 agency (37% vs. 6%) the hole is predicted to slim to eight% in 2025 and solely 4% in 2026.

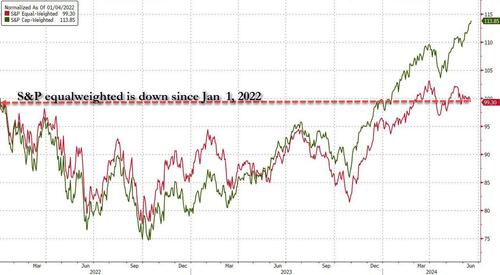

The efficiency hole between the SPX cap-weighted and equal-weight indices during the last two years is the widest in almost 24 years. In truth, the equal-weighted index is now unchanged for the reason that begin of 2022.

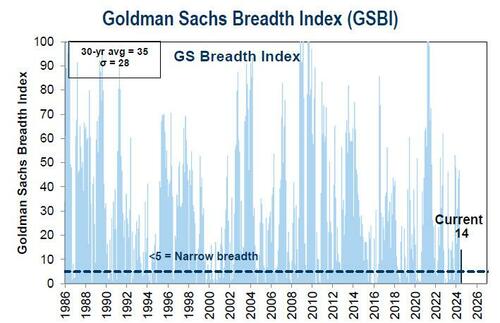

The results are clear: breadth is catastrophic, and in response to Morgan Stanley, one month breadth simply hit a brand new low, with the share of shares outperforming the S&P reaching the bottom stage on file.

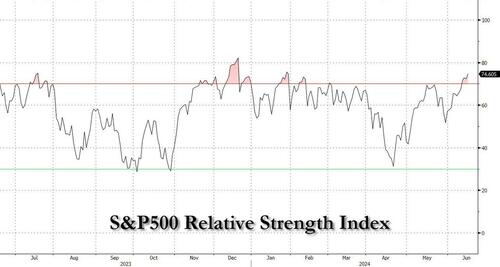

That has not stopped the cap-weighted SPX to formally be again in “overbought” territory with RSI at 75 however solely 49% of S&P corporations are above their 50dma.

Inside the broader S&P, the six mega-caps with $1+ trillion market caps are up a median of ~11.5% in Q2. The remaining 490+ shares within the index are down a median of ~3% in Q2.

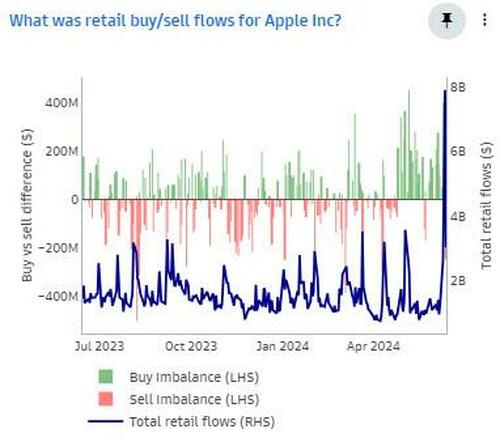

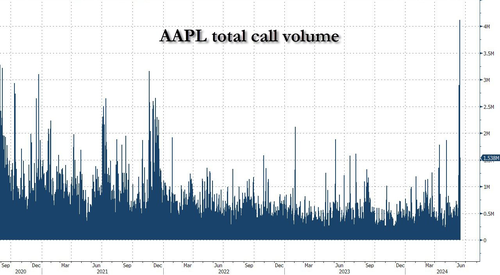

AAPL was up 8% final week, including $260B in market cap this week alone after a flood of inventory buybacks, a burst of retail shopping for…

… and a gamma squeeze, all of which mixed to assist the (previously) world’s greatest firm soar almost 30% from its year-to-date lows as Tim Prepare dinner was hell-bent to reverse the narrative after dismal initial reception to the “Apple Intelligence” WWDC day.

Bloomberg’s John Authers asks:

‘Can this final’?

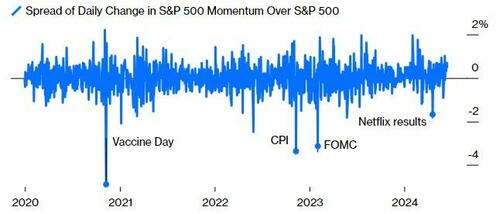

The query rings louder with each file the market breaks. Momentum tends to hold on for a very long time till one thing stops it, however it’s very uncommon for such a rally to persist so long as this one.

The one snag with momentum methods is that after they reverse, they will achieve this in a really critical means. There hasn’t been a momentum crash for some time; the closest method got here when tech shares offered off on April 19 after outcomes from Netflix that have been higher than official forecasts however disenchanted the market.

This was nothing in comparison with sharp strikes in response to dovish indicators from inflation knowledge or from the Federal Reserve earlier on this cycle.

The largest momentum reversal this decade got here on the day in November 2020 when the outcomes of Covid-19 vaccine assessments satisfied buyers that the worst of the pandemic might be over a lot sooner than thought.

The reshuffle within the inventory market was spectacular.

The Downside With Momentum – When it reverses, it might probably achieve this in an enormous means

Supply: Bloomberg

With the identical winners successful day after day, largely on rising enthusiasm reasonably than their outcomes, it does make sense to worry an enormous reverse sooner or later, or certainly a bubble.

It’s maybe much more regarding that the power driving the winners on is usually valuations; it’s not about any nice momentum in rising earnings, though a number of corporations have very a lot proven it.

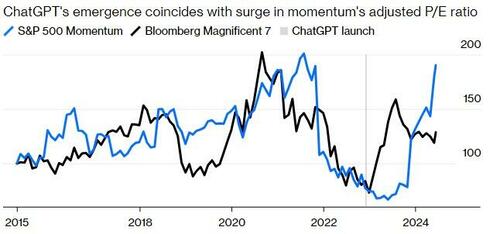

The S&P 500 Momentum index’s earnings a number of tripled after plumbing its lowest level in over a decade solely final Could.

Over that interval, its a number of progress has far outstripped that of the Magnificent Seven — though it’s apparent that the AI craze has a stake on this:

Supply: Bloomberg

As one veteran dealer remarked (whereas we word he admits taking part tactically on this farce):

“This would possibly not finish nicely…”

Loading…