In April, the crypto and the non-fungible token (NFT) market witnessed vital declines, signaling a cooling interval for digital asset transactions.

As buying and selling actions dwindled, key gamers and Crypto platforms confronted marked declines in transaction metrics. This shift signifies a recalibration of crypto market dynamics, reflecting investor warning and a reevaluation of asset values.

Crypto Buying and selling Quantity and NFT Gross sales Drop

Knowledge from centralized exchanges (CEXs) revealed a considerable lower in spot buying and selling volumes. These have plummeted by 35.7% from March’s $2.49 trillion to only $1.6 trillion.

Binance, the largest participant within the area, accounted for 43.7% of this quantity, translating to roughly $699.25 billion.

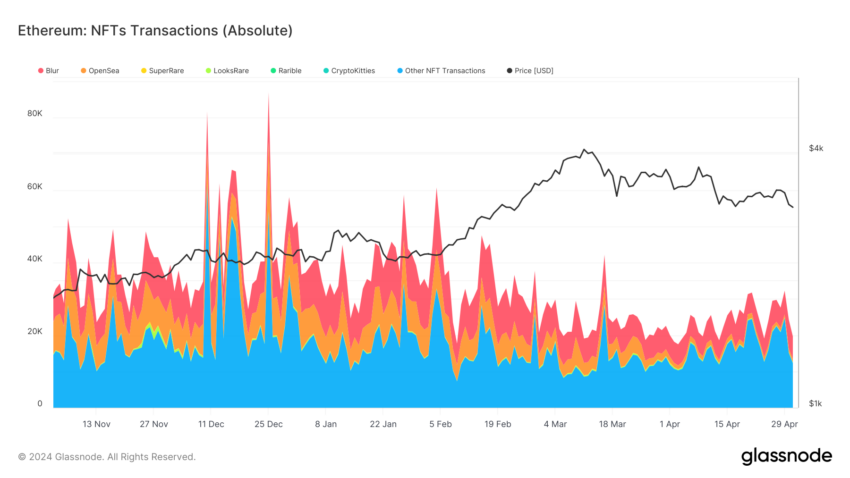

Parallel to this, the NFT sector additionally skilled a downturn. NFT gross sales dipped to $1.15 billion in April, marking a 31.26% decline from the earlier month.

The drop was not restricted to gross sales alone. Certainly, the variety of energetic NFT consumers and sellers additionally decreased considerably. Purchaser participation fell by over half, down 51.88%, and vendor exercise lowered by 45.72%, indicating a shrinking market curiosity.

The downturn affected a number of blockchains the place NFTs are generally traded. Ethereum and Solana, as an illustration, noticed their NFT gross sales lower dramatically.

Ethereum’s NFT transactions halved, sinking by 56.8%, whereas Solana recorded a 39.4% fall in gross sales. This pattern was constant throughout varied blockchains. Nevertheless, only some exceptions, like Immutable X and Avalanche, surprisingly registered will increase in NFT transactions.

Learn extra: 7 Greatest NFT Marketplaces You Ought to Know in 2024

Particular Bitcoin-based NFT collections bucked the downward spiral regardless of the general damaging pattern. In April, The Bitcoin Puppets and the Bitcoin-based WZRDs assortment noticed their values skyrocket by 2,064.97% and 25,796%, respectively.

“Provided that NFT mortgage originations are nonetheless dominated by Ethereum NFT collections because of the synergy between Mix and Blur, the affect of more and more standard Bitcoin Ordinals on the NFT lending market could also be price watching,” researchers at CoinGecko wrote.

This means that whereas the broader market is in decline, area of interest collections can nonetheless seize vital curiosity and command excessive valuations.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.